Auto And Homeowners Insurance Companies

The world of insurance is vast and complex, and within it, auto and homeowners insurance companies play a pivotal role in safeguarding individuals and their assets. These insurance providers offer essential financial protection against various risks, from car accidents to natural disasters. In this in-depth article, we'll explore the intricate workings of these insurance companies, their significance, and the impact they have on our daily lives.

Understanding Auto Insurance Companies

Auto insurance companies are integral to the automotive industry, providing coverage for a wide range of vehicles, from cars and motorcycles to commercial trucks. Their primary goal is to protect policyholders from the financial consequences of accidents, whether it’s repairing or replacing damaged vehicles, covering medical expenses, or providing liability coverage in case of lawsuits.

Key Features of Auto Insurance

- Liability Coverage: This is a fundamental aspect of auto insurance, ensuring the policyholder is financially protected in case they cause an accident that results in property damage or bodily injury to others.

- Comprehensive Coverage: It covers non-collision-related incidents like theft, vandalism, fire, or natural disasters. This type of coverage is essential for protecting your vehicle against unforeseen events.

- Collision Coverage: As the name suggests, it provides coverage for damages resulting from collisions, regardless of who is at fault. This is especially crucial for protecting your vehicle’s value and ensuring its repair or replacement.

- Personal Injury Protection (PIP): PIP coverage, often mandated in certain states, covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder if they are involved in an accident with a driver who has insufficient or no insurance.

Auto insurance companies employ a team of experts, including underwriters, claims adjusters, and risk analysts, who assess the risks associated with each policyholder and determine the appropriate coverage and premiums. They utilize advanced data analytics and actuarial science to calculate the probability of accidents and set insurance rates accordingly.

| Auto Insurance Coverage | Description |

|---|---|

| Liability | Covers damages to others caused by the policyholder. |

| Comprehensive | Protects against non-collision incidents. |

| Collision | Covers damages from vehicle collisions. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and passengers. |

| Uninsured/Underinsured Motorist | Protects against accidents with uninsured or underinsured drivers. |

Homeowners Insurance: A Pillar of Financial Security

Homeowners insurance is a critical component of homeownership, offering financial protection against a myriad of risks associated with owning a home. From natural disasters to theft and liability claims, homeowners insurance provides a safety net for policyholders, ensuring they can rebuild and recover after unforeseen events.

Key Components of Homeowners Insurance

- Dwelling Coverage: This is the cornerstone of homeowners insurance, providing coverage for the physical structure of the home. It covers repairs or rebuilding costs in case of damage caused by perils like fire, wind, or vandalism.

- Personal Property Coverage: It protects the policyholder’s personal belongings, such as furniture, electronics, and clothing, in case of theft, damage, or loss.

- Liability Coverage: Homeowners insurance also extends to liability protection, covering the policyholder in case a guest is injured on their property or if their actions off-site result in injury or property damage to others.

- Additional Living Expenses (ALE): In the event that a home becomes uninhabitable due to a covered loss, ALE coverage helps policyholders with temporary living expenses, such as hotel stays or rental costs.

- Loss of Use Coverage: This coverage reimburses the policyholder for additional living expenses incurred while their home is being repaired or rebuilt after a covered loss.

Homeowners insurance companies assess the risks associated with each home and its location, taking into account factors like the home's age, construction materials, and the likelihood of natural disasters. They also consider the policyholder's claims history and the value of their possessions to determine the appropriate coverage and premiums.

| Homeowners Insurance Coverage | Description |

|---|---|

| Dwelling | Covers the physical structure of the home. |

| Personal Property | Protects personal belongings inside the home. |

| Liability | Provides coverage for injuries or property damage to others. |

| Additional Living Expenses (ALE) | Covers temporary living expenses if the home is uninhabitable. |

| Loss of Use | Reimburses for additional living expenses during repairs. |

The Impact of Auto and Homeowners Insurance Companies

The influence of auto and homeowners insurance companies extends far beyond the policies they offer. These companies play a vital role in the economy, providing stability and security to individuals and businesses alike. Here’s a deeper look at their impact:

Economic Stability

Auto and homeowners insurance companies contribute significantly to economic stability by providing a safety net for policyholders. In the event of an accident or disaster, these companies step in to cover the financial losses, allowing individuals and businesses to recover and continue their operations. This stability is crucial for maintaining a healthy economy, as it prevents widespread financial hardship and encourages investment and growth.

Community Resilience

In the face of natural disasters or widespread crises, auto and homeowners insurance companies are often the first line of defense for communities. By providing timely and comprehensive coverage, these companies enable communities to rebuild and recover quickly. Their presence and support are instrumental in fostering community resilience and ensuring that neighborhoods can bounce back from even the most devastating events.

Job Creation and Economic Growth

The insurance industry is a significant employer, providing jobs for a wide range of professionals, from underwriters and claims adjusters to customer service representatives and marketing specialists. Additionally, the economic activity generated by insurance companies, such as through investments and business operations, contributes to overall economic growth and development.

Consumer Protection

Auto and homeowners insurance companies are subject to strict regulations designed to protect consumers. These regulations ensure that policyholders receive fair and transparent treatment, with clear policies and practices. Insurance companies are also required to maintain adequate reserves to cover potential claims, providing an additional layer of financial protection for policyholders.

Advancements in Technology and Data Analytics

The insurance industry has been at the forefront of technological advancements, leveraging data analytics and artificial intelligence to improve risk assessment and claims processing. This has led to more accurate and efficient insurance processes, benefiting both insurance companies and policyholders. Additionally, the industry’s focus on data-driven decision-making has enhanced overall risk management practices.

The Future of Auto and Homeowners Insurance

As we look ahead, the future of auto and homeowners insurance is poised for significant transformation. Emerging technologies, changing consumer preferences, and evolving risk landscapes are shaping the industry in profound ways. Here’s a glimpse into what the future might hold:

Digital Transformation

The insurance industry is embracing digital technologies at an unprecedented pace. From online policy management and digital claims submission to the use of chatbots and artificial intelligence for customer service, the digital transformation is enhancing efficiency, convenience, and customer satisfaction. Insurance companies are also exploring blockchain technology for secure and transparent transactions.

Personalized Insurance

Advancements in data analytics and machine learning are enabling insurance companies to offer highly personalized insurance products. By analyzing vast amounts of data, insurers can tailor policies to individual needs and circumstances, providing more precise coverage and pricing. This shift towards personalized insurance is expected to revolutionize the industry, making insurance more accessible and affordable for a wider range of consumers.

Connected Devices and Telematics

The rise of connected devices and telematics is transforming the auto insurance landscape. Telematics devices installed in vehicles can provide real-time data on driving behavior, enabling pay-as-you-drive (PAYD) and usage-based insurance (UBI) models. These models offer dynamic pricing based on individual driving habits, encouraging safer driving practices and potentially reducing insurance costs for responsible drivers.

Sustainable and Green Insurance

With growing concerns about climate change and environmental sustainability, insurance companies are exploring ways to promote green initiatives and sustainable practices. This includes offering incentives for policyholders who adopt eco-friendly measures, such as solar panel installations or energy-efficient home upgrades. Insurance companies are also developing products to protect against emerging risks associated with climate change, such as extreme weather events.

Artificial Intelligence and Risk Assessment

Artificial intelligence (AI) is set to play a pivotal role in the future of insurance, particularly in risk assessment and claims management. AI-powered systems can analyze vast amounts of data, including satellite imagery, social media feeds, and weather patterns, to assess risks more accurately and efficiently. This advanced risk assessment capability will enable insurance companies to offer more precise coverage and pricing, while also improving claims handling and fraud detection.

Conclusion

Auto and homeowners insurance companies are integral to our modern society, providing essential financial protection and peace of mind. Their impact extends far beyond individual policyholders, shaping the economy, fostering community resilience, and driving technological advancements. As we navigate an ever-changing landscape of risks and opportunities, these insurance companies will continue to adapt and innovate, ensuring a secure and sustainable future for individuals and businesses alike.

How do I choose the right auto insurance coverage for my needs?

+When selecting auto insurance, consider your state’s requirements, the value of your vehicle, and your personal risk tolerance. Assess your needs for liability, collision, and comprehensive coverage, and don’t forget about optional coverages like uninsured/underinsured motorist protection and personal injury protection (PIP). It’s crucial to strike a balance between adequate coverage and affordability.

What factors influence homeowners insurance rates?

+Homeowners insurance rates are influenced by a variety of factors, including the location and age of your home, the construction materials used, and the likelihood of natural disasters in your area. Your personal claims history and the value of your possessions also play a role in determining rates. It’s essential to discuss your specific needs and circumstances with an insurance agent to find the right coverage and pricing.

How can I save money on my insurance premiums?

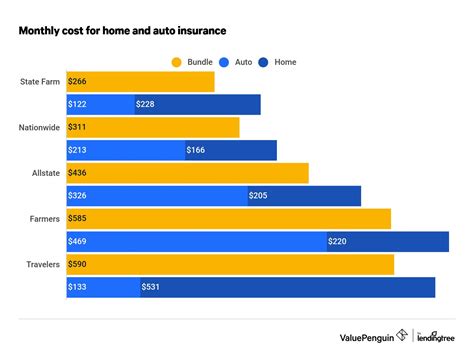

+To save on insurance premiums, consider bundling your auto and homeowners insurance policies with the same provider, as this often leads to discounts. Additionally, maintain a good driving record and claims history, as insurance companies reward responsible behavior. You can also explore usage-based insurance (UBI) models for auto insurance, which offer dynamic pricing based on your driving behavior.