Auto Insurance Basics

Understanding auto insurance is essential for every vehicle owner. It provides financial protection and peace of mind in the event of accidents, theft, or other unforeseen circumstances. Auto insurance is a contract between you and the insurance company, where you pay a premium, and in return, the insurer agrees to cover specific losses as outlined in your policy. This comprehensive guide aims to delve into the fundamentals of auto insurance, offering valuable insights to help you make informed decisions.

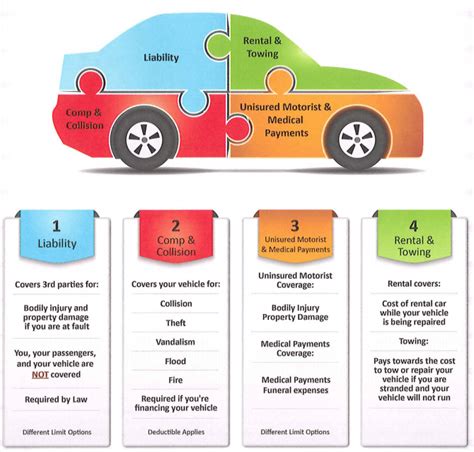

Key Components of Auto Insurance

Auto insurance policies are tailored to meet individual needs, but they generally consist of several core components. These components include liability coverage, which is mandatory in most states and covers damages you cause to others, their property, or vehicles. Collision coverage, on the other hand, is optional and pays for repairs to your vehicle after an accident, regardless of fault.

Comprehensive coverage is another optional feature that provides protection against theft, vandalism, and natural disasters. Medical payments or personal injury protection (PIP) coverage pays for medical expenses for you and your passengers, regardless of who is at fault. Uninsured/underinsured motorist coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough coverage.

Liability Coverage

Liability coverage is the foundation of any auto insurance policy. It protects you from financial loss if you’re found legally responsible for causing bodily injury or property damage to others. This coverage typically includes two parts: bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident you caused. Property damage liability covers the cost of repairing or replacing another person's vehicle or property damaged in an accident you caused.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical costs and compensation for injuries to others. |

| Property Damage Liability | Pays for repairs or replacement of damaged property. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional additions to your auto insurance policy. They offer protection for your vehicle in specific situations.

Collision coverage kicks in when your vehicle collides with another vehicle or object, regardless of fault. It covers the cost of repairing your vehicle up to its actual cash value, minus your deductible. Comprehensive coverage, on the other hand, provides protection for damages caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals.

| Coverage Type | Description |

|---|---|

| Collision | Covers repairs after an accident, regardless of fault. |

| Comprehensive | Protects against non-collision incidents like theft or natural disasters. |

Medical Payments and Personal Injury Protection (PIP)

Medical payments and personal injury protection coverage focus on providing medical benefits for you and your passengers, regardless of who is at fault in an accident. These coverages can help ensure that medical bills are covered promptly, reducing the financial burden of injuries sustained in a vehicle accident.

Medical payments coverage, often referred to as MedPay, covers reasonable and necessary medical expenses for you and your passengers. This can include doctor visits, hospital stays, ambulance services, and more. Personal injury protection (PIP) coverage is similar but often offers broader coverage, including not only medical expenses but also lost wages, funeral expenses, and sometimes even rehabilitation and child care costs.

| Coverage Type | Description |

|---|---|

| Medical Payments (MedPay) | Covers medical expenses for you and your passengers. |

| Personal Injury Protection (PIP) | Offers comprehensive medical and financial benefits for policyholders and passengers. |

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an essential component of auto insurance, providing protection in cases where you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have sufficient coverage to pay for the damages they’ve caused. This coverage helps ensure that you’re not left financially responsible for the costs of an accident caused by an uninsured or underinsured driver.

Uninsured motorist coverage covers you, your family members, and your passengers in the event of an accident with an uninsured driver. It pays for medical expenses, lost wages, and pain and suffering. Underinsured motorist coverage, on the other hand, steps in when the at-fault driver's insurance coverage is insufficient to cover all the damages they've caused.

| Coverage Type | Description |

|---|---|

| Uninsured Motorist Coverage | Protects you when involved with an uninsured driver. |

| Underinsured Motorist Coverage | Covers additional expenses when the at-fault driver's insurance is insufficient. |

Factors Influencing Auto Insurance Rates

Auto insurance rates are determined by various factors, and understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums. Insurance companies consider a range of criteria when calculating rates, including your driving record, the type of vehicle you drive, your age and gender, your location, and even your credit score.

Driving Record and Safety History

Your driving record is a significant factor in determining your auto insurance rates. Insurance companies review your driving history to assess your risk level. A clean driving record with no accidents or moving violations typically results in lower premiums. On the other hand, a history of accidents, speeding tickets, or other traffic violations can lead to higher insurance costs.

Additionally, insurance providers consider your safety history, which includes factors like whether you've completed defensive driving courses or installed safety features in your vehicle. These measures can potentially lower your rates by demonstrating a commitment to safe driving practices.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly impact your auto insurance rates. Insurance companies take into account the make, model, and year of your vehicle, as well as its safety ratings and theft statistics. Vehicles that are more expensive to repair or more frequently targeted by thieves may result in higher insurance premiums.

Your vehicle's usage is also a consideration. If you primarily drive for personal use, your rates may be lower compared to those who commute long distances or use their vehicles for business purposes. The more miles you drive, the higher the risk of an accident, which can lead to increased insurance costs.

Age, Gender, and Location

Your age and gender are additional factors that influence auto insurance rates. Statistically, younger drivers, especially males under the age of 25, tend to have higher accident rates, resulting in higher insurance premiums. As you age and gain more driving experience, your rates may decrease.

Your location is another crucial factor. Insurance rates can vary significantly based on where you live. Urban areas with higher population densities and more traffic typically have higher insurance rates due to the increased risk of accidents and theft. Rural areas, on the other hand, may offer lower premiums due to fewer risks.

Credit Score and Insurance History

Your credit score is an unexpected but influential factor in determining your auto insurance rates. Insurance companies often use credit-based insurance scores to assess your risk level. A higher credit score can indicate better financial responsibility, which may result in lower insurance premiums. Conversely, a lower credit score could lead to higher rates.

Your insurance history is also considered. A continuous history of insurance coverage with no lapses demonstrates stability and responsibility, which can positively impact your rates. On the other hand, gaps in insurance coverage or frequent policy changes may raise concerns about your risk level.

Choosing the Right Auto Insurance Coverage

Selecting the right auto insurance coverage involves careful consideration of your needs and circumstances. It’s essential to balance the cost of insurance with the level of protection you require. While it’s tempting to choose the cheapest option, it’s crucial to ensure that your coverage meets your specific needs and provides adequate financial protection in the event of an accident or other covered incident.

Assessing Your Coverage Needs

Start by evaluating your personal circumstances and financial situation. Consider factors like your budget, the value of your vehicle, and your risk tolerance. If you have a newer or more expensive vehicle, you may want to prioritize collision and comprehensive coverage to protect your investment. On the other hand, if you drive an older vehicle, you might opt for liability coverage only to keep costs down.

Think about your driving habits and the risks you face on the road. If you live in an area with a high risk of theft or natural disasters, comprehensive coverage becomes more crucial. Similarly, if you frequently commute in busy urban areas, collision coverage can provide peace of mind.

Comparing Insurance Providers and Quotes

Once you have a clear idea of your coverage needs, it’s time to compare insurance providers and their quotes. Getting multiple quotes is essential to finding the best coverage at the most competitive price. Insurance companies use different criteria to calculate rates, so shopping around can reveal significant variations in pricing for similar coverage.

When comparing quotes, pay attention to the details. Ensure that the quotes you're comparing are for the same coverage limits and deductibles. Consider the reputation and financial stability of the insurance companies, as well as their customer service ratings. Look for providers who offer discounts for safe driving, multiple policies, or other factors that may apply to your situation.

Understanding Policy Exclusions and Limitations

While choosing your auto insurance coverage, it’s crucial to understand the exclusions and limitations of your policy. Insurance policies typically have specific exclusions, which are situations or events that are not covered by your policy. These exclusions can vary widely between insurers and policy types, so it’s essential to read the fine print and understand what is and isn’t covered.

For example, some policies may exclude coverage for certain types of damage, such as wear and tear or mechanical breakdowns. Others may have limitations on coverage for specific perils, such as flood or earthquake damage. Understanding these exclusions can help you make informed decisions about additional coverage you may need to purchase separately.

Tips for Lowering Auto Insurance Costs

Lowering your auto insurance costs is possible without compromising on the coverage you need. Here are some practical tips to help you save money on your auto insurance policy.

Safe Driving Habits

Maintaining a clean driving record is one of the most effective ways to lower your auto insurance costs. Insurance companies reward safe drivers with lower premiums. Avoid accidents, keep your driving record free of moving violations, and complete defensive driving courses to demonstrate your commitment to safe driving.

Additionally, consider installing safety features in your vehicle. Anti-theft devices, advanced driver assistance systems, and other safety technologies can qualify you for insurance discounts. These features not only enhance your safety on the road but also reduce the risk of accidents and theft, which can lead to lower insurance rates.

Bundling Policies and Loyalty Discounts

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can result in significant savings. Many insurance companies offer multi-policy discounts, rewarding customers who choose to insure multiple aspects of their lives with the same provider. By bundling your policies, you not only save money but also simplify your insurance management.

Loyalty to an insurance provider can also pay off. Some companies offer loyalty discounts to customers who maintain their policies over an extended period. These discounts can be substantial, so it's worth considering long-term relationships with reputable insurers.

Raising Deductibles and Reducing Coverage

Increasing your deductible is a simple way to lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re agreeing to pay more in the event of a claim, which can result in lower monthly premiums. However, it’s essential to ensure that you can afford the higher deductible in the event of an accident.

Reducing certain types of coverage, especially if you have an older vehicle, can also lead to cost savings. For example, if your vehicle has low monetary value, you might consider dropping collision and comprehensive coverage, which are optional and typically more expensive. However, be cautious when making these decisions, as you want to maintain adequate coverage to protect your financial well-being.

What is the average cost of auto insurance?

+The average cost of auto insurance can vary significantly based on numerous factors, including the state you live in, your age and driving record, the type of vehicle you drive, and the coverage limits you choose. According to the Insurance Information Institute, the national average cost of car insurance was $1,674 per year as of 2022. However, it’s essential to get personalized quotes to understand your specific costs.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever your life circumstances change significantly. Life events such as getting married, buying a new car, moving to a new location, or changing jobs can impact your insurance needs and rates. Regular reviews ensure that your coverage remains up-to-date and cost-effective.

Can I switch auto insurance providers to save money?

+Absolutely! Shopping around for auto insurance is a great way to find the best coverage at the most competitive price. Insurance rates can vary significantly between providers, so obtaining multiple quotes and comparing coverage options can lead to substantial savings. Switching providers is often a simple process, and you can even bundle your insurance policies to save more.