Auto Insurance Companies Online

The world of auto insurance is undergoing a significant transformation, with a growing number of companies embracing the digital realm. This evolution has led to the emergence of online auto insurance companies, offering a fresh and convenient approach to traditional insurance services. These companies are leveraging the power of technology to streamline the insurance process, making it more accessible and efficient for customers.

In this article, we delve into the fascinating world of online auto insurance companies, exploring their rise, the innovative services they provide, and their impact on the insurance landscape. From their unique business models to the cutting-edge technologies they employ, we uncover the secrets behind their success and how they are shaping the future of the insurance industry.

The Rise of Online Auto Insurance Companies: A Disruptive Force

The traditional insurance industry has long been characterized by a certain level of complexity and bureaucracy. However, the advent of the internet and advancements in technology have paved the way for a new breed of insurance companies—those operating solely online. These companies are challenging the status quo, offering a more streamlined and customer-centric approach to auto insurance.

Online auto insurance companies have gained significant traction over the past decade, attracting a growing number of customers who appreciate the convenience and transparency they provide. By eliminating the need for physical interactions and paperwork, these companies have simplified the insurance process, making it more accessible and appealing to a wide range of consumers.

One of the key factors driving the success of online auto insurance companies is their ability to leverage data and analytics. Through advanced algorithms and machine learning, these companies can assess risk factors with greater accuracy and efficiency. This allows them to offer personalized insurance plans tailored to individual customer needs, providing a level of customization that was previously unattainable in the traditional insurance market.

Benefits of Online Auto Insurance Companies for Consumers

The rise of online auto insurance companies has brought about a host of benefits for consumers. Here are some of the key advantages:

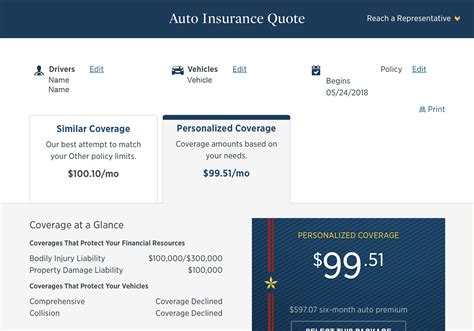

- Convenience and Accessibility: Online insurance companies provide a seamless and convenient experience, allowing customers to obtain quotes, purchase policies, and manage their accounts entirely online. This eliminates the need for in-person meetings or lengthy phone calls, saving time and effort.

- Real-Time Quoting and Comparison: With just a few clicks, customers can obtain multiple quotes from different insurance providers, enabling them to compare prices and coverage options instantly. This transparency empowers consumers to make informed decisions and find the best value for their insurance needs.

- Personalized Coverage: Through advanced data analysis, online insurance companies can offer highly personalized coverage plans. By considering various factors such as driving behavior, vehicle usage, and even telematics data, these companies can tailor policies to individual drivers, ensuring they receive the coverage they truly need.

- Paperless and Eco-Friendly: By conducting business online, these companies significantly reduce their environmental impact. The absence of physical paperwork and the use of digital signatures contribute to a more sustainable and eco-friendly insurance experience.

Innovative Services and Technologies Shaping the Industry

Online auto insurance companies are not only disrupting the industry but also leading the way in terms of innovation. They are leveraging cutting-edge technologies to enhance the customer experience and streamline their operations.

Telematics and Usage-Based Insurance

One of the most significant innovations in the auto insurance space is the integration of telematics and usage-based insurance. Online insurance companies are at the forefront of this trend, offering policies that take into account actual driving behavior rather than relying solely on traditional risk factors.

Telematics devices, often installed in vehicles, collect data on driving habits such as speed, acceleration, and braking patterns. This data is then used to assess the risk level of the driver and determine insurance premiums accordingly. Usage-based insurance plans, also known as pay-as-you-drive or pay-how-you-drive, provide customers with more control over their insurance costs and encourage safer driving habits.

| Telematics Device Features | Benefits |

|---|---|

| GPS Tracking | Accurate location data for emergency services and stolen vehicle recovery. |

| Driving Behavior Analysis | Real-time feedback on driving habits to improve safety and reduce premiums. |

| Crash Detection | Automatic notification to insurance company and emergency contacts in case of an accident. |

| Vehicle Diagnostics | Monitoring of vehicle health and performance to identify potential issues. |

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the way online insurance companies operate. These technologies enable companies to process vast amounts of data quickly and accurately, enhancing their risk assessment capabilities and improving overall efficiency.

AI-powered chatbots and virtual assistants are becoming increasingly common in the customer service realm. These intelligent systems can handle a wide range of inquiries, provide instant quotes, and guide customers through the insurance process, offering a more personalized and efficient experience.

Digital Claims Processing

Online insurance companies are also revolutionizing the claims process by leveraging digital technologies. Customers can now report claims online, upload necessary documentation, and track the progress of their claims in real-time. This digital claims processing streamlines the entire process, reducing the time and effort required for both customers and insurance companies.

Performance Analysis: How Online Auto Insurance Companies Stack Up

With their innovative approaches and customer-centric models, online auto insurance companies are making significant strides in the market. Let’s take a closer look at their performance and the factors contributing to their success.

Customer Satisfaction and Retention

Online insurance companies have consistently demonstrated high levels of customer satisfaction. The convenience, transparency, and personalized coverage they offer have resonated with consumers, leading to strong retention rates. Customers appreciate the ease of managing their policies online and the ability to tailor their coverage to their specific needs.

Furthermore, the use of telematics and usage-based insurance has been well-received by drivers who value the fairness and accuracy of these plans. By incentivizing safe driving behavior, these insurance models not only reduce the risk of accidents but also lower insurance premiums for responsible drivers.

Cost-Efficiency and Competitive Pricing

The digital nature of online insurance companies allows them to operate with lower overhead costs compared to traditional insurers. This cost-efficiency is often passed on to customers in the form of competitive pricing. Online insurance companies can offer lower premiums, especially for those who demonstrate safe driving habits and take advantage of usage-based insurance plans.

Additionally, the ability to obtain multiple quotes and compare prices online empowers consumers to find the best value for their insurance needs. This competitive pricing landscape has put pressure on traditional insurers to adapt and offer more competitive rates.

Market Share and Growth

Online auto insurance companies have experienced rapid growth and gained significant market share in recent years. Their ability to attract tech-savvy consumers and offer innovative services has propelled them to the forefront of the industry. As more people embrace digital technologies and seek convenient insurance solutions, the demand for online insurance providers continues to rise.

According to industry reports, the online insurance market is expected to witness substantial growth over the next decade. This growth is fueled by the increasing adoption of digital technologies, the expanding reach of the internet, and the changing preferences of consumers who value convenience and personalized experiences.

Future Implications and Industry Insights

The rise of online auto insurance companies is set to have a lasting impact on the insurance industry. As these companies continue to innovate and gain market share, they are shaping the future of insurance in several key ways.

Continued Digital Transformation

The success of online insurance companies has highlighted the importance of digital transformation for traditional insurers. To remain competitive, insurance providers are investing in digital technologies and adopting more customer-centric approaches. The industry as a whole is moving towards a more digital and data-driven future, with online platforms and mobile apps becoming integral to the insurance experience.

Focus on Customer Experience

Online insurance companies have set a new standard for customer experience in the insurance industry. Their emphasis on convenience, transparency, and personalization has raised the bar for all insurance providers. As a result, traditional insurers are reevaluating their customer service strategies and adopting more customer-centric models to stay relevant.

Data-Driven Decision Making

The ability to analyze vast amounts of data and leverage AI and machine learning is a game-changer for the insurance industry. Online insurance companies have demonstrated the power of data-driven decision making, enabling more accurate risk assessments and personalized coverage plans. This trend is likely to continue, with insurers relying on advanced analytics to improve their operations and better serve their customers.

Expanding Use of Telematics and Usage-Based Insurance

The success of telematics and usage-based insurance models has paved the way for their wider adoption. Online insurance companies are leading the charge, but traditional insurers are also exploring these innovative approaches. As more insurers embrace these technologies, we can expect to see a shift towards pay-as-you-drive and pay-how-you-drive insurance plans, offering greater fairness and accuracy in pricing.

What is the average savings for customers who switch to online auto insurance companies?

+

The average savings for customers who switch to online auto insurance companies can vary based on factors such as driving history, location, and the specific company. However, studies have shown that customers can often save anywhere from 10% to 40% on their insurance premiums by opting for online providers. These savings are primarily attributed to the lower overhead costs and more efficient business models of online companies.

Are online auto insurance companies suitable for all drivers?

+

Online auto insurance companies cater to a wide range of drivers, including those with clean driving records as well as those with at-fault accidents or moving violations. However, it’s important to note that insurance policies and rates can vary based on individual circumstances. Some online providers may specialize in offering coverage for high-risk drivers, while others may focus on attracting low-risk drivers with competitive rates. It’s advisable to compare quotes from multiple online insurers to find the best fit for your specific needs.

How do online auto insurance companies determine insurance premiums?

+

Online auto insurance companies determine insurance premiums based on a combination of factors, including your driving history, the make and model of your vehicle, your location, and the level of coverage you require. Additionally, many online insurers offer usage-based insurance, where premiums are influenced by your actual driving behavior as monitored through telematics devices. This data-driven approach allows for more personalized and accurate pricing.

What are the advantages of using AI and machine learning in the insurance industry?

+

The integration of AI and machine learning in the insurance industry brings several advantages. These technologies enable insurers to analyze vast amounts of data quickly and accurately, improving risk assessment and fraud detection capabilities. AI-powered chatbots and virtual assistants enhance customer service, providing instant support and guidance. Additionally, AI can optimize pricing and coverage recommendations, leading to more efficient and personalized insurance plans.