Auto Insurance Comparison

When it comes to safeguarding your financial well-being and ensuring peace of mind, auto insurance is an essential aspect of responsible vehicle ownership. With a multitude of insurance providers and varying policies available, comparing and choosing the right coverage can be a daunting task. This comprehensive guide aims to navigate you through the process, offering expert insights and valuable information to make an informed decision. From understanding the basics of auto insurance to exploring the critical factors that influence policy costs, we'll delve into the intricacies of this vital financial protection.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance, also known as motor insurance or car insurance, is a contractual agreement between an individual and an insurance provider. It offers financial protection against potential losses and liabilities arising from vehicle-related incidents. These incidents can range from accidents, theft, vandalism, or natural disasters. The primary objective of auto insurance is to mitigate the financial risks associated with vehicle ownership, providing a safety net for policyholders.

The world of auto insurance is diverse, offering a range of coverage types to cater to the unique needs of different drivers. These include:

- Liability Coverage: This is the most basic form of auto insurance, covering bodily injury and property damage caused by the policyholder to others. It's legally required in most states and is essential for protecting your financial interests in the event of an at-fault accident.

- Collision Coverage: As the name suggests, this coverage kicks in when your vehicle collides with another vehicle or object. It covers the cost of repairing or replacing your vehicle, even if you're at fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against non-collision-related incidents such as theft, vandalism, natural disasters, or damage caused by animals. It's an essential addition to your policy if you want to be covered for a wide range of potential risks.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when you're involved in an accident with a driver who either doesn't have insurance or doesn't have enough insurance to cover the damages. It ensures you're protected financially even when the other driver is at fault but lacks adequate insurance.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. It's a crucial component of auto insurance, ensuring that medical bills are covered promptly.

Factors Influencing Auto Insurance Costs

The cost of auto insurance is influenced by a multitude of factors, each playing a significant role in determining the premium you pay. Understanding these factors can help you make more informed choices and potentially save money on your policy.

1. Personal Information and Driving History

Insurance providers assess your personal details and driving history to gauge the level of risk you pose. Factors such as age, gender, marital status, and driving record can impact your premium. For instance, younger drivers, especially males, are often considered higher-risk due to their propensity for more aggressive driving and higher accident rates. Similarly, a clean driving record with no accidents or traffic violations can lead to lower premiums.

2. Vehicle Type and Usage

The type of vehicle you drive and how you use it also affect your insurance costs. Sports cars and luxury vehicles generally have higher insurance premiums due to their higher repair costs and greater susceptibility to theft. Additionally, the primary purpose of your vehicle (e.g., personal use, business use, or pleasure driving) can influence your premium. For instance, using your vehicle for business purposes may result in a higher premium due to increased mileage and potential exposure to more hazardous driving conditions.

3. Coverage and Deductibles

The level of coverage you choose and the associated deductibles are critical factors in determining your insurance costs. Higher coverage limits typically result in higher premiums, as they offer more extensive financial protection. Similarly, opting for a higher deductible (the amount you pay out of pocket before your insurance coverage kicks in) can lead to lower premiums. It’s a trade-off between upfront costs and potential future savings.

4. Location and Geographical Factors

Where you live and drive your vehicle plays a significant role in insurance costs. Urban areas with higher population densities and increased traffic often have higher premiums due to the higher likelihood of accidents and vehicle-related crimes. Similarly, geographical factors such as severe weather conditions (e.g., hurricanes, tornadoes) or high rates of natural disasters can impact insurance rates.

5. Claims History

Your past claims history is a crucial factor in determining your insurance premium. Frequent claims, even if they’re for minor incidents, can lead to higher premiums. Insurance providers view frequent claims as an indication of increased risk, and they may adjust your premium accordingly. Therefore, it’s essential to drive safely and avoid situations that could lead to claims.

6. Credit Score

Believe it or not, your credit score can also impact your insurance premium. Many insurance providers use credit-based insurance scores to assess the risk you pose as a policyholder. A higher credit score often correlates with lower insurance premiums, as it’s seen as an indicator of financial responsibility and stability. However, it’s important to note that this practice varies by state, and some states have banned the use of credit scores in insurance pricing.

Comparing Auto Insurance Providers: A Step-by-Step Guide

With a solid understanding of the factors that influence auto insurance costs, it’s time to delve into the process of comparing insurance providers. Here’s a comprehensive, step-by-step guide to help you make an informed decision.

1. Identify Your Coverage Needs

Before you begin comparing insurance providers, it’s crucial to understand your specific coverage needs. Consider the following factors:

- What type of coverage do you require? (e.g., liability only, collision, comprehensive)

- What are your state's minimum insurance requirements?

- Do you have any additional coverage needs, such as uninsured motorist protection or rental car coverage?

- What's your budget for insurance premiums?

2. Research Insurance Providers

Once you have a clear idea of your coverage needs, it’s time to research and identify potential insurance providers. Here are some key considerations:

- Reputation and Financial Stability: Choose providers with a solid reputation and financial stability. This ensures they'll be able to pay out claims in the event of an accident.

- Coverage Options: Ensure the providers offer the specific coverage types you need. Some providers may specialize in certain types of coverage, so it's essential to find one that aligns with your requirements.

- Customer Service and Claims Handling: Look for providers with a strong track record of excellent customer service and efficient claims handling. This can make a significant difference in your experience as a policyholder.

- Discounts and Rewards: Many providers offer discounts for various factors, such as good driving records, loyalty, or certain safety features in your vehicle. Research these discounts to see if you can benefit from them.

3. Obtain Quotes

Now that you’ve identified potential insurance providers, it’s time to obtain quotes. Here’s a step-by-step process:

- Visit the provider's website or call their customer service hotline.

- Provide the necessary information, including your personal details, vehicle information, and desired coverage types.

- Compare the quotes based on the coverage provided and the associated premiums. Ensure you're comparing apples to apples by ensuring the quotes offer similar coverage levels.

4. Analyze the Quotes

When analyzing quotes, consider the following:

- Coverage Limits: Ensure the quotes provide adequate coverage limits for your needs. Higher coverage limits may cost more, but they offer greater financial protection.

- Deductibles: Compare the deductibles associated with each quote. A higher deductible can lower your premium, but it means you'll pay more out of pocket if you need to make a claim.

- Additional Coverages: Some providers may include additional coverages, such as roadside assistance or rental car coverage, in their standard policies. These can be valuable additions, so consider their value in your decision-making process.

5. Read the Fine Print

Before making a decision, it’s crucial to read the policy documents thoroughly. Pay attention to the exclusions and limitations, as these can impact your coverage in the event of a claim. Additionally, review the terms and conditions to understand the provider’s obligations and your responsibilities as a policyholder.

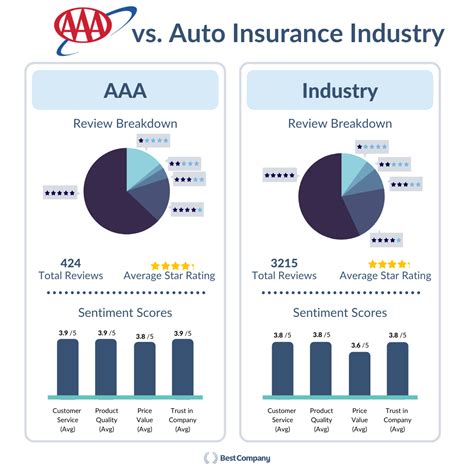

6. Consider Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the provider’s performance and customer satisfaction. Look for reviews on trusted websites and forums, and pay attention to recurring themes or complaints. This can help you make an informed decision and avoid potential pitfalls.

7. Make an Informed Decision

Based on your research, analysis, and review of customer feedback, make a decision that best aligns with your needs and budget. Remember, the cheapest quote may not always be the best option, as it might offer insufficient coverage. Strive for a balance between cost and coverage to ensure you’re adequately protected.

Auto Insurance: A Long-Term Investment

Auto insurance is more than just a legal requirement; it’s a long-term investment in your financial security and peace of mind. By understanding the basics of auto insurance, the factors that influence costs, and the process of comparing providers, you can make informed decisions that protect your interests. Remember, the right auto insurance policy should provide adequate coverage, offer excellent value for money, and align with your unique needs as a driver.

Stay informed, drive safely, and choose wisely to ensure you're always protected on the road.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually, especially when your policy is up for renewal. This allows you to assess if your coverage is still adequate and if there are any changes in your personal circumstances or driving habits that may impact your premium.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but you may incur fees for canceling your current policy early. Ensure you understand the cancellation terms and conditions before making a switch.

What factors can lead to my insurance premium increasing mid-policy term?

+Your insurance premium can increase mid-policy term if you make a claim, get a traffic violation, or if there’s a significant change in your personal circumstances (e.g., moving to a different location with higher insurance rates). It’s important to keep your insurance provider informed of any changes that may impact your policy.

Are there any ways to reduce my auto insurance premium besides shopping around for providers?

+Yes, there are several strategies you can employ to reduce your auto insurance premium. These include maintaining a clean driving record, taking defensive driving courses, installing safety features in your vehicle, and increasing your deductible. Additionally, some providers offer discounts for good students, senior citizens, or members of certain professional organizations.