Auto Insurance Consumer Reports

Welcome to this in-depth exploration of auto insurance, a crucial aspect of vehicle ownership that ensures financial protection in the event of accidents or other mishaps. Auto insurance is a complex topic, with numerous factors influencing coverage, costs, and consumer satisfaction. In this comprehensive guide, we'll delve into the world of auto insurance, providing valuable insights, expert tips, and real-world examples to empower consumers like yourself to make informed decisions.

Understanding Auto Insurance: A Comprehensive Guide

Auto insurance is a contract between an individual and an insurance provider, designed to offer financial protection for vehicles against various risks, including accidents, theft, and other damages. It’s a vital aspect of responsible vehicle ownership, ensuring that you and others are covered in the face of unforeseen circumstances.

The Importance of Auto Insurance

The significance of auto insurance cannot be overstated. In the event of an accident, medical bills, vehicle repairs, and legal fees can quickly accumulate, potentially leading to significant financial strain. Auto insurance acts as a safety net, providing coverage for these expenses and offering peace of mind. It’s a legal requirement in most regions, and having adequate coverage can also help protect your assets and financial stability.

Let's take a look at a real-world example. Imagine you're involved in a minor fender bender. Without insurance, you'd be responsible for the full cost of repairs, which could amount to thousands of dollars. With comprehensive auto insurance, however, your policy might cover the repairs, and you'd only be responsible for your deductible, a much more manageable expense.

Key Components of Auto Insurance Policies

Auto insurance policies are intricate, comprising various components that cater to different needs. Here’s a breakdown of the essential elements:

- Liability Coverage: This covers damages you cause to others' property or injuries you inflict upon others in an accident. It's typically divided into bodily injury liability and property damage liability.

- Collision Coverage: This covers damages to your own vehicle in the event of an accident, regardless of fault. It's an optional coverage but is highly recommended for newer or more expensive vehicles.

- Comprehensive Coverage: This covers damages to your vehicle resulting from non-collision events like theft, vandalism, natural disasters, or collisions with animals. Like collision coverage, it's optional but can provide valuable protection.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have sufficient coverage to pay for the damages they caused.

- Medical Payments Coverage: This covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

- Personal Injury Protection (PIP): PIP is similar to medical payments coverage but also covers lost wages and other related expenses. It's required in some states.

Factors Influencing Auto Insurance Rates

Auto insurance rates can vary significantly, influenced by a multitude of factors. Understanding these factors can help consumers make informed choices and potentially save on their insurance premiums.

Risk Assessment

Insurance companies assess the risk associated with insuring a particular individual or vehicle. Higher-risk drivers or vehicles typically result in higher premiums. Risk factors include:

- Driver's Age and Experience: Younger, less experienced drivers often pay higher premiums due to their higher risk profile.

- Driving Record: A history of accidents, tickets, or violations can significantly impact insurance rates.

- Vehicle Type and Usage: Sports cars, luxury vehicles, and those used for business purposes may attract higher premiums.

- Location: Urban areas often have higher rates due to increased risk of accidents and theft.

Coverage and Deductibles

The level of coverage and the chosen deductible can significantly affect insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums.

| Coverage Type | Description |

|---|---|

| Liability Only | Covers damages to others but not your own vehicle. Typically the most affordable option. |

| Liability + Collision | Provides coverage for damages to others and your vehicle in the event of an accident. |

| Full Coverage | Includes liability, collision, and comprehensive coverage, offering the most extensive protection. |

Discounts and Bundling

Insurance companies often offer discounts to encourage certain behaviors or to reward safe driving. Common discounts include:

- Safe Driver Discount: Rewards drivers with clean records and safe driving habits.

- Multi-Policy Discount: Bundling your auto insurance with other policies, like home or renters insurance, can result in significant savings.

- Payment Plan Discounts: Some insurers offer discounts for paying your premium annually or semi-annually rather than monthly.

Shopping for Auto Insurance: Tips and Strategies

Shopping for auto insurance can be a daunting task, but with the right approach, you can find the best coverage at the most competitive rates. Here are some strategies to consider:

- Compare Quotes: Obtain quotes from multiple insurers to compare rates and coverage. Online comparison tools can be a valuable resource.

- Understand Your Needs: Assess your specific needs and choose coverage accordingly. Consider factors like the age and value of your vehicle, your driving habits, and any potential risks in your area.

- Review Your Coverage Regularly: Life circumstances and insurance needs can change over time. Review your policy annually to ensure it still meets your requirements and take advantage of any discounts you may be eligible for.

- Consider Bundling: Bundling your auto insurance with other policies can lead to substantial savings. Many insurers offer discounts for bundling home, renters, or life insurance with your auto policy.

- Enhance Your Driving Record: A clean driving record can lead to significant savings. Consider taking a defensive driving course or installing a telematics device to track your driving habits and potentially earn discounts.

Consumer Reports: Auto Insurance Satisfaction

Consumer satisfaction is a critical aspect of the auto insurance industry. Numerous surveys and reports provide insights into consumer experiences and preferences. Here’s a look at some key findings:

J.D. Power Auto Insurance Study

J.D. Power’s annual U.S. Auto Insurance Study evaluates customer satisfaction across various aspects of the insurance experience. The study ranks insurers based on factors like policy offerings, price, billing process, and claims handling. Here’s a glimpse at the top performers in the most recent study:

| Insurer | Rating |

|---|---|

| Erie Insurance | 877 |

| Auto-Owners Insurance | 876 |

| Amica Mutual Insurance | 869 |

| State Farm | 868 |

| USAA | 865 |

The study highlights that while price is a significant factor in consumer satisfaction, other aspects like the claims process, policy offerings, and customer service also play crucial roles.

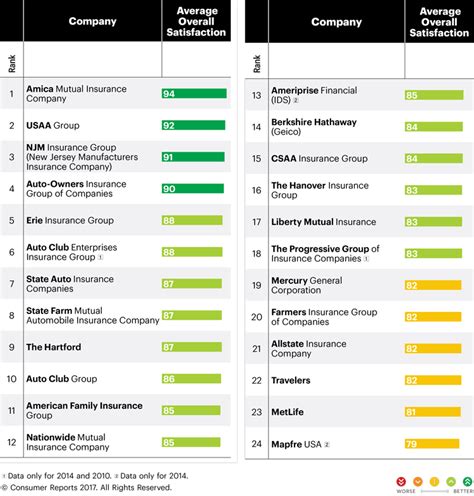

Consumer Reports Auto Insurance Ratings

Consumer Reports also conducts annual auto insurance ratings, evaluating insurers based on factors like customer service, financial strength, and policy offerings. Here’s a look at their top-rated insurers for 2023:

| Insurer | Rating |

|---|---|

| Amica Mutual Insurance | Top-Rated |

| Erie Insurance | Top-Rated |

| State Farm | Top-Rated |

| USAA | Top-Rated |

| GEICO | Very Good |

Consumer Reports emphasizes the importance of considering an insurer's financial strength and customer service reputation when choosing an auto insurance provider.

Additional Consumer Insights

Beyond these reports, various consumer surveys and forums offer valuable insights into consumer experiences. Common themes include:

- Claims Handling: Efficient and fair claims handling is a top priority for consumers. Insurers that provide prompt and transparent claims processes tend to receive higher satisfaction ratings.

- Price and Coverage: While price is a significant factor, consumers also value insurers that offer comprehensive coverage options at competitive rates.

- Customer Service: Accessible and responsive customer service is highly valued. Insurers with knowledgeable and friendly representatives often receive positive feedback.

The Future of Auto Insurance: Trends and Innovations

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse at some key trends shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining popularity. These programs use real-time data to assess driving behavior and offer personalized premiums. Insurers can offer discounts to safe drivers and provide feedback to help improve driving habits.

Artificial Intelligence and Data Analytics

AI and data analytics are transforming the insurance industry. Insurers are using advanced analytics to assess risk more accurately, personalize coverage, and improve the overall customer experience. AI-powered chatbots and virtual assistants are also enhancing customer service.

Digital Transformation

The digital landscape is revolutionizing the insurance industry. Consumers now expect convenient, digital interactions, from quote comparisons to policy management and claims submissions. Insurers are investing in digital platforms and mobile apps to meet these expectations.

Electric Vehicles and Autonomous Cars

The rise of electric vehicles and autonomous cars is prompting insurers to adapt. Insurers are developing specialized coverage options for these vehicles, considering factors like battery replacement costs and autonomous driving features.

Conclusion: Empowering Consumers with Knowledge

Auto insurance is a complex but essential aspect of vehicle ownership. By understanding the various components of auto insurance policies, the factors influencing rates, and the strategies for finding the best coverage, consumers can make informed decisions. Additionally, staying informed about consumer reports and industry trends ensures that you can choose an insurer that aligns with your needs and provides a satisfying experience.

As the auto insurance landscape continues to evolve, staying up-to-date with the latest trends and innovations can help you navigate the market and find the best coverage at the most competitive rates. Remember, your auto insurance is a crucial aspect of your financial well-being, and choosing wisely can provide peace of mind and protect your assets.

How do I choose the right auto insurance coverage for my needs?

+Assessing your specific needs is crucial. Consider factors like the age and value of your vehicle, your driving habits, and potential risks in your area. Choose coverage that aligns with your needs, and don’t be afraid to seek advice from insurance professionals to ensure you’re adequately protected.

What are some common discounts offered by auto insurers?

+Common discounts include safe driver discounts, multi-policy discounts, and payment plan discounts. Some insurers also offer discounts for installing safety features or for taking defensive driving courses. It’s worth exploring these options to potentially save on your premium.

How can I improve my auto insurance experience and satisfaction?

+Improving your auto insurance experience starts with choosing a reputable insurer with a strong customer service reputation. Additionally, regularly reviewing your policy to ensure it aligns with your needs and taking advantage of available discounts can enhance your overall satisfaction.