Auto Insurance Florida Quotes

Florida, known for its sunny beaches and vibrant culture, is a popular state for both residents and tourists alike. With a diverse range of cities and a unique set of driving conditions, understanding auto insurance in Florida is essential for anyone looking to protect their vehicles and finances. In this comprehensive guide, we delve into the world of auto insurance in Florida, offering expert insights, real-world examples, and a detailed analysis of quotes to help you make informed decisions.

Understanding Auto Insurance in Florida

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. In Florida, the insurance landscape is shaped by a combination of state regulations, local laws, and the unique driving conditions prevalent in the Sunshine State. From bustling cities like Miami and Tampa to the tranquil beaches of the Panhandle, understanding the specific needs of Florida drivers is key to obtaining adequate coverage.

Florida operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each party typically files a claim with their own insurance company. This system aims to streamline the claims process and provide quicker access to compensation. However, it also means that Florida drivers must carry certain mandatory coverages to ensure they can cover their own losses in the event of an accident.

Mandatory Coverages in Florida

The state of Florida requires drivers to carry a minimum level of auto insurance coverage. These mandatory coverages include:

- Personal Injury Protection (PIP): PIP coverage is designed to cover medical expenses and lost wages for the policyholder and their passengers, regardless of fault. In Florida, drivers must carry at least 10,000 in PIP coverage.</li> <li><strong>Property Damage Liability (PDL)</strong>: PDL coverage protects against claims for damage to another person's property caused by the policyholder. The minimum required limit in Florida is 10,000.

While these are the basic requirements, many drivers opt for additional coverages to ensure more comprehensive protection. Some common optional coverages in Florida include:

- Bodily Injury Liability (BIL): BIL coverage provides protection against claims for injuries sustained by others in an accident caused by the policyholder.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who has insufficient or no insurance coverage.

- Comprehensive Coverage: Comprehensive coverage provides protection against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage covers damage to the policyholder's vehicle in the event of a collision, regardless of fault.

The specific coverages and limits chosen by a driver will depend on their individual needs, the value of their vehicle, and their personal financial situation. It's important to carefully assess these factors when selecting auto insurance in Florida to ensure adequate protection without overpaying for unnecessary coverage.

Factors Influencing Auto Insurance Quotes in Florida

Auto insurance quotes in Florida are influenced by a variety of factors, each playing a role in determining the cost of coverage. Understanding these factors can help drivers make more informed decisions when comparing quotes and selecting an insurance provider.

Vehicle Type and Usage

The type of vehicle being insured is a significant factor in determining insurance quotes. Factors such as the make, model, and year of the vehicle, as well as its intended usage (e.g., personal use, business use, or pleasure driving), can impact the cost of insurance. For example, a high-performance sports car may be more expensive to insure due to its higher risk profile, while a basic sedan used primarily for commuting may be more affordable.

Driver’s Profile and History

The driver’s profile and history are key considerations for insurance providers when determining quotes. Factors such as age, gender, driving experience, and claims history can all influence the cost of insurance. For instance, young drivers, especially those under the age of 25, often face higher insurance premiums due to their relative inexperience on the road. Additionally, a history of accidents or traffic violations can result in higher premiums, as these factors indicate a higher risk of future claims.

Location and Driving Conditions

The location where the vehicle is primarily garaged and driven can significantly impact insurance quotes. Florida, with its diverse geography and climate, presents a range of driving conditions. For example, drivers in coastal areas may face higher insurance costs due to the risk of hurricanes and tropical storms, while those in urban areas may experience higher rates due to the increased risk of accidents and theft.

Coverage Levels and Deductibles

The level of coverage chosen by the driver, including the specific coverages and limits, directly affects the cost of insurance. Higher coverage limits and additional coverages will typically result in higher premiums. Additionally, the deductible chosen by the driver can impact the overall cost of insurance. A higher deductible may result in lower premiums, as it reduces the insurer’s risk exposure, but it also means the driver will have to pay more out of pocket in the event of a claim.

| Coverage Type | Average Cost in Florida |

|---|---|

| Liability Coverage | $500 - $1,200 annually |

| Comprehensive Coverage | $200 - $500 annually |

| Collision Coverage | $300 - $800 annually |

| Uninsured Motorist Coverage | $150 - $350 annually |

These averages provide a general idea of the cost of coverage in Florida, but actual quotes can vary widely based on individual circumstances and the specific insurance provider.

Shopping for Auto Insurance in Florida

When shopping for auto insurance in Florida, it’s essential to compare quotes from multiple providers to ensure you’re getting the best value for your money. Here are some steps to help you navigate the process:

Research Insurance Companies

Start by researching reputable insurance companies that offer coverage in Florida. Look for companies with a strong financial rating, positive customer reviews, and a history of paying claims promptly. Consider factors such as customer service, claim response times, and the range of coverage options offered.

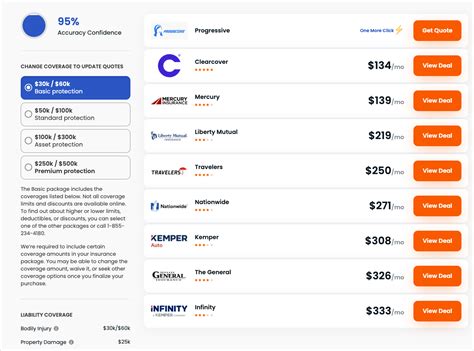

Obtain Multiple Quotes

Reach out to several insurance companies or use online comparison tools to obtain quotes for your specific situation. Be sure to provide accurate and detailed information about your vehicle, driving history, and desired coverage limits. Compare the quotes based on both price and the level of coverage provided.

Review Policy Details

When comparing quotes, carefully review the policy details to ensure you understand the coverage provided. Look for any exclusions or limitations that may impact your protection. Pay attention to the specific coverages, limits, and deductibles included in each quote to ensure they align with your needs.

Consider Bundling Options

Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. If you’re in the market for other types of insurance, consider the potential savings you could achieve by bundling your policies with a single provider. This can often result in significant cost savings and streamlined billing.

Understand Discounts and Savings

Insurance companies often offer a variety of discounts to help reduce the cost of coverage. These may include discounts for safe driving records, vehicle safety features, multi-policy bundles, or even certain professional affiliations. Be sure to inquire about available discounts and apply for those that are relevant to your situation.

Seek Professional Advice

If you’re unsure about the best coverage options for your needs, consider consulting with an independent insurance agent or broker. These professionals can provide expert advice tailored to your specific circumstances and help you navigate the complex world of auto insurance. They can also assist in comparing quotes and identifying potential savings opportunities.

Future Implications and Industry Insights

The auto insurance landscape in Florida is constantly evolving, influenced by technological advancements, changing regulations, and shifting market trends. Here are some key industry insights and future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which uses data from onboard sensors and GPS systems to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, use telematics data to offer customized insurance rates based on an individual’s actual driving habits. This technology has the potential to reward safe drivers with lower premiums and encourage safer driving practices overall.

Rising Claims Costs

The cost of auto insurance in Florida has been on the rise in recent years, in part due to increasing claims costs. Factors such as rising medical costs, increasing repair expenses, and a higher frequency of severe weather events have contributed to this trend. Insurance companies are responding by adjusting their rates to ensure they can continue to provide adequate coverage while remaining financially stable.

Regulatory Changes

The Florida Department of Financial Services (DFS) regularly reviews and updates insurance regulations to ensure fairness and consumer protection. Any changes in state regulations, such as modifications to the mandatory coverage requirements or the implementation of new laws, can have a significant impact on insurance costs and coverage options. Staying informed about these regulatory changes is essential for understanding the evolving insurance landscape in Florida.

Advancements in Vehicle Technology

Advancements in vehicle technology, such as autonomous driving features and advanced safety systems, have the potential to significantly impact auto insurance. These technologies can reduce the frequency and severity of accidents, leading to lower claims costs for insurance companies. As these technologies become more prevalent, insurance providers may adjust their underwriting practices and offer discounts or incentives for vehicles equipped with advanced safety features.

Competitive Market Dynamics

The auto insurance market in Florida is highly competitive, with a diverse range of providers offering various coverage options and pricing structures. This competition benefits consumers by driving down prices and encouraging innovation. However, it also means that insurance companies must continuously adapt their offerings and pricing strategies to remain competitive and attract new customers.

Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing focus on online platforms, mobile apps, and digital tools for policy management and claims processing. Insurance companies that embrace these technologies can offer more convenient and efficient services, improving the overall customer experience. Additionally, digital tools can provide consumers with greater transparency and control over their insurance coverage, making it easier to compare options and make informed decisions.

How can I reduce my auto insurance costs in Florida?

+There are several strategies you can employ to reduce your auto insurance costs in Florida. First, maintain a clean driving record by avoiding accidents and traffic violations. Insurance companies often offer discounts for safe driving records. Additionally, consider increasing your deductible, as this can result in lower premiums. Review your coverage options and ensure you’re not paying for unnecessary coverages. Finally, shop around and compare quotes from multiple insurance providers to find the best combination of price and coverage.

What are some common discounts offered by auto insurance companies in Florida?

+Common discounts offered by auto insurance companies in Florida include safe driver discounts, multi-policy discounts (for bundling auto and home insurance), good student discounts (for young drivers with good grades), and loyalty discounts for long-term customers. Some companies may also offer discounts for certain vehicle safety features, such as anti-theft devices or advanced driver assistance systems.

How can I ensure I’m getting the best value for my auto insurance in Florida?

+To ensure you’re getting the best value for your auto insurance in Florida, start by understanding your coverage needs and the mandatory requirements in the state. Compare quotes from multiple insurance providers, ensuring you’re comparing policies with similar coverage limits and deductibles. Read reviews and seek recommendations from trusted sources to assess the reputation and customer service of each provider. Finally, consider working with an independent insurance agent who can provide personalized advice and help you navigate the complex world of auto insurance.