Auto Insurance For Car Repairs

In the world of automotive ownership, unforeseen circumstances like accidents or mechanical failures are inevitable. When these events occur, having the right auto insurance coverage can be a crucial factor in ensuring a smooth and financially manageable repair process. This article aims to provide an in-depth exploration of auto insurance for car repairs, delving into the various aspects, considerations, and benefits that make it an essential component of vehicle ownership.

Understanding Auto Insurance Coverage for Repairs

Auto insurance policies are tailored to offer comprehensive protection for vehicle owners, and this includes coverage for a range of repair scenarios. While the specifics can vary based on the policy and the insurer, there are key components that are integral to understanding how auto insurance works for car repairs.

Collision Coverage

One of the primary types of coverage offered by auto insurance is collision coverage. This type of insurance is designed to cover the cost of repairs to your vehicle in the event of a collision, regardless of who is at fault. Collision coverage is essential for ensuring that you can get your car back on the road after an accident, without incurring substantial out-of-pocket expenses.

In a real-world example, imagine a scenario where you're driving and a deer suddenly runs into the road, resulting in a collision. With collision coverage, the insurance company will pay for the repairs to your vehicle, up to the limits specified in your policy. This coverage provides peace of mind, knowing that even in unforeseen accidents, your car can be restored to its pre-accident condition.

Comprehensive Coverage

In addition to collision coverage, auto insurance policies often include comprehensive coverage. This type of insurance covers damages to your vehicle that are not caused by a collision. Comprehensive coverage can include repairs for events like theft, vandalism, fire, or natural disasters. It is a critical component of auto insurance, as it ensures that your vehicle is protected against a wide range of potential risks.

Consider a situation where your parked car is vandalized, resulting in broken windows and damaged exterior. With comprehensive coverage, the insurance company will cover the cost of repairing these damages, helping you restore your vehicle without shouldering the entire financial burden. This type of coverage is especially beneficial for unexpected events that are beyond your control.

Deductibles and Policy Limits

When choosing an auto insurance policy, it’s important to understand the concept of deductibles and policy limits. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Policy limits, on the other hand, refer to the maximum amount the insurance company will pay for covered repairs or damages. Understanding these aspects is crucial, as they can significantly impact the financial implications of a repair scenario.

For instance, if your policy has a deductible of $500 and the repair costs for your vehicle amount to $3,000, you will be responsible for paying the first $500, while the insurance company covers the remaining $2,500. It's important to choose a deductible that aligns with your financial comfort level, as a higher deductible can lead to lower premiums, but a more substantial out-of-pocket expense in the event of a claim.

| Coverage Type | Description | Average Cost |

|---|---|---|

| Collision | Covers repair costs for accidents | $200 - $1,000 annually |

| Comprehensive | Covers non-collision damages | $150 - $300 annually |

The Benefits of Auto Insurance for Repairs

Auto insurance for car repairs offers a multitude of benefits that extend beyond the financial protection it provides. Understanding these advantages can help vehicle owners make informed decisions about their insurance coverage.

Financial Security

One of the most significant benefits of auto insurance for repairs is the financial security it offers. Repairs, especially those resulting from accidents or extensive damage, can be incredibly costly. Without insurance coverage, these expenses can quickly become overwhelming, potentially leading to financial strain or even debt. Auto insurance acts as a safety net, ensuring that vehicle owners can afford the necessary repairs without facing financial ruin.

For instance, a major accident that results in extensive body damage and engine repairs can easily cost tens of thousands of dollars. With auto insurance, a large portion of these costs are covered by the insurer, providing the policyholder with the financial means to get their vehicle back in working condition.

Peace of Mind

Having auto insurance for car repairs provides a sense of peace of mind for vehicle owners. Knowing that you are protected against unexpected repair costs can alleviate the stress and anxiety associated with potential accidents or mechanical failures. This peace of mind extends beyond the financial aspect, as it also ensures that you can continue using your vehicle without interruption, maintaining your daily routines and commitments.

Consider a scenario where you're on a long road trip and your car breaks down due to a mechanical issue. With auto insurance, you can rest assured that the necessary repairs will be covered, allowing you to continue your journey without worrying about the financial implications of the breakdown.

Quick and Efficient Repairs

Auto insurance companies often have established relationships with repair shops and mechanics, which can lead to quicker and more efficient repairs. These partnerships ensure that your vehicle is serviced by trusted professionals, and the insurance company can often expedite the repair process, getting you back on the road sooner.

In some cases, insurance companies may even offer preferred repair shops or mobile repair services, providing additional convenience and speed in the repair process. This benefit is especially valuable for busy individuals who rely on their vehicles for daily transportation or for those who prefer a hassle-free repair experience.

Legal Compliance and Liability Protection

In many jurisdictions, having auto insurance is not just a personal choice but a legal requirement. Carrying adequate insurance coverage ensures that you are in compliance with the law, avoiding potential penalties and legal consequences. Additionally, auto insurance provides liability protection, covering damages or injuries caused to others in the event of an accident for which you are at fault.

Liability coverage is especially important, as it protects your assets and finances in the event of a lawsuit resulting from an accident. This aspect of auto insurance is a critical component of responsible vehicle ownership, ensuring that you are protected against the potential financial fallout of an accident.

Choosing the Right Auto Insurance Coverage

Selecting the appropriate auto insurance coverage for your needs is a critical decision. It involves considering various factors, such as the value of your vehicle, your driving habits, and your financial situation. Here are some key considerations when choosing the right auto insurance for car repairs.

Assessing Your Needs

The first step in choosing auto insurance is to assess your needs. Consider the value of your vehicle, the likelihood of accidents or mechanical failures, and your financial capacity to handle unexpected repair costs. If you own an older vehicle with a lower market value, you may opt for more basic coverage, while newer, high-value vehicles may require comprehensive coverage to ensure adequate protection.

Additionally, consider your driving habits and the risks associated with your daily commute. If you frequently drive in high-risk areas or during hazardous weather conditions, you may want to opt for more extensive coverage to mitigate the increased chances of an accident or damage.

Comparing Insurance Providers

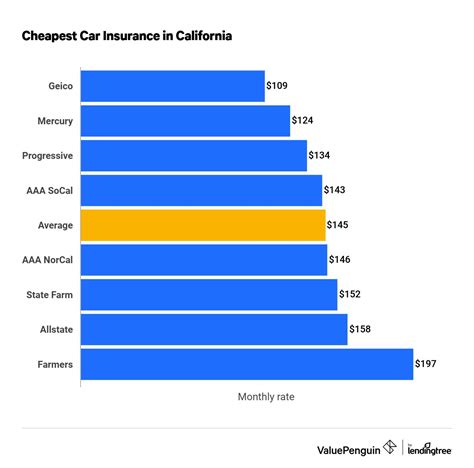

The market for auto insurance is highly competitive, with numerous providers offering a range of policies and coverage options. It’s essential to compare insurance providers to find the best fit for your needs. Look for insurers with a strong reputation for customer service and claim handling, as this can significantly impact your experience in the event of a repair scenario.

When comparing providers, consider factors such as coverage options, deductibles, policy limits, and any additional benefits or discounts they offer. Some insurers may provide incentives like loyalty discounts, safe driver rewards, or multi-policy discounts, which can make their offerings more attractive and cost-effective.

Understanding Policy Terms and Conditions

Before finalizing your auto insurance policy, it’s crucial to understand the terms and conditions of the coverage. Read through the policy document carefully, paying attention to the specific exclusions, limitations, and conditions that may apply to your coverage. This ensures that you are fully aware of what is and isn’t covered by your policy.

Additionally, be mindful of any policy exclusions that may impact your coverage. For instance, some policies may exclude coverage for certain types of damage, such as wear and tear or mechanical breakdowns that occur due to regular use. Understanding these exclusions is essential to ensure that you are not left with unexpected repair costs.

Seeking Professional Advice

If you’re unsure about which auto insurance coverage to choose, consider seeking professional advice from an insurance broker or financial advisor. These experts can provide guidance based on your specific circumstances and needs, helping you navigate the complex world of auto insurance policies. They can offer insights into the best coverage options, potential savings, and any additional benefits that may be available to you.

Insurance brokers often have access to a wide range of insurance providers and can shop around to find the best policy for your needs. Their expertise can be invaluable in ensuring that you have the right coverage at a competitive price, providing peace of mind and financial security for your vehicle ownership journey.

The Future of Auto Insurance for Repairs

The auto insurance industry is continually evolving, and the future holds exciting developments that will further enhance the experience of vehicle ownership. As technology advances, auto insurance providers are exploring innovative ways to improve the repair process and enhance coverage options.

Telematics and Usage-Based Insurance

One of the emerging trends in auto insurance is the use of telematics and usage-based insurance. Telematics involves the use of technology to track driving behavior, such as speed, acceleration, and braking patterns. This data can be used to offer more personalized insurance rates, rewarding safe driving habits with lower premiums. Usage-based insurance takes this concept further, offering real-time tracking and adjusting premiums based on actual usage.

For instance, if you primarily drive during off-peak hours and maintain a safe driving record, your insurance provider may offer you a discounted rate, recognizing your low-risk driving behavior. This technology-driven approach to insurance not only encourages safer driving but also provides a more tailored and cost-effective insurance experience.

Enhanced Repair Networks and Technologies

Auto insurance companies are also investing in enhanced repair networks and technologies to improve the repair process. This includes partnerships with advanced repair shops that utilize cutting-edge technologies, such as computer-aided design (CAD) systems for precise repairs and diagnostics. These networks ensure that vehicles are repaired with the highest level of accuracy and efficiency, getting policyholders back on the road faster.

Additionally, some insurance providers are exploring the use of virtual reality (VR) technologies for repair estimates and inspections. VR can provide a more immersive and accurate assessment of vehicle damage, reducing the need for physical inspections and speeding up the claims process. This innovation not only improves efficiency but also enhances the overall customer experience.

Predictive Analytics and Risk Assessment

The future of auto insurance also involves the use of predictive analytics and risk assessment tools. These technologies leverage data and advanced algorithms to predict potential risks and identify areas where coverage can be optimized. By analyzing patterns and trends, insurance providers can offer more precise and tailored coverage options, ensuring that policyholders are adequately protected without overpaying for unnecessary coverage.

For example, predictive analytics can identify high-risk areas for certain types of accidents or mechanical failures, allowing insurance providers to offer specialized coverage or discounts for policyholders who take preventive measures, such as regular vehicle maintenance or driver training.

Conclusion

Auto insurance for car repairs is a critical component of responsible vehicle ownership. It provides financial security, peace of mind, and the assurance of quick and efficient repairs. By understanding the various types of coverage, their benefits, and the factors to consider when choosing a policy, vehicle owners can make informed decisions to protect their investments and ensure a smooth driving experience.

As the auto insurance industry continues to evolve, the future holds exciting prospects, with technology-driven innovations enhancing the repair process and offering more personalized and efficient coverage options. With the right auto insurance coverage, vehicle owners can drive with confidence, knowing they are protected against the unexpected.

What happens if I’m in an accident and my vehicle is not repairable?

+In the event that your vehicle is deemed a total loss and is not repairable, your insurance company will typically pay out the actual cash value of the vehicle. This means you’ll receive a payout based on the vehicle’s current market value, minus any applicable deductibles.

Can I choose my own repair shop, or does the insurance company dictate where I take my vehicle for repairs?

+While insurance companies often have preferred repair shops, you generally have the right to choose your own repair facility. However, it’s important to check your policy and discuss this with your insurer to ensure that your choice of repair shop is covered under your policy.

How can I lower my auto insurance premiums while still maintaining adequate coverage for repairs?

+To lower your premiums while maintaining sufficient coverage, consider increasing your deductible. A higher deductible can lead to lower premiums, but it’s important to ensure that the increased deductible aligns with your financial comfort level in the event of a claim.