Auto Insurance Liability Coverage Limits

Liability insurance is a crucial component of any auto insurance policy, as it provides financial protection for policyholders in the event they are found legally responsible for causing harm or damage to others while driving. Understanding liability coverage limits is essential for both individuals and businesses, as it ensures adequate protection against potential risks and liabilities on the road. This article delves into the intricacies of auto insurance liability coverage limits, exploring the key aspects, considerations, and real-world implications for drivers and businesses alike.

Understanding Liability Coverage Limits

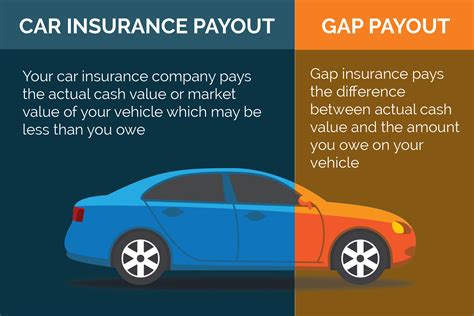

Liability coverage limits refer to the maximum amount an insurance company will pay for bodily injury and property damage claims resulting from an at-fault accident. These limits are typically expressed as three numbers, such as 100/300/100, representing thousands of dollars. In this example, the liability limits would be 100,000 per person</strong> for bodily injury, <strong>300,000 per accident for bodily injury, and $100,000 per accident for property damage.

Bodily Injury Liability Coverage

Bodily injury liability coverage is a critical component of auto insurance, as it protects the policyholder against claims for injuries or fatalities caused to others in an accident. This coverage pays for medical expenses, lost wages, and pain and suffering resulting from the accident. The first number in the liability limits, such as $100,000, represents the maximum amount the insurance company will pay for bodily injury to one person in a single accident.

In a real-world example, if a policyholder with a liability limit of $100,000 per person is involved in an accident that causes serious injuries to another driver, the insurance company would pay up to $100,000 for that individual's medical expenses and other related costs. However, if the total damages exceed this limit, the policyholder may be held personally responsible for any remaining costs.

Property Damage Liability Coverage

Property damage liability coverage protects the policyholder against claims for damage to others’ property in an accident. This coverage pays for repairs or replacements of vehicles, structures, or other property damaged in the accident. The third number in the liability limits, such as $100,000, represents the maximum amount the insurance company will pay for property damage in a single accident.

Imagine a scenario where a policyholder with a liability limit of $100,000 per accident for property damage accidentally collides with multiple vehicles in a parking lot. If the total cost of repairs exceeds $100,000, the insurance company would pay up to this limit, and the policyholder would be responsible for any remaining costs.

Understanding the Difference: Per Person vs. Per Accident Limits

It’s important to distinguish between the “per person” and “per accident” limits in liability coverage. The “per person” limit, such as 100,000</strong>, represents the maximum amount the insurance company will pay for bodily injury to one person in a single accident. On the other hand, the <strong>"per accident"</strong> limit, such as <strong>300,000, is the maximum amount the insurance company will pay for bodily injury to all persons involved in a single accident.

For instance, if a policyholder with a 100/300/100 liability limit is involved in an accident causing injuries to multiple people, the insurance company would pay up to $100,000 for each person's injuries, with a total maximum payout of $300,000 for all injuries combined.

Selecting the Right Liability Coverage Limits

Choosing the appropriate liability coverage limits is a critical decision that can significantly impact an individual’s or business’s financial well-being. While higher limits provide greater protection, they also result in higher insurance premiums. It’s essential to strike a balance between adequate coverage and affordability.

Factors to Consider When Choosing Liability Limits

- Personal or Business Assets: Individuals and businesses should consider their net worth and the value of their assets when selecting liability limits. Higher limits provide greater protection against lawsuits that could potentially result in the loss of personal or business assets.

- Risk Profile: Understanding one’s risk profile is crucial. Factors such as driving history, frequency of driving, and the type of vehicle driven can influence the choice of liability limits. Those with a higher risk profile may benefit from higher limits to ensure adequate protection.

- State Requirements: Different states have varying minimum liability coverage requirements. It’s essential to understand the minimum limits required by law in your state and consider whether these limits are sufficient for your needs.

- Cost-Benefit Analysis: When selecting liability limits, individuals and businesses should conduct a cost-benefit analysis. Higher limits typically result in higher premiums, so it’s important to find a balance between coverage and affordability.

Recommended Liability Coverage Limits

While there is no one-size-fits-all recommendation for liability coverage limits, industry experts generally suggest higher limits to provide adequate protection. The following are some commonly recommended liability coverage limits:

- Individuals: Many experts recommend liability limits of at least 300/500/100 or higher for individuals. This provides a higher level of protection, especially for those with significant assets or a higher risk profile.

- Businesses: Businesses, particularly those that rely heavily on vehicles or have a higher risk of accidents, should consider liability limits of 1,000,000 or more. This ensures adequate protection against potential lawsuits and minimizes the financial impact of accidents.

Real-World Scenarios and Implications

Understanding liability coverage limits becomes even more crucial when considering real-world scenarios and the potential financial implications. Let’s explore a few examples to illustrate the significance of adequate liability coverage.

Scenario 1: Bodily Injury Claim

Imagine a scenario where a policyholder with a liability limit of 100/300/100 is involved in an accident causing serious injuries to another driver and their passenger. The total medical expenses, lost wages, and pain and suffering claims amount to 250,000</strong>. In this case, the insurance company would pay up to <strong>100,000 for each person’s injuries, totaling 200,000</strong>. However, the policyholder would be responsible for the remaining <strong>50,000, which could have a significant financial impact.

Scenario 2: Property Damage Claim

Consider a situation where a policyholder with a liability limit of 100/300/100 accidentally collides with multiple vehicles in a parking lot, causing extensive damage. The total cost of repairs exceeds 150,000</strong>. The insurance company would pay up to <strong>100,000 for property damage, leaving the policyholder responsible for the remaining $50,000 in repairs.

Scenario 3: Combined Bodily Injury and Property Damage Claim

In a more complex scenario, a policyholder with a liability limit of 100/300/100 is involved in an accident causing serious injuries to two people and significant property damage. The total bodily injury claims amount to 180,000</strong>, and the property damage claims total <strong>120,000. In this case, the insurance company would pay 100,000</strong> for each person's injuries and <strong>100,000 for property damage, resulting in a total payout of 300,000</strong>. However, the policyholder would still be responsible for the remaining <strong>20,000 in bodily injury claims, highlighting the importance of higher liability limits.

The Role of Umbrella Insurance

For individuals and businesses seeking additional liability protection beyond their auto insurance policy, umbrella insurance is an essential consideration. Umbrella insurance provides excess liability coverage, offering protection above and beyond the limits of primary insurance policies, such as auto and homeowners insurance.

Understanding Umbrella Insurance

Umbrella insurance policies typically have minimum liability limits of 1,000,000</strong> and can provide coverage up to <strong>5,000,000 or even higher. This additional coverage extends to a wide range of personal and business liabilities, including auto accidents, property damage, and personal liability claims.

Benefits of Umbrella Insurance

- Increased Protection: Umbrella insurance provides an additional layer of protection, ensuring that individuals and businesses are adequately covered for potential liabilities.

- Cost-Effective: Umbrella insurance policies are often relatively affordable, especially when considering the high limits of coverage they provide.

- Broad Coverage: Umbrella insurance covers a wide range of liabilities, including those not typically covered by primary insurance policies.

Conclusion

Understanding auto insurance liability coverage limits is crucial for individuals and businesses to ensure they have adequate protection against potential risks and liabilities on the road. By selecting appropriate liability limits and considering the need for umbrella insurance, policyholders can safeguard their financial well-being and protect their assets. Real-world scenarios highlight the importance of higher limits and the potential financial implications of inadequate coverage. With the right insurance coverage in place, drivers and businesses can navigate the roads with confidence, knowing they are prepared for the unexpected.

What happens if I exceed my liability coverage limits in an accident?

+

If you exceed your liability coverage limits in an accident, you may be held personally responsible for any remaining costs. This means that your insurance company will pay up to the limit of your policy, but you will be liable for any damages or claims that exceed this limit. It’s crucial to choose liability limits that provide adequate protection to minimize the financial impact of such situations.

Are liability coverage limits the same in every state?

+

No, liability coverage limits can vary from state to state. Each state has its own minimum liability coverage requirements, which may differ in terms of the per person and per accident limits. It’s important to understand the specific requirements of your state and consider whether these limits are sufficient for your needs.

Can I increase my liability coverage limits after purchasing my auto insurance policy?

+

Yes, you can typically increase your liability coverage limits at any time by contacting your insurance provider and requesting a policy change. However, it’s important to note that increasing your limits may result in higher insurance premiums. It’s advisable to regularly review your coverage and adjust your limits as needed to ensure adequate protection.