Auto Insurance Low Rate

Auto insurance is a necessity for every vehicle owner, but finding the best rates can be a daunting task. With countless providers offering different policies and premiums, it's easy to get overwhelmed. However, with the right knowledge and a strategic approach, you can secure low auto insurance rates that fit your budget and needs. In this comprehensive guide, we will delve into the world of auto insurance, exploring the factors that influence rates, sharing expert tips, and providing real-world examples to help you navigate the process confidently.

Understanding the Factors that Impact Auto Insurance Rates

Several key factors come into play when determining auto insurance rates. By understanding these influences, you can make informed decisions to secure the best possible premiums. Here’s an overview of the primary considerations:

Driving History

Your driving record is a significant determinant of your insurance rates. A clean driving history, free from accidents, violations, and claims, is likely to result in lower premiums. On the other hand, a history marred by accidents, speeding tickets, or DUI convictions will lead to higher rates. Insurance companies view drivers with a clean record as lower risk, making them eligible for discounts and lower premiums.

| Driving Record Status | Average Rate Impact |

|---|---|

| Clean Record | 5%–10% Discount |

| Minor Violations | 5%–15% Increase |

| Major Accidents | 20%–30% Increase |

Note: The rate impact varies based on the severity of the violation or accident and the insurance provider's policies.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also influence your insurance rates. Generally, sports cars, luxury vehicles, and high-performance cars are considered more risky and expensive to insure due to their higher repair costs and potential for speed-related accidents. Additionally, the purpose for which you use your vehicle matters. If you primarily use your car for personal use, your rates will be different from those who use their vehicles for business or commercial purposes.

Location and Mileage

Your geographic location and annual mileage are other critical factors in determining insurance rates. Areas with higher crime rates, more frequent accidents, or severe weather conditions often have higher insurance premiums. Additionally, the number of miles you drive annually affects your risk profile. Higher mileage typically results in increased premiums due to the higher likelihood of being involved in an accident.

Demographics and Credit Score

Certain demographic factors, such as age, gender, and marital status, can also impact insurance rates. Younger drivers, especially males under 25, are often considered higher risk due to their lack of driving experience and higher propensity for accidents. Similarly, your credit score can influence your insurance rates. Many insurance companies use credit-based insurance scores to assess your financial responsibility, with higher scores resulting in lower premiums.

Tips to Secure Low Auto Insurance Rates

Now that we’ve explored the key factors influencing auto insurance rates, let’s dive into some expert tips to help you secure the best possible premiums.

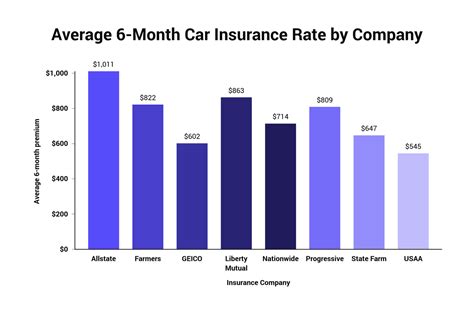

Shop Around and Compare Quotes

One of the most effective ways to find low auto insurance rates is to shop around and compare quotes from multiple providers. Each insurance company uses different rating factors and algorithms to calculate premiums, so it’s essential to obtain quotes from various sources. Online quote comparison tools can be incredibly helpful in this process, allowing you to quickly and easily gather quotes from numerous insurers.

Consider Bundle Discounts

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts when you combine multiple policies, resulting in substantial savings on your overall premiums. By bundling your insurance, you not only save money but also simplify your insurance management, as you’ll only have one provider to deal with.

Take Advantage of Discounts

Insurance companies offer various discounts to incentivize certain behaviors and attract specific customer segments. Some common discounts include:

- Safe Driver Discount: This discount is offered to drivers with a clean driving record, free from accidents or violations for a certain period.

- Good Student Discount: Students under 25 who maintain a certain GPA or rank in their class may be eligible for this discount.

- Defensive Driving Course Discount: Completing an approved defensive driving course can earn you a discount on your insurance premium.

- Low Mileage Discount: If you drive fewer miles annually, you may qualify for a low-mileage discount.

- Multi-Policy Discount: Similar to the bundle discount, this applies when you have multiple policies with the same provider.

Raise Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can significantly lower your insurance premiums. However, it’s essential to ensure that your deductible is an amount you can comfortably afford to pay in the event of a claim. This strategy works best for responsible drivers with a low risk of making claims.

Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Maintaining a good credit score can help you secure lower premiums. If your credit score is less than ideal, consider taking steps to improve it, such as paying your bills on time, reducing your debt, and regularly monitoring your credit report for inaccuracies.

Choose the Right Coverage

When selecting auto insurance coverage, it’s crucial to choose the right amount and type of coverage for your needs. While it’s tempting to opt for the most extensive coverage available, this may not always be necessary or cost-effective. Evaluate your vehicle’s value, your personal financial situation, and the level of risk you’re comfortable with to determine the appropriate coverage limits for liability, comprehensive, and collision insurance.

Real-World Examples of Low Auto Insurance Rates

To illustrate the impact of the factors and strategies discussed above, let’s explore some real-world examples of how individuals have secured low auto insurance rates.

Example 1: Safe Driver Discount

John, a 30-year-old professional, has maintained a clean driving record for over 10 years. He recently switched insurance providers and was able to secure a 10% safe driver discount on his premium. By shopping around and comparing quotes, he found an insurer that offered this discount, resulting in a significant savings on his annual insurance cost.

Example 2: Bundle Discount

Sarah, a homeowner and car owner, recently moved to a new city. She decided to bundle her home and auto insurance policies with the same provider. By doing so, she qualified for a 15% bundle discount on her total premiums, saving her a substantial amount each year.

Example 3: Low Mileage Discount

Michael, a retired individual, primarily uses his vehicle for local errands and occasional long-distance travel. He drives fewer than 5,000 miles annually. When he renewed his insurance policy, he qualified for a low-mileage discount, resulting in a 10% reduction in his premium.

Example 4: Defensive Driving Course Discount

Emily, a 22-year-old student, recently completed a defensive driving course through her university. By providing her insurance provider with the course completion certificate, she was eligible for a 5% discount on her premium, further reducing her insurance costs.

Conclusion

Securing low auto insurance rates requires a combination of understanding the factors that influence premiums, implementing strategic approaches, and taking advantage of available discounts. By following the expert tips outlined in this guide and learning from real-world examples, you can confidently navigate the auto insurance landscape and find the best rates that meet your needs and budget.

How often should I review and compare my auto insurance rates?

+

It’s recommended to review and compare your auto insurance rates at least once a year, or whenever your policy is up for renewal. This allows you to stay up-to-date with the market and take advantage of any new discounts or promotions offered by insurance providers.

Can my insurance rates change during the policy period?

+

Yes, your insurance rates can change during the policy period. Insurance companies may adjust rates based on various factors, such as changes in your driving record, vehicle usage, or even external market conditions. It’s important to stay informed and regularly review your policy to ensure you’re still getting the best rates.

Are there any disadvantages to switching insurance providers frequently?

+

Switching insurance providers frequently can have potential disadvantages. Firstly, it may impact your driving record, as some insurers consider frequent changes as a sign of higher risk. Additionally, it can be time-consuming and may require additional paperwork. However, if you consistently find better rates with other providers, it may be worth the effort to switch.