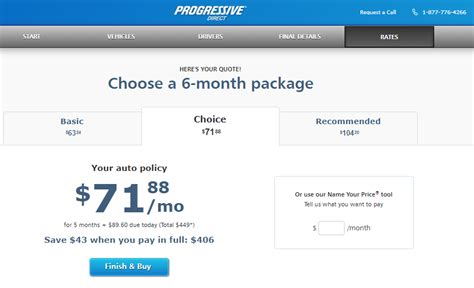

Auto Insurance Progressive Quote

Welcome to the comprehensive guide on understanding Progressive's auto insurance quotes. In this article, we will delve into the world of Progressive Insurance, exploring the factors that influence their quotes and providing you with the knowledge to make informed decisions about your vehicle coverage. With Progressive being one of the largest auto insurers in the United States, it's essential to understand their quotation process to secure the best possible coverage for your unique needs.

Unraveling Progressive’s Auto Insurance Quote Process

Progressive Insurance has built a reputation for offering innovative and flexible auto insurance solutions. Their quote process is designed to provide personalized coverage options, ensuring you get the right protection for your vehicle. Here’s an in-depth look at the key aspects that influence Progressive’s auto insurance quotes.

Understanding Progressive’s Coverage Options

Progressive Insurance offers a wide range of coverage options to cater to various driver needs. These include:

- Liability Coverage: This is the foundation of any auto insurance policy, covering bodily injury and property damage claims made against you in an at-fault accident.

- Collision Coverage: This optional coverage pays for repairs or replacements of your vehicle if it’s damaged in a collision, regardless of fault.

- Comprehensive Coverage: It covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you in the event of an accident with a driver who doesn’t have sufficient insurance.

- Medical Payments Coverage: Provides coverage for medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Covers a wide range of medical expenses and lost wages, often mandatory in no-fault states.

Factors Influencing Progressive’s Quotes

Progressive, like most insurers, considers a variety of factors when calculating auto insurance quotes. These factors help them assess the risk associated with insuring a particular vehicle and driver. Here are some of the key considerations:

- Vehicle Type and Usage: The make, model, and year of your vehicle, along with its primary usage (e.g., commuting, business, pleasure), can impact your quote. Vehicles with a higher likelihood of accidents or theft may result in higher premiums.

- Driver Information: Your driving history, including any accidents, violations, and claims, is a critical factor. Progressive may also consider your age, gender, and marital status, as these demographics can influence driving behavior.

- Location and Usage: Where you live and how often you drive can affect your quote. Areas with higher accident rates or theft incidents may have higher premiums. Additionally, frequent driving can increase the risk of accidents.

- Credit History: In many states, insurers use credit-based insurance scores to assess risk. A good credit history can potentially lead to lower premiums.

- Claims History: A history of frequent claims can signal higher risk to insurers, potentially resulting in higher quotes.

- Coverage Selection: The coverage options and limits you choose will directly impact your quote. Higher coverage limits and additional coverages will increase your premium.

Progressive’s Discounts and Savings

Progressive Insurance offers a range of discounts to help drivers save on their auto insurance premiums. These discounts can significantly reduce the overall cost of your coverage. Here are some of the notable discounts Progressive provides:

- Multi-Policy Discount: If you bundle your auto insurance with other policies, such as homeowners or renters insurance, Progressive may offer a discount.

- Multi-Car Discount: Having multiple vehicles insured with Progressive can lead to savings.

- Snapshot Discount: Progressive’s usage-based insurance program, Snapshot, allows you to save by linking your driving behavior to your policy. Safe driving habits can result in significant discounts.

- Good Student Discount: If you’re a young driver with good grades, Progressive may offer a discount, encouraging safe driving practices.

- Continuous Insurance Discount: Maintaining continuous auto insurance coverage can result in savings, as it demonstrates a stable and responsible driver profile.

- Paperless Discount: Opting for paperless billing and policy documents can save you a small percentage on your premium.

Comparing Progressive’s Quotes with Other Insurers

It’s always a good practice to compare quotes from multiple insurers to ensure you’re getting the best deal. Progressive’s quotes should be benchmarked against other leading auto insurers to understand their competitiveness in the market. Factors to consider when comparing quotes include:

- Coverage Options: Ensure that you’re comparing quotes with similar coverage limits and options. This ensures an apples-to-apples comparison.

- Discounts: Take into account the discounts offered by each insurer. Progressive’s Snapshot program, for instance, may provide significant savings for safe drivers, which should be considered when comparing quotes.

- Customer Service and Claims Handling: Research the insurer’s reputation for customer service and claims handling. While quotes are important, the overall experience with the insurer is just as crucial.

- Financial Strength: Check the financial strength ratings of the insurers you’re considering. A strong financial rating indicates the insurer’s ability to pay claims.

Understanding Progressive’s Claims Process

In the event of an accident or incident, understanding the claims process is essential. Progressive has a well-established claims process designed to make filing a claim as smooth as possible. Here’s an overview:

- Reporting the Claim: You can report a claim to Progressive 24⁄7 by phone, online, or through their mobile app. Provide as much detail as possible about the incident, including any injuries or damages.

- Claims Adjustment: A claims adjuster will be assigned to evaluate your claim. They will review the details, assess the damages, and determine liability. Progressive aims to provide a quick and fair assessment.

- Repairs and Settlements: Once the claim is approved, Progressive will either arrange for repairs at a preferred repair shop or provide a settlement amount for you to handle the repairs yourself. In some cases, they may offer a rental car while your vehicle is being repaired.

- Communication and Updates: Progressive strives to keep you informed throughout the claims process. You can expect regular updates on the status of your claim and any necessary next steps.

Tips for Securing the Best Progressive Quote

To get the most accurate and competitive quote from Progressive, consider the following tips:

- Be Honest and Accurate: Provide accurate and honest information about your vehicle, driving history, and coverage needs. Misrepresenting information can lead to issues down the line.

- Shop Around: Compare Progressive’s quotes with those from other reputable insurers. This ensures you’re getting the best value for your insurance dollar.

- Consider Bundle Discounts: If you have other insurance needs, such as homeowners or renters insurance, explore the potential savings of bundling these policies with your auto insurance.

- Review Your Coverage Annually: Your life and circumstances can change, so it’s essential to review your coverage annually. Progressive may have new discounts or coverage options that can benefit you.

- Ask About Discounts: Don’t hesitate to inquire about all the discounts you may be eligible for. Progressive’s agents can guide you through the available options.

Future Trends in Progressive’s Auto Insurance

Progressive Insurance is known for its innovative approach to auto insurance. As the industry evolves, they continue to adapt and introduce new technologies and services. Here’s a glimpse into the future of Progressive’s auto insurance:

- Telematics and Usage-Based Insurance: Progressive’s Snapshot program is a pioneer in usage-based insurance. As technology advances, we can expect more sophisticated telematics systems that provide even more accurate data on driving behavior, leading to more personalized premiums.

- Artificial Intelligence and Machine Learning: Progressive is likely to leverage AI and machine learning to enhance their underwriting and claims processes. These technologies can improve accuracy and efficiency, potentially reducing costs for customers.

- Connected Car Technology: With the rise of connected cars, Progressive may explore partnerships or develop technologies that integrate with vehicle systems, providing real-time data on driving behavior and vehicle health.

- Autonomous Vehicles: As self-driving cars become a reality, Progressive will need to adapt its insurance offerings to cater to this new paradigm. They may develop specialized coverage for autonomous vehicles, addressing unique risks and liabilities.

- Enhanced Customer Experience: Progressive has already invested in digital tools and mobile apps to enhance the customer experience. We can expect further improvements, making it easier and more convenient for customers to manage their policies and file claims.

How often should I review my auto insurance policy with Progressive?

+It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and that you’re taking advantage of any new discounts or coverage options.

Can I get a Progressive quote without providing my Social Security Number?

+Yes, you can obtain a quote without providing your Social Security Number. Progressive understands the sensitivity of this information and may request it only if you decide to purchase a policy.

How does Progressive’s Snapshot program work, and how much can I save with it?

+The Snapshot program uses a small device or a mobile app to track your driving behavior, such as speeding and braking habits. The data is used to calculate a personalized discount. Savings can vary, but safe drivers can expect significant discounts.

What should I do if I’m not satisfied with my Progressive quote?

+If you’re not satisfied with your quote, it’s recommended to reach out to Progressive’s customer service team. They can review your quote, discuss your concerns, and potentially offer alternative coverage options or discounts.

Can I add rental car coverage to my Progressive auto insurance policy?

+Yes, Progressive offers rental car coverage as an optional add-on to your auto insurance policy. This coverage provides reimbursement for the cost of renting a vehicle if your insured car is in the shop for repairs covered by your policy.