Auto Insurance Purchase Online

In today's digital age, purchasing auto insurance has become more accessible and convenient than ever before. With just a few clicks, drivers can now compare policies, customize coverage, and complete the entire insurance purchase process online. This article delves into the world of online auto insurance purchases, exploring the benefits, the process, and the key considerations to help you make an informed decision.

The Rise of Online Auto Insurance: A Digital Revolution

The traditional method of buying auto insurance, involving visits to physical offices and lengthy paperwork, has undergone a significant transformation. The digital revolution has empowered consumers, providing them with an efficient and transparent way to purchase insurance. Online auto insurance platforms offer a user-friendly interface, allowing drivers to obtain quotes, review policy details, and make informed choices about their coverage.

This shift towards digital insurance purchasing has gained momentum, particularly with the increasing reliance on technology and the desire for instant gratification. Insurers have recognized the importance of embracing digital platforms to cater to the evolving preferences of their customers.

Benefits of Purchasing Auto Insurance Online

Online auto insurance purchases offer a multitude of advantages, revolutionizing the way drivers obtain coverage. Here are some key benefits that make online insurance purchasing an attractive option:

Convenience and Accessibility

One of the most significant advantages of online insurance purchasing is the unparalleled convenience it provides. With 24⁄7 access to insurance platforms, drivers can obtain quotes, compare policies, and complete the entire process from the comfort of their homes or on the go. This flexibility eliminates the need for time-consuming appointments or visits to insurance offices.

Additionally, online insurance purchasing accommodates individuals with busy schedules or those who prefer the privacy and ease of conducting transactions digitally. Whether it's during lunch breaks, late at night, or on weekends, the online platform is always accessible, ensuring a seamless and efficient experience.

Instant Quotes and Comparisons

Obtaining instant quotes is a game-changer in the insurance industry. Online platforms utilize sophisticated algorithms to provide drivers with personalized quotes based on their specific needs and circumstances. This feature allows drivers to quickly assess multiple policies, compare coverages, and identify the best value for their money.

By entering their details once, drivers can receive multiple quotes from various insurers, enabling them to make informed decisions without the hassle of contacting each provider individually. This instant comparison feature saves time and effort, ensuring drivers can secure the most suitable coverage for their needs.

Customization and Personalization

Online auto insurance platforms empower drivers to tailor their coverage to their unique requirements. Whether it’s adjusting deductibles, selecting additional endorsements, or opting for specific add-ons, drivers have the flexibility to create a policy that aligns with their budget and needs.

This level of customization ensures that drivers are not paying for coverage they don't need, and it allows them to optimize their insurance spending. By having control over their policy, drivers can make informed decisions, ensuring they are adequately protected without overspending.

Paperless Process and Environmental Benefits

The online insurance purchasing process is inherently paperless, which aligns with the growing trend of digital transformation and sustainability. By eliminating the need for physical paperwork, online platforms reduce their environmental impact and contribute to a greener future.

Additionally, the paperless process streamlines the entire insurance journey, making it faster and more efficient. Drivers can receive their policy documents and certificates instantly, without the wait times associated with traditional mail delivery. This digital approach not only benefits the environment but also enhances the overall customer experience.

The Online Auto Insurance Purchase Process: Step-by-Step Guide

Understanding the step-by-step process of purchasing auto insurance online is crucial to making an informed decision. Here’s a comprehensive guide to walk you through each stage:

Step 1: Research and Compare Insurers

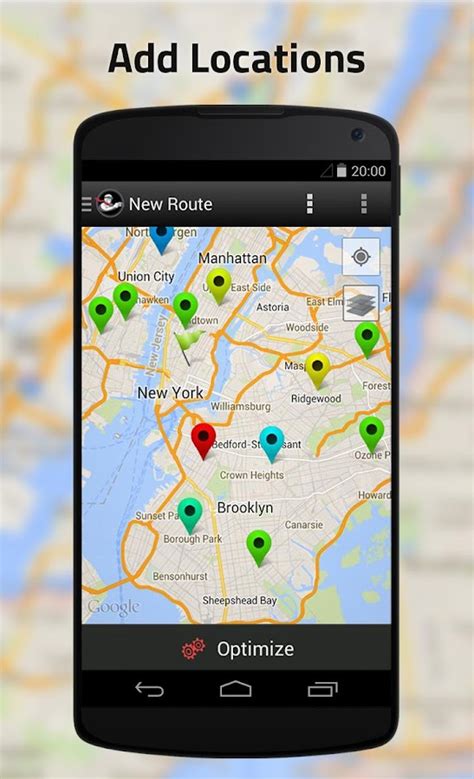

Before initiating the purchase process, it’s essential to research and compare different insurance providers. Explore reputable online platforms that aggregate insurance quotes from multiple insurers. Consider factors such as financial stability, customer satisfaction ratings, and the range of coverage options offered.

By reviewing online reviews and ratings, you can gain insights into the experiences of other policyholders. This step ensures that you choose an insurer that aligns with your specific needs and provides a positive customer experience.

Step 2: Obtain Quotes and Assess Coverage

Utilize online quote tools to obtain personalized quotes from multiple insurers. These tools require basic information such as your age, location, vehicle details, and driving history. Based on this data, you’ll receive instant quotes, allowing you to compare coverage, premiums, and additional features.

Assess the coverage options carefully, ensuring that you understand the limits, deductibles, and any exclusions. Consider your specific needs and circumstances, such as the value of your vehicle, the level of liability protection required, and any additional coverage you may desire (e.g., rental car reimbursement, roadside assistance, etc.).

Step 3: Customize Your Policy

Once you’ve identified the insurer that best meets your needs, it’s time to customize your policy. Online platforms provide an intuitive interface that allows you to select the coverage limits, deductibles, and any additional endorsements or add-ons.

Tailor your policy to your budget and requirements, ensuring you have the right balance of coverage and affordability. Consider any discounts or promotions offered by the insurer, as these can further reduce your premium costs.

Step 4: Review and Purchase

Before finalizing your purchase, thoroughly review the policy details, including the coverage limits, exclusions, and any additional provisions. Ensure that the policy accurately reflects your needs and expectations.

Once you're satisfied with the policy, proceed with the payment process. Online platforms offer secure payment gateways, allowing you to complete the transaction using various payment methods, such as credit/debit cards, e-wallets, or bank transfers.

Upon successful payment, you'll receive an instant confirmation and your policy documents, which can be downloaded and stored for future reference. Some insurers may also provide the option to have the policy documents mailed to you.

Key Considerations for a Successful Online Insurance Purchase

While the online insurance purchasing process offers convenience and efficiency, there are some key considerations to keep in mind to ensure a smooth and successful experience:

Understand Your Coverage Needs

Before purchasing auto insurance online, take the time to assess your specific coverage needs. Consider factors such as the value of your vehicle, your driving record, and any unique circumstances (e.g., frequent long-distance travel, high-risk areas, etc.).

Understanding your coverage requirements will help you choose a policy that provides adequate protection without unnecessary expenses. Research the different types of coverage available, such as liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage.

Compare Multiple Quotes

Don’t settle for the first quote you receive. Take advantage of the online comparison tools to obtain quotes from multiple insurers. By comparing premiums, coverage limits, and additional features, you can identify the best value for your money.

Consider not only the price but also the reputation and financial stability of the insurer. A low premium may be attractive, but it's crucial to ensure that the insurer has a strong financial standing and a positive track record of claims handling.

Read the Policy Documents Thoroughly

Before finalizing your purchase, take the time to read through the policy documents carefully. These documents outline the terms, conditions, coverage limits, and any exclusions or restrictions. Understanding the fine print ensures that you are aware of your rights and responsibilities as a policyholder.

If you have any questions or concerns about the policy, don't hesitate to reach out to the insurer's customer support team. They can provide clarification and ensure that you fully comprehend the coverage you're purchasing.

Consider Add-ons and Endorsements

Online insurance platforms often offer a range of add-ons and endorsements that can enhance your coverage. These additional features may include rental car coverage, roadside assistance, gap insurance, or accident forgiveness.

Evaluate whether these add-ons are necessary for your specific circumstances. While they may increase your premium, they can provide valuable protection in certain situations. Consider your driving habits, the likelihood of specific incidents, and the potential financial impact to determine if these add-ons are worth the added cost.

Review Payment Options and Discounts

Explore the payment options offered by the insurer, including the availability of installment plans, electronic payments, or discounts for paying in full. Consider your financial situation and preferences to choose the most suitable payment method.

Additionally, inquire about any discounts or promotions that may be applicable to your policy. Insurers often offer discounts for various reasons, such as safe driving records, bundling multiple policies, or having certain safety features in your vehicle. Taking advantage of these discounts can further reduce your premium costs.

Future Trends and Innovations in Online Auto Insurance

The world of online auto insurance is constantly evolving, with insurers embracing technological advancements and innovative approaches to enhance the customer experience. Here are some future trends and innovations to watch out for:

Artificial Intelligence and Personalized Recommendations

Artificial Intelligence (AI) is poised to revolutionize the online insurance purchasing process. AI-powered platforms can analyze vast amounts of data, including driving behavior, vehicle usage patterns, and risk profiles, to provide personalized coverage recommendations.

By leveraging AI, insurers can offer tailored policies that align with individual needs, ensuring drivers receive the most suitable coverage at competitive prices. This technology will further enhance the efficiency and accuracy of the online insurance journey.

Telematics and Usage-Based Insurance

Telematics technology, which involves tracking driving behavior through connected devices, is gaining traction in the insurance industry. Usage-Based Insurance (UBI) programs utilize telematics data to assess driving habits and offer customized premiums based on actual driving behavior.

Online insurance platforms may integrate UBI programs, allowing drivers to voluntarily participate and potentially benefit from lower premiums. This pay-as-you-drive approach rewards safe driving and encourages drivers to adopt safer habits, leading to reduced accident risks and more accurate pricing.

Blockchain Technology for Secure Transactions

Blockchain technology, known for its secure and transparent nature, is being explored by insurers to enhance the security of online transactions. By leveraging blockchain, insurers can ensure the integrity and authenticity of policy documents, claims data, and other sensitive information.

This technology provides an immutable ledger, making it virtually impossible to tamper with or manipulate data. It adds an extra layer of security to the online insurance process, giving policyholders peace of mind and confidence in their transactions.

Enhanced Customer Experience through Digital Assistants

Digital assistants, such as chatbots and virtual agents, are increasingly being integrated into online insurance platforms to enhance the customer experience. These intelligent assistants can provide real-time assistance, answer frequently asked questions, and guide users through the insurance purchasing process.

With the help of natural language processing and machine learning, digital assistants can understand and respond to customer inquiries, providing instant support and streamlining the overall experience. This innovation improves customer satisfaction and reduces the need for human intervention in routine queries.

Conclusion: Embracing the Digital Future of Auto Insurance

The rise of online auto insurance purchases has transformed the way drivers obtain coverage, offering convenience, efficiency, and personalized experiences. With the power of technology, drivers can now navigate the insurance landscape with ease, comparing policies, customizing coverage, and making informed decisions.

As the digital revolution continues to shape the insurance industry, online platforms will become even more sophisticated, incorporating cutting-edge technologies to enhance the customer journey. From AI-powered recommendations to secure blockchain transactions and intuitive digital assistants, the future of online auto insurance is bright and full of exciting possibilities.

By understanding the benefits, following a step-by-step guide, and considering key factors, drivers can confidently embrace the digital future of auto insurance, ensuring they secure the right coverage at the best value. The online insurance purchasing experience is set to evolve further, providing an even more seamless and tailored experience for policyholders.

Can I still purchase auto insurance through traditional methods if I prefer in-person interaction?

+Absolutely! While online auto insurance purchases offer convenience and efficiency, traditional methods are still available for those who prefer in-person interactions. You can visit insurance agents or brokers in their offices, discuss your coverage needs, and obtain quotes and policies in a face-to-face setting.

Are there any drawbacks to purchasing auto insurance online?

+One potential drawback is the lack of personalized advice and guidance from an insurance professional. Online platforms primarily focus on providing quotes and allowing customization, but they may not offer the same level of detailed explanations or tailored recommendations as an insurance agent. However, many online insurers also provide customer support teams that can assist with any questions or concerns.

Can I switch my auto insurance policy to another insurer online?

+Yes, switching auto insurance policies to another insurer online is a straightforward process. Many online platforms offer a simple process to compare quotes and switch insurers. You can input your details, obtain quotes from multiple insurers, and then choose the new insurer and policy that best suits your needs. Once you’ve made your selection, you can complete the switch online, ensuring a seamless transition.