Auto Insurance Quote Car

Auto insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind to drivers. When seeking an auto insurance quote, understanding the various factors that influence rates is crucial. In this comprehensive guide, we will delve into the world of auto insurance quotes, exploring the key elements that impact pricing, the insurance coverage options available, and the steps to obtain an accurate quote for your vehicle. By the end of this article, you'll have a thorough understanding of the auto insurance landscape and be equipped to make informed decisions about your coverage.

Factors Influencing Auto Insurance Quotes

Numerous factors contribute to the determination of auto insurance rates. Insurance providers consider a range of variables to assess the risk associated with insuring a particular driver and vehicle. These factors include:

- Driver's Age and Experience: Younger drivers, especially those under 25, often face higher insurance premiums due to their lack of experience on the road. As drivers gain more years of experience, their insurance rates typically decrease.

- Driving Record: A clean driving record is essential for obtaining affordable auto insurance. Traffic violations, such as speeding tickets or DUIs, can significantly impact insurance rates. Accidents, especially those deemed the driver's fault, can also lead to higher premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a role in insurance rates. Sports cars and luxury vehicles often carry higher premiums due to their higher repair costs and increased likelihood of theft. Additionally, the primary use of your vehicle (e.g., commuting, business, pleasure) can influence rates.

- Location and Mileage: Where you live and the number of miles you drive annually impact your insurance rates. High-risk areas with frequent accidents or thefts may result in higher premiums. Insurance providers also consider the average annual mileage, as higher mileage vehicles tend to have increased wear and tear and a higher likelihood of accidents.

- Credit Score: In many states, insurance providers are allowed to use credit-based insurance scores when determining rates. A higher credit score can lead to lower insurance premiums, as it is seen as an indicator of financial responsibility.

- Marital Status: Married individuals often benefit from lower insurance rates compared to single drivers. Insurance providers view marriage as a stabilizing factor, as married couples tend to have a lower incidence of accidents and traffic violations.

It's important to note that insurance providers may weigh these factors differently, and some factors may carry more weight in certain states or regions. Additionally, insurance companies may offer discounts or incentives for specific driver profiles or vehicle types, so it's worthwhile to explore these options when seeking quotes.

Understanding Auto Insurance Coverage Options

Auto insurance policies offer a range of coverage options, each designed to provide protection in different scenarios. Understanding these coverage types is crucial when selecting an insurance policy that meets your needs. Here are the primary types of auto insurance coverage:

Liability Coverage

Liability coverage is the most basic and legally required form of auto insurance in most states. It provides financial protection if you are found at fault in an accident, covering the costs of injuries or damages sustained by the other party. Liability coverage typically includes two components:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: Covers repairs or replacements for property damaged in an accident for which you are responsible.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. These coverages provide protection for your own vehicle in various situations:

- Collision Coverage: Pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. This coverage is particularly beneficial if you have a newer or more valuable vehicle.

- Comprehensive Coverage: Covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, weather-related incidents (e.g., hail, flooding), or animal collisions. Comprehensive coverage is essential for protecting your vehicle from unexpected incidents.

Medical Payments Coverage

Medical payments coverage, also known as Personal Injury Protection (PIP), provides financial assistance for medical expenses incurred by you or your passengers in an accident, regardless of fault. This coverage can help cover costs such as doctor visits, hospital stays, and rehabilitation.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. This coverage can help cover medical expenses, lost wages, and other related costs.

Additional Coverages

Depending on your state and insurance provider, you may have access to additional coverage options, such as:

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease in the event of a total loss.

- Rental Car Reimbursement: Provides coverage for rental car expenses if your vehicle is being repaired or is declared a total loss.

- Roadside Assistance: Offers assistance in case of emergencies, such as towing, flat tire changes, or battery jump-starts.

Obtaining an Auto Insurance Quote

Now that you understand the factors influencing insurance rates and the coverage options available, let's explore the process of obtaining an auto insurance quote.

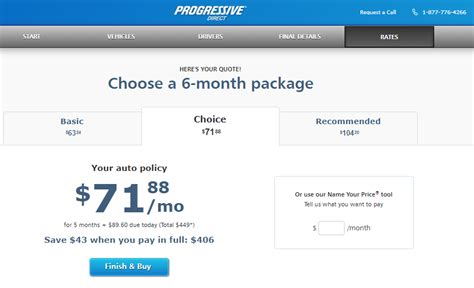

Online Quotes

Many insurance providers offer online quote tools on their websites. These tools allow you to input your personal and vehicle information, and they generate a quote based on the data you provide. Online quotes are a convenient way to compare rates from multiple providers and get a quick estimate of your insurance costs.

Agent-Assisted Quotes

Working with an insurance agent can provide personalized guidance and assistance in obtaining an accurate quote. Insurance agents can help you navigate the various coverage options, explain the nuances of the policy, and tailor the insurance to your specific needs. They can also answer any questions you may have about the quote or the insurance process.

Comparing Quotes

When comparing auto insurance quotes, it's essential to ensure that you're comparing apples to apples. Make sure that the quotes you're evaluating include the same coverage limits and deductibles. Additionally, consider the reputation and financial stability of the insurance providers, as well as their customer service ratings.

While price is an important factor, it's not the only consideration. Opting for the lowest-priced policy may result in inadequate coverage or poor customer service in the event of a claim. Strike a balance between affordability and the level of coverage that provides you with the financial protection you need.

Frequently Asked Questions (FAQ)

How often should I review my auto insurance policy and quotes?

+It's recommended to review your auto insurance policy and quotes annually or whenever your personal circumstances or vehicle usage change significantly. This ensures that your coverage remains adequate and that you're not overpaying for unnecessary coverage.

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate auto insurance rates with my provider?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While insurance rates are primarily determined by the factors mentioned earlier, it doesn't hurt to ask your insurance provider if they offer any discounts or rate adjustments based on your driving record, vehicle usage, or other relevant factors. Some providers may be willing to negotiate rates to retain your business.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I receive a high auto insurance quote?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you receive a high auto insurance quote, consider shopping around for quotes from multiple providers. Compare coverage limits, deductibles, and reputation before making a decision. Additionally, review your driving habits and consider if there are any changes you can make to lower your risk profile, such as reducing annual mileage or taking a defensive driving course.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any ways to lower my auto insurance premiums?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are several strategies to lower your auto insurance premiums. These include maintaining a clean driving record, increasing your credit score, opting for higher deductibles, bundling multiple insurance policies with the same provider, and taking advantage of any available discounts, such as safe driver discounts or loyalty discounts.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between liability coverage and collision coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Liability coverage protects you financially if you are at fault in an accident, covering the costs of injuries and damages sustained by the other party. Collision coverage, on the other hand, covers damages to your own vehicle, regardless of fault, in the event of an accident. Collision coverage is optional but highly recommended, especially for newer or more valuable vehicles.</p>

</div>

</div>

In conclusion, obtaining an auto insurance quote is a crucial step in ensuring you have adequate financial protection for your vehicle. By understanding the factors that influence insurance rates and exploring the various coverage options available, you can make informed decisions about your auto insurance coverage. Remember to compare quotes, review your policy regularly, and take advantage of any available discounts to get the best value for your insurance needs.