Auto Insurance Quote New Jersey

Welcome to the ultimate guide to understanding and obtaining auto insurance quotes in the state of New Jersey. As an informed resident or prospective driver in the Garden State, it's crucial to navigate the complexities of auto insurance to find the best coverage at the most competitive rates. This comprehensive article aims to provide you with an in-depth analysis of the factors influencing auto insurance rates in New Jersey, offering practical insights and expert advice to help you make informed decisions.

Understanding Auto Insurance in New Jersey

New Jersey’s auto insurance landscape is unique, with a combination of factors influencing rates. From the state’s no-fault insurance laws to the high population density and resulting traffic congestion, there are several aspects to consider when seeking an auto insurance quote. By delving into these specifics, you’ll gain a clearer understanding of how your insurance premium is calculated and what steps you can take to secure the best coverage.

The Influence of New Jersey’s Insurance Laws

New Jersey operates under a no-fault insurance system, which means that when you’re involved in an accident, your own insurance company covers your medical expenses and lost wages, regardless of who was at fault. This system aims to streamline the claims process and reduce legal disputes. However, it also has implications for your insurance rates, as it can result in higher premiums due to the potential for more extensive coverage.

Additionally, New Jersey requires all drivers to carry personal injury protection (PIP) coverage as part of their auto insurance policy. PIP coverage provides compensation for medical expenses, lost wages, and other related costs resulting from an auto accident. This mandatory coverage further contributes to the overall cost of auto insurance in the state.

The Impact of Population Density and Traffic

New Jersey’s population density, particularly in urban areas like Newark, Jersey City, and Camden, significantly impacts auto insurance rates. With more vehicles on the road, the risk of accidents increases, leading to higher insurance premiums. The state’s notorious traffic congestion, exacerbated by its strategic location between major metropolitan areas, also plays a role in determining insurance costs.

For instance, a driver residing in a densely populated area with a high incidence of traffic accidents may face higher insurance premiums compared to a driver in a more rural part of the state. The frequency and severity of accidents, influenced by traffic patterns and population density, are key factors considered by insurance providers when determining rates.

Factors Affecting Auto Insurance Quotes

Beyond the state-specific considerations, several personal factors also come into play when obtaining an auto insurance quote in New Jersey. These include your driving record, the type of vehicle you drive, your age and gender, and your credit score. Each of these factors can significantly influence your insurance premium, and understanding their impact is essential for making informed decisions.

For example, a driver with a clean driving record and a history of safe driving may be eligible for lower insurance rates compared to a driver with a record of accidents or traffic violations. Similarly, the make and model of your vehicle, as well as its safety features, can impact your insurance premium. Younger drivers, especially those under the age of 25, often face higher insurance rates due to their relative lack of driving experience.

| Factor | Description |

|---|---|

| Driving Record | A clean record can lead to lower rates, while violations and accidents may increase premiums. |

| Vehicle Type | Sports cars and luxury vehicles often have higher insurance costs due to their performance and value. |

| Age and Gender | Younger drivers and certain genders may face higher rates due to statistical risk factors. |

| Credit Score | A good credit score can result in lower insurance premiums, as it is seen as a marker of financial responsibility. |

Obtaining Auto Insurance Quotes in New Jersey

Now that we’ve explored the factors influencing auto insurance rates in New Jersey, let’s delve into the practical steps you can take to obtain competitive quotes. By following these expert-recommended strategies, you can ensure you’re getting the best value for your insurance coverage.

Comparing Quotes from Multiple Providers

One of the most effective ways to secure a competitive auto insurance quote in New Jersey is to compare rates from multiple providers. With a diverse insurance market, there’s no one-size-fits-all solution. Each insurer may offer different rates and coverage options, so it’s essential to shop around to find the best fit for your needs.

Utilize online quote comparison tools and reach out to various insurance agents to gather a range of quotes. This approach allows you to see the variations in rates and coverage, giving you a clearer picture of the market and your options. By comparing quotes, you can identify the providers that offer the most competitive rates for your specific circumstances.

Understanding Coverage Options and Limits

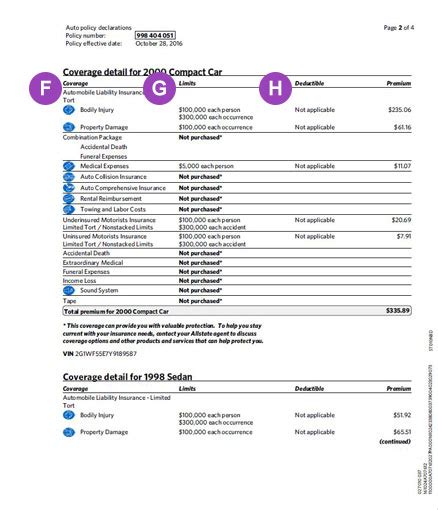

When seeking auto insurance quotes, it’s crucial to understand the different coverage options and limits available. New Jersey’s insurance laws mandate certain coverage types, but you also have the option to customize your policy to meet your specific needs. Familiarize yourself with the various coverage types, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage.

Liability coverage, for instance, is mandatory in New Jersey and protects you from claims arising from accidents you cause. Collision coverage, on the other hand, covers damages to your vehicle in an accident, regardless of fault. Understanding these coverage types and their limits will help you tailor your policy to your preferences and budget.

Exploring Discounts and Savings Opportunities

Insurance providers often offer a variety of discounts to attract customers and reward safe driving behavior. By taking advantage of these discounts, you can significantly reduce your insurance premiums. Some common discounts include safe driver discounts, multi-policy discounts (for bundling your auto insurance with other types of insurance), and loyalty discounts for long-term customers.

Additionally, certain vehicle features and safety equipment may qualify you for discounts. For example, vehicles equipped with anti-theft devices or advanced safety features like lane departure warning systems may be eligible for reduced rates. By exploring these savings opportunities, you can make your insurance coverage more affordable while still maintaining the level of protection you need.

Customizing Your Policy to Fit Your Needs

Auto insurance policies are not one-size-fits-all. Your specific circumstances, such as your driving habits, the type of vehicle you drive, and your financial situation, should influence the coverage and limits you choose. Tailor your policy to fit your needs by considering factors like the value of your vehicle, the level of coverage you require, and any additional services or benefits you may desire.

For instance, if you own a classic car, you may want to explore specialized insurance policies that cater to the unique needs of vintage vehicles. On the other hand, if you have a long commute or frequently drive in urban areas, you may benefit from higher liability limits to protect against potential accidents. By customizing your policy, you can ensure you're adequately covered without paying for unnecessary extras.

Future Implications and Industry Insights

As the auto insurance landscape in New Jersey continues to evolve, staying informed about industry trends and future developments is crucial. By understanding the potential changes and challenges facing the insurance market, you can make more strategic decisions regarding your coverage and premiums.

Emerging Technologies and Their Impact

The advancement of technology is transforming the auto insurance industry. Telematics, for example, allows insurance providers to track your driving behavior in real-time, offering the potential for more personalized and dynamic insurance rates. While this technology is still in its early stages, it’s worth considering how it might influence your insurance premiums in the future.

Additionally, the rise of electric vehicles (EVs) and autonomous driving technologies is set to disrupt the insurance market. As EV adoption increases, insurance providers will need to adapt their policies to address the unique risks and benefits associated with these vehicles. Similarly, the advent of autonomous driving features and fully autonomous vehicles will require new insurance models to address liability and coverage issues.

Regulatory Changes and Their Effect on Rates

Regulatory changes can significantly impact auto insurance rates. For instance, any alterations to New Jersey’s insurance laws, such as changes to mandatory coverage requirements or reforms to the no-fault insurance system, could have a direct effect on your insurance premiums. Staying abreast of proposed and enacted legislation is essential for anticipating potential rate fluctuations.

Furthermore, external factors like changes in fuel prices, vehicle manufacturing trends, and economic conditions can also influence insurance rates. These factors may impact the cost of vehicle repairs, the frequency of accidents, and the overall financial health of insurance providers, all of which can trickle down to affect your insurance premiums.

The Importance of Staying Informed

In the dynamic world of auto insurance, staying informed is key to making the most advantageous decisions. By regularly reviewing your policy, keeping up with industry developments, and comparing quotes, you can ensure you’re getting the best value for your insurance coverage. Don’t hesitate to reach out to insurance professionals for guidance and advice, as they can provide valuable insights tailored to your specific circumstances.

What is the average cost of auto insurance in New Jersey?

+The average cost of auto insurance in New Jersey varies depending on numerous factors, including your driving record, the type of vehicle you drive, and your location. However, according to recent data, the average annual premium for a standard policy in New Jersey is approximately $2,300. This figure can be higher or lower depending on your specific circumstances.

Are there any ways to reduce my auto insurance premiums in New Jersey?

+Yes, there are several strategies to potentially reduce your auto insurance premiums in New Jersey. These include maintaining a clean driving record, shopping around for quotes from multiple providers, exploring discounts (such as safe driver or multi-policy discounts), and customizing your policy to your specific needs. Additionally, improving your credit score can positively impact your insurance rates.

What factors determine my auto insurance rates in New Jersey?

+Several factors influence your auto insurance rates in New Jersey. These include your driving history, the make and model of your vehicle, your age and gender, your credit score, and the coverage limits and options you choose. Additionally, New Jersey's no-fault insurance system and the state's population density and traffic congestion also play a role in determining rates.

How can I compare auto insurance quotes in New Jersey effectively?

+To compare auto insurance quotes effectively in New Jersey, utilize online quote comparison tools and reach out to multiple insurance providers. This allows you to see variations in rates and coverage. Consider factors like the coverage limits, deductible amounts, and any additional services or benefits offered. Also, ensure you understand the specific coverage types and their implications to make an informed decision.

In conclusion, obtaining an auto insurance quote in New Jersey requires a comprehensive understanding of the state’s unique insurance landscape and the factors that influence rates. By familiarizing yourself with New Jersey’s insurance laws, exploring coverage options, and comparing quotes from multiple providers, you can secure the best coverage at competitive rates. Stay informed about industry trends and emerging technologies to make strategic decisions regarding your auto insurance coverage.