Auto Insurance Quotes Nj

When it comes to auto insurance, finding the right coverage and a competitive quote is essential for New Jersey residents. With a unique set of laws and regulations, understanding the insurance landscape in the Garden State can be a daunting task. This comprehensive guide aims to shed light on the factors that influence auto insurance quotes in New Jersey, offering valuable insights and tips to help you navigate the process.

Understanding the Cost of Auto Insurance in New Jersey

New Jersey is known for its relatively high auto insurance rates compared to many other states. Several factors contribute to this, including the state’s no-fault insurance system, stringent coverage requirements, and a high population density, which can lead to increased accident risks. Understanding these influences is crucial for obtaining an accurate and affordable auto insurance quote.

No-Fault Insurance System

New Jersey operates under a no-fault insurance system, which means that drivers are required to carry Personal Injury Protection (PIP) coverage as part of their auto insurance policy. This coverage pays for medical expenses and lost wages, regardless of who is at fault in an accident. While this system aims to streamline the claims process, it can also result in higher insurance premiums.

| PIP Coverage Requirement | $250,000 minimum |

|---|---|

| Additional Coverage Options | Variable, based on individual needs |

Strict Coverage Requirements

New Jersey has some of the most comprehensive auto insurance coverage requirements in the nation. Along with the mandatory PIP coverage, drivers must also carry bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. These requirements ensure that all drivers have a basic level of protection, but they can also drive up insurance costs.

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

|---|---|

| Property Damage Liability | $5,000 minimum |

| Uninsured/Underinsured Motorist Coverage | $15,000 per person / $30,000 per accident |

Population Density and Accident Risks

New Jersey’s high population density, particularly in urban areas like Newark, Jersey City, and Trenton, can contribute to increased accident risks. With more vehicles on the road, the chances of being involved in an accident rise, which can impact insurance rates. Additionally, the state’s proximity to major metropolitan areas like New York City can further influence insurance costs.

Factors Influencing Auto Insurance Quotes in New Jersey

Several factors play a significant role in determining auto insurance quotes in New Jersey. By understanding these influences, you can make informed decisions to potentially reduce your insurance costs.

Driving Record

Your driving history is a crucial factor in determining your insurance rates. In New Jersey, a clean driving record can lead to lower premiums. On the other hand, traffic violations, accidents, and DUIs can significantly increase your insurance costs. It’s essential to maintain a safe driving record to keep your insurance rates as low as possible.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Generally, newer, more expensive vehicles tend to have higher insurance premiums due to the cost of repairs and replacement parts. Additionally, if you use your vehicle for business purposes or commute long distances, your insurance rates may be higher.

Age and Gender

In New Jersey, insurance rates can vary based on age and gender. Younger drivers, particularly those under 25, often face higher insurance costs due to their perceived lack of driving experience. Similarly, male drivers may pay slightly more than female drivers, as they are statistically more likely to be involved in accidents.

Credit Score

Believe it or not, your credit score can also influence your auto insurance rates. Many insurance companies in New Jersey use credit-based insurance scoring to assess the risk associated with insuring a driver. A higher credit score may result in lower insurance premiums, while a lower credit score could lead to higher costs.

Location

Where you live and where your vehicle is primarily garaged can significantly impact your insurance rates. Urban areas with higher population densities and increased accident risks tend to have higher insurance premiums. Additionally, certain neighborhoods may be more prone to car theft or vandalism, further influencing insurance costs.

Tips for Getting Affordable Auto Insurance Quotes in New Jersey

Navigating the auto insurance landscape in New Jersey can be challenging, but there are strategies you can employ to find affordable coverage.

Shop Around

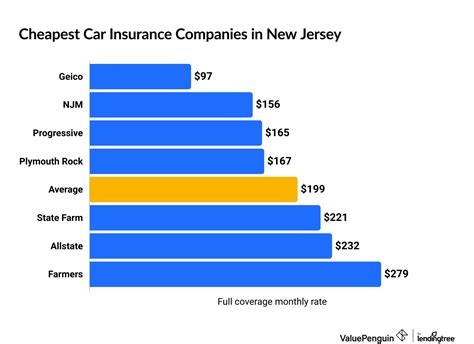

Don’t settle for the first insurance quote you receive. It’s crucial to shop around and compare quotes from multiple insurance providers. Each company has its own rating factors and pricing structures, so getting multiple quotes can help you identify the most competitive rates.

Understand Your Coverage Needs

Review your current insurance policy and ensure you understand the coverage you have and the coverage you need. Consider your specific circumstances, such as your driving habits, the value of your vehicle, and any additional risks you may face. This knowledge will help you make informed decisions when choosing insurance coverage.

Consider Bundle Discounts

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts when you combine multiple policies, potentially saving you a considerable amount on your overall insurance costs.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a critical factor in determining your insurance rates. Strive to maintain a clean driving record by avoiding traffic violations and accidents. If you have a less-than-perfect driving history, consider taking a defensive driving course to improve your skills and potentially reduce your insurance costs.

Explore Discounts

Insurance companies often offer a variety of discounts to their policyholders. These can include discounts for safe driving, good student status, loyalty, and even certain vehicle safety features. Be sure to inquire about all available discounts when shopping for insurance to maximize your savings.

Conclusion: Empowering Your Auto Insurance Journey in New Jersey

Obtaining an auto insurance quote in New Jersey requires a thorough understanding of the state’s unique insurance landscape. By familiarizing yourself with the factors that influence insurance rates and implementing strategic approaches, you can navigate the process with confidence and find the best coverage at the most competitive price.

Remember, auto insurance is not a one-size-fits-all proposition. Your specific circumstances, from your driving record to your vehicle's make and model, will influence your insurance costs. By shopping around, understanding your coverage needs, and exploring discounts, you can take control of your auto insurance journey and secure the protection you need without breaking the bank.

How can I find out if I’m getting a good auto insurance quote in New Jersey?

+To determine if you’re getting a competitive auto insurance quote in New Jersey, compare it with quotes from several other reputable insurance providers. Ensure you’re comparing policies with similar coverage limits and deductibles. Additionally, research the average insurance rates in your area to get a sense of the market.

What are some common discounts available for auto insurance in New Jersey?

+Common discounts for auto insurance in New Jersey include safe driver discounts, multi-policy discounts (when you bundle your auto insurance with other policies like home or renters insurance), good student discounts, and loyalty discounts for long-term customers.

Can my credit score really impact my auto insurance rates in New Jersey?

+Yes, in New Jersey, insurance companies often use credit-based insurance scoring to assess the risk associated with insuring a driver. A higher credit score may lead to lower insurance premiums, while a lower credit score could result in higher costs. It’s essential to maintain a good credit score to potentially save on your auto insurance.