Auto Insurance Quotes Progressive

In the ever-evolving world of insurance, finding the right coverage at an affordable rate is a top priority for many vehicle owners. Among the vast array of insurance providers, Progressive has established itself as a prominent player in the auto insurance market. This article aims to provide an in-depth exploration of Progressive's auto insurance offerings, shedding light on their quote process, coverage options, and the unique features that set them apart. By the end of this comprehensive guide, you'll have a clear understanding of whether Progressive aligns with your insurance needs and expectations.

Unraveling Progressive’s Auto Insurance Quotes

Obtaining an auto insurance quote from Progressive is a straightforward process designed to be quick and convenient for customers. Here’s a step-by-step breakdown of how it works:

Step 1: Gather Essential Information

Before initiating the quote process, ensure you have the following details readily available:

- Your driver’s license number and state of issuance.

- The Vehicle Identification Number (VIN) of your car.

- The make, model, and year of your vehicle.

- Details about any existing auto insurance coverage (if applicable), including the carrier, policy number, and expiration date.

- Information about any accidents or traffic violations on your record.

Step 2: Navigate to Progressive’s Quote Page

Visit Progressive’s official website and locate the “Get a Quote” or “Auto Insurance Quote” button, typically found on the homepage or in the navigation menu. This will direct you to their dedicated quote page.

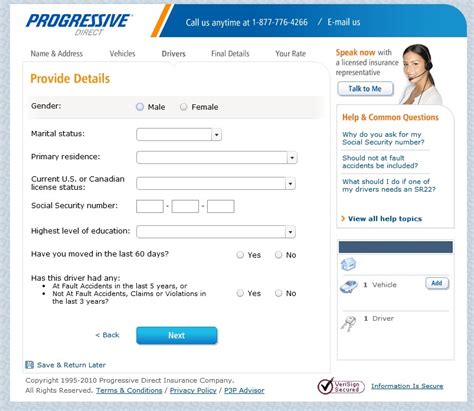

Step 3: Provide Vehicle and Driver Details

On the quote page, you’ll be prompted to input the necessary information about your vehicle and driving history. This includes the vehicle’s make, model, year, and usage, as well as details about the primary and additional drivers. Progressive may also ask for information about your garage location, annual mileage, and the primary purpose of using the vehicle (e.g., commuting, business, pleasure).

Step 4: Disclose Accident and Violation History

Progressive will request information about any accidents or traffic violations you’ve been involved in over the past few years. Providing accurate details is crucial, as it directly impacts the accuracy of your quote.

Step 5: Choose Coverage Options

Progressive offers a range of coverage options to customize your policy. During the quote process, you’ll have the opportunity to select the types and limits of coverage you prefer. Common coverage options include liability, collision, comprehensive, medical payments, uninsured/underinsured motorist coverage, and additional add-ons like rental car coverage or roadside assistance.

Step 6: Review and Finalize Your Quote

Once you’ve provided all the necessary information and selected your coverage options, Progressive’s system will generate a personalized quote. Review the quote carefully, ensuring that all the details are accurate and that the coverage limits meet your needs. If you’re satisfied, you can proceed to purchase the policy or explore additional customization options.

Progressive’s Coverage Options and Features

Progressive stands out in the auto insurance market for its comprehensive range of coverage options and unique features designed to enhance the customer experience. Here’s an overview of some key aspects of their coverage:

Liability Coverage

Progressive offers liability coverage to protect you financially in the event of an at-fault accident. This coverage includes both bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses and potential legal costs of others injured in an accident you cause. Property damage liability covers repairs or replacements for any property damaged in the accident, including other vehicles, fences, buildings, or personal property.

Collision and Comprehensive Coverage

Collision coverage helps cover the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault. It’s particularly beneficial for newer or financed vehicles. Comprehensive coverage, on the other hand, protects against non-collision incidents such as theft, vandalism, natural disasters, or damage caused by animals. Both collision and comprehensive coverage typically come with a deductible, which is the amount you pay out of pocket before Progressive covers the rest.

Medical Payments Coverage

Medical payments coverage, often referred to as “MedPay,” provides additional medical expense coverage for you and your passengers after an accident, regardless of fault. This coverage can be especially valuable in situations where your health insurance doesn’t cover all medical costs.

Uninsured/Underinsured Motorist Coverage

Progressive’s uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who doesn’t have insurance or has insufficient coverage to compensate for the damages. This coverage can help cover your medical bills, lost wages, and other expenses resulting from such an accident.

Rental Car Coverage and Roadside Assistance

Progressive offers optional add-ons like rental car coverage, which provides reimbursement for a rental vehicle if your car is being repaired after an accident. Roadside assistance coverage is also available, offering services like towing, flat tire changes, jump-starts, and fuel delivery.

Unique Features and Benefits

In addition to its standard coverage options, Progressive offers several unique features that set it apart from other insurance providers:

- Snapshot Program: Progressive’s Snapshot program allows drivers to save on their premiums by installing a small device that tracks their driving habits. This device collects data on driving behaviors like acceleration, braking, and time of day, which Progressive uses to offer personalized discounts based on safe driving practices.

- Name Your Price Tool: Progressive’s Name Your Price tool lets customers set their desired monthly premium and explore coverage options that align with their budget. This innovative feature provides transparency and control over insurance costs.

- Mobile App and Digital Services: Progressive’s mobile app and online platform offer a range of digital services, including policy management, claims filing, and real-time updates on the status of repairs.

- Claim Forgiveness: Progressive’s claim forgiveness program allows policyholders to maintain their good driver discounts even after filing a claim, provided they meet certain conditions.

Progressive’s Performance and Customer Experience

Progressive has established a strong reputation in the auto insurance industry, known for its competitive pricing, comprehensive coverage options, and innovative features. However, as with any insurance provider, customer experiences can vary. Here’s an analysis of Progressive’s performance and some key considerations:

Pricing and Discounts

Progressive is renowned for offering competitive rates and a range of discounts to help customers save on their premiums. Some of the notable discounts include:

- Multi-Policy Discount: Save by bundling your auto insurance with other Progressive policies, such as homeowners or renters insurance.

- Good Student Discount: Eligible students under 25 can receive a discount by maintaining a certain GPA or academic ranking.

- Continuous Insurance Discount: Progressive rewards policyholders who maintain continuous auto insurance coverage with them.

- Snapshot Discount: As mentioned earlier, the Snapshot program can lead to significant discounts for safe drivers.

Customer Service and Claims Process

Progressive prides itself on its customer-centric approach, offering 24⁄7 claims support and a dedicated team of claims adjusters. Their claims process is designed to be efficient and straightforward, with online and mobile options available for filing and tracking claims. However, customer reviews and ratings can vary, with some praising Progressive’s quick response times and friendly service, while others have expressed concerns about the claims process or customer support.

Financial Strength and Stability

Progressive is one of the largest auto insurance providers in the United States, with a strong financial foundation. Their solid financial standing ensures that they can meet their obligations to policyholders and provide stable coverage over the long term. As of [current year], Progressive holds an “A+” rating from AM Best, indicating excellent financial strength and stability.

Comparative Analysis and Industry Insights

When considering Progressive for your auto insurance needs, it’s essential to evaluate their offerings against those of other leading providers. Here’s a comparative analysis of Progressive’s strengths and weaknesses, along with some industry insights:

Strengths

- Innovative Features: Progressive’s Snapshot program and Name Your Price tool are unique offerings that set them apart from competitors and provide added value to customers.

- Competitive Pricing: Progressive is known for its affordable rates and extensive range of discounts, making it an attractive option for budget-conscious consumers.

- Digital Services: Their mobile app and online platform offer convenient policy management and claims filing, catering to the needs of tech-savvy customers.

- Claim Forgiveness: Progressive’s claim forgiveness program is a valuable benefit for policyholders, ensuring that a single claim doesn’t significantly impact their future premiums.

Weaknesses

- Varying Customer Experiences: While Progressive has a strong reputation, customer experiences can vary. Some customers have reported issues with claims handling or customer service, highlighting the importance of thorough research and reviews before choosing a provider.

- Limited Physical Locations: Progressive primarily operates online and through a network of independent agents, which may not suit those who prefer in-person interactions with local agents.

Industry Insights

- Market Share: Progressive is a major player in the auto insurance market, consistently ranking among the top providers in the United States. Their market share continues to grow, indicating their popularity and competitiveness.

- Technological Advancements: Progressive’s focus on digital services and innovative features aligns with the industry’s shift towards technology-driven solutions. Their Snapshot program, in particular, has been a pioneer in usage-based insurance, influencing other providers to offer similar programs.

- Customer Satisfaction: While Progressive receives positive feedback from many customers, it’s essential to consider individual experiences and review ratings when assessing their overall customer satisfaction.

Conclusion

Progressive’s auto insurance offerings provide a compelling blend of competitive pricing, comprehensive coverage options, and innovative features. Their Snapshot program and Name Your Price tool offer unique value propositions, catering to a wide range of customer needs and preferences. However, as with any insurance provider, it’s crucial to weigh the strengths and weaknesses, evaluate customer experiences, and compare Progressive’s offerings against those of other leading competitors.

Ultimately, choosing the right auto insurance provider is a personal decision based on your specific needs, budget, and expectations. Progressive's strong financial stability, digital services, and innovative features make them a top contender in the auto insurance market. By thoroughly researching and understanding your options, you can make an informed decision that aligns with your insurance goals.

How accurate are Progressive’s auto insurance quotes?

+Progressive’s quotes are based on the information you provide during the quote process. While they aim for accuracy, factors like your driving record, vehicle type, and location can influence the final quote. It’s advisable to review your quote carefully and verify any discrepancies before finalizing your policy.

What are the eligibility criteria for Progressive’s Snapshot program?

+Eligibility for the Snapshot program typically depends on your state of residence and the type of vehicle you drive. Progressive may have specific guidelines regarding the types of vehicles eligible for the program, so it’s best to check their website or consult with an agent for more details.

Can I bundle my auto insurance with other Progressive policies to save money?

+Yes, Progressive offers a multi-policy discount when you bundle your auto insurance with other Progressive policies, such as homeowners, renters, or umbrella insurance. Bundling can lead to significant savings, so it’s worth exploring this option if you’re a Progressive customer.

What is the process for filing a claim with Progressive?

+Progressive offers multiple ways to file a claim, including online, through their mobile app, or by calling their 24⁄7 claims hotline. You can also initiate the claims process by visiting a Progressive claims center or contacting an independent agent. The specific steps and requirements may vary based on the nature of your claim, so it’s best to refer to Progressive’s website or consult with a representative for detailed instructions.