Auto Insurance Website

Welcome to the ultimate guide to understanding the world of auto insurance and its digital presence. In today's fast-paced and tech-driven era, having a comprehensive auto insurance policy is not just a necessity but also a smart financial decision. With the rise of online platforms and comparison websites, navigating the auto insurance landscape has become more accessible and transparent. This article delves into the critical aspects of auto insurance, its digital transformation, and how a well-designed website can be a game-changer for insurance providers and consumers alike.

The Evolution of Auto Insurance: From Traditional to Digital

Auto insurance, a cornerstone of modern life, has undergone a remarkable transformation over the years. Traditionally, obtaining an insurance policy involved visiting local agents, filling out extensive paperwork, and relying on word-of-mouth recommendations. However, the digital age has revolutionized this industry, offering convenience, efficiency, and a wealth of information at our fingertips.

The rise of online auto insurance websites has not only made the process of purchasing insurance more straightforward but has also empowered consumers with the tools to make informed decisions. These websites act as virtual insurance brokers, providing detailed policy information, instant quotes, and comparative analyses, thus streamlining the entire insurance shopping experience.

Key Benefits of Auto Insurance Websites

- Instant Quotations: One of the most significant advantages is the ability to obtain real-time quotes. With just a few clicks, users can input their vehicle details, driving history, and personal information to receive tailored quotes from multiple insurers. This instant feedback saves time and effort, allowing consumers to quickly compare prices and coverage options.

- Enhanced Transparency: Online platforms offer a transparent view of the insurance market. Users can access detailed policy information, including coverage limits, deductibles, and add-on options. This transparency ensures that consumers fully understand the terms and conditions before making a purchase, reducing the chances of unpleasant surprises later on.

- User-Friendly Interfaces: Well-designed auto insurance websites prioritize user experience. They are intuitive, easy to navigate, and often provide helpful tools such as FAQs, blog articles, and interactive calculators. This ensures that even those new to insurance can easily understand the process and make informed choices.

Furthermore, these websites often utilize advanced technology, such as AI-powered chatbots, to provide instant support and guidance. This level of personalization and convenience has significantly improved the overall customer experience, making auto insurance more accessible and less daunting.

The Role of Website Design in Auto Insurance

In the competitive world of auto insurance, having a well-designed and functional website is not just desirable but essential. It serves as the primary interface between the insurance provider and its potential customers, shaping their first impressions and influencing their decision-making process.

Key Considerations for Auto Insurance Website Design

- Visual Appeal and Brand Identity: The website’s design should align with the insurance provider’s brand identity, creating a cohesive and recognizable online presence. A visually appealing interface with a clean layout and intuitive navigation ensures a positive user experience, encouraging visitors to explore further.

- Mobile Optimization: With the majority of internet users accessing websites via mobile devices, a responsive and mobile-friendly design is non-negotiable. Auto insurance websites should be optimized for various screen sizes, ensuring a seamless and fast-loading experience for mobile users.

- User-Centric Features: The website should be designed with the user’s needs and preferences in mind. This includes providing clear and concise information about policy options, coverage details, and claim processes. Additionally, including interactive elements like quote calculators and policy comparison tools can enhance the user experience and encourage conversions.

A well-designed auto insurance website should also prioritize security and data protection. With sensitive personal and financial information being exchanged, implementing robust security measures and adhering to data privacy regulations is crucial to building trust with users.

| Website Feature | Importance |

|---|---|

| Secure Data Encryption | Protects user information during transmission |

| Two-Factor Authentication | Adds an extra layer of security for user accounts |

| Regular Security Audits | Ensures website vulnerabilities are identified and patched |

Comparative Analysis: Leading Auto Insurance Websites

To better understand the impact of website design on the auto insurance industry, let’s analyze and compare some of the leading insurance providers’ websites. These websites not only serve as examples of best practices but also highlight the key features that drive user engagement and conversions.

Website A: Comprehensive Coverage and User Experience

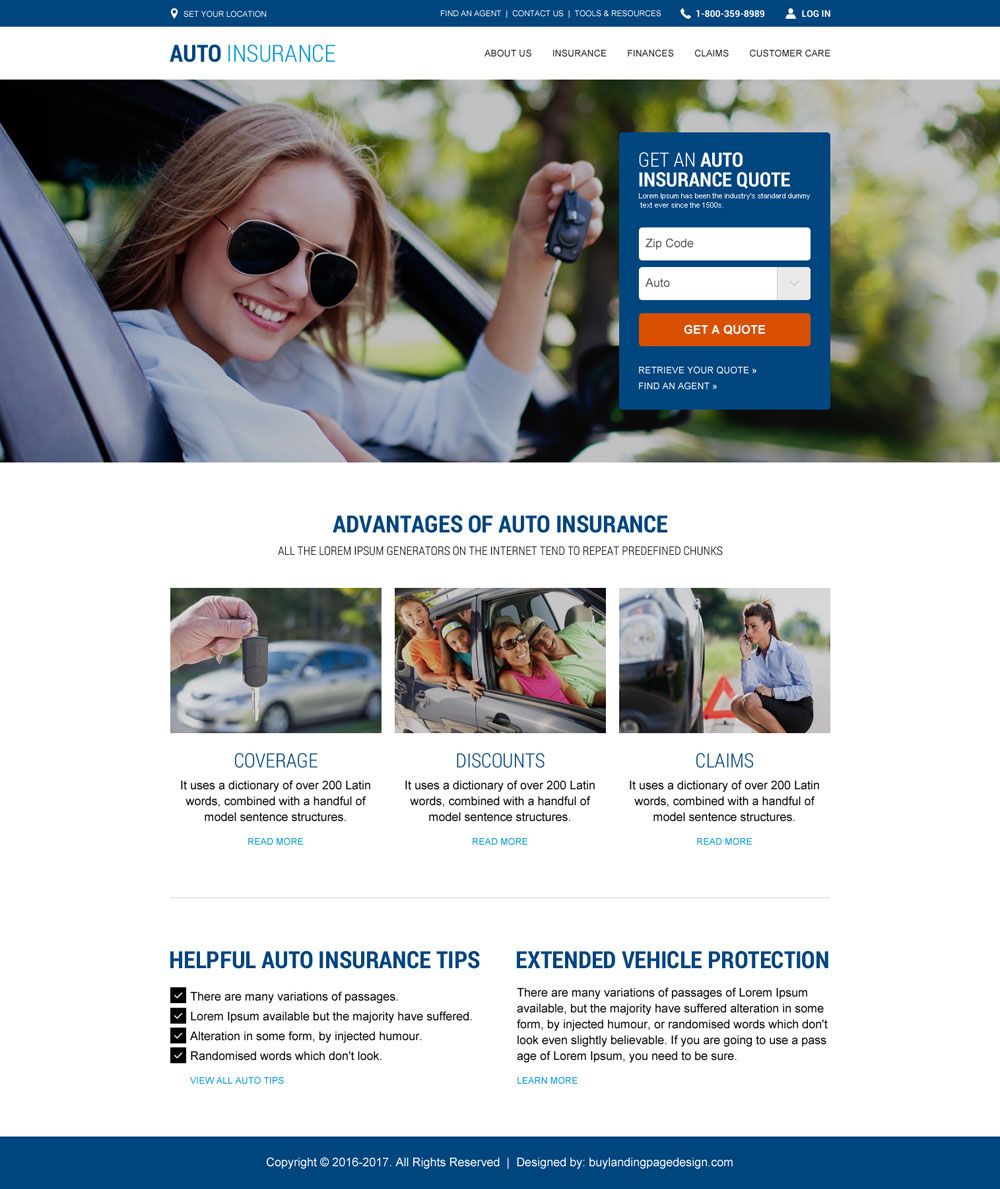

Website A, belonging to a well-established insurance provider, boasts a sleek and modern design. Its homepage features a prominent call-to-action (CTA) button, encouraging users to “Get a Quote” right away. The website’s navigation is intuitive, with clear labels and a logical flow, making it easy for users to find the information they need.

One standout feature of Website A is its comprehensive coverage section. It provides detailed explanations of various insurance types, such as liability, collision, and comprehensive coverage, along with real-life examples and scenarios. This approach helps users understand the nuances of each coverage type, ensuring they choose the right policy for their needs.

Additionally, Website A offers an interactive quote calculator. Users can input their details and instantly see the estimated cost of their insurance policy. This tool not only provides transparency but also empowers users to make adjustments and see the impact on their premium in real-time.

Website B: Personalized Experience and Advanced Technology

Website B takes a more personalized approach to auto insurance. Upon visiting the homepage, users are greeted with a personalized greeting and a brief survey to understand their insurance needs. This data-driven approach allows Website B to offer tailored recommendations and a more customized experience.

One of the website's standout features is its AI-powered virtual assistant. This chatbot not only provides instant support and answers to common queries but also guides users through the insurance process, offering personalized advice and suggestions based on their specific circumstances. This level of personalization enhances the user experience and builds trust.

Furthermore, Website B offers an advanced claim tracking system. Users can log in to their accounts and track the progress of their claims in real-time. This feature not only provides transparency but also reduces the anxiety often associated with the claims process, setting Website B apart from its competitors.

Future Implications and Industry Trends

As technology continues to advance and consumer expectations evolve, the auto insurance industry is set to experience further digital transformations. Here are some key trends and future implications to consider:

Digital Transformation and InsurTech

The rise of InsurTech (insurance technology) startups is reshaping the industry. These innovative companies are leveraging technology to offer more efficient and customer-centric insurance solutions. From AI-powered risk assessment to blockchain-based claim processing, InsurTech is revolutionizing the way auto insurance is delivered and experienced.

In the future, we can expect to see more integration of advanced technologies into auto insurance websites. This includes the use of virtual reality (VR) for immersive policy explanations, natural language processing for more accurate quote generation, and predictive analytics for improved risk assessment and personalized recommendations.

Data-Driven Personalization

With the increasing availability of data and advanced analytics tools, auto insurance providers will be able to offer even more personalized experiences. By analyzing user behavior, driving patterns, and historical data, insurers can tailor policies and premiums to individual needs, making insurance more affordable and relevant.

Furthermore, data-driven insights can be used to develop targeted marketing campaigns, improve customer segmentation, and enhance overall customer satisfaction. Personalization will become a key differentiator in the auto insurance market, with providers leveraging data to offer unique and tailored solutions.

Integration of Telematics and Usage-Based Insurance

Telematics, the technology that collects and transmits data from vehicles, is expected to play a significant role in the future of auto insurance. Usage-based insurance (UBI) policies, which calculate premiums based on actual driving behavior, are gaining traction. These policies use telematics devices to monitor driving habits, such as speed, acceleration, and mileage, to determine insurance rates.

As UBI becomes more mainstream, auto insurance websites will need to adapt to accommodate this shift. This may include providing users with tools to monitor and optimize their driving behavior, as well as offering real-time feedback and incentives to encourage safer driving practices.

Conclusion

The world of auto insurance is rapidly evolving, and the role of a well-designed website cannot be overstated. From providing instant quotes and enhanced transparency to offering personalized experiences and leveraging advanced technology, auto insurance websites are at the forefront of this digital transformation.

As we've seen through our comparative analysis, leading insurance providers are continuously innovating and improving their online platforms to meet the evolving needs of consumers. By prioritizing user experience, security, and personalization, these websites are not just a means to purchase insurance but a valuable resource for consumers to make informed decisions and take control of their financial well-being.

The future of auto insurance looks bright, with technology and data driving innovation and improvements. As the industry embraces digital transformation, we can expect to see even more exciting developments, making auto insurance more accessible, affordable, and tailored to individual needs.

How can I choose the right auto insurance provider based on their website design?

+When evaluating auto insurance providers through their websites, consider factors such as visual appeal, user-friendliness, and the availability of essential information. Look for clear navigation, comprehensive coverage details, and interactive tools like quote calculators. A well-designed website often indicates a provider’s commitment to delivering a positive customer experience.

What are some common mistakes to avoid when designing an auto insurance website?

+Common pitfalls include cluttered designs, slow page loading times, and inadequate security measures. Avoid excessive use of pop-ups or intrusive ads, as they can detract from the user experience. Additionally, ensure that your website is optimized for mobile devices, as many users prefer accessing insurance information on their smartphones.

How can I stay updated with the latest trends in auto insurance website design and functionality?

+Staying informed is crucial in this rapidly evolving industry. Follow reputable insurance blogs and industry publications, attend relevant conferences and webinars, and connect with experts in the field. By keeping abreast of the latest trends and best practices, you can ensure your auto insurance website remains competitive and user-centric.