Auto Insurance Wuotes

Auto insurance quotes are an essential part of the vehicle ownership journey. They provide an estimate of the cost of insuring your vehicle, offering peace of mind and financial protection. Understanding how these quotes work and what factors influence them is crucial for making informed decisions about your auto insurance coverage.

The Significance of Auto Insurance Quotes

Auto insurance quotes serve as a gateway to comprehensive coverage, ensuring you’re prepared for the unexpected on the road. These quotes provide a detailed breakdown of the costs associated with insuring your vehicle, taking into account various factors such as your driving history, the make and model of your car, and the level of coverage you require. By obtaining multiple quotes, you can compare different insurance providers and find the best policy that suits your needs and budget.

Moreover, auto insurance quotes play a vital role in financial planning. They help you estimate and allocate funds for insurance expenses, ensuring you're not caught off guard by unexpected costs. With accurate quotes, you can make informed decisions about your insurance coverage, choosing the right provider and policy that offers the best value for your money.

Factors Influencing Auto Insurance Quotes

Several key factors come into play when it comes to determining auto insurance quotes. These factors can significantly impact the cost of your insurance policy, and understanding them can help you navigate the insurance landscape more effectively.

Driver Profile and History

Your driving record and personal details are crucial in determining your auto insurance quote. Insurance providers assess your age, gender, and driving history to gauge the level of risk they are insuring. Young drivers, for instance, are often considered high-risk due to their lack of experience, resulting in higher insurance quotes. Similarly, drivers with a history of accidents or traffic violations may face increased insurance costs.

Additionally, your credit score can also influence your insurance quote. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A good credit score may lead to lower insurance rates, as it indicates financial responsibility and stability.

Vehicle Details

The make, model, and year of your vehicle are essential considerations when obtaining an auto insurance quote. Certain vehicles, especially high-performance or luxury cars, may attract higher insurance costs due to their higher repair and replacement expenses. Additionally, vehicles with advanced safety features or those that are less commonly stolen may qualify for lower insurance rates.

The purpose of your vehicle can also impact your insurance quote. If you use your car for business purposes or as a commercial vehicle, your insurance needs and costs may differ from those who use their cars primarily for personal use.

Coverage Options and Limits

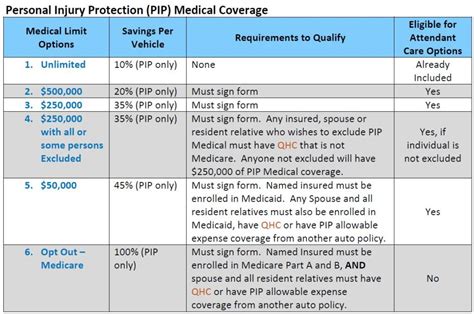

The level of coverage you choose is a significant factor in determining your auto insurance quote. Different coverage options, such as liability, collision, comprehensive, and personal injury protection, offer varying levels of protection and come with different costs. The higher the coverage limits you select, the more expensive your insurance policy will likely be.

It's essential to strike a balance between the coverage you need and the cost of your insurance. Assessing your specific needs and risks can help you choose the right coverage options without overspending on unnecessary features.

Location and Usage

Your geographical location and how you use your vehicle can also influence your auto insurance quote. Insurance rates can vary significantly from one state to another and even within different regions of the same state. Factors such as traffic density, crime rates, and weather conditions can impact insurance costs.

Additionally, the frequency and purpose of your vehicle usage can affect your insurance quote. Those who drive long distances or use their vehicles for commuting may face higher insurance costs compared to occasional drivers or those who primarily use their cars for pleasure trips.

Comparing Auto Insurance Quotes

Obtaining multiple auto insurance quotes is a wise strategy to ensure you’re getting the best value for your money. Comparing quotes from different providers can help you identify the most competitive rates and the best coverage options for your needs.

When comparing quotes, pay close attention to the coverage limits, deductibles, and any additional benefits or discounts offered. Ensure that you're comparing apples to apples by evaluating quotes with similar coverage levels and comparable deductibles. This will help you make an informed decision and choose the insurance provider that offers the best combination of coverage and cost.

Online Quote Comparison Tools

Online quote comparison tools have revolutionized the process of obtaining auto insurance quotes. These tools allow you to input your details and receive multiple quotes from various insurance providers in a matter of minutes. By utilizing these tools, you can efficiently compare quotes and find the most suitable insurance option without spending hours on the phone or visiting multiple insurance agents.

However, it's essential to exercise caution when using online quote comparison tools. Ensure that you provide accurate and complete information to receive the most accurate quotes. Additionally, verify the credibility and reputation of the comparison websites to ensure you're getting unbiased and reliable quotes.

The Role of Insurance Agents

While online quote comparison tools are convenient, consulting with an insurance agent can provide valuable insights and personalized advice. Insurance agents have a deep understanding of the insurance market and can help you navigate the complex world of auto insurance. They can offer guidance on coverage options, explain the fine print of insurance policies, and assist you in choosing the best provider for your needs.

Insurance agents can also help you identify discounts and special offers that may not be readily apparent when obtaining quotes online. They can assess your specific circumstances and recommend tailored insurance solutions that align with your budget and requirements.

Tips for Lowering Your Auto Insurance Costs

While auto insurance quotes are influenced by various factors, there are strategies you can employ to potentially lower your insurance costs.

Improve Your Driving Record

A clean driving record is a significant factor in determining your insurance rates. Maintaining a safe and responsible driving history can lead to lower insurance costs. Avoid traffic violations, practice defensive driving, and consider taking a defensive driving course to demonstrate your commitment to safe driving.

Bundle Your Insurance Policies

Bundling your insurance policies, such as auto and home insurance, with the same provider can often result in significant savings. Many insurance companies offer multi-policy discounts, rewarding customers who choose to insure multiple aspects of their lives with the same carrier.

Explore Discounts and Rewards

Insurance providers offer a variety of discounts and rewards to attract and retain customers. These discounts can include safe driver discounts, good student discounts, loyalty discounts, and discounts for vehicle safety features. By understanding the available discounts and qualifying for them, you can potentially reduce your insurance costs.

Consider Higher Deductibles

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re accepting more financial responsibility in the event of a claim, which can result in reduced insurance costs.

Review Your Coverage Regularly

Your insurance needs may change over time, so it’s essential to regularly review your coverage. As your life circumstances evolve, your insurance requirements may also change. Whether you’ve purchased a new vehicle, moved to a different location, or experienced a significant life event, it’s crucial to reassess your insurance coverage to ensure it aligns with your current needs.

The Future of Auto Insurance Quotes

The auto insurance industry is constantly evolving, and technological advancements are shaping the way quotes are obtained and policies are tailored. The rise of telematics and usage-based insurance (UBI) is a prime example of this evolution.

Telematics devices, installed in vehicles, can track driving behavior and provide real-time data on factors such as acceleration, braking, and mileage. This data is used to assess a driver's risk profile and determine insurance rates. UBI policies offer personalized insurance rates based on an individual's driving habits, rewarding safe drivers with lower premiums.

Additionally, the integration of artificial intelligence (AI) and machine learning is transforming the auto insurance landscape. AI algorithms can analyze vast amounts of data, including driving behavior, vehicle performance, and external factors, to provide more accurate and personalized insurance quotes. This technology can also identify patterns and trends, helping insurance providers make more informed decisions and offer tailored coverage options.

The future of auto insurance quotes looks promising, with advancements in technology and data analytics paving the way for more precise and customized insurance solutions. As the industry continues to innovate, drivers can expect more efficient and accurate quote processes, along with insurance policies that better meet their unique needs.

Conclusion

Auto insurance quotes are a critical component of vehicle ownership, providing financial protection and peace of mind. By understanding the factors that influence these quotes and employing strategies to potentially lower insurance costs, you can make informed decisions about your insurance coverage. Whether you’re a new driver or an experienced motorist, staying informed and proactive about your auto insurance needs is essential for ensuring you’re adequately protected on the road.

How often should I review my auto insurance policy and quotes?

+It’s recommended to review your auto insurance policy and quotes annually, or whenever your life circumstances change significantly. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

Can I negotiate auto insurance quotes with providers?

+While insurance quotes are typically non-negotiable, you can negotiate certain aspects of your policy, such as coverage limits or deductibles. Engaging in an open dialogue with your insurance provider can help you understand your options and potentially find a more suitable policy.

What are some common misconceptions about auto insurance quotes?

+One common misconception is that auto insurance quotes are solely based on the make and model of your vehicle. In reality, quotes are influenced by a multitude of factors, including your driving record, credit score, and coverage choices. Understanding these factors can help dispel misconceptions and lead to more informed decisions.