Automobile Insurance Definition

Automobile insurance, often referred to as car insurance, is a vital aspect of vehicle ownership and road safety. It is a legal and financial safeguard that protects drivers, passengers, and other road users from potential financial risks and liabilities arising from vehicle-related incidents. With millions of vehicles on the roads globally, understanding the intricacies of automobile insurance is crucial for both personal protection and adherence to local laws and regulations.

The Fundamentals of Automobile Insurance

At its core, automobile insurance is a contract between an individual (the policyholder) and an insurance provider. This contract outlines the terms and conditions under which the insurance company agrees to provide financial protection in the event of an accident, theft, or other covered incidents involving the insured vehicle. The specific coverage and benefits offered by an automobile insurance policy can vary significantly depending on the type of policy, the provider, and the jurisdiction.

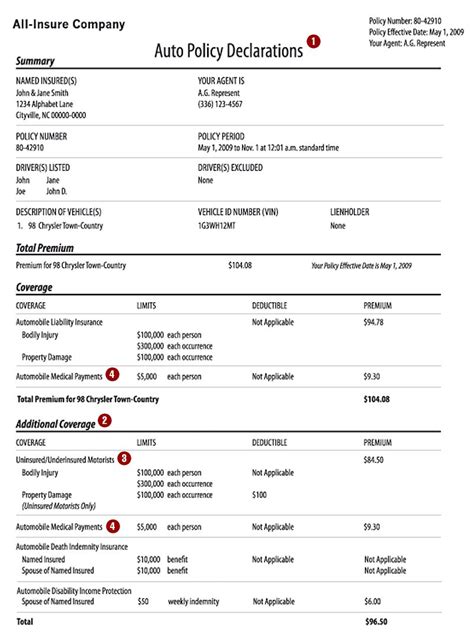

Key Components of Automobile Insurance Policies

Automobile insurance policies typically consist of several components, each addressing different aspects of vehicle-related risks. These components often include:

- Liability Coverage: This is the most fundamental aspect of automobile insurance. It covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident for which the insured driver is at fault. Liability coverage is mandatory in most jurisdictions and is designed to protect the insured from potentially devastating financial consequences of a lawsuit.

- Collision Coverage: This optional coverage pays for damages to the insured vehicle resulting from a collision, regardless of fault. It is particularly beneficial for newer or leased vehicles, as it can cover repair or replacement costs that might otherwise be prohibitively expensive.

- Comprehensive Coverage: Also known as ‘other than collision’ coverage, this optional component covers damages caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. Comprehensive coverage provides an additional layer of protection for the insured vehicle.

- Medical Payments Coverage: This coverage, often referred to as ‘MedPay,’ provides reimbursement for medical expenses incurred by the policyholder or their passengers due to an accident, regardless of fault. It can cover a wide range of medical services, from emergency room visits to long-term care.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who either does not have insurance or does not have sufficient coverage to pay for the damages caused. It is particularly valuable in ensuring that the policyholder is not left financially burdened due to the actions of another driver.

Additional Features and Benefits

Automobile insurance policies can also include a range of additional features and benefits that enhance the overall protection and convenience for the policyholder. These may include:

- Rental Car Reimbursement: This coverage provides a daily allowance to cover the cost of renting a vehicle while the insured vehicle is being repaired or replaced due to a covered incident.

- Roadside Assistance: Many insurance providers offer 24-hour roadside assistance, which can include services like towing, flat tire changes, jump-starts, and fuel delivery.

- Glass Coverage: Some policies offer coverage for damages to the vehicle’s glass, including windshields, side windows, and rear windows, often without applying a deductible.

- Accident Forgiveness: This feature allows policyholders to maintain their current premium rate after an at-fault accident, provided they have maintained a clean driving record for a certain period.

- Usage-Based Insurance (UBI): UBI policies use telematics devices or smartphone apps to track driving behavior, offering discounts to safe drivers based on their actual driving habits and mileage.

The Importance of Automobile Insurance

Automobile insurance serves as a critical financial safety net for vehicle owners and drivers. It provides peace of mind by offering protection against the potentially devastating financial consequences of vehicle-related incidents. Here are some key reasons why automobile insurance is essential:

Legal Compliance

In most countries and states, automobile insurance is a legal requirement for anyone operating a motor vehicle on public roads. Failure to maintain adequate insurance coverage can result in significant fines, suspension of driving privileges, and even criminal charges. Automobile insurance ensures that drivers are financially capable of covering the costs associated with accidents, thus reducing the burden on the legal system and ensuring that victims of accidents receive fair compensation.

Financial Protection

Automobile insurance protects policyholders from the financial fallout of accidents, theft, and other covered incidents. The cost of repairing or replacing a vehicle, covering medical expenses, or compensating for property damage can be substantial. Without insurance, these costs could be devastating for individuals or families, potentially leading to bankruptcy or severe financial strain. Insurance provides a financial safety net, ensuring that policyholders can manage these expenses without significant hardship.

Peace of Mind

Knowing that you have adequate automobile insurance coverage can provide significant peace of mind. It allows drivers to focus on the road without constant worry about the potential financial implications of an accident. With insurance, policyholders can trust that they are protected from the unpredictable nature of road travel, allowing them to enjoy their driving experience with reduced stress and anxiety.

Protection Against Fraud and Scams

Automobile insurance can also serve as a safeguard against fraud and scams. In the event of an accident, insurance companies have the resources and expertise to investigate claims and identify potential fraud. This protection ensures that policyholders are not held liable for false claims or scams perpetrated by other drivers, which could otherwise result in significant financial losses.

Automobile Insurance: A Comprehensive Overview

Automobile insurance is a multifaceted financial tool that plays a crucial role in the lives of vehicle owners and drivers. It offers a range of benefits, from legal compliance and financial protection to peace of mind and protection against fraud. By understanding the various components and features of automobile insurance, policyholders can make informed decisions to ensure they have the right coverage for their needs.

The Future of Automobile Insurance

As technology continues to advance, the automobile insurance industry is also evolving. The rise of autonomous vehicles, connected cars, and advanced driver-assistance systems is likely to impact the way insurance policies are structured and priced. Additionally, the increasing focus on sustainability and eco-friendly vehicles may also influence insurance rates and coverage options. The future of automobile insurance promises innovative solutions to meet the changing needs and risks associated with modern vehicle technology.

Making Informed Choices

Choosing the right automobile insurance policy requires careful consideration of various factors, including personal driving habits, the type of vehicle owned, and local laws and regulations. It is essential to compare policies from different providers, understand the coverage and exclusions, and choose a reputable insurer. By making informed choices, policyholders can ensure they have the protection they need without paying for unnecessary coverage.

The Bottom Line

In conclusion, automobile insurance is a critical component of responsible vehicle ownership. It provides essential financial protection, ensures legal compliance, and offers peace of mind to drivers and their families. With a thorough understanding of the different components and features of automobile insurance, individuals can make informed decisions to protect themselves and their loved ones on the road.

What is the difference between liability and collision coverage in automobile insurance?

+Liability coverage is mandatory and covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident. Collision coverage, on the other hand, is optional and pays for damages to the insured vehicle resulting from a collision, regardless of fault.

Is comprehensive coverage necessary for all vehicle owners?

+Comprehensive coverage is generally recommended, especially for newer or valuable vehicles. It provides protection against a wide range of non-collision incidents, including theft, vandalism, and natural disasters.

How does usage-based insurance (UBI) work, and is it beneficial for drivers?

+UBI policies use telematics or smartphone apps to track driving behavior, offering discounts to safe drivers based on their actual driving habits and mileage. This can be beneficial for drivers who have a clean driving record and drive relatively few miles each year.