Automobile Insurance Quote Comparison

Finding the best automobile insurance quote can be a daunting task, especially with the multitude of options and providers available in the market. It's crucial to compare quotes thoroughly to ensure you're getting the most suitable coverage at the most competitive price. In this comprehensive guide, we'll delve into the world of automobile insurance quotes, exploring the factors that influence them, the steps to compare them effectively, and provide valuable insights to help you make an informed decision.

Understanding the Factors that Influence Automobile Insurance Quotes

The price of automobile insurance is influenced by a range of factors, each playing a significant role in determining the final quote. By understanding these factors, you can better navigate the quote comparison process and make more informed choices.

Vehicle Type and Age

The type and age of your vehicle are primary factors in determining insurance quotes. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their replacement value and advanced features. Sports cars and luxury vehicles often come with higher premiums as they are more prone to accidents and theft. On the other hand, older, less expensive cars might have lower insurance costs, but they may also have higher repair costs due to their age and availability of parts.

Driver Profile

Your driving record and personal details are crucial in calculating insurance quotes. Insurers consider factors such as age, gender, driving experience, and location. Younger drivers, particularly those under 25, often face higher premiums due to their lack of experience and higher accident rates. Similarly, certain areas may have higher insurance rates due to higher accident or theft rates in those regions.

Your driving history is another critical factor. A clean driving record with no accidents or violations can lead to lower premiums. However, if you have a history of accidents, especially if you were at fault, your insurance costs may be significantly higher. Some insurers also consider credit scores, assuming that individuals with higher credit scores are more responsible and likely to make fewer claims.

Coverage and Deductibles

The level of coverage you choose and the associated deductibles also impact your insurance quotes. Comprehensive and collision coverage, which cover damage to your vehicle from accidents, theft, or natural disasters, typically come with higher premiums. Liability coverage, which protects you against claims for bodily injury or property damage caused by you, is usually mandatory but has more affordable options.

Deductibles, the amount you pay out of pocket before your insurance coverage kicks in, also affect your premiums. Choosing a higher deductible can lower your monthly premiums, but it means you'll have to pay more if you need to make a claim. On the other hand, a lower deductible can increase your monthly premiums but provides more financial protection in the event of an accident.

Insurance Provider and Policy Features

Different insurance providers offer varying levels of coverage and policy features, which can impact the overall cost of your insurance. Some providers might specialize in certain types of vehicles or driver profiles, offering more competitive rates for those specific groups. Additionally, policy features like roadside assistance, rental car reimbursement, or accident forgiveness can influence the cost of your insurance.

Comparing Automobile Insurance Quotes

Now that we’ve explored the factors influencing automobile insurance quotes, let’s dive into the steps to effectively compare quotes and find the best deal.

Define Your Coverage Needs

Before you start comparing quotes, it’s essential to define your coverage needs. Consider the type of coverage you require (liability, collision, comprehensive, etc.) and the level of coverage that suits your needs and budget. Keep in mind that while lower coverage limits may result in lower premiums, they might not provide adequate protection in the event of an accident or claim.

Research Insurance Providers

Familiarize yourself with a variety of insurance providers. You can start by researching the major players in the industry, but don’t limit yourself to just a few. Consider smaller, regional insurers who might offer more specialized coverage or better rates for your specific needs. Look for providers with a good reputation and financial stability to ensure they can provide reliable coverage in the long term.

Obtain Multiple Quotes

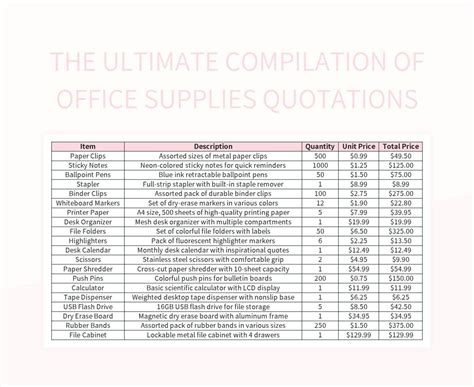

The key to finding the best automobile insurance quote is to obtain multiple quotes from different providers. You can use online comparison tools, which allow you to enter your details once and receive quotes from multiple insurers, or visit the websites or offices of individual providers to get quotes. Ensure that you’re comparing apples to apples by requesting quotes with similar coverage limits and deductibles.

Evaluate the Quotes

Once you have a selection of quotes, it’s time to evaluate them. Compare the premiums, deductibles, coverage limits, and any additional policy features offered. Look for quotes that provide the best balance of coverage and cost. Remember, the cheapest quote might not always be the best option if it doesn’t provide adequate coverage.

Consider Discounts and Additional Benefits

Many insurance providers offer discounts and additional benefits that can make their policies more attractive. Look for discounts based on your driving record, vehicle safety features, multi-policy bundles (combining auto insurance with other types of insurance), or loyalty rewards for long-term customers. Some providers might also offer unique benefits like accident forgiveness, which waives a rate increase after your first at-fault accident.

Read the Policy Documents

Before finalizing your decision, it’s crucial to read the policy documents thoroughly. Understand the fine print, including any exclusions or limitations, to ensure you’re not missing any critical details. Pay attention to the terms and conditions, the process for making claims, and any potential penalties or fees associated with the policy.

Customer Service and Claims Process

Consider the reputation and reliability of the insurance provider’s customer service and claims process. Read reviews and seek recommendations from friends or family to gauge the provider’s responsiveness and efficiency in handling claims. A provider with excellent customer service can make a significant difference in the event of an accident or claim.

Future Implications and Considerations

When comparing automobile insurance quotes, it’s important to keep in mind that your insurance needs may change over time. Regularly review your insurance coverage to ensure it aligns with your current situation and any changes in your vehicle, driving habits, or personal circumstances. Stay informed about market trends and changes in insurance regulations that might impact your coverage and premiums.

Additionally, consider the potential impact of technological advancements on automobile insurance. Telematics or usage-based insurance, which uses devices to monitor your driving habits and provide personalized insurance rates, is becoming increasingly popular. While this can offer more accurate pricing for safe drivers, it also means your premiums might increase if your driving habits are less than ideal.

Conclusion

Comparing automobile insurance quotes is a crucial step in ensuring you get the best coverage at the most competitive price. By understanding the factors that influence quotes and following the steps outlined in this guide, you can make an informed decision that suits your needs and budget. Remember to regularly review your coverage and stay up-to-date with industry trends to ensure you’re always getting the best value for your insurance.

How often should I compare automobile insurance quotes?

+It’s a good practice to compare quotes annually, especially if you haven’t reviewed your policy in a while. This ensures you’re always getting the best deal and haven’t been left behind by changing market conditions or new policies offered by your insurer. Additionally, any significant changes to your vehicle, driving habits, or personal circumstances should trigger a review of your insurance coverage.

Can I negotiate my automobile insurance quote?

+While insurance quotes are generally based on standardized formulas, there may be some room for negotiation, especially with smaller, independent insurers. You can try negotiating by highlighting your safe driving record, loyalty to the insurer, or by bundling multiple policies. However, keep in mind that insurers have strict guidelines and negotiating power may be limited.

What are some common mistakes to avoid when comparing automobile insurance quotes?

+One common mistake is solely focusing on the lowest premium without considering the coverage provided. Another mistake is not reading the policy documents thoroughly, which can lead to unexpected exclusions or limitations. Additionally, failing to research the insurer’s reputation and financial stability can leave you vulnerable in the event of a claim.