Automobile Insurance Reviews

Automobile insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With a myriad of insurance providers offering different coverage options, it can be challenging for individuals to navigate the complex landscape and make informed decisions. This comprehensive review aims to shed light on the intricacies of automobile insurance, offering expert insights, real-world examples, and in-depth analysis to assist readers in understanding the key factors that influence their insurance choices.

Understanding the Fundamentals of Automobile Insurance

At its core, automobile insurance is a contract between an individual and an insurance provider, whereby the insurer agrees to provide financial protection in the event of an accident, theft, or other specified incidents involving the insured vehicle. This protection extends to cover medical expenses, property damage, and potential liability claims arising from vehicular accidents.

The insurance coverage typically includes various components, such as:

- Liability Coverage: This aspect of insurance covers the policyholder for bodily injury and property damage caused to others in an accident for which the insured is deemed responsible.

- Collision Coverage: This option provides coverage for damage to the insured vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: It covers damage to the insured vehicle resulting from events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Medical Payments or Personal Injury Protection (PIP): These coverages provide payment for medical expenses incurred by the insured and their passengers due to an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured in the event of an accident with a driver who either has no insurance or insufficient insurance to cover the damages.

Understanding these fundamental components is crucial when evaluating insurance policies and ensuring adequate protection.

Factors Influencing Automobile Insurance Premiums

Insurance providers use a range of factors to assess the risk associated with insuring a particular individual and their vehicle. These factors influence the premium, which is the amount the policyholder pays for their insurance coverage. Some of the key factors include:

- Driver's Age and Experience: Younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience, while more experienced drivers may enjoy lower rates.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or violations may result in higher rates.

- Vehicle Type and Usage: The type of vehicle, its age, make, and model, as well as the primary purpose of its use (e.g., personal, business, or pleasure) can impact insurance premiums. Sports cars and high-performance vehicles often command higher premiums due to their association with higher risk.

- Location: The geographic location where the vehicle is primarily garaged and driven can affect insurance rates. Urban areas with higher traffic density and crime rates may result in higher premiums.

- Credit History: In many states, insurance providers are allowed to consider an individual's credit score when determining premiums. A good credit history can lead to lower rates.

These factors, among others, are taken into account by insurance providers when calculating premiums. Understanding how these factors influence insurance rates can help individuals make informed decisions about their coverage and potentially negotiate better terms.

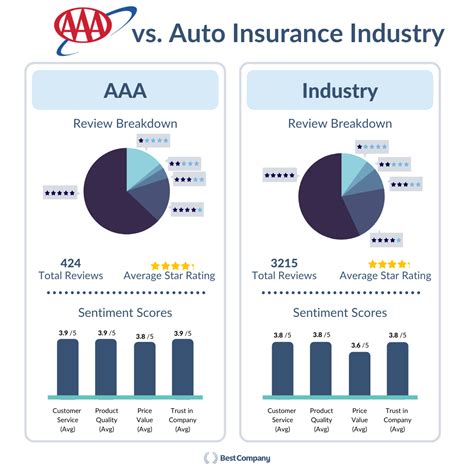

The Role of Insurance Providers and Their Reputation

Choosing an insurance provider is a critical decision that can significantly impact the overall insurance experience. The reputation of an insurance company is often a strong indicator of the quality of service and coverage it offers. Reputable providers are known for their financial stability, ensuring they can fulfill their obligations to policyholders even in the event of widespread claims, such as those resulting from natural disasters.

Furthermore, a strong reputation often signifies a provider's commitment to customer service and satisfaction. This includes prompt and fair claim processing, a comprehensive understanding of the local market and its specific risks, and a range of coverage options tailored to individual needs.

Comparing Insurance Providers: A Real-World Example

Let’s consider a hypothetical scenario to illustrate the importance of choosing the right insurance provider. Imagine two drivers, John and Sarah, who live in the same city and have similar driving records and vehicle types. John chooses Provider A, known for its low premiums, while Sarah opts for Provider B, renowned for its excellent customer service and comprehensive coverage.

Over the course of a year, both drivers encounter different scenarios. John, with Provider A, experiences a minor fender bender and is impressed with the swift claim processing, receiving a full payout for his repairs within a week. However, when he inquires about adding comprehensive coverage, he discovers the premium would increase significantly, impacting his budget.

Meanwhile, Sarah, with Provider B, also experiences a minor accident. Her claim is processed efficiently, and she receives guidance on finding a reputable repair shop. Additionally, when she expresses interest in adding comprehensive coverage, Provider B offers her a tailored package that fits her budget and provides the additional protection she desires.

This example highlights how the reputation and offerings of different insurance providers can significantly impact the overall insurance experience, from claim processing to the flexibility of coverage options.

The Impact of Technological Advancements on Automobile Insurance

The automobile insurance industry has undergone significant transformations with the advent of technology. From online quote comparisons to the use of telematics for usage-based insurance, technology has revolutionized the way insurance is purchased and managed.

Online Quote Comparisons and Digital Convenience

The internet has made it easier than ever for individuals to compare insurance quotes from multiple providers. Online platforms and comparison websites offer a convenient way to shop for insurance, allowing users to input their details once and receive multiple quotes tailored to their needs.

This digital convenience not only saves time but also empowers individuals to make more informed decisions. They can easily compare premiums, coverage options, and provider reputations, ensuring they choose the best policy for their circumstances.

Usage-Based Insurance and Telematics

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is an innovative approach that uses telematics devices to monitor driving behavior and tailor insurance premiums accordingly. These devices track factors such as miles driven, time of day, and driving habits, providing insurers with real-time data to assess risk and set premiums.

For instance, a driver who primarily uses their vehicle during low-traffic hours and maintains a safe driving record may qualify for lower premiums under a usage-based insurance plan. This approach incentivizes safe driving and rewards individuals who exhibit low-risk behavior, potentially leading to significant savings on insurance costs.

The Future of Automobile Insurance: Industry Trends and Predictions

As technology continues to advance, the automobile insurance industry is poised for further transformation. Several emerging trends are expected to shape the future of insurance, offering enhanced convenience, customization, and risk management for policyholders.

Autonomous Vehicles and Their Impact on Insurance

The rise of autonomous vehicles is expected to have a significant impact on automobile insurance. As self-driving cars become more prevalent, the traditional notion of “driver responsibility” may shift, leading to a reevaluation of liability and coverage needs. Insurers will need to adapt their policies and underwriting practices to accommodate this evolving landscape.

Additionally, the increased safety features and reduced accident rates associated with autonomous vehicles could potentially lead to lower insurance premiums for policyholders. However, the transition period as autonomous vehicles integrate into the existing vehicular ecosystem may present unique challenges and opportunities for the insurance industry.

Data-Driven Insurance and Advanced Analytics

The insurance industry is increasingly leveraging data analytics to enhance its understanding of risk and tailor coverage options. Advanced analytics techniques, such as machine learning and artificial intelligence, are being used to identify patterns and trends in insurance claims, enabling insurers to offer more precise and personalized coverage.

For instance, by analyzing vast amounts of data on driving behavior, weather conditions, and accident trends, insurers can develop more accurate risk models. This allows them to offer customized insurance packages that better align with the unique needs and circumstances of individual policyholders, potentially leading to more efficient risk management and cost savings.

| Insurance Provider | Premium (Annual) | Coverage Options | Claim Processing Time |

|---|---|---|---|

| Provider A | $1,200 | Basic Coverage | 5 Days |

| Provider B | $1,500 | Comprehensive Coverage | 3 Days |

| Provider C | $1,350 | Customizable Coverage | 7 Days |

Conclusion

Automobile insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind. By understanding the fundamentals of insurance, the factors that influence premiums, and the role of reputable insurance providers, individuals can make informed decisions when choosing their coverage. Additionally, embracing technological advancements and staying abreast of industry trends can further enhance the insurance experience, ensuring policyholders receive the best value and protection for their needs.

What is the average cost of automobile insurance in the United States?

+

The average cost of automobile insurance in the U.S. varies significantly depending on factors such as the state, driver’s age and record, and the type of vehicle. According to the Insurance Information Institute, the national average annual premium for automobile insurance was approximately $1,674 in 2021. However, it’s important to note that this is just an average, and individual premiums can be significantly higher or lower based on various factors.

How often should I review my automobile insurance policy?

+

It’s a good practice to review your automobile insurance policy annually or whenever your life circumstances change significantly. This could include buying a new vehicle, moving to a different state or city, getting married or divorced, or adding a teen driver to your policy. Regular reviews ensure that your coverage remains adequate and up-to-date, and you’re not overpaying for unnecessary coverage.

What are some common discounts available for automobile insurance policies?

+

Many insurance providers offer a variety of discounts to policyholders. Common discounts include multi-policy discounts (when you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance), good student discounts (for students with a certain GPA), safe driver discounts (for drivers with a clean record), and loyalty discounts (for long-term customers). Additionally, some providers offer discounts for vehicles equipped with safety features or for policyholders who maintain a good credit score.