Average Auto Insurance Rates By Car

Understanding the cost of auto insurance is crucial for every car owner. The premium you pay can vary significantly based on various factors, including the make and model of your vehicle. In this comprehensive guide, we delve into the world of average auto insurance rates, specifically focusing on how different car types impact your insurance costs. By exploring real-world data and expert insights, we aim to provide you with a detailed analysis to help you make informed decisions about your car insurance.

Demystifying Auto Insurance Rates: An In-Depth Analysis

Auto insurance is a vital aspect of car ownership, providing financial protection in the event of accidents, theft, or other mishaps. The cost of this protection, however, can be influenced by numerous factors, making it essential to understand the average rates and their determinants.

The type of car you drive is one of the primary factors that insurance companies consider when calculating your premium. In this section, we'll explore how different car models and makes affect insurance rates, providing you with valuable insights to help you navigate the insurance landscape.

Sedans: The Popular Choice

Sedans are a popular choice among car buyers, known for their practicality, comfort, and fuel efficiency. These vehicles often come with a range of safety features, which can impact insurance rates positively. Here's a breakdown of the average insurance rates for some popular sedan models:

| Sedan Model | Average Annual Premium |

|---|---|

| Toyota Corolla | $1,250 |

| Honda Civic | $1,300 |

| Nissan Sentra | $1,180 |

| Hyundai Elantra | $1,220 |

| Kia Forte | $1,150 |

Sedans are generally considered affordable to insure due to their relatively low repair costs and the availability of safety features. Additionally, their popularity means that spare parts are often readily available, which can further reduce insurance costs.

SUVs: The Rising Stars

SUVs (Sports Utility Vehicles) have gained immense popularity in recent years, offering a blend of versatility, power, and style. However, their insurance rates can vary significantly depending on the model and features.

| SUV Model | Average Annual Premium |

|---|---|

| Ford Explorer | $1,450 |

| Jeep Grand Cherokee | $1,520 |

| Toyota RAV4 | $1,380 |

| Honda CR-V | $1,350 |

| Chevrolet Equinox | $1,420 |

While SUVs are generally considered more expensive to insure than sedans, the insurance rates can vary widely. Some SUVs, especially those with advanced safety features and good safety ratings, may offer competitive insurance rates. However, larger and more powerful SUVs can often attract higher premiums due to their higher repair costs and potential for causing more severe damage in accidents.

Luxury Cars: Premium Prices

Luxury cars are synonymous with opulence and performance, but they often come with a hefty insurance price tag. Here's a glimpse at the average insurance rates for some luxury car models:

| Luxury Car Model | Average Annual Premium |

|---|---|

| Mercedes-Benz C-Class | $2,100 |

| BMW 3 Series | $2,050 |

| Audi A4 | $1,980 |

| Lexus ES | $1,850 |

| Volvo S60 | $1,720 |

Luxury cars often command higher insurance premiums due to their expensive repair costs, advanced technology, and the potential for higher theft rates. Additionally, the performance capabilities of these vehicles can increase the risk of accidents, further impacting insurance rates.

Electric Vehicles: A Unique Consideration

Electric vehicles (EVs) are becoming increasingly popular, offering eco-friendly and cost-effective alternatives to traditional gas-powered cars. However, their insurance rates can be a bit of a puzzle.

| Electric Vehicle Model | Average Annual Premium |

|---|---|

| Tesla Model 3 | $1,600 |

| Chevrolet Bolt | $1,480 |

| Nissan Leaf | $1,320 |

| Hyundai Kona Electric | $1,450 |

| Audi e-Tron | $1,900 |

Insurance rates for EVs can vary depending on the model and its features. Some EVs, especially those with advanced safety systems and good crash test ratings, may offer competitive insurance rates. However, the cost of replacing specialized parts and the potential for higher repair costs can sometimes result in higher insurance premiums.

Sports Cars: The Thrill Comes at a Cost

Sports cars are designed for performance and excitement, but their insurance rates reflect the risks associated with their high speeds and handling capabilities.

| Sports Car Model | Average Annual Premium |

|---|---|

| Porsche 911 | $3,200 |

| Chevrolet Corvette | $2,850 |

| Nissan GT-R | $2,650 |

| Ford Mustang | $2,350 |

| Audi TT | $2,200 |

Sports cars often attract higher insurance premiums due to their performance capabilities, which can increase the risk of accidents. Additionally, their specialized parts and high-end technology can result in higher repair costs, further impacting insurance rates.

Classic Cars: A Different Ballgame

Classic cars are a category of their own, often attracting enthusiasts and collectors. The insurance rates for classic cars can vary widely, depending on factors such as the car's rarity, condition, and intended use.

For classic cars, insurance providers often offer specialized policies that take into account the unique value and nature of these vehicles. These policies may have different criteria for determining premiums, such as the car's agreed value, the frequency of use, and the level of coverage required. Classic car insurance policies often provide comprehensive coverage for events such as theft, fire, and damage, ensuring that the vehicle's unique value is protected.

Factors Influencing Auto Insurance Rates

Beyond the type of car, several other factors influence insurance rates. These include your driving history, age, location, and the coverage and deductibles you choose. Here's a quick breakdown:

- Driving History: A clean driving record with no accidents or violations can lead to lower insurance rates.

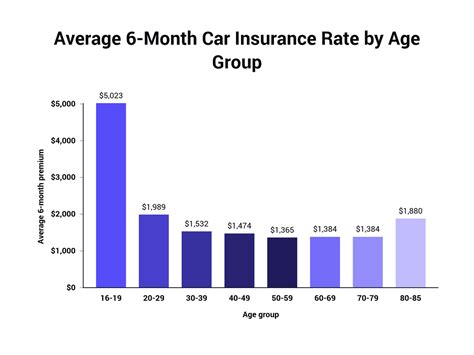

- Age: Younger drivers, especially those under 25, often pay higher premiums due to their lack of driving experience.

- Location: Insurance rates can vary based on where you live, with urban areas often associated with higher premiums due to increased risk of accidents and theft.

- Coverage and Deductibles: The level of coverage you choose (e.g., liability-only vs. comprehensive) and your deductible amount can significantly impact your premium.

Strategies to Reduce Auto Insurance Costs

While insurance rates are influenced by various factors, there are strategies you can employ to potentially reduce your premiums. Here are some tips:

- Shop Around: Compare quotes from multiple insurance providers to find the best rate for your car and circumstances.

- Bundle Policies: Insuring your car and home (or other policies) with the same provider can often result in discounts.

- Increase Your Deductible: Opting for a higher deductible can lower your premium, but be sure you can afford the out-of-pocket expense in the event of a claim.

- Maintain a Good Driving Record: Avoid accidents and violations to keep your insurance rates as low as possible.

- Consider Telematics: Some insurance providers offer usage-based insurance, where your driving behavior is monitored and can lead to discounts for safe driving.

The Future of Auto Insurance

The auto insurance landscape is evolving rapidly, driven by advancements in technology and changing consumer behaviors. The rise of autonomous vehicles, for instance, is likely to have a significant impact on insurance rates and policies in the future. Additionally, the increasing adoption of electric vehicles and the development of new safety technologies are expected to influence insurance costs and coverage options.

As we move towards a more connected and sustainable future, the insurance industry is adapting to provide innovative solutions. This includes the development of new coverage options, such as cyber insurance for connected cars, and the integration of advanced analytics and artificial intelligence to better assess risk and offer personalized insurance products.

Conclusion

Understanding the average auto insurance rates by car is a crucial step in making informed decisions about your car insurance. While the type of car you drive is a significant factor, it's important to consider other variables such as your driving history, age, location, and the coverage and deductibles you choose. By being mindful of these factors and employing strategies to reduce costs, you can find an insurance policy that provides adequate coverage at a competitive price.

As the auto insurance landscape continues to evolve, staying informed and proactive is key. Whether you're a sedan owner, an SUV enthusiast, or a proud driver of a classic car, keeping abreast of the latest trends and developments in the insurance industry can help you make the most of your coverage while keeping costs in check.

How do insurance companies determine rates for different car types?

+

Insurance companies use a variety of factors to determine rates, including the car’s make, model, age, and safety features. They also consider statistical data on repair costs, theft rates, and accident frequencies associated with different car types.

Are there any ways to lower insurance rates for high-risk vehicles like sports cars or luxury cars?

+

While the type of car is a significant factor, you can potentially lower your rates by maintaining a clean driving record, increasing your deductible, and shopping around for the best deals. Some insurance providers also offer discounts for advanced safety features or driver training courses.

What should I consider when choosing an insurance policy for my car?

+

When choosing an insurance policy, consider factors such as the level of coverage you need (liability-only vs. comprehensive), your deductible amount, and any additional features or benefits offered by the insurer. It’s also important to compare quotes from multiple providers to find the best value for your circumstances.