Average Car Insurance Cost Per Month

Understanding the average cost of car insurance is crucial for any vehicle owner. While the exact price can vary significantly depending on numerous factors, gaining insight into these averages can provide a solid starting point for budgeting and comparison. This article aims to delve into the intricacies of average car insurance costs, exploring the various influences that can affect your premium.

Average Monthly Car Insurance Costs

On average, car insurance costs in the United States can range from approximately 50 to 200 per month, depending on several key factors. These averages are calculated based on data from various insurance providers and reflect the median premiums paid by policyholders across the country.

Influencing Factors

Several factors contribute to the variation in car insurance costs. Here are some of the primary influences:

- Vehicle Type and Value: The make, model, and age of your vehicle play a significant role. High-performance cars or luxury vehicles often carry higher insurance costs due to their expensive repair and replacement costs.

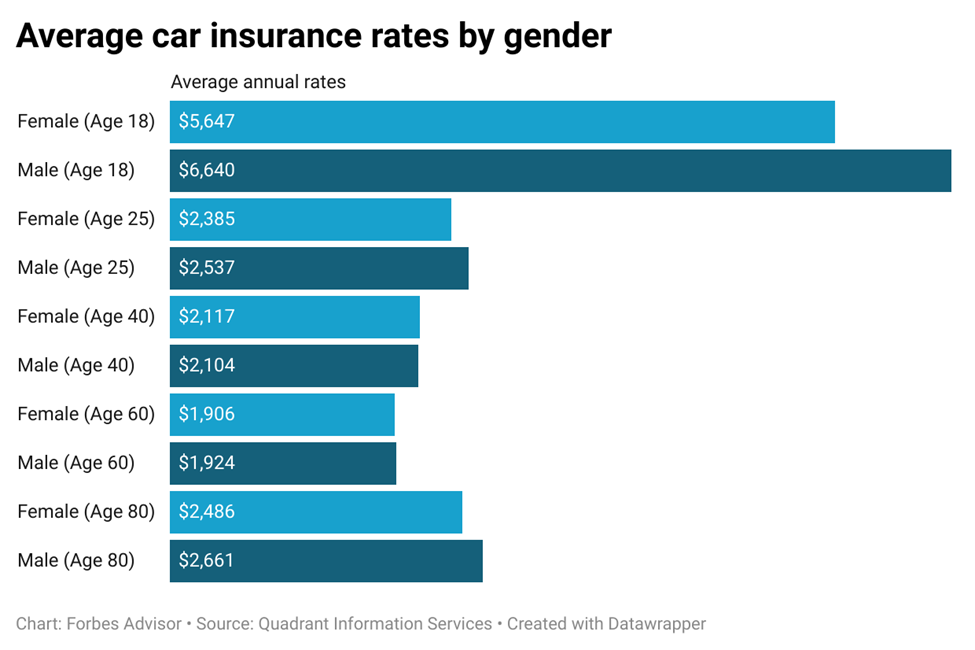

- Driver Profile: Your age, gender, driving history, and credit score are key considerations. Younger drivers, especially males under 25, typically face higher premiums due to their perceived risk. A clean driving record and a good credit score can work in your favor, leading to lower insurance costs.

- Coverage and Deductibles: The level of coverage you choose impacts your premium. Comprehensive and collision coverage provide broader protection but can increase your costs. Additionally, higher deductibles can reduce your monthly premium but mean you pay more out-of-pocket if you file a claim.

- Location: The state and even the specific area where you live or park your car matters. Areas with higher crime rates or more frequent accidents may see elevated insurance costs. Similarly, rural areas with fewer accidents and lower population density often have lower insurance rates.

- Insurance Provider: Different insurance companies offer varying rates based on their risk assessment models and business strategies. Shopping around and comparing quotes from multiple providers can help you find the best deal for your specific circumstances.

| Coverage Type | Average Monthly Cost |

|---|---|

| Liability Only | $40 - $80 |

| Full Coverage (including Collision and Comprehensive) | $100 - $200 |

Breaking Down the Average Cost by Coverage Type

The average cost of car insurance can vary significantly based on the type of coverage you choose. Here’s a closer look at the average monthly costs for different coverage options:

Liability-Only Coverage

Liability insurance is the most basic form of car insurance, covering the costs of damages and injuries you cause to others in an accident. It’s required by law in most states and is often the cheapest option. On average, liability-only coverage costs 40 to 80 per month. This range can vary depending on your driving record, the state you live in, and other factors.

Full Coverage (including Collision and Comprehensive)

Full coverage car insurance offers a more comprehensive level of protection, including coverage for damage to your own vehicle, regardless of fault. This type of insurance typically includes collision coverage (covering damages to your vehicle in an accident) and comprehensive coverage (covering damages caused by non-collision incidents like theft, vandalism, or natural disasters). The average monthly cost for full coverage car insurance is 100 to 200, with the exact amount influenced by the factors mentioned earlier.

Regional Variations in Car Insurance Costs

The average cost of car insurance can vary significantly across different regions in the United States. Factors such as traffic density, crime rates, and the frequency of accidents can all impact insurance rates. Here’s a look at how average monthly car insurance costs can differ based on region:

Urban vs. Rural Areas

In general, urban areas tend to have higher car insurance costs than rural areas. This is primarily due to increased traffic density and a higher likelihood of accidents and theft in urban environments. For instance, the average monthly car insurance premium in a large city like New York City can be upwards of 250</strong>, while in a rural area, it might be closer to <strong>100.

State-by-State Differences

Car insurance rates can also vary significantly from one state to another. This variation is influenced by a range of factors, including state laws, the cost of living, and the overall driving culture. For example, states with a higher cost of living, like California and New Jersey, often have higher average insurance rates. On the other hand, states with a lower cost of living and fewer claims, like North Dakota and Idaho, tend to have lower average insurance costs.

Tips for Reducing Your Car Insurance Costs

While the average car insurance costs provide a benchmark, there are strategies you can employ to potentially reduce your premiums. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the most competitive rates for your specific circumstances.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premium, but remember that you'll pay more out-of-pocket if you need to file a claim.

- Bundle Policies: If you have multiple vehicles or need other types of insurance, like homeowners or renters insurance, consider bundling your policies with the same provider. Many insurers offer discounts for bundling multiple policies.

- Maintain a Clean Driving Record: A clean driving record with no accidents or violations can lead to lower insurance costs. Safe driving habits and avoiding traffic citations are key.

- Explore Discounts: Many insurance providers offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty discounts. Be sure to ask your insurer about any applicable discounts.

The Impact of Driving Behavior on Insurance Costs

Your driving behavior is a significant factor in determining your car insurance costs. Insurance companies use data-driven models to assess your risk profile, and certain driving behaviors can lead to higher premiums. Here’s how your driving behavior can impact your insurance costs:

Speeding and Traffic Violations

Speeding tickets and other traffic violations can have a direct impact on your insurance rates. These violations suggest a higher risk of being involved in an accident, which can lead to increased premiums. In some cases, multiple violations within a short period can result in a significant hike in your insurance costs or even the cancellation of your policy.

Accident History

Your accident history is a key consideration for insurance companies. Even a single at-fault accident can lead to higher insurance premiums. The more accidents you’ve been involved in, the higher your perceived risk, which can result in significantly increased rates or difficulty finding affordable insurance.

Safe Driving Habits

On the other hand, maintaining safe driving habits can lead to lower insurance costs. This includes avoiding aggressive driving, following traffic laws, and practicing defensive driving techniques. Some insurance companies even offer discounts for safe driving behaviors or provide telematics devices that track your driving habits and reward safe driving with lower premiums.

The Role of Technology in Car Insurance Costs

Advancements in technology have had a significant impact on the car insurance industry. From the introduction of telematics devices to the development of usage-based insurance (UBI) programs, technology is changing the way insurance rates are determined. Here’s how technology is influencing car insurance costs:

Telematics Devices and UBI Programs

Telematics devices are small gadgets that can be installed in your vehicle to track your driving behavior. These devices collect data on various aspects of your driving, such as speed, acceleration, braking, and even the time of day you drive. Insurance companies use this data to assess your risk and offer personalized insurance rates based on your actual driving habits. UBI programs, which use telematics data, can provide significant savings for safe drivers.

Vehicle Technology and Safety Features

The technology built into modern vehicles can also impact your insurance costs. Advanced safety features like lane departure warning systems, automatic emergency braking, and adaptive cruise control can reduce the likelihood of accidents, leading to lower insurance premiums. Insurance companies often offer discounts for vehicles equipped with these advanced safety technologies.

Digital Tools for Policy Management

Insurance companies are also leveraging technology to enhance the policy management process. Online platforms and mobile apps allow policyholders to manage their policies, make payments, and file claims more efficiently. These digital tools can streamline the insurance process, potentially leading to cost savings for both the insurer and the policyholder.

Future Trends in Car Insurance Costs

The car insurance landscape is continually evolving, and several trends are shaping the future of insurance costs. Here are some key trends to watch:

Autonomous Vehicles

The rise of autonomous vehicles (AVs) is expected to have a significant impact on car insurance costs. As AVs become more prevalent, the number of accidents is expected to decrease, leading to lower insurance premiums. However, the transition period as AVs share the road with traditional vehicles could see increased insurance costs due to the potential for more complex accidents and liability issues.

Connected Car Technology

Connected car technology, which allows vehicles to communicate with each other and with infrastructure, has the potential to improve road safety and reduce accidents. This technology can provide real-time data on road conditions, traffic patterns, and vehicle performance, which can be used by insurance companies to assess risk more accurately. As connected car technology becomes more widespread, it could lead to more personalized insurance rates based on real-time data.

Data Analytics and Artificial Intelligence

Insurance companies are increasingly using advanced data analytics and artificial intelligence (AI) to assess risk and determine insurance rates. These technologies allow insurers to analyze vast amounts of data, including driving behavior, vehicle performance, and even weather patterns, to more accurately predict and price risk. As these technologies evolve, insurance rates are likely to become even more personalized and dynamic.

How often should I review my car insurance policy and rates?

+It’s a good practice to review your car insurance policy and rates at least once a year. Insurance rates can change based on various factors, including your driving record, the value of your vehicle, and changes in your personal circumstances. By reviewing your policy annually, you can ensure you’re still getting the best rate and coverage for your needs.

Can I negotiate my car insurance rates with my provider?

+While insurance rates are largely determined by algorithms and risk assessments, you can still negotiate with your provider to some extent. You can ask for a review of your policy and discuss any changes in your circumstances that might impact your risk profile. Additionally, shopping around and obtaining quotes from multiple providers can give you leverage during negotiations.

What factors can lead to an increase in my car insurance rates?

+Several factors can lead to an increase in your car insurance rates. These include getting into an at-fault accident, receiving traffic violations, or making frequent insurance claims. Changes in your personal circumstances, such as moving to a new location with higher insurance rates or adding a young driver to your policy, can also result in higher premiums. It’s important to review your policy regularly and take steps to maintain a safe driving record to avoid unnecessary rate increases.