Average Car Insurance Cost Per Year

Car insurance is a fundamental aspect of vehicle ownership, offering financial protection and peace of mind to drivers across the globe. The cost of this essential coverage, however, can vary significantly depending on numerous factors. Understanding the average car insurance cost per year is crucial for individuals looking to budget effectively and make informed decisions about their insurance coverage.

Factors Influencing Car Insurance Costs

Before delving into the average costs, it’s essential to recognize the myriad factors that can influence car insurance premiums. These factors are often unique to each driver and can result in substantial variations in insurance costs. Here’s an overview of some key considerations:

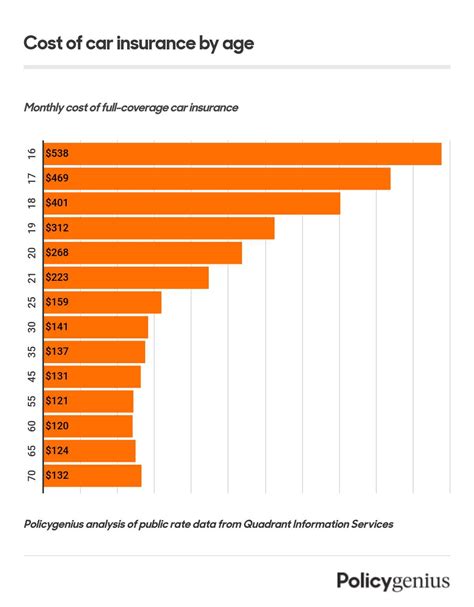

- Driver's Age and Gender: Insurance companies often categorize drivers based on their age and gender, as these factors can significantly impact the likelihood of accidents. Younger drivers, particularly males, are generally considered higher risk and thus may face higher premiums.

- Driving Record: A clean driving record with no accidents or violations is a major factor in keeping insurance costs down. Conversely, a history of accidents or traffic violations can lead to significantly higher premiums.

- Vehicle Type and Usage: The type of vehicle and its intended usage can greatly affect insurance costs. Sports cars and luxury vehicles often attract higher premiums due to their higher repair costs. Similarly, vehicles used for business purposes or long commutes may also result in increased insurance costs.

- Location: The area in which a driver resides and operates their vehicle can have a substantial impact on insurance rates. Urban areas with higher populations and traffic volumes often result in higher premiums due to increased accident risks.

- Coverage Options: The level of coverage chosen by the policyholder can significantly affect the overall cost. Comprehensive and collision coverage, while providing more extensive protection, can also increase the insurance premium.

- Insurance Company and Policy: Different insurance companies offer various policies with different coverage options and price points. Shopping around and comparing quotes is crucial to finding the best deal.

Understanding the Average Car Insurance Cost

The average annual car insurance cost is a useful benchmark for individuals seeking to understand the general expense associated with this essential coverage. However, it’s important to remember that this average is a broad estimate and can vary significantly based on individual circumstances.

According to recent industry data, the average annual car insurance cost in the United States is approximately $1,674. This figure represents a composite of various coverage levels, vehicles, and driving records. However, it's essential to note that this average can vary widely from state to state, with some states having significantly higher or lower average premiums.

State-by-State Variations

Car insurance costs can differ significantly across states due to variations in state laws, regulations, and demographics. For instance, states with higher population densities and more congested urban areas often have higher average insurance costs. Similarly, states with stricter insurance regulations or higher average claim costs may also see increased insurance premiums.

| State | Average Annual Premium |

|---|---|

| Michigan | $3,500 |

| Florida | $2,200 |

| New York | $1,900 |

| Texas | $1,500 |

| California | $1,400 |

Factors Influencing Average Costs

Several key factors contribute to the average car insurance cost, providing insight into why insurance premiums can vary so widely.

- Population Density: States or regions with higher population densities often experience higher average insurance costs due to increased traffic congestion and accident risks.

- Traffic Volume and Accidents: Areas with high traffic volumes and a history of frequent accidents tend to have higher insurance costs. This is particularly true for urban areas.

- Demographics: The demographics of a region, including the average age and gender distribution, can significantly impact insurance costs. Areas with a higher proportion of younger drivers, for instance, may see increased premiums.

- State Laws and Regulations: Different states have varying insurance laws and regulations, which can impact the cost of insurance. Some states, for example, require more extensive coverage, leading to higher average premiums.

- Claim Frequency and Severity: The frequency and severity of insurance claims in a given area can greatly affect insurance costs. Regions with higher claim rates or more severe accidents may experience increased insurance premiums.

Tips for Reducing Car Insurance Costs

While the average car insurance cost provides a useful benchmark, many individuals may seek ways to reduce their insurance premiums. Here are some effective strategies to consider:

- Shop Around: Comparing quotes from multiple insurance providers is crucial to finding the best deal. Online comparison tools and direct quotes from insurance companies can help identify the most competitive rates.

- Improve Your Driving Record: Maintaining a clean driving record is essential to keeping insurance costs down. Avoid accidents and traffic violations, and consider taking a defensive driving course to demonstrate your commitment to safe driving.

- Choose Your Vehicle Wisely: The type of vehicle you drive can significantly impact your insurance costs. Sports cars and luxury vehicles often attract higher premiums due to their higher repair costs. Opting for a safer, more economical vehicle can help reduce insurance expenses.

- Consider Bundle Discounts: Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Bundling can lead to significant savings.

- Adjust Your Coverage: Review your insurance coverage regularly and adjust it as needed. If your vehicle is older or has low monetary value, you may not need as extensive coverage, allowing you to reduce your premium.

- Explore Discounts: Insurance companies offer various discounts, including safe driver discounts, good student discounts, and loyalty discounts. Ask your insurance provider about the discounts they offer and ensure you're taking advantage of all applicable ones.

The Future of Car Insurance Costs

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer trends. These developments are likely to impact the average car insurance cost in the coming years.

Technological Innovations

Technological advancements, particularly in the realm of autonomous and connected vehicles, are poised to significantly impact car insurance costs. As these technologies become more prevalent, insurance companies may adjust their underwriting models and pricing structures. For instance, autonomous vehicles are expected to reduce accident rates, potentially leading to lower insurance premiums.

Changing Consumer Behavior

Shifts in consumer behavior, such as the increasing popularity of ride-sharing services and the rise of electric vehicles, are also likely to influence car insurance costs. As more individuals opt for alternative transportation methods, the number of personal vehicles on the road may decrease, potentially reducing accident rates and insurance premiums.

Regulatory Changes

Changes in insurance regulations and laws at the state and federal levels can also impact insurance costs. For example, the introduction of mandatory coverage requirements or changes in rating factors can lead to increased or decreased insurance premiums.

Environmental Factors

Environmental factors, such as severe weather events and natural disasters, can also influence insurance costs. As climate change continues to impact weather patterns, the frequency and severity of these events may increase, potentially leading to higher insurance premiums to cover the rising cost of claims.

Conclusion

Understanding the average car insurance cost per year is a critical step in budgeting for vehicle ownership. While this average provides a useful benchmark, it’s important to recognize that insurance costs can vary widely based on individual circumstances and regional factors. By staying informed about the factors influencing insurance costs and adopting strategies to reduce premiums, individuals can make more informed decisions about their insurance coverage and potentially save money.

FAQ

What is the primary factor influencing car insurance costs?

+The primary factor influencing car insurance costs is the driver’s individual circumstances, including their age, gender, driving record, and the type of vehicle they drive.

Can I reduce my car insurance costs by switching providers?

+Yes, shopping around and comparing quotes from different insurance providers can often lead to significant savings. It’s important to ensure that you’re comparing policies with similar coverage levels.

How do state laws impact car insurance costs?

+State laws can significantly impact car insurance costs by influencing the required coverage levels and the regulatory environment in which insurance companies operate. For example, states with more stringent insurance requirements may result in higher average premiums.