Average Car Insurance Costs

Understanding the average costs associated with car insurance is crucial for any vehicle owner. Car insurance rates are influenced by a myriad of factors, from individual demographics to vehicle type and location. This article aims to provide an in-depth analysis of the average car insurance costs, shedding light on the key elements that contribute to these expenses.

The Average Car Insurance Costs Across the Nation

According to recent data, the average cost of car insurance in the United States stands at approximately 1,674 annually</strong>, or roughly <strong>139.50 per month. However, this figure is merely an average, and actual costs can vary significantly based on a multitude of factors.

To gain a comprehensive understanding, let's delve into the specific factors that influence car insurance rates and how they contribute to the overall costs.

Factors Influencing Car Insurance Costs

The insurance industry employs a complex system to determine the premiums for car insurance policies. These factors can be broadly categorized into two main groups: those related to the vehicle and its usage, and those related to the policyholder’s personal information and history.

Vehicle and Usage Factors

- Vehicle Type and Age: Generally, newer and more expensive vehicles tend to have higher insurance costs. This is because they are often more costly to repair or replace. Similarly, vehicles with powerful engines or those known for high-speed capabilities may attract higher premiums due to the increased risk of accidents.

- Vehicle Usage: How often and for what purpose you use your vehicle can significantly impact your insurance costs. Those who drive long distances, especially in urban areas, are considered a higher risk and often pay more. Additionally, using your vehicle for business purposes may also lead to higher premiums.

- Vehicle Safety Features: Cars equipped with advanced safety features like lane departure warnings, automatic emergency braking, and collision avoidance systems often qualify for lower insurance rates. These features reduce the likelihood of accidents and can result in substantial savings on insurance premiums.

Policyholder Information and History

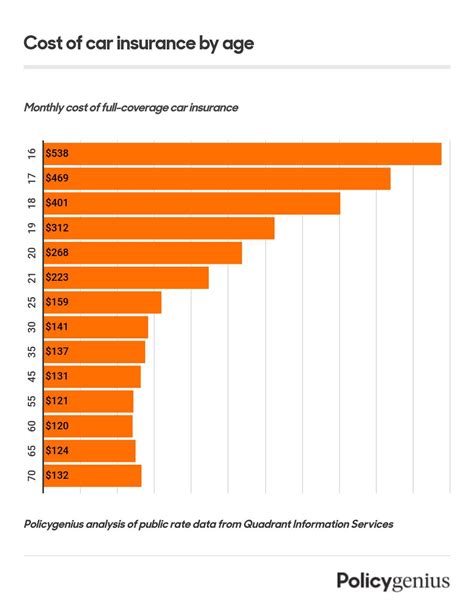

- Age and Gender: Age and gender play a significant role in determining insurance rates. Young drivers, especially males, are often considered higher-risk and thus pay more for insurance. This is due to their lack of driving experience and the higher likelihood of being involved in accidents.

- Driving History: A clean driving record is highly beneficial when it comes to insurance costs. Those with a history of accidents or traffic violations are often charged higher premiums. On the other hand, a long period of safe driving can lead to substantial discounts.

- Credit Score: Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk. Individuals with higher credit scores are often seen as more responsible and therefore may qualify for lower premiums.

- Location: The area where you live and park your vehicle can significantly affect your insurance costs. Urban areas with high crime rates or a history of frequent accidents often result in higher premiums. Additionally, the density of traffic and the prevalence of weather-related incidents in your area can also influence insurance rates.

Real-World Examples and Data

To illustrate the impact of these factors, let’s consider some real-world scenarios and their corresponding insurance costs:

| Scenario | Estimated Annual Premium |

|---|---|

| A 30-year-old male with a clean driving record, driving a 2020 Toyota Camry in a suburban area | $1,200 |

| A 22-year-old female with a minor accident history, driving a 2018 Ford Mustang in an urban area | $2,100 |

| A 45-year-old couple with a safe driving history, driving a 2015 Honda CR-V in a rural area | $950 |

| A 60-year-old retired male with no recent driving experience, driving a 2010 Chevrolet Impala in a suburban area | $850 |

Tips for Lowering Your Car Insurance Costs

While many factors influencing insurance costs are beyond your control, there are several strategies you can employ to potentially reduce your premiums.

- Compare Multiple Quotes: Insurance rates can vary significantly between providers. By comparing quotes from different companies, you can identify the most cost-effective option for your specific circumstances.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as combining your car insurance with home or life insurance.

- Maintain a Good Driving Record: As mentioned earlier, a clean driving record can lead to substantial savings. Avoid accidents and traffic violations to keep your insurance costs low.

- Choose a Higher Deductible: Opting for a higher deductible can reduce your monthly premiums. However, this strategy requires careful consideration, as it means you'll have to pay more out of pocket if you're involved in an accident.

- Take Advantage of Discounts: Many insurance companies offer discounts for a variety of reasons. These can include discounts for safe driving, being a loyal customer, having safety features in your vehicle, or even being a member of certain organizations.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, influenced by advancements in technology and changes in driving behavior. Here are some key trends and their potential impact on car insurance costs:

Advancements in Autonomous Driving

The development and adoption of autonomous driving technologies have the potential to significantly reduce accident rates. As a result, insurance companies may adjust their premiums downward over time. However, the initial introduction of these technologies may lead to increased costs as insurance companies assess the associated risks.

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are becoming increasingly popular. These programs monitor driving behavior and reward safe driving with lower premiums. As these programs become more widespread, we can expect insurance costs to be more closely tied to individual driving habits.

Changing Demographic Trends

Demographic shifts, such as an aging population and changing urban-rural dynamics, can also influence insurance costs. For instance, as the population ages, there may be a higher proportion of safe, experienced drivers on the roads, potentially leading to overall lower insurance rates.

Environmental Factors

Environmental factors, including climate change and extreme weather events, can also impact insurance rates. Increased frequency and severity of natural disasters can lead to higher insurance costs, particularly in vulnerable areas.

Conclusion

Understanding the average car insurance costs and the factors that influence them is essential for any vehicle owner. By being aware of these factors and implementing strategies to reduce costs, you can make more informed decisions about your insurance coverage. Additionally, keeping abreast of industry trends can help you anticipate changes in insurance rates and make necessary adjustments to your coverage and financial planning.

What is the best way to find the most affordable car insurance?

+

The most effective way to find affordable car insurance is to shop around and compare quotes from multiple insurance providers. Additionally, consider bundling your policies and maintaining a good driving record to qualify for discounts.

Do all insurance companies use the same factors to determine rates?

+

No, while there are common factors used by most insurance companies, the weight given to each factor can vary. It’s important to understand the specific rating factors and discounts offered by each provider to find the best fit for your needs.

How can I improve my insurance rates if I have a poor driving record?

+

If you have a poor driving record, the best approach is to maintain a clean record going forward. Many states offer point systems where violations and accidents are assigned points, and these points gradually decrease over time. Additionally, some insurance companies offer programs to help high-risk drivers improve their records and qualify for lower rates.