Average Car Insurance Per Month

When it comes to car insurance, one of the most common questions that arises is: "What is the average cost of car insurance per month?" Understanding the average monthly insurance rates can provide valuable insights for vehicle owners and help them budget effectively. In this comprehensive analysis, we delve into the factors influencing car insurance costs, explore regional variations, and offer strategies to secure the best rates. Additionally, we'll examine the data to uncover the average monthly car insurance expenses, shedding light on this essential aspect of vehicle ownership.

Factors Influencing Car Insurance Costs

Car insurance rates are determined by a myriad of factors, each playing a significant role in the overall cost. These factors include the driver’s age, gender, and driving record, with younger drivers often facing higher premiums due to their perceived higher risk. The type of vehicle insured, its make and model, and the coverage options chosen also impact the monthly premiums. Furthermore, the driver’s location, with certain areas having higher accident rates or theft incidents, can lead to increased insurance costs. Understanding these factors is crucial for drivers aiming to secure the most cost-effective insurance plans.

Driver Profile and Risk Assessment

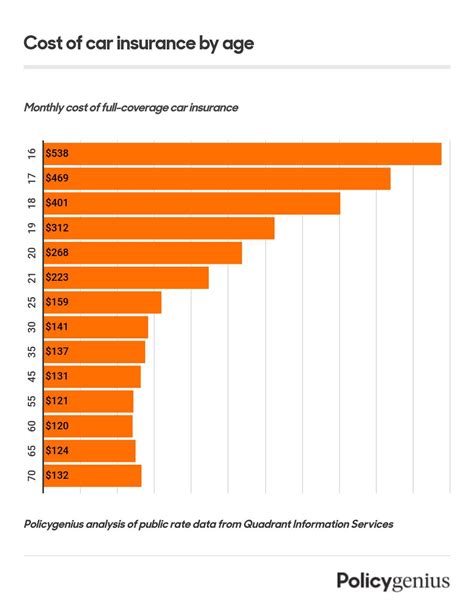

The assessment of a driver’s profile is a key component in determining car insurance rates. Insurance providers analyze factors such as age, gender, and driving history to gauge the risk associated with insuring a particular individual. Younger drivers, especially those under 25, are often considered higher risk due to their lack of experience on the road. Consequently, they tend to pay higher premiums. Conversely, more mature drivers with a clean driving record and extensive driving experience often benefit from lower insurance rates.

Gender is another consideration in risk assessment. Historically, male drivers have been statistically associated with a higher frequency of accidents and traffic violations, which can result in higher insurance premiums. However, it's important to note that this trend is gradually changing as insurance providers adopt more nuanced risk assessment models.

A driver's past driving record is a significant factor. A history of accidents, traffic violations, or claims can lead to increased insurance rates. Insurance companies closely examine these records to determine the level of risk a driver poses, which directly impacts the insurance premiums they offer.

Vehicle Type and Coverage Options

The type of vehicle being insured is another critical factor in determining insurance costs. Different vehicles have varying levels of risk associated with them, and this is reflected in insurance rates. For instance, sports cars or high-performance vehicles often attract higher insurance premiums due to their association with higher speeds and increased accident risks. In contrast, sedans or compact cars are generally considered safer and may result in lower insurance rates.

The coverage options chosen by the policyholder also significantly impact the monthly insurance premium. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, often comes with a higher premium. Similarly, collision coverage, which covers repairs or replacements in the event of an accident, can also increase the monthly insurance cost. Policyholders can opt for lower coverage levels to reduce their monthly premiums, but this should be done carefully to ensure adequate protection.

Regional Variations and Risk Factors

Regional variations in car insurance rates are a notable aspect of the industry. The cost of car insurance can differ significantly between states and even within different areas of the same state. This variation is primarily driven by the varying levels of risk associated with different regions.

Areas with a higher incidence of accidents, theft, or natural disasters often see higher insurance rates. For instance, regions with frequent hurricanes or tornadoes may have higher insurance costs due to the increased risk of property damage. Similarly, areas with high crime rates may experience higher premiums due to the elevated risk of vehicle theft or vandalism.

Population density is another factor. Urban areas, with their higher traffic volumes and increased accident risks, often have higher insurance rates compared to rural areas. Additionally, the cost of living and repair services in a particular region can influence insurance rates, as these factors impact the potential cost of claims.

Average Monthly Car Insurance Costs

According to recent data, the average monthly cost of car insurance in the United States stands at approximately $150. However, it’s crucial to note that this figure is merely an average and can vary significantly based on the factors discussed earlier. For instance, younger drivers or those with a history of accidents may pay significantly more, while more experienced drivers with clean records could pay considerably less.

The table below provides a breakdown of average monthly car insurance costs based on different states. It's important to remember that these averages are broad estimates and individual rates can vary based on personal circumstances and the insurance provider.

| State | Average Monthly Cost |

|---|---|

| Alabama | $165 |

| California | $140 |

| Florida | $170 |

| New York | $190 |

| Texas | $135 |

Strategies to Lower Car Insurance Costs

While car insurance is a necessary expense for vehicle owners, there are strategies to help reduce the monthly cost. Here are some effective approaches to consider:

- Compare Quotes: Shopping around and comparing quotes from different insurance providers is a great way to find the best rates. Online tools and insurance comparison websites can make this process easier and more efficient.

- Bundle Policies: Combining multiple insurance policies, such as auto and home insurance, often results in discounts. Many insurance companies offer bundle discounts, so it's worth exploring this option.

- Increase Deductibles: Opting for a higher deductible can lead to lower monthly premiums. However, it's important to ensure that the chosen deductible is an amount you can comfortably afford to pay out of pocket in the event of a claim.

- Maintain a Clean Driving Record: A clean driving record is crucial for keeping insurance costs low. Avoid traffic violations and accidents, as these can significantly increase your insurance premiums.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons. These could include safe driving discounts, loyalty discounts, good student discounts, or discounts for completing defensive driving courses. Be sure to inquire about available discounts and take advantage of those that apply to you.

Conclusion: Understanding Your Car Insurance Options

Understanding the average monthly cost of car insurance is just the first step in managing this essential expense. By familiarizing yourself with the factors that influence insurance rates and adopting strategies to lower your premiums, you can make more informed decisions about your car insurance coverage. Remember, car insurance is a critical component of responsible vehicle ownership, providing financial protection in the event of accidents or other unforeseen circumstances.

Stay informed, compare quotes, and consider your personal circumstances and coverage needs when choosing an insurance policy. With the right approach, you can secure adequate coverage at a competitive rate, ensuring both your safety and your financial well-being on the road.

What are the minimum car insurance requirements in the US?

+

The minimum car insurance requirements vary by state. However, most states require liability coverage, which includes bodily injury liability and property damage liability. Bodily injury liability covers the cost of injuries you cause to others in an accident, while property damage liability covers the cost of damage you cause to others’ property.

How can I save money on my car insurance without compromising coverage?

+

There are several ways to save money on car insurance without sacrificing coverage. These include shopping around for quotes, bundling policies with the same insurer, maintaining a good driving record, increasing your deductible, and taking advantage of discounts such as safe driver discounts, loyalty discounts, or good student discounts.

What factors influence the cost of car insurance for young drivers?

+

The cost of car insurance for young drivers is often higher due to their perceived higher risk. Factors such as age, lack of driving experience, and gender (historically, male drivers have been associated with higher accident rates) can influence insurance rates. Additionally, the type of vehicle and the coverage options chosen also impact the cost.