Average Car Insurance Rates By Vehicle

When it comes to car insurance, the cost can vary significantly depending on numerous factors, including the make and model of your vehicle. Understanding the average insurance rates for different vehicles is crucial for anyone looking to purchase a new car or switch insurance providers. In this comprehensive article, we delve into the world of car insurance, exploring the key factors that influence rates and providing you with detailed insights into the average insurance costs for various vehicles.

The Influence of Vehicle Type on Insurance Rates

The type of vehicle you drive plays a pivotal role in determining your insurance premiums. Insurance companies assess various characteristics of a vehicle to calculate the associated risk and, consequently, the insurance rate. Here’s an in-depth look at how different vehicle types can impact your insurance costs:

Sports Cars and High-Performance Vehicles

Sports cars and other high-performance vehicles often come with higher insurance premiums. These vehicles are typically more expensive to repair or replace due to their specialized parts and unique engineering. Additionally, they are often associated with higher speeds and a greater likelihood of accidents, which further increases the risk for insurance providers.

For instance, a Porsche 911, known for its exceptional performance, may have an average annual insurance rate of $2,500. On the other hand, a Nissan GT-R, another high-performance vehicle, might cost an average of $1,800 annually for insurance. These rates reflect the added risk and higher repair costs associated with these powerful machines.

Sedans and Compact Cars

Sedans and compact cars are generally considered more affordable to insure compared to sports cars. They are often seen as practical, everyday vehicles, and their lower speeds and moderate performance reduce the risk of severe accidents. As a result, insurance companies often offer more competitive rates for these vehicle types.

The Toyota Corolla, a popular sedan known for its reliability, has an average insurance rate of around $1,200 per year. Similarly, the Honda Civic, another reliable and widely used compact car, averages at about $1,100 annually for insurance.

SUVs and Crossovers

SUVs (Sports Utility Vehicles) and crossovers have become increasingly popular due to their versatility and all-terrain capabilities. However, insurance rates for these vehicles can vary depending on their size, engine power, and safety features.

The Ford Explorer, a mid-size SUV, typically has an average insurance rate of $1,500 annually. Meanwhile, the Jeep Wrangler, known for its off-road capabilities, may cost slightly more at an average of $1,600 per year to insure. These rates reflect the balance between the vehicle's size and its intended use.

Luxury Vehicles and Exotic Cars

Luxury vehicles and exotic cars are often associated with higher insurance costs due to their expensive parts, specialized maintenance, and unique design. These vehicles are typically driven by enthusiasts who prioritize performance and exclusivity, which can increase the risk of accidents and subsequent insurance claims.

A Mercedes-Benz S-Class, a luxurious sedan, might have an average insurance rate of $2,200 annually. The Lamborghini Aventador, an iconic exotic car, could cost an astronomical $4,500 or more per year to insure. These rates highlight the increased risks and costs associated with owning and insuring such prestigious vehicles.

Factors Influencing Insurance Rates Beyond Vehicle Type

While the type of vehicle is a significant factor, it’s not the only consideration when it comes to insurance rates. Several other factors play a crucial role in determining the cost of your insurance premium. Here’s a closer look at these additional influences:

Driver’s Age and Experience

Insurance companies carefully consider the age and driving experience of the primary driver when calculating insurance rates. Younger drivers, especially those under 25, are often seen as higher-risk individuals due to their lack of experience on the road. As a result, insurance rates for younger drivers tend to be higher.

On the other hand, experienced drivers with a clean driving record and a long history of safe driving often enjoy lower insurance rates. The insurance industry recognizes the reduced risk associated with mature and cautious drivers.

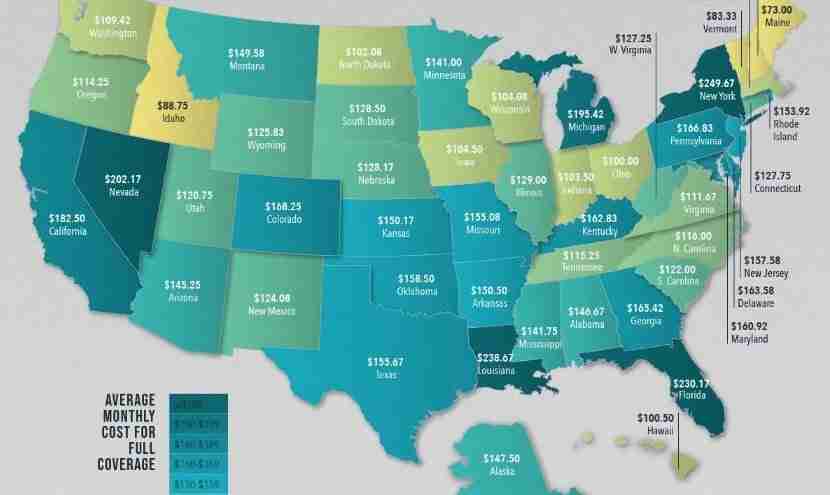

Location and Driving Conditions

The geographic location where you reside and drive can significantly impact your insurance rates. Areas with high traffic density, frequent accidents, or a higher risk of natural disasters often result in higher insurance premiums. Similarly, the climate and weather conditions in your region can also influence insurance rates.

For instance, drivers in metropolitan areas like New York City or Los Angeles often face higher insurance rates due to the increased risk of accidents and congestion. In contrast, drivers in rural areas with lower population density and fewer accidents may enjoy more competitive insurance rates.

Driving History and Claims

Your driving history is a critical factor in determining insurance rates. Insurance companies carefully examine your record for any violations, accidents, or claims. A clean driving record with no recent accidents or traffic violations can lead to lower insurance rates, as it indicates a lower risk of future claims.

Conversely, a history of accidents, especially those involving significant damage or injuries, can result in higher insurance premiums. Insurance companies consider such incidents as indicators of increased risk and adjust rates accordingly.

Safety Features and Discounts

The safety features equipped in your vehicle can also impact insurance rates. Modern vehicles often come with advanced safety technologies, such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. These features are designed to prevent accidents and reduce the severity of impacts, which can lead to lower insurance rates.

Additionally, many insurance companies offer discounts for vehicles equipped with specific safety features. These discounts incentivize drivers to choose safer vehicles and can result in significant savings on insurance premiums.

The Future of Car Insurance: Telematics and Usage-Based Insurance

The traditional model of car insurance, which primarily relies on demographic and vehicle-related factors, is evolving. The rise of telematics and usage-based insurance is transforming the industry, offering a more personalized and data-driven approach to insurance pricing.

Telematics and Real-Time Data

Telematics involves the use of technology to track and analyze driving behavior in real-time. Insurance companies can install small devices or use smartphone apps to collect data on driving habits, including speed, acceleration, braking, and even the time of day you drive.

By analyzing this data, insurance providers can gain a more accurate understanding of individual driving risks. This allows them to offer insurance rates that are tailored to your specific driving behavior, potentially resulting in significant savings for safe drivers.

Usage-Based Insurance (UBI)

Usage-based insurance, often referred to as pay-as-you-drive insurance, takes telematics a step further. With UBI, insurance rates are directly linked to the actual miles driven. This model is particularly beneficial for low-mileage drivers who may only use their vehicles for short commutes or occasional trips.

UBI policies often come with tracking devices or apps that record mileage. Insurance rates are then calculated based on the number of miles driven, with lower rates for drivers who travel fewer miles. This approach rewards cautious and conservative driving habits, providing an incentive for safer and more environmentally friendly driving practices.

Conclusion: Navigating the World of Car Insurance

Understanding the average insurance rates for different vehicles is just the first step in navigating the complex world of car insurance. By considering the various factors that influence insurance rates, from vehicle type to driving history and safety features, you can make informed decisions when choosing a car and selecting an insurance provider.

As the industry continues to evolve with the integration of telematics and usage-based insurance, drivers have even more opportunities to customize their insurance policies and potentially save on premiums. Stay informed, compare insurance options, and drive safely to ensure you get the best value for your insurance needs.

What is the average insurance rate for an electric vehicle (EV)?

+The average insurance rate for electric vehicles can vary depending on the make and model. For example, a Tesla Model 3 may have an average insurance rate of around 1,400 per year, while a Nissan Leaf might cost around 1,200 annually. EV insurance rates are influenced by factors such as battery replacement costs and the vehicle’s safety features.

Do insurance rates differ for male and female drivers?

+In many regions, insurance rates are now determined primarily by individual driving records and other factors, rather than gender. However, some insurance providers may still consider gender as a factor, as statistical data suggests that certain age groups and genders have historically been associated with different levels of risk. It’s important to note that this practice is subject to regulatory oversight and varies by location.

How can I lower my car insurance rates?

+There are several strategies to reduce your car insurance rates. These include maintaining a clean driving record, taking defensive driving courses, installing safety features in your vehicle, and comparing quotes from multiple insurance providers. Additionally, bundling your car insurance with other policies, such as home or life insurance, can often result in discounts.

Are there any discounts available for specific vehicle types or safety features?

+Yes, many insurance companies offer discounts for vehicles with advanced safety features, such as automatic emergency braking or lane departure warning systems. Additionally, certain vehicle types, like hybrids or electric vehicles, may be eligible for eco-friendly or alternative fuel discounts. It’s worth inquiring with your insurance provider about these potential savings.