Average Cost Of Car Insurance

Understanding the average cost of car insurance is crucial for any vehicle owner, as it provides insight into the financial responsibilities associated with operating a motor vehicle. The cost of car insurance can vary significantly depending on numerous factors, including your location, driving history, the type of vehicle you own, and the coverage options you choose. In this comprehensive guide, we will delve into the factors influencing car insurance costs, explore average rates, and offer valuable tips to help you secure the best coverage at an affordable price.

Factors Influencing Car Insurance Costs

The cost of car insurance is determined by a multitude of variables, each playing a unique role in shaping the final premium. These factors can be broadly categorized into personal and vehicle-related aspects, with the former encompassing your demographic information, driving history, and credit score, while the latter focuses on the make, model, and usage of your vehicle.

Personal Factors

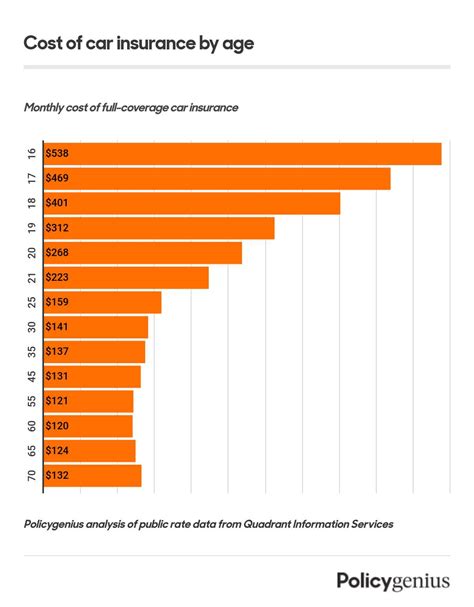

- Age and Gender: Age and gender are two of the most significant personal factors influencing insurance rates. Generally, younger drivers, particularly those under 25, are considered higher risk and may face higher premiums. Gender, though less prominent in recent years due to legal changes, can still influence rates, with young male drivers often facing higher costs.

- Driving History: Your driving record is a critical factor in determining insurance costs. A clean driving history, free from accidents and violations, can lead to lower premiums. Conversely, a history of accidents, especially those deemed your fault, can significantly increase your insurance rates.

- Credit Score: Believe it or not, your credit score can also impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, with higher scores often leading to lower premiums. Improving your credit score can, therefore, be a strategy to reduce insurance costs.

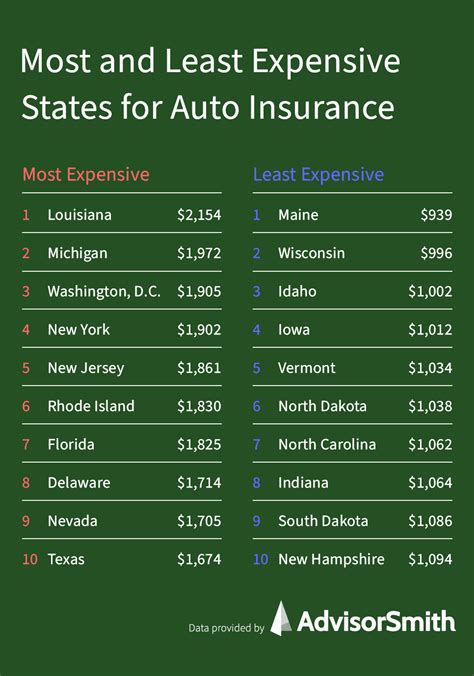

- Location: The area you live in can affect your insurance rates. Urban areas, for instance, often have higher rates due to increased traffic, congestion, and the higher likelihood of accidents. Additionally, areas with higher crime rates may see increased rates due to the risk of vehicle theft or vandalism.

Vehicle-Related Factors

- Vehicle Make and Model: The type of vehicle you drive can significantly impact your insurance rates. Sports cars and luxury vehicles, for example, often have higher insurance costs due to their higher repair costs and the increased likelihood of theft. On the other hand, sedans and compact cars are generally more affordable to insure.

- Vehicle Usage: How you use your vehicle can also affect your insurance rates. If you use your car for personal use only, your rates may be lower compared to those who use their vehicles for business purposes or as part of a ride-sharing service.

- Coverage and Deductibles: The level of coverage you choose and your deductible amount can significantly impact your insurance costs. Higher levels of coverage, such as comprehensive and collision coverage, can increase your premiums. Additionally, opting for a higher deductible can lower your monthly premiums, but you'll pay more out of pocket if you need to file a claim.

Average Car Insurance Rates

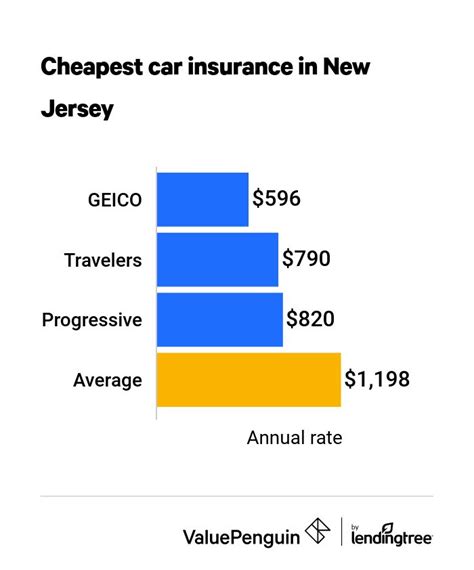

According to the Insurance Information Institute, the average cost of car insurance in the United States was approximately $1,674 per year as of 2021. However, it's important to note that this figure is just an average, and actual costs can vary widely depending on the factors discussed above.

| Coverage Type | Average Cost |

|---|---|

| Liability Only | $500 - $1,500 per year |

| Full Coverage (Liability, Collision, Comprehensive) | $1,000 - $2,500 per year |

| High-Risk Insurance (for drivers with poor records) | $3,000 - $7,000 per year |

It's worth noting that these averages are just a guide, and your personal rates may differ significantly. The best way to understand your insurance costs is to obtain quotes from multiple insurers and compare the rates and coverage options they offer.

Tips to Lower Your Car Insurance Costs

While the cost of car insurance is influenced by numerous factors beyond your control, there are still several strategies you can employ to potentially reduce your insurance costs.

Shop Around and Compare Quotes

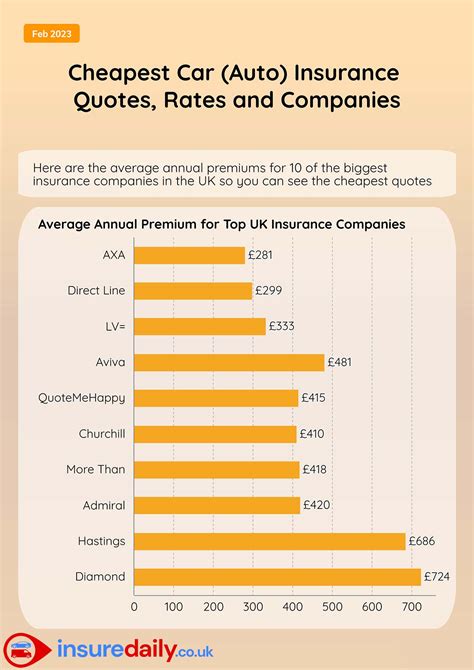

Insurance rates can vary significantly between different providers. By shopping around and comparing quotes from multiple insurers, you can identify the companies offering the best rates for your specific situation.

Choose the Right Coverage

While it's tempting to opt for the cheapest coverage, it's important to ensure you have adequate protection. Consider your personal financial situation and the potential risks you face on the road. If you're involved in an accident, will you be able to cover the costs of repairs or medical expenses without insurance coverage? Choosing the right coverage is a balance between cost and adequate protection.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance costs low. Avoid speeding, always follow traffic rules, and never drive under the influence. Even a single violation or accident can significantly increase your insurance rates for several years.

Improve Your Credit Score

As mentioned earlier, your credit score can impact your insurance rates. By improving your credit score, you may be able to negotiate better insurance rates. Focus on paying your bills on time, reducing your debt, and maintaining a healthy credit utilization ratio.

Take Advantage of Discounts

Many insurance companies offer discounts for various reasons. Common discounts include safe driver discounts, multi-policy discounts (if you bundle your car insurance with other policies like home or life insurance), and loyalty discounts for long-term customers. Additionally, some insurers offer discounts for specific occupations, educational achievements, or membership in certain organizations.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your insurance premium is based on your actual driving behavior. These policies use telematics devices to monitor your driving habits, such as how often you drive, your speed, and how harshly you brake. If you're a safe and cautious driver, you may be able to save significantly with this type of insurance.

The Future of Car Insurance

The car insurance industry is continually evolving, and several trends are shaping the future of automotive coverage.

Technology and Telematics

The integration of technology and telematics in the insurance industry is expected to grow, with more insurers offering usage-based insurance policies. These policies not only provide an opportunity for drivers to save money but also encourage safer driving habits, which can lead to fewer accidents and lower insurance costs for everyone.

Increased Focus on Data Analytics

Insurance companies are increasingly leveraging data analytics to better understand risk and set more accurate premiums. By analyzing vast amounts of data, insurers can more accurately assess individual risk factors, leading to more tailored and potentially more affordable insurance policies.

Rise of Electric Vehicles

The growing popularity of electric vehicles (EVs) is expected to have an impact on car insurance. EVs generally have lower maintenance costs and are considered safer than traditional combustion engine vehicles, which could lead to lower insurance premiums for EV owners. However, the unique nature of EV repairs and the potential for more complex accidents may also introduce new risk factors and influence insurance rates.

Emphasis on Prevention

The insurance industry is moving towards a more preventative approach, offering incentives and rewards for drivers who take steps to reduce their risk of accidents. This could include providing discounts for completing defensive driving courses, offering rewards for maintaining a safe driving record, or even providing discounts for vehicles equipped with advanced safety features.

Regulatory Changes

Regulatory changes can also impact insurance rates. For example, changes in state laws regarding insurance requirements, such as minimum liability coverage limits, can affect the cost of insurance. Additionally, changes in federal regulations, such as those related to autonomous vehicles or cybersecurity, could have a significant impact on the insurance industry and, consequently, insurance rates.

Conclusion

Understanding the average cost of car insurance is just the first step in securing the best coverage for your needs. By being aware of the factors that influence insurance rates and implementing strategies to lower your costs, you can find affordable and comprehensive car insurance. Remember, shopping around, maintaining a clean driving record, and taking advantage of discounts are key to keeping your insurance costs as low as possible.

Frequently Asked Questions

How much does car insurance typically cost per month?

+The average monthly cost of car insurance in the United States is approximately $139. However, this can vary significantly based on individual factors such as driving history, credit score, location, and the type of vehicle insured.

What factors can I control to lower my car insurance costs?

+While some factors influencing insurance rates are beyond your control, you can take steps to lower your costs. These include maintaining a clean driving record, improving your credit score, shopping around for the best rates, and taking advantage of discounts offered by insurance companies.

Are there any alternatives to traditional car insurance policies?

+Yes, there are alternative insurance options such as usage-based insurance policies (also known as pay-as-you-drive) which base your premium on your actual driving behavior. Additionally, some insurers offer customized policies that allow you to choose the level of coverage you need, potentially saving you money if you don’t require extensive coverage.

How can I get the best car insurance deal?

+To get the best car insurance deal, compare quotes from multiple insurers, take advantage of discounts you may be eligible for, and consider usage-based insurance policies if your driving behavior is safe and cautious. Additionally, maintain a clean driving record and a good credit score to keep your insurance costs as low as possible.