Average Cost Of Long Term Healthcare Insurance

Long-term healthcare insurance is a vital consideration for individuals planning for their future and aiming to safeguard their financial well-being as they age. This form of insurance provides coverage for extended periods of time, typically offering assistance with daily living activities and medical care in the event of chronic illnesses or disabilities that require long-term support. As such, understanding the average cost of long-term healthcare insurance is crucial for making informed decisions about one's financial future and healthcare needs.

Understanding Long-Term Healthcare Insurance

Long-term healthcare insurance is designed to cover the costs associated with extended care needs that may arise due to aging, chronic illnesses, or disabilities. It serves as a safety net, ensuring individuals have access to necessary care without depleting their savings or relying solely on public healthcare systems. The coverage typically includes a range of services, such as assistance with daily activities like bathing, dressing, and eating, as well as skilled nursing care, rehabilitation services, and even respite care for caregivers.

The need for long-term healthcare insurance arises from the increasing longevity of individuals and the associated rise in chronic conditions. As people live longer, the likelihood of requiring extended care increases. According to the U.S. Department of Health and Human Services, over 70% of individuals aged 65 and above will require some form of long-term care during their lifetime. This statistic underscores the importance of planning for these potential needs.

Factors Influencing the Cost of Long-Term Healthcare Insurance

The cost of long-term healthcare insurance is influenced by a multitude of factors, making it a complex and personalized financial decision. Here are some key elements that play a role in determining the average cost:

- Age of the Policyholder: One of the most significant factors is the age at which the policy is purchased. Premiums are generally lower when individuals purchase long-term care insurance at a younger age, as they are considered less likely to require immediate care.

- Health and Medical History: The overall health and medical history of the policyholder is carefully assessed by insurance providers. Pre-existing conditions or a history of chronic illnesses can lead to higher premiums or even denial of coverage.

- Policy Benefits and Coverage Limits: The scope of coverage, including the daily benefit amount, the maximum duration of coverage, and the types of services covered, all influence the cost of the policy. Comprehensive policies with higher daily benefit amounts and extended coverage periods tend to be more expensive.

- Inflation Protection: Some policies offer inflation protection, which ensures that the daily benefit amount increases over time to keep pace with rising healthcare costs. While this feature provides added security, it also increases the premium.

- Elimination Period: This refers to the number of days an individual must wait after a long-term care event before the policy starts paying benefits. A longer elimination period can result in lower premiums.

- Policy Type and Provider: The type of policy, whether it's a traditional long-term care policy, a hybrid policy (such as a life insurance policy with long-term care benefits), or a short-term care policy, can significantly impact costs. Additionally, different insurance providers may offer varying rates and coverage options.

Average Cost of Long-Term Healthcare Insurance

Determining the average cost of long-term healthcare insurance is challenging due to the personalized nature of these policies. The cost can vary significantly based on the factors mentioned above and the unique circumstances of each policyholder. However, industry data and studies provide some insights into the range of premiums individuals can expect.

According to a study by the American Association for Long-Term Care Insurance (AALTCI), the average cost of a traditional long-term care insurance policy in the United States is approximately $2,500 to $5,000 per year. This average cost is based on a policy purchased by a healthy individual in their 50s or early 60s, with a daily benefit amount of $150 to $250 and a coverage period of 3 to 5 years. It's important to note that these averages can vary widely depending on the individual's location, health status, and the specific policy features chosen.

| Policy Feature | Average Cost |

|---|---|

| Daily Benefit Amount | $150 - $250 |

| Coverage Period | 3 - 5 years |

| Inflation Protection | Increases premium by approximately 5% |

| Elimination Period | Varies, but 90 days is common |

It's crucial to understand that these averages are just a starting point. The actual cost of long-term healthcare insurance can be significantly higher or lower depending on individual circumstances and the specific policy chosen. For instance, a policy with a higher daily benefit amount, an extended coverage period, or robust inflation protection can easily cost upwards of $10,000 per year.

Comparative Analysis: Long-Term Care vs. Other Insurance Types

When considering long-term healthcare insurance, it’s natural to compare it to other types of insurance, such as health insurance, life insurance, or disability insurance. While these insurance types have some overlapping elements, they also have distinct differences that make them unique in their own right.

Long-Term Care vs. Health Insurance

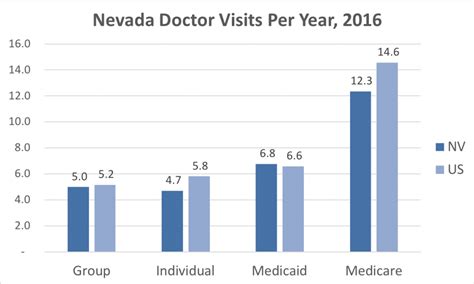

Health insurance primarily covers medical expenses related to illnesses, injuries, and preventive care. It focuses on acute care needs, such as hospital stays, doctor visits, and prescription medications. In contrast, long-term care insurance is designed to cover the costs of extended care services, often provided outside of traditional healthcare settings. These services include assistance with activities of daily living, skilled nursing care, and rehabilitation, which are typically not covered by standard health insurance plans.

Long-Term Care vs. Life Insurance

Life insurance provides financial protection to beneficiaries upon the policyholder’s death. While some life insurance policies offer riders or add-ons for long-term care benefits, they typically have more limited coverage compared to dedicated long-term care insurance policies. The main purpose of life insurance is to provide a death benefit, whereas long-term care insurance is specifically tailored to cover the costs of extended care needs.

Long-Term Care vs. Disability Insurance

Disability insurance replaces a portion of an individual’s income if they become disabled and unable to work. It provides short-term or long-term financial support. While disability insurance can help cover some expenses associated with long-term disabilities, it does not typically cover the costs of extended care services like long-term care insurance does. Long-term care insurance focuses on providing care and support, not income replacement.

Performance Analysis: Long-Term Healthcare Insurance Benefits

Long-term healthcare insurance offers several key benefits that make it an essential consideration for individuals planning for their future care needs:

- Financial Protection: Long-term care insurance provides a financial safety net, protecting an individual's assets and savings from being depleted by the high costs of extended care. Without insurance, the financial burden of long-term care can be overwhelming.

- Peace of Mind: Knowing that one has the necessary coverage in place to address potential long-term care needs can bring immense peace of mind. It allows individuals to focus on their health and well-being without worrying about the financial implications.

- Choice of Care Providers: With long-term care insurance, individuals often have more flexibility in choosing their care providers. This can include in-home care, assisted living facilities, or skilled nursing homes, depending on their preferences and needs.

- Inflation Protection: Many long-term care insurance policies offer inflation protection, ensuring that the daily benefit amount increases over time to keep pace with rising healthcare costs. This feature helps maintain the policy's value and coverage.

- Tax Benefits: In some cases, the premiums paid for long-term care insurance may be tax-deductible, providing additional financial benefits to policyholders.

Future Implications and Considerations

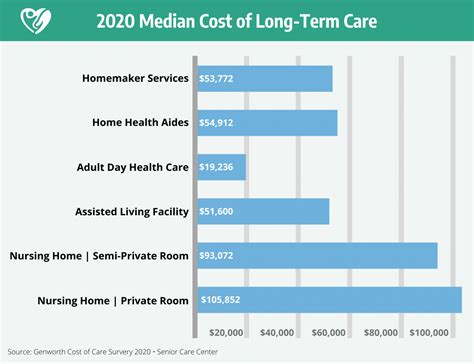

As individuals and families plan for their long-term care needs, it’s essential to consider the evolving landscape of healthcare and insurance. The cost of long-term care is expected to continue rising, driven by factors such as an aging population, advances in medical technology, and inflation. This makes the decision to purchase long-term care insurance even more critical.

Additionally, the ongoing COVID-19 pandemic has highlighted the importance of long-term care planning. The pandemic has underscored the vulnerability of older adults and individuals with pre-existing conditions, emphasizing the need for comprehensive care plans. Long-term care insurance can provide a vital layer of protection during uncertain times, ensuring access to necessary care without financial strain.

When considering long-term care insurance, it's advisable to start early. Purchasing a policy at a younger age, when health is typically better, can lead to lower premiums and more comprehensive coverage. It's also essential to review and update policies regularly to ensure they align with changing needs and circumstances.

In conclusion, understanding the average cost of long-term healthcare insurance is a crucial step in planning for one's financial future and ensuring access to necessary care. While the cost can vary significantly based on individual circumstances, the benefits of long-term care insurance, including financial protection and peace of mind, make it a valuable investment for many individuals and families.

What is the typical age range for purchasing long-term care insurance, and why is it important to buy early?

+The ideal age range for purchasing long-term care insurance is typically between 50 and 65 years old. Buying early has several advantages. Premiums are generally lower when purchased at a younger age, and individuals are more likely to be in good health, which can lead to more affordable rates. Additionally, starting early provides more time for the policy to build value and ensure comprehensive coverage.

Are there any tax benefits associated with long-term care insurance premiums?

+Yes, in certain circumstances, the premiums paid for long-term care insurance may be tax-deductible. This is particularly true for individuals who itemize their deductions and meet specific criteria. It’s important to consult with a tax professional to understand the potential tax benefits in your specific situation.

What happens if I purchase long-term care insurance but never need to use it?

+If you purchase long-term care insurance and fortunately never require the benefits, the policy will typically remain in force as long as premiums are paid. The premiums you pay are essentially an investment in your future care, providing peace of mind and financial protection in the event that you do need long-term care services.