Average Health Insurance Cost California

Health insurance is a vital aspect of financial planning and overall well-being, especially in a state like California, where healthcare costs can be significantly higher than the national average. Understanding the average health insurance costs in California is crucial for individuals and families to make informed decisions about their healthcare coverage. This article delves into the intricacies of health insurance in the Golden State, providing a comprehensive analysis of costs, coverage options, and key factors that influence premiums.

The California Health Insurance Landscape

California, known for its diverse population and progressive healthcare policies, has a unique health insurance market. The state actively promotes access to affordable healthcare, offering various programs and initiatives to assist residents in obtaining coverage. Despite these efforts, the cost of health insurance remains a significant concern for many Californians.

Key Factors Influencing Health Insurance Costs

Several factors contribute to the average health insurance cost in California. These include:

- Geographic Location: The cost of living varies across different regions of California. Cities like San Francisco and Los Angeles tend to have higher healthcare costs, which can impact insurance premiums.

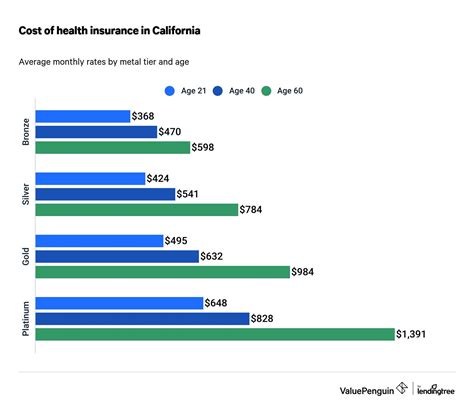

- Age: Older individuals generally pay higher premiums due to the increased likelihood of requiring medical services.

- Tobacco Usage: Smokers often face higher premiums, as tobacco use is associated with various health risks.

- Plan Type and Coverage: The type of health insurance plan and the level of coverage chosen greatly influence the cost. Comprehensive plans with lower deductibles and out-of-pocket expenses are typically more expensive.

- Family Size: Family plans accommodate multiple individuals, which can result in higher premiums compared to individual plans.

Average Health Insurance Costs in California

According to recent data from Covered California, the state's official health insurance marketplace, the average monthly premium for an individual plan in 2023 is approximately $500. This figure can vary based on the factors mentioned above and the specific insurance provider.

For family plans, the average monthly premium in 2023 is around $1,500. Again, this average can fluctuate depending on the family's size, age, and other demographic factors.

| Plan Type | Average Monthly Premium (2023) |

|---|---|

| Individual Plan | $500 |

| Family Plan | $1,500 |

Understanding Health Insurance Plans

Health insurance plans in California, as elsewhere in the United States, come in various forms, each with its own set of benefits and drawbacks. Here's a breakdown of some common plan types:

1. Bronze Plans

These plans typically have lower premiums but higher deductibles and out-of-pocket expenses. They are suitable for individuals who rarely need medical services and are willing to pay more when they do.

2. Silver Plans

Silver plans offer a balance between premiums and out-of-pocket costs. They are a popular choice for individuals who anticipate occasional medical needs but want some financial protection.

3. Gold Plans

Gold plans provide comprehensive coverage with lower deductibles and out-of-pocket expenses. These plans are ideal for those who require frequent medical care or have chronic conditions.

4. Catastrophic Plans

Designed for individuals under 30 or those with a hardship exemption, catastrophic plans have low monthly premiums but high deductibles. They are intended for emergencies and major medical events.

Strategies for Affording Health Insurance

For many Californians, the cost of health insurance can be a significant financial burden. Here are some strategies to make health insurance more affordable:

1. Subsidies and Tax Credits

Individuals and families with moderate incomes may be eligible for subsidies and tax credits to lower their monthly premiums. These financial aids are available through the Covered California marketplace.

2. Employer-Sponsored Plans

Many employers offer health insurance as a benefit. These plans can provide comprehensive coverage at a reduced cost, as employers often negotiate group rates with insurance providers.

3. Health Savings Accounts (HSAs)

HSAs allow individuals to save pre-tax dollars for medical expenses. These accounts can be used in conjunction with certain high-deductible health plans to manage out-of-pocket costs.

4. Comparing Plans and Providers

Shopping around for health insurance is crucial. Different providers offer varying rates and coverage options. Comparing plans and seeking personalized quotes can help identify the most cost-effective option.

The Future of Health Insurance in California

The health insurance landscape in California is continually evolving, influenced by federal and state policies, market trends, and technological advancements. Here are some potential future implications:

1. Expansion of Coverage Options

California has been at the forefront of expanding healthcare access. The state may continue to explore innovative ways to provide coverage to underserved populations, such as through public-private partnerships or expanded Medicaid programs.

2. Technology-Driven Solutions

Digital health platforms and telemedicine services are gaining traction. These technologies can improve access to care and reduce costs by streamlining processes and eliminating unnecessary visits.

3. Focus on Preventive Care

Promoting preventive care and health education can lead to reduced healthcare costs in the long term. California may invest more in initiatives that encourage healthy lifestyles and early detection of health issues.

4. Continued Policy Advocacy

Advocacy for affordable and accessible healthcare remains a priority for many Californians. Ongoing efforts to influence policy changes at the state and federal levels can impact the cost and availability of health insurance.

Frequently Asked Questions

What is the penalty for not having health insurance in California?

+As of 2019, California no longer imposes a penalty for not having health insurance. However, it's important to note that federal laws may still apply, and it's generally advisable to maintain coverage to avoid potential gaps in healthcare access.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any low-cost health insurance options for students in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Covered California offers special plans for students. These plans often have lower premiums and are designed to meet the unique needs of students. It's worth exploring these options if you're a student in California.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I qualify for Medi-Cal even if I'm not a citizen?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Non-citizens may qualify for Medi-Cal, California's Medicaid program, under certain circumstances. Eligibility is based on factors like immigration status, length of residence, and income. It's recommended to consult with a healthcare navigator or legal expert for accurate information.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right health insurance plan for my family's needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Choosing a health insurance plan involves considering factors like your family's healthcare needs, preferred providers, and budget. It's beneficial to compare plans, understand the coverage offered, and seek advice from insurance experts to make an informed decision.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I can't afford my health insurance premiums?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you're facing financial challenges with your health insurance premiums, it's important to explore options like seeking financial assistance, adjusting your plan to a more affordable level, or reaching out to community resources that may provide support. Remember, maintaining some level of coverage is crucial for your health and well-being.</p>

</div>

</div>