Average Healthcare Insurance Cost

Healthcare insurance is a crucial aspect of modern life, providing financial protection and access to essential medical services. With rising healthcare costs, understanding the average expenses associated with health insurance is vital for individuals and families planning their budgets. This comprehensive guide delves into the factors influencing health insurance premiums, offering insights and strategies to navigate the complex world of healthcare coverage.

Understanding Healthcare Insurance Costs

Healthcare insurance costs, often referred to as premiums, are the regular payments made by policyholders to maintain their coverage. These costs can vary significantly based on a multitude of factors, making it essential to grasp the key determinants to make informed decisions.

Factors Influencing Healthcare Insurance Premiums

Several variables contribute to the overall cost of healthcare insurance, including:

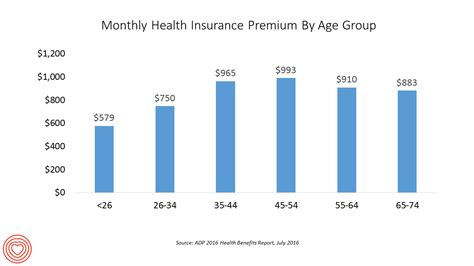

- Age: Generally, younger individuals pay lower premiums due to their lower risk of developing health issues. As people age, their premiums tend to increase, reflecting the higher likelihood of medical needs.

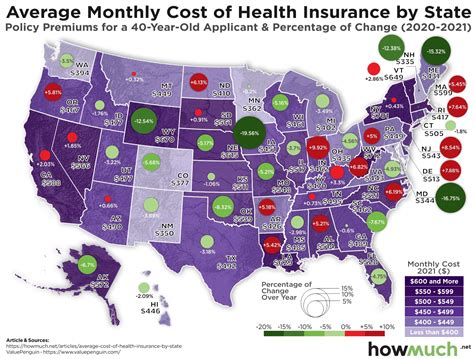

- Location: Healthcare costs can vary significantly between different regions. Premiums may be higher in areas with a higher cost of living or more specialized medical facilities.

- Plan Type: Different health insurance plans offer varying levels of coverage. Plans with more comprehensive benefits, such as lower deductibles and copays, often come with higher premiums.

- Tobacco Use: Insurers may charge higher premiums for individuals who use tobacco products, as these habits are associated with increased health risks.

- Family Size: Policies covering more family members typically have higher premiums, as they provide coverage for a larger group.

- Pre-Existing Conditions: Some health insurance plans may charge higher premiums for individuals with pre-existing medical conditions, as these conditions can lead to higher healthcare utilization.

Average Healthcare Insurance Costs in Different Regions

The average cost of healthcare insurance can vary significantly based on geographical location. Here’s a snapshot of average monthly premiums for different regions:

| Region | Average Monthly Premium |

|---|---|

| United States (National Average) | 450</td> </tr> <tr> <td>Canada (National Average)</td> <td>800 |

| United Kingdom (National Average) | £250 |

| Australia (National Average) | AUD $200 |

These averages provide a rough estimate, but actual premiums can deviate based on the factors mentioned earlier and the specific plan chosen.

Strategies to Reduce Healthcare Insurance Costs

While healthcare insurance is a necessity, there are strategies to mitigate the financial burden:

- Shop Around: Compare different insurance providers and plans to find the best value for your needs. Online marketplaces and brokers can make this process easier.

- Consider High-Deductible Plans: Plans with higher deductibles often have lower premiums. If you’re healthy and rarely utilize healthcare services, this can be a cost-effective option.

- Utilize Employer-Sponsored Plans: Many employers offer healthcare insurance as a benefit, and these plans can be more affordable due to group rates.

- Explore Government Programs: Government-sponsored programs like Medicare, Medicaid, or the Affordable Care Act’s subsidies can provide more affordable coverage for eligible individuals.

- Negotiate Premiums: If you have a good health record or are a loyal customer, you may be able to negotiate lower premiums with your insurer.

The Impact of Healthcare Insurance Costs on Individuals

The cost of healthcare insurance can significantly influence an individual’s financial well-being and access to healthcare services. For many, it is a major expense that must be carefully budgeted for. Here’s a deeper look at the implications:

Financial Considerations

Healthcare insurance premiums can be a substantial monthly expense, especially for those with limited incomes. The financial burden can be further exacerbated by high deductibles and copays, which can lead to individuals delaying or forgoing necessary medical care.

Access to Healthcare Services

The affordability of healthcare insurance directly impacts an individual’s ability to access medical services. Those with comprehensive coverage may have more flexibility in choosing providers and treatments, while those with limited coverage may face restrictions and higher out-of-pocket costs.

Impact on Overall Health

The cost of healthcare insurance can influence an individual’s overall health and well-being. Delaying or avoiding medical care due to financial concerns can lead to the progression of treatable conditions, potentially resulting in more severe health issues and increased healthcare costs in the long run.

Case Study: Impact of Rising Healthcare Costs

Consider the case of Sarah, a single mother with two children. With a limited income, Sarah struggles to balance the cost of healthcare insurance with other essential expenses. She opts for a plan with a high deductible to keep premiums affordable, but this means she must pay a significant portion of her children’s medical expenses out of pocket.

As a result, Sarah often delays routine check-ups and non-urgent medical care for her children, concerned about the financial impact. This delay in care can lead to potential health issues going undetected and untreated, which may have long-term consequences for her family’s well-being.

The Future of Healthcare Insurance Costs

The landscape of healthcare insurance is constantly evolving, influenced by policy changes, technological advancements, and shifts in the healthcare industry. Understanding these trends can provide insights into the potential future of healthcare insurance costs.

Emerging Trends in Healthcare Insurance

Several trends are shaping the future of healthcare insurance:

- Digital Health Solutions: The integration of digital health technologies, such as telemedicine and wearable health devices, is revolutionizing healthcare delivery. These innovations have the potential to reduce costs and improve access to care, which could lead to more affordable insurance plans.

- Value-Based Care: Shifting from a fee-for-service model to value-based care, where providers are reimbursed based on patient outcomes, can lead to more efficient healthcare delivery and potentially lower insurance costs.

- Prevention and Wellness Programs: Insurers are increasingly focusing on prevention and wellness initiatives to reduce the incidence of costly chronic conditions. By encouraging healthy lifestyles, insurers can potentially lower the overall cost of healthcare and insurance premiums.

Potential Future Changes in Healthcare Insurance Costs

While it’s challenging to predict exact changes, here are some potential developments:

- Lower Costs: With the adoption of digital health solutions and value-based care models, there’s a possibility that healthcare insurance costs could decrease over time.

- Increased Focus on Prevention: As insurers continue to emphasize prevention, premiums may be adjusted to incentivize healthy behaviors, potentially lowering costs for those who actively maintain their health.

- Personalized Healthcare Plans: Advances in healthcare technology may lead to more personalized insurance plans tailored to an individual’s unique health needs and risks, potentially offering more cost-effective coverage.

Frequently Asked Questions

How can I find the best healthcare insurance plan for my needs?

+Research is key. Compare plans based on your specific healthcare needs and budget. Consider factors like coverage limits, deductibles, and out-of-pocket costs. Online marketplaces and brokers can be useful tools for comparing plans.

Are there any government programs that can help reduce healthcare insurance costs?

+Yes, government programs like Medicare, Medicaid, and the Affordable Care Act’s subsidies can provide more affordable coverage options for eligible individuals. It’s worth exploring these programs to see if you qualify.

Can I negotiate my healthcare insurance premiums?

+In some cases, yes. If you have a good health record or are a loyal customer, you may be able to negotiate lower premiums with your insurer. It’s worth discussing your options with your provider.