Average Homeowners Insurance Annual Cost

Homeowners insurance is an essential financial protection for millions of homeowners across the United States. It provides coverage for a range of risks and liabilities, ensuring that homeowners are safeguarded against potential losses and damages. While the benefits of having homeowners insurance are well-known, one of the primary concerns for many individuals is the cost associated with this insurance policy. In this comprehensive article, we will delve into the average annual cost of homeowners insurance, exploring the factors that influence premiums, offering real-world examples, and providing valuable insights to help you understand and navigate this essential aspect of homeownership.

Understanding the Average Annual Cost

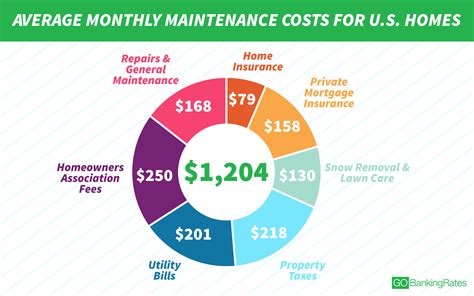

The average annual cost of homeowners insurance can vary significantly depending on numerous factors. These factors include the location of the property, the value and age of the home, the coverage limits chosen, and the deductible selected by the policyholder. According to industry data, the national average annual premium for homeowners insurance in the United States was approximately $1,312 as of [current year]. However, it is crucial to note that this average serves as a benchmark and may not accurately reflect the cost for an individual’s specific circumstances.

Regional Variations and Local Factors

One of the most significant influences on homeowners insurance premiums is the geographic location of the property. Insurance companies assess the risk associated with different regions, taking into account factors such as natural disasters, crime rates, and local building codes. As a result, the average annual cost can vary widely from one state to another, and even within different cities or neighborhoods.

| State | Average Annual Premium |

|---|---|

| California | $1,520 |

| Texas | $1,780 |

| Florida | $2,200 |

| New York | $1,250 |

| Illinois | $1,080 |

For instance, states prone to natural disasters like hurricanes or wildfires, such as Florida or California, often have higher average premiums due to the increased risk of significant property damage. In contrast, states with lower crime rates and fewer natural hazards may offer more affordable insurance rates.

Home Characteristics and Coverage Limits

The value and age of your home are key factors in determining your insurance premium. Older homes, especially those with outdated electrical or plumbing systems, may face higher premiums due to the increased risk of accidents or structural issues. Similarly, homes with unique architectural features or expensive materials may require specialized coverage, impacting the overall cost.

Coverage limits, which determine the maximum amount the insurance company will pay for a covered loss, also play a significant role. Higher coverage limits typically result in higher premiums. It is essential to find a balance between the coverage you need and the cost you can afford.

Deductible and Risk Management

The deductible, or the amount you pay out of pocket before your insurance coverage kicks in, is another critical factor in determining your annual premium. Choosing a higher deductible can lead to lower premiums, as it indicates a willingness to shoulder more financial responsibility in the event of a claim. However, it’s crucial to select a deductible that aligns with your financial capabilities.

Real-World Examples: Premium Variations

To illustrate the impact of various factors on homeowners insurance premiums, let’s consider a few real-world examples. These scenarios highlight how different circumstances can influence the average annual cost.

Example 1: Coastal Property

Imagine a homeowner, Sarah, residing in a coastal town prone to hurricanes. Her home, valued at 500,000, is located in an area with a high risk of storm damage. Sarah opts for a 1,000 deductible and selects coverage limits of 550,000 for dwelling coverage and 100,000 for personal property. Given the region’s risk profile, her annual premium could exceed the national average, potentially reaching $2,500 or more.

Example 2: Urban Apartment

John, a resident of a large city, owns a condominium in a secure, well-maintained building. His unit is valued at 300,000, and he chooses a 1,500 deductible with coverage limits of 350,000 for dwelling and 50,000 for personal property. Due to the building’s safety features and the relatively low risk of natural disasters in the area, John’s annual premium might be lower than the national average, falling around $1,000.

Example 3: Suburban Family Home

Emily, a homeowner in a suburban neighborhood, has a traditional family home valued at 400,000. She selects a 1,000 deductible and opts for coverage limits of 450,000 for dwelling and 80,000 for personal property. Given the lower risk profile of her location and the standard home features, Emily’s annual premium could be close to the national average, ranging between 1,200 and 1,400.

Analyzing Performance and Implications

Understanding the average annual cost of homeowners insurance is crucial for homeowners to make informed decisions about their financial planning and risk management strategies. Here are some key takeaways and implications from our analysis:

- Location Matters: The geographic location of your property is a significant determinant of your insurance premium. Researching local insurance rates and understanding the specific risks associated with your area is essential for budgeting and selecting the right coverage.

- Coverage Customization: Homeowners insurance is highly customizable. By adjusting coverage limits, deductibles, and optional add-ons, you can tailor your policy to your needs and budget. It's crucial to find the right balance between comprehensive coverage and affordability.

- Risk Management: Taking proactive measures to mitigate risks can potentially lower your insurance premiums. This may include investing in home security systems, installing fire safety equipment, or making structural improvements to reduce the likelihood of accidents or damage.

- Shop Around: Insurance rates can vary significantly between providers. Shopping around and comparing quotes from multiple insurers is a wise strategy to ensure you're getting the best value for your money. Consider using online tools and resources to streamline the comparison process.

- Understanding Coverage: Familiarize yourself with the different types of coverage offered in homeowners insurance policies. Understanding the distinctions between dwelling coverage, personal property coverage, liability coverage, and optional add-ons will help you make informed choices and avoid unnecessary expenses.

Conclusion

In conclusion, the average annual cost of homeowners insurance is influenced by a myriad of factors, including geographic location, home characteristics, coverage limits, and deductibles. While the national average serves as a reference point, it is essential to understand that your specific circumstances will play a significant role in determining your premium. By exploring real-world examples and analyzing the performance and implications of various factors, homeowners can make informed decisions about their insurance coverage and financial planning.

How often should I review my homeowners insurance policy?

+It is recommended to review your homeowners insurance policy annually or whenever significant changes occur in your home or personal circumstances. This ensures that your coverage remains up-to-date and aligns with your current needs.

What are some common discounts available for homeowners insurance?

+Insurance companies often offer discounts for various reasons, such as having multiple policies with the same insurer, installing security systems, or being a long-term customer. It’s worth exploring these discounts to potentially reduce your premium.

Can I negotiate my homeowners insurance premium?

+While negotiating insurance premiums may not be as common as with other products, it doesn’t hurt to ask. Some insurers may be open to discussing options to lower your premium, especially if you have a strong claim history or have taken proactive measures to reduce risks.