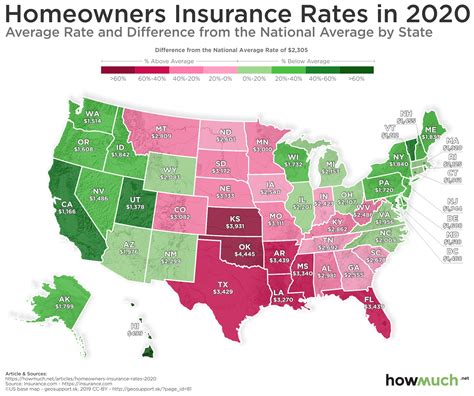

Average Homeowners Insurance Costs

Understanding homeowners insurance is crucial for any property owner, as it provides financial protection against a range of unforeseen events. In this comprehensive guide, we delve into the world of homeowners insurance costs, exploring the factors that influence premiums, regional variations, and strategies to secure the best coverage at the right price. By unraveling the intricacies of this essential coverage, we aim to empower homeowners with the knowledge to make informed decisions and protect their most valuable assets.

Unraveling the Complexity of Homeowners Insurance Costs

Homeowners insurance is a critical investment for anyone who owns a home, offering protection against potential losses and damages. However, the cost of this insurance can vary significantly, influenced by a multitude of factors. Let’s delve into the world of homeowners insurance costs and uncover the key elements that shape the premiums.

The Impact of Location on Homeowners Insurance Premiums

One of the most significant factors influencing homeowners insurance costs is the location of the property. Insurance companies assess the risk associated with a particular area, taking into account a range of variables. For instance, regions prone to natural disasters such as hurricanes, earthquakes, or floods may incur higher premiums due to the increased likelihood of claims. Additionally, areas with a higher crime rate or a history of frequent weather-related incidents can also result in elevated insurance costs.

To illustrate, let's consider two hypothetical homes: one located in a coastal region frequently affected by hurricanes and the other situated in a suburban area with a low crime rate and minimal weather risks. The insurance premium for the coastal home is likely to be substantially higher due to the elevated risk of hurricane damage. In contrast, the suburban home may enjoy lower premiums as it is considered a lower-risk area.

| Location | Premium |

|---|---|

| Coastal Region | $2,500 |

| Suburban Area | $1,800 |

The Role of Home Characteristics in Insurance Costs

Beyond location, the characteristics of the home itself are another key consideration when determining homeowners insurance premiums. Insurance companies assess factors such as the age of the home, its construction materials, and any unique features that may impact the risk of damage or loss.

For instance, an older home built with outdated materials or lacking modern safety features may be deemed a higher risk, leading to increased insurance costs. Similarly, homes with unique architectural features, such as a steep roof or a complex heating system, may also attract higher premiums due to the potential for more complex and costly repairs.

Let's consider two hypothetical homes to illustrate this point: a newly constructed home built with modern materials and equipped with state-of-the-art safety features, and an older home with outdated electrical wiring and a roof in need of repair.

| Home Characteristics | Premium |

|---|---|

| Newly Constructed Home | $1,500 |

| Older Home with Outdated Features | $2,200 |

The Influence of Coverage Limits and Deductibles

The level of coverage chosen by the homeowner is another critical factor in determining homeowners insurance costs. Insurance companies offer various coverage limits, and the higher the limit, the more extensive the protection. However, this increased coverage often comes at a higher cost.

For instance, a homeowner who opts for a higher coverage limit to protect against potential losses from natural disasters or theft may pay a significantly higher premium than someone with a more basic coverage plan. Similarly, the choice of deductible - the amount the homeowner agrees to pay out of pocket before the insurance coverage kicks in - can also impact the overall cost of the policy.

A higher deductible generally leads to a lower premium, as the homeowner assumes more financial responsibility in the event of a claim. Conversely, a lower deductible results in a higher premium, as the insurance company assumes more of the financial burden.

| Coverage Limit | Deductible | Premium |

|---|---|---|

| $500,000 | $1,000 | $2,000 |

| $300,000 | $2,500 | $1,800 |

Understanding the Impact of Claims History

Insurance companies also consider a homeowner’s claims history when determining premiums. A history of frequent or costly claims may lead to increased insurance costs, as it indicates a higher risk of future claims. Conversely, a clean claims history can result in lower premiums, as it suggests a lower risk profile.

For instance, a homeowner who has filed multiple claims in the past few years for various incidents, such as water damage, theft, and storm-related repairs, may face higher insurance costs. In contrast, a homeowner with no claims history or a history of only minor, infrequent claims may enjoy more competitive premiums.

| Claims History | Premium |

|---|---|

| Multiple Claims in Recent Years | $2,800 |

| Clean Claims History | $1,600 |

The Importance of Comparing Insurance Providers

When it comes to homeowners insurance, the choice of provider can significantly impact the cost and quality of coverage. Different insurance companies offer varying levels of coverage, additional benefits, and price points. Therefore, it’s essential to compare multiple providers to find the best fit for one’s specific needs and budget.

For instance, let's consider three hypothetical insurance providers offering homeowners insurance: Provider A, Provider B, and Provider C. Each provider offers different coverage options, with varying premiums and additional benefits such as discounted rates for bundled policies or loyalty programs.

| Provider | Coverage | Premium | Additional Benefits |

|---|---|---|---|

| Provider A | Standard | $2,200 | Discounted rates for bundled policies |

| Provider B | Enhanced | $2,500 | Loyalty program with rewards |

| Provider C | Comprehensive | $3,000 | No additional benefits |

Strategies for Securing Competitive Homeowners Insurance Premiums

While homeowners insurance costs can vary significantly based on a multitude of factors, there are strategies that homeowners can employ to potentially secure more competitive premiums. Here are some tips to consider:

- Maintain a Clean Claims History: As mentioned earlier, a clean claims history can lead to lower premiums. While insurance is in place to provide financial protection, it's important to use it responsibly and only file claims when truly necessary.

- Bundle Policies: Many insurance providers offer discounts when homeowners bundle multiple policies, such as homeowners insurance with auto insurance. This can result in significant savings, so it's worth exploring this option.

- Review and Update Coverage Regularly: Homeowners' needs and circumstances can change over time. Regularly reviewing and updating one's coverage to align with these changes can help ensure that the insurance remains adequate and competitive.

- Consider Higher Deductibles: As discussed, opting for a higher deductible can lead to lower premiums. However, it's crucial to carefully assess one's financial situation and risk tolerance before making this decision.

- Improve Home Security: Upgrading home security features, such as installing a monitored alarm system or strengthening doors and windows, can reduce the risk of theft and potential damage. This, in turn, may lead to lower insurance costs.

- Shop Around and Compare: As mentioned earlier, comparing multiple insurance providers is crucial to finding the best value. Don't settle for the first quote; take the time to research and compare different options to identify the most competitive premiums and coverage.

Conclusion

In conclusion, homeowners insurance costs are influenced by a complex interplay of factors, including location, home characteristics, coverage limits, deductibles, claims history, and the choice of insurance provider. By understanding these factors and implementing strategies to manage them, homeowners can take control of their insurance costs and secure the best coverage to protect their valuable assets.

Remember, homeowners insurance is an essential investment that provides peace of mind and financial protection. By staying informed and proactive, homeowners can navigate the complexities of insurance costs and make decisions that align with their specific needs and budget.

FAQ

What is the average cost of homeowners insurance in the United States?

+

The average cost of homeowners insurance in the United States varies significantly depending on factors such as location, home value, and coverage limits. According to recent data, the national average for homeowners insurance is approximately $1,200 per year. However, it’s important to note that this is just an average, and actual costs can range from a few hundred dollars to several thousand dollars annually.

How can I reduce my homeowners insurance costs?

+

There are several strategies you can employ to potentially reduce your homeowners insurance costs. These include maintaining a clean claims history, bundling your policies with the same provider, increasing your deductible (although be mindful of your financial situation), improving your home’s security features, and regularly reviewing and updating your coverage to ensure it aligns with your needs.

Are there any discounts available for homeowners insurance?

+

Yes, many insurance providers offer a variety of discounts to their customers. Common discounts include those for bundling policies (such as homeowners and auto insurance), loyalty rewards, home safety features (such as monitored alarm systems), and even certain occupations or affiliations. It’s worth inquiring with your insurance provider to see if you’re eligible for any discounts.