Average Insurance

Welcome to this in-depth exploration of the concept of "Average Insurance," a term that might initially sound rather straightforward, but as we delve deeper, we uncover a multifaceted and intricate system that plays a crucial role in our daily lives. From protecting our health to safeguarding our homes and assets, insurance is an essential financial tool. This article aims to demystify the world of average insurance, shedding light on its various aspects, including its historical evolution, current trends, and future prospects.

Understanding the Basics: What is Average Insurance?

Average insurance, a fundamental concept in the insurance industry, refers to the principle of sharing risks among a group of policyholders. It is a mechanism that ensures that losses or damages suffered by a few individuals are distributed across a larger pool, thereby reducing the financial burden on any single person. This collective approach to risk management forms the very foundation of the insurance sector.

The term "average" in insurance has its roots in marine insurance, where it originally referred to a proportionate contribution made by each party to a shipping venture in the event of a loss. Over time, this concept evolved and found application in various other insurance sectors, including property, health, and liability insurance.

How Does Average Insurance Work?

In practical terms, average insurance operates on the principle of risk pooling. When you purchase an insurance policy, you essentially contribute to a larger fund. This fund is then used to compensate policyholders who experience covered losses or damages. The premise is that not all policyholders will incur losses simultaneously, and by spreading the risk across a large group, the financial impact of any individual loss is significantly reduced.

For instance, consider a group of 100 homeowners who each pay an annual premium of $500 for fire insurance. If one homeowner experiences a fire-related loss costing $10,000 to repair, the insurance company will draw from the collective fund to cover this expense. In this scenario, each policyholder's contribution helps mitigate the financial risk for the affected individual.

| Policyholder | Annual Premium | Contribution to Fund |

|---|---|---|

| Homeowner 1 | $500 | $500 |

| Homeowner 2 | $500 | $500 |

| ... | ... | ... |

| Homeowner 100 | $500 | $500 |

| Total Fund | $50,000 | $50,000 |

The Evolution of Average Insurance: A Historical Perspective

The origins of average insurance can be traced back to ancient civilizations, where early forms of insurance were practiced to mitigate the risks associated with trade and travel. However, the concept as we understand it today evolved significantly over centuries, influenced by societal changes, technological advancements, and economic shifts.

Ancient Origins

Some of the earliest records of insurance practices date back to ancient Babylonia, where merchants would contribute to a common fund to cover losses incurred during trade expeditions. This rudimentary form of insurance, though not as sophisticated as modern average insurance, laid the groundwork for the concept of risk sharing.

In ancient Greece and Rome, similar practices were documented, with ship owners and merchants forming syndicates to pool resources and cover losses. These early forms of insurance were often ad-hoc and lacked the structured framework that we associate with modern insurance policies.

The Renaissance and Beyond

The Renaissance period saw a significant expansion of trade and exploration, which in turn led to a greater need for more sophisticated insurance mechanisms. The development of marine insurance, particularly in places like England and Italy, played a pivotal role in shaping the modern insurance industry.

During this era, the concept of "general average" emerged, which required all parties involved in a shipping venture to contribute proportionally to any losses incurred. This principle, though it may seem straightforward now, was a significant development in ensuring fair risk distribution.

The Industrial Revolution and Modern Times

The Industrial Revolution brought about massive changes in society and the economy, leading to a surge in demand for insurance. As industries grew and cities expanded, the need for insurance to cover a wide range of risks became apparent. This period saw the emergence of various types of insurance, including fire, life, and property insurance.

The 20th century witnessed further evolution, with the introduction of complex insurance products and the expansion of insurance coverage to include health, automobile, and liability insurance. The development of actuarial science and statistical modeling played a crucial role in refining the calculation of insurance premiums and risk assessment.

Average Insurance in Practice: A Real-World Example

To better understand the workings of average insurance, let’s consider a real-world scenario: a group of homeowners in a flood-prone area who have purchased flood insurance.

Scenario: Flood Insurance for Homeowners

Imagine a neighborhood of 500 homeowners, all of whom have purchased flood insurance policies with an annual premium of 1,000. This collective premium pool amounts to 500,000, which is set aside to cover potential flood-related damages.

In a given year, if one homeowner experiences a severe flood that causes $50,000 in damages, the insurance company will utilize the premium pool to compensate this individual. Each of the other 499 homeowners has contributed to this fund, effectively sharing the risk and financial burden.

| Homeowner | Annual Premium | Contribution to Fund |

|---|---|---|

| Homeowner 1 | $1,000 | $1,000 |

| Homeowner 2 | $1,000 | $1,000 |

| ... | ... | ... |

| Homeowner 500 | $1,000 | $1,000 |

| Total Fund | $500,000 | $500,000 |

This scenario demonstrates how average insurance operates in practice, ensuring that the financial impact of a disaster is shared equitably among the policyholders.

The Future of Average Insurance: Trends and Predictions

The insurance industry is continuously evolving, and average insurance is no exception. Several trends and factors are shaping the future of this vital financial mechanism.

Digital Transformation

The digital age has brought about significant changes in the insurance sector. With the rise of online platforms and mobile apps, insurance companies are increasingly adopting digital technologies to enhance their services. This includes streamlined processes for policy issuance, claims management, and customer engagement.

Digital transformation also opens up new opportunities for average insurance. For instance, the use of big data and advanced analytics can improve risk assessment and pricing, making average insurance policies more accurate and tailored to individual needs.

Changing Risk Landscape

The world is facing new and emerging risks, from climate change-induced natural disasters to cyber attacks and pandemics. These changing risk factors are prompting insurance companies to adapt and innovate. Average insurance policies are being revised to include coverage for these new risks, ensuring that policyholders are adequately protected.

Sustainability and Social Responsibility

There is a growing emphasis on sustainability and social responsibility within the insurance industry. Many companies are now incorporating environmental, social, and governance (ESG) factors into their operations and insurance offerings. This includes promoting sustainable practices, investing in green initiatives, and offering insurance products that support social causes.

Personalization and Customization

With the advent of digital technologies and data analytics, insurance companies are now able to offer more personalized and customized insurance products. Average insurance policies can be tailored to individual needs, taking into account factors such as lifestyle, occupation, and personal preferences. This level of customization enhances the value proposition of average insurance for policyholders.

Conclusion: Average Insurance in a Changing World

Average insurance is a dynamic and vital component of the modern financial landscape. From its ancient origins to its contemporary applications, it has evolved to meet the changing needs and risks of society. As we navigate an increasingly complex and unpredictable world, average insurance continues to provide a crucial safety net, offering financial protection and peace of mind to individuals and businesses alike.

The future of average insurance looks promising, with digital transformation, changing risk landscapes, and a focus on sustainability driving innovation and adaptation. As the insurance industry continues to evolve, average insurance will remain a cornerstone, ensuring that risks are shared and financial burdens are equitably distributed.

Frequently Asked Questions

How is the premium for average insurance calculated?

+

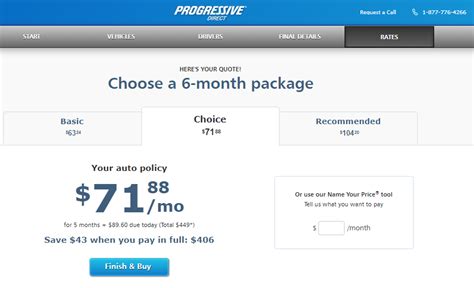

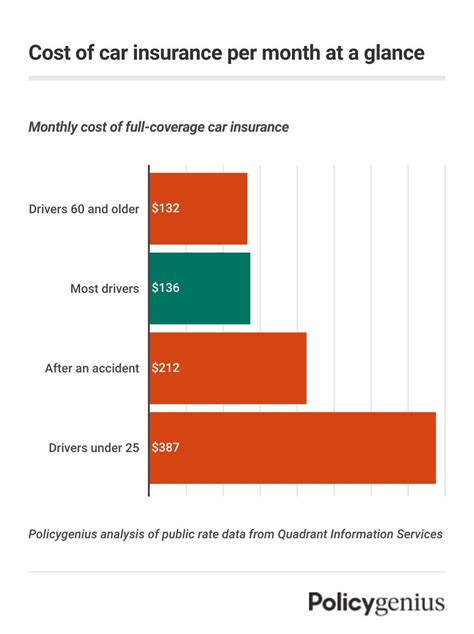

Premiums for average insurance are calculated based on a variety of factors, including the type of insurance, the level of risk associated with the policyholder, and the overall risk profile of the insurance company. Actuarial science plays a crucial role in determining premiums, ensuring they are fair and adequate to cover potential losses.

Can average insurance policies be customized to individual needs?

+

Yes, many average insurance policies can be customized to meet individual needs. Insurance companies often offer optional add-ons or riders that allow policyholders to tailor their coverage. This customization ensures that individuals can choose the level of protection that suits their specific circumstances.

How does average insurance differ from other types of insurance, like whole life insurance or health insurance?

+

Average insurance differs from other types of insurance in its focus on risk sharing and collective protection. Whole life insurance, for instance, provides coverage for the policyholder’s entire life, with a death benefit paid to beneficiaries upon the insured’s passing. Health insurance, on the other hand, covers medical expenses, often with a focus on preventive care. Average insurance, in contrast, is designed to protect against specific risks, with the premium pool covering losses incurred by policyholders.