Average Insurance Costs

Insurance is a vital aspect of financial planning and risk management for individuals and businesses alike. Understanding the average insurance costs is essential for making informed decisions about coverage and ensuring adequate protection. This comprehensive article aims to delve into the world of insurance costs, exploring various types of insurance, their average expenses, and the factors influencing these prices.

The Landscape of Insurance Costs

Insurance costs can vary significantly depending on the type of coverage sought. From health insurance to auto insurance, life insurance to property insurance, each category presents its own set of variables that impact the final price. Let’s break down the average costs associated with some common insurance types.

Health Insurance

Health insurance is a critical aspect of personal financial security, especially in regions without universal healthcare coverage. The average cost of health insurance can vary greatly depending on factors such as age, location, and the level of coverage desired. For instance, a young, healthy individual may pay an average monthly premium of 250</strong>, while older individuals or those with pre-existing conditions could face premiums upwards of <strong>600 or more.

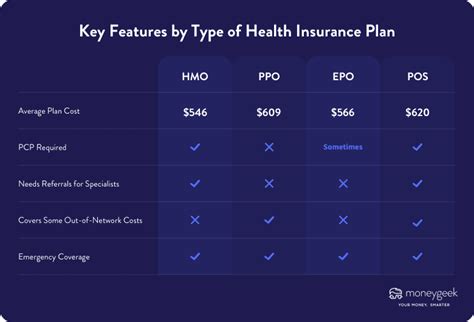

Health insurance plans often come with a range of deductibles and out-of-pocket maximums. A popular choice is the High Deductible Health Plan (HDHP), which typically has lower premiums but requires the insured to pay a higher deductible before the insurance coverage kicks in. On the other hand, Preferred Provider Organization (PPO) plans offer more flexibility in choosing healthcare providers but may come with slightly higher premiums.

| Health Insurance Type | Average Monthly Premium |

|---|---|

| HDHP | $250 - $500 |

| PPO | $300 - $700 |

| HMO | $200 - $450 |

Auto Insurance

Auto insurance is mandatory in most regions, ensuring financial protection in case of accidents or vehicle-related incidents. The average cost of auto insurance varies based on several factors, including the make and model of the vehicle, the driver’s age and driving history, and the level of coverage required.

For a typical sedan driven by a middle-aged individual with a clean driving record, the average annual premium can range from $800 to $1,200. However, younger drivers or those with a history of accidents or traffic violations may face premiums upwards of $2,000 or more.

Auto insurance policies often come with different coverage options, such as liability-only coverage, comprehensive coverage, or collision coverage. Liability-only coverage is the most basic and usually the least expensive, while comprehensive and collision coverage provide more extensive protection but come at a higher cost.

| Auto Insurance Coverage | Average Annual Premium |

|---|---|

| Liability-only | $800 - $1,500 |

| Comprehensive | $1,200 - $2,000 |

| Collision | $1,000 - $1,800 |

Life Insurance

Life insurance provides financial protection to loved ones in the event of the policyholder’s death. The average cost of life insurance can vary widely depending on factors such as age, health status, and the amount of coverage required.

For a healthy, non-smoking individual in their 30s, a term life insurance policy with a coverage amount of $500,000 can cost an average of $25 to $50 per month. However, older individuals or those with health issues may face premiums that are several times higher.

Life insurance policies come in two main types: term life and whole life insurance. Term life insurance offers coverage for a specific period, such as 10 or 20 years, and is generally more affordable. Whole life insurance, on the other hand, provides coverage for the policyholder's entire life and also includes a cash value component, making it more expensive but offering a potential investment opportunity.

| Life Insurance Type | Average Monthly Premium |

|---|---|

| Term Life | $25 - $150 |

| Whole Life | $100 - $500 |

Property Insurance

Property insurance, including homeowners’ insurance and renters’ insurance, protects against losses or damages to one’s property. The average cost of property insurance depends on factors such as the location of the property, its value, and the level of coverage required.

For a typical single-family home, the average annual premium for homeowners' insurance can range from $1,000 to $2,000. Renters' insurance, which typically covers personal belongings and liability, can cost an average of $150 to $300 per year.

Property insurance policies often come with various coverage options, such as coverage for structural damage, personal belongings, liability, and additional living expenses in case of a disaster. It's important to carefully review these options and tailor the policy to your specific needs.

| Property Insurance Type | Average Annual Premium |

|---|---|

| Homeowners' Insurance | $1,000 - $2,500 |

| Renters' Insurance | $150 - $350 |

Factors Influencing Insurance Costs

The cost of insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Understanding these factors can help individuals make more informed decisions when choosing insurance coverage.

Risk Assessment

Insurance companies assess risk to determine the likelihood of a claim being made. Higher risk generally results in higher premiums. For example, in health insurance, pre-existing conditions or a history of chronic illnesses can increase the risk and thus the cost of coverage. Similarly, in auto insurance, a driver’s age, driving record, and the type of vehicle all contribute to the risk assessment.

Location

The location of the insured individual or property can significantly impact insurance costs. Areas prone to natural disasters, such as hurricanes or earthquakes, often have higher insurance premiums. Additionally, crime rates, traffic density, and healthcare costs can all influence insurance rates in a given region.

Coverage and Deductibles

The level of coverage chosen directly affects the cost of insurance. Higher coverage limits generally result in higher premiums. Deductibles, which are the amount the insured pays out of pocket before the insurance coverage kicks in, can also impact costs. Choosing a higher deductible can lower premiums, but it means the insured will pay more out of pocket if a claim is made.

Market Competition

The insurance market is competitive, and companies often adjust their premiums to stay competitive while still maintaining profitability. In areas with a higher concentration of insurance providers, there may be more pricing variability, allowing for better deals for consumers.

Regulations and Taxes

Government regulations and taxes can also impact insurance costs. Some regions may have mandatory coverage requirements or additional taxes on insurance policies, which can increase the overall cost for consumers.

Maximizing Cost-Effectiveness

While insurance costs can be a significant expense, there are strategies to maximize cost-effectiveness and ensure you’re getting the best value for your money.

Comparative Shopping

Comparing quotes from multiple insurance providers is crucial to finding the best deal. Online tools and brokers can help simplify this process, allowing you to quickly assess different options and choose the one that best fits your needs and budget.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as combining auto and home insurance or life and health insurance. Bundling can result in significant savings, so it’s worth exploring this option.

Understanding Coverage

Before purchasing insurance, thoroughly understand the coverage provided and any exclusions or limitations. Ensure the policy aligns with your specific needs to avoid paying for coverage you don’t require.

Reviewing and Adjusting Coverage

Regularly review your insurance policies to ensure they still meet your needs. Life circumstances, such as a new job, marriage, or the purchase of a new home, can impact your insurance requirements. Adjusting your coverage accordingly can help optimize costs.

Safe Habits and Discounts

Adopting safe habits, such as driving carefully or maintaining a healthy lifestyle, can qualify you for discounts on insurance. Many companies offer incentives for safe behaviors, so it’s worth inquiring about these opportunities.

The Future of Insurance Costs

The insurance industry is evolving, and the future of insurance costs is likely to be influenced by several key trends.

Technological Advancements

The rise of technology, particularly in the form of digital health records and telematics in auto insurance, is expected to enhance risk assessment and pricing accuracy. This could lead to more personalized insurance plans and potentially lower costs for some individuals.

Increasing Healthcare Costs

Rising healthcare costs are a significant concern, and they directly impact the affordability of health insurance. As healthcare expenses continue to rise, so too will the premiums for health insurance, making it crucial for individuals to explore cost-saving measures.

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change are expected to drive up property insurance costs, particularly in high-risk areas. This underscores the importance of comprehensive coverage and preparedness.

Regulatory Changes

Changes in government regulations can impact insurance costs. For instance, the implementation of universal healthcare or alterations to existing laws could significantly alter the landscape of insurance, potentially affecting premiums.

The Sharing Economy

The rise of the sharing economy, with services like Airbnb and car-sharing apps, is creating new insurance challenges. Insurance providers are adapting to cover these new models, but the costs and coverage options are still evolving.

Conclusion

Understanding average insurance costs is a crucial step in managing personal finances and ensuring adequate protection. From health insurance to auto and property insurance, each type of coverage comes with its own set of costs and considerations. By familiarizing yourself with the factors influencing insurance costs and adopting cost-saving strategies, you can make informed decisions about your insurance needs and maximize the value of your coverage.

As the insurance landscape continues to evolve, staying informed about the latest trends and developments is essential. Whether it's embracing technological advancements, preparing for rising healthcare costs, or adapting to the challenges of the sharing economy, being proactive can help you navigate the world of insurance with confidence.

How do I find the best insurance deal for my needs?

+To find the best insurance deal, compare quotes from multiple providers, use online tools and brokers to streamline the process, and consider bundling policies for potential discounts. Additionally, ensure you thoroughly understand the coverage provided to avoid paying for unnecessary extras.

What factors influence the cost of health insurance?

+Health insurance costs are influenced by factors such as age, location, pre-existing conditions, and the level of coverage desired. Plans with higher deductibles and out-of-pocket maximums tend to have lower premiums, while more comprehensive coverage may cost more.

How can I lower my auto insurance premiums?

+To lower auto insurance premiums, consider choosing a higher deductible, which can reduce your monthly payments. Additionally, maintaining a clean driving record, shopping around for quotes, and exploring discounts for safe driving habits can help reduce costs.

What should I consider when choosing life insurance coverage?

+When choosing life insurance coverage, consider your family’s financial dependencies and future goals. Determine the amount of coverage needed to ensure your loved ones’ financial security. Compare term life and whole life policies to find the best fit for your needs and budget.