Average Life Insurance Monthly Cost

When it comes to financial planning and securing your loved ones' future, life insurance is an essential consideration. The cost of life insurance is a topic that often raises questions and concerns among individuals looking to make informed decisions. In this comprehensive guide, we will delve into the factors influencing the average life insurance monthly cost, explore real-world examples, and provide valuable insights to help you understand and manage this important financial aspect.

Understanding the Average Life Insurance Cost

Life insurance policies are designed to provide financial protection to your beneficiaries in the event of your untimely demise. The cost of this protection varies significantly based on several key factors, each playing a crucial role in determining the monthly premium you’ll pay.

Factors Influencing Monthly Premiums

The average life insurance monthly cost is influenced by a multitude of factors, each contributing to the overall affordability and accessibility of these policies. Let’s break down these factors and understand their impact on your financial commitment.

- Age and Health: One of the primary determinants of life insurance costs is your age and overall health. Younger individuals typically enjoy lower premiums as they pose a lower risk to insurance providers. Additionally, your health status, including any pre-existing conditions, can significantly impact the cost. For instance, individuals with a clean bill of health often qualify for preferred rates, while those with medical complications may face higher premiums or even policy exclusions.

- Policy Type and Coverage Amount: The type of life insurance policy you choose and the coverage amount you select are pivotal in determining your monthly costs. There are primarily two types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specific period, often ranging from 10 to 30 years, and is generally more affordable. On the other hand, permanent life insurance, such as whole life or universal life insurance, provides lifelong coverage but comes with higher premiums. The coverage amount you opt for also affects your monthly premium; higher coverage means higher costs.

- Tobacco Use: Tobacco use, including smoking and chewing tobacco, is a significant risk factor for various health complications. Insurance providers often categorize individuals based on their tobacco use, with non-smokers enjoying more favorable rates. Smokers, on the other hand, may face higher premiums or even policy denials due to the increased health risks associated with tobacco consumption.

- Lifestyle and Occupation: Your lifestyle and occupation can also influence your life insurance costs. Engaging in high-risk activities like extreme sports or having a hazardous occupation may result in higher premiums. Insurance providers assess these factors to evaluate the potential risks associated with your lifestyle and occupation, which ultimately impact the cost of your policy.

- Family History and Genetics: Your family's medical history and genetic predispositions can play a role in determining your life insurance costs. If your family has a history of certain health conditions, such as heart disease or cancer, insurance providers may consider this when assessing your risk profile, potentially leading to higher premiums.

- Location and Policy Add-Ons: The cost of life insurance can also vary based on your geographical location. Additionally, certain policy add-ons or riders, such as accidental death benefits or waiver of premium riders, can increase your monthly premiums.

Real-World Examples of Average Monthly Costs

To better understand the range of average life insurance monthly costs, let’s explore some real-world examples based on different policy types and coverage amounts.

Term Life Insurance

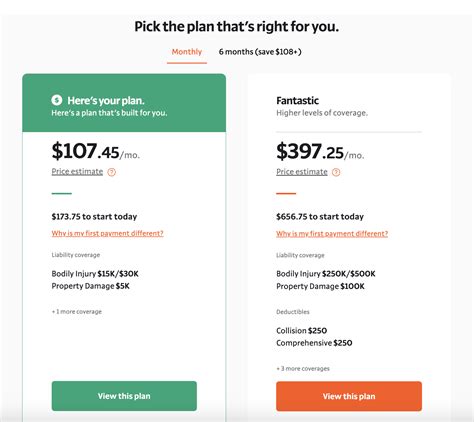

Term life insurance is often the more affordable option, making it a popular choice for individuals seeking temporary coverage. Here are some average monthly costs for term life insurance policies:

| Coverage Amount ($) | Average Monthly Premium for a 30-Year-Old Non-Smoker |

|---|---|

| $250,000 | $20 - $30 |

| $500,000 | $35 - $50 |

| $1,000,000 | $50 - $75 |

Permanent Life Insurance

Permanent life insurance, including whole life and universal life policies, offers lifelong coverage and typically carries higher monthly premiums. Here’s an example of average monthly costs for permanent life insurance:

| Coverage Amount ($) | Average Monthly Premium for a 35-Year-Old Non-Smoker |

|---|---|

| $250,000 | $100 - $150 |

| $500,000 | $200 - $300 |

| $1,000,000 | $350 - $500 |

Analyzing Performance and Future Implications

Understanding the average life insurance monthly cost is just the first step in your financial planning journey. It’s essential to analyze the performance and potential future implications of these policies to make well-informed decisions.

Performance Analysis

When evaluating the performance of your life insurance policy, consider the following aspects:

- Return on Investment: Assess the long-term return on your investment. While life insurance primarily provides peace of mind and financial security, understanding the potential growth and returns associated with permanent life insurance policies is crucial.

- Policy Flexibility: Evaluate the flexibility of your policy. Some permanent life insurance policies offer cash value accumulation, allowing you to access funds in the future. Term life insurance, on the other hand, offers straightforward coverage without the accumulation of cash value.

- Policy Riders: Consider the additional benefits or riders you've chosen. These add-ons can enhance your coverage but may also increase your monthly premiums. Ensure that the riders you've selected align with your specific needs and financial goals.

Future Implications

Life insurance is a long-term commitment, and understanding its future implications is vital for effective financial planning. Here are some key considerations:

- Inflation and Cost of Living: Inflation can impact the future cost of your life insurance premiums. As your coverage amount remains fixed, the purchasing power of your policy may decrease over time. Regularly reviewing and adjusting your coverage amount can help mitigate this risk.

- Changing Health and Lifestyle Factors: Your health and lifestyle can evolve over time, impacting your life insurance costs. Regular health check-ups and maintaining a healthy lifestyle can help you qualify for more favorable rates in the future. Additionally, consider reviewing your policy if your occupation or lifestyle changes significantly.

- Family and Financial Changes: Life events such as marriage, the birth of children, or significant changes in your financial situation may prompt a reevaluation of your life insurance needs. Ensure that your policy coverage aligns with your current and future financial obligations.

Conclusion

Understanding the average life insurance monthly cost is crucial for making informed decisions about your financial security and the well-being of your loved ones. By considering the various factors that influence premiums and analyzing real-world examples, you can navigate the life insurance landscape with confidence. Remember, your financial situation and needs are unique, so it’s essential to seek professional advice and compare quotes from multiple insurers to find the best policy that suits your requirements.

How do I choose the right coverage amount for my life insurance policy?

+Determining the right coverage amount involves assessing your financial obligations and goals. Consider factors like outstanding debts, mortgage payments, future education expenses for your children, and the income needed to maintain your current standard of living. A financial advisor can help you calculate the appropriate coverage amount based on your unique circumstances.

Can I switch my life insurance policy if I find a better deal?

+Absolutely! Life insurance policies are not set in stone, and you have the freedom to switch providers if you find a more competitive rate or a policy that better suits your needs. However, it’s essential to carefully review the new policy’s terms and conditions to ensure you’re not losing any valuable benefits or riders.

What happens if I miss a monthly premium payment for my life insurance policy?

+Missing a monthly premium payment can have serious consequences. Most insurance providers offer a grace period, typically 30 days, during which you can still make the payment without losing coverage. However, if you miss the grace period, your policy may lapse, and you’ll need to reapply, potentially facing higher premiums or even policy denials due to any changes in your health or lifestyle.