Average Medical Insurance Price

When it comes to medical insurance, understanding the average costs is crucial for individuals and families alike. The price of medical insurance can vary significantly based on several factors, including the type of coverage, the provider, and the location. This article aims to delve into the intricacies of medical insurance pricing, providing an in-depth analysis and insights to help you make informed decisions.

Factors Influencing Medical Insurance Prices

Several key factors contribute to the variability in medical insurance prices. Let's explore these factors and their impact on the overall cost.

Coverage Options and Plan Types

One of the primary determinants of medical insurance prices is the type of coverage chosen. Plans can vary widely, from basic health maintenance organization (HMO) plans with limited provider networks to more comprehensive preferred provider organization (PPO) plans offering greater flexibility. Additionally, the level of coverage, such as the inclusion of dental and vision benefits, can significantly affect the price.

For instance, consider the case of Jane, a 35-year-old individual residing in a metropolitan area. She opts for a PPO plan with a broad network of providers and additional dental coverage. This choice results in a higher premium compared to a basic HMO plan, but it provides her with more options and peace of mind.

Age and Gender Considerations

Age and gender are two demographic factors that insurance providers take into account when determining prices. Generally, younger individuals tend to pay lower premiums as they are statistically less likely to require extensive medical care. However, as individuals age, the risk of health issues increases, leading to higher insurance costs.

Furthermore, gender can also impact insurance prices. In some regions, insurance providers are allowed to charge different rates based on gender, with women often facing higher premiums due to their higher life expectancy and increased healthcare needs during reproductive years.

Geographical Location

The cost of medical insurance can vary significantly based on geographical location. Urban areas with higher living costs and more specialized healthcare facilities often have higher insurance premiums. Conversely, rural areas may offer more affordable options due to lower overhead costs for healthcare providers.

Let's consider an example: John, a 40-year-old individual, resides in a small town with limited access to specialized healthcare services. As a result, his insurance premiums are relatively lower compared to someone living in a major city with numerous hospitals and medical centers.

Lifestyle and Health Factors

Insurance providers also consider an individual's lifestyle and health history when determining prices. Those with unhealthy lifestyles, such as smokers or individuals with obesity, may face higher premiums due to the increased risk of developing health complications. Similarly, individuals with pre-existing medical conditions or a history of frequent healthcare utilization may also experience higher insurance costs.

Understanding Average Medical Insurance Prices

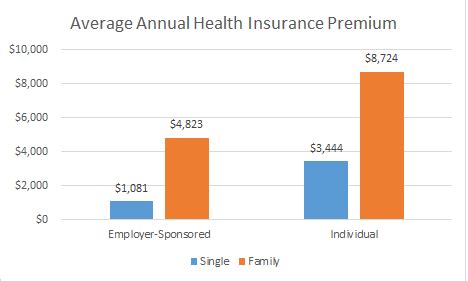

Now that we've explored the key factors influencing medical insurance prices, let's delve into the average costs associated with different coverage types.

Basic HMO Plans

Health Maintenance Organization (HMO) plans are typically the most affordable option, offering a restricted network of providers and limited coverage. The average monthly premium for an HMO plan can range from $200 to $400, depending on the specific plan and the individual's age and location.

For instance, Sarah, a 25-year-old individual living in a suburban area, opts for an HMO plan with a narrow provider network. Her monthly premium amounts to $250, providing her with essential healthcare coverage at an affordable rate.

PPO and EPO Plans

Preferred Provider Organization (PPO) and Exclusive Provider Organization (EPO) plans offer more flexibility and a broader network of providers. These plans generally come with higher premiums, ranging from $300 to $600 per month. The exact cost depends on the plan's coverage, the individual's age, and their location.

David, a 30-year-old professional, chooses a PPO plan with a wide network of providers and additional coverage for specialized healthcare services. His monthly premium amounts to $450, allowing him access to a diverse range of healthcare options.

High-Deductible Health Plans (HDHPs)

High-deductible health plans (HDHPs) are another popular option, particularly for those who prioritize lower monthly premiums. These plans have higher deductibles, meaning individuals must pay a larger portion of their healthcare costs before the insurance coverage kicks in. The average monthly premium for an HDHP can range from $150 to $350.

Emily, a 28-year-old with a stable income, opts for an HDHP with a monthly premium of $200. While her plan has a higher deductible, the lower monthly premium allows her to save money, especially if she remains relatively healthy and requires minimal medical care.

Performance Analysis and Future Implications

Analyzing the performance of medical insurance plans is crucial to understanding their effectiveness and identifying areas for improvement. Here, we explore some key performance metrics and their implications for the future of medical insurance.

Claim Processing Efficiency

The efficiency of claim processing is a critical aspect of medical insurance performance. Delays in claim processing can lead to financial burdens for both patients and healthcare providers. Insurance providers should aim to streamline their claim processing systems to ensure timely reimbursement, enhancing overall customer satisfaction.

Recent advancements in technology, such as the implementation of electronic claim submission and automated claim processing, have significantly improved claim processing efficiency. These innovations have reduced the time taken to process claims, minimizing delays and potential financial losses.

Provider Network Adequacy

The adequacy of the provider network is another crucial factor in medical insurance performance. A comprehensive and diverse provider network ensures that individuals have access to a wide range of healthcare services, promoting better health outcomes. Insurance providers should regularly assess and expand their provider networks to meet the evolving needs of their policyholders.

In recent years, there has been a growing trend towards value-based care, where insurance providers collaborate with healthcare providers to improve patient outcomes and reduce costs. This shift has led to the expansion of provider networks, incorporating more specialized healthcare services and focusing on preventive care.

Cost Containment Strategies

Implementing effective cost containment strategies is essential for the long-term sustainability of medical insurance plans. Insurance providers should explore innovative approaches to control costs while maintaining the quality of care. This may include negotiating discounted rates with healthcare providers, promoting generic drug usage, and incentivizing preventive healthcare measures.

Some insurance providers have successfully implemented cost containment strategies by partnering with pharmaceutical companies to offer discounted medications to their policyholders. Additionally, incentivizing policyholders to undergo regular health screenings and promoting healthy lifestyle choices can help prevent costly medical conditions in the long run.

Customer Satisfaction and Retention

Customer satisfaction and retention are vital for the success of any medical insurance provider. Insurance companies should prioritize providing excellent customer service, offering clear and transparent communication, and ensuring prompt resolution of any issues or complaints.

To enhance customer satisfaction, insurance providers can invest in user-friendly digital platforms, providing policyholders with easy access to their insurance information and claims status. Additionally, implementing feedback mechanisms and actively addressing customer concerns can lead to improved retention rates and positive word-of-mouth recommendations.

Comparative Analysis: Medical Insurance Plans

When choosing a medical insurance plan, it's essential to compare different options to find the best fit for your needs and budget. Here, we present a comparative analysis of various medical insurance plans, highlighting their key features and costs.

| Plan Type | Provider | Monthly Premium | Coverage Highlights |

|---|---|---|---|

| HMO Basic | HealthInsure | $250 | Limited provider network, basic coverage, suitable for healthy individuals |

| PPO Standard | MedicarePlus | $420 | Broad provider network, includes dental and vision coverage, ideal for families |

| EPO Premium | HealthPartners | $550 | Exclusive provider network, comprehensive coverage, covers specialized services |

| HDHP Bronze | InsureCo | $180 | High deductible, lower premium, suitable for cost-conscious individuals |

The table above provides a glimpse of the diverse range of medical insurance plans available. It's important to note that these plans may vary based on location and individual circumstances. Conducting thorough research and consulting with insurance brokers can help you make an informed decision.

Frequently Asked Questions

How do medical insurance prices vary by state or region?

+Medical insurance prices can vary significantly across different states and regions due to factors such as healthcare costs, provider availability, and state-specific regulations. For instance, states with higher living costs and more specialized healthcare facilities often have higher insurance premiums. It’s essential to compare plans within your specific region to find the most suitable and affordable option.

Are there any government-funded medical insurance options available?

+Yes, government-funded medical insurance programs, such as Medicaid and Medicare, provide coverage to eligible individuals. Medicaid is primarily aimed at low-income individuals and families, while Medicare is designed for seniors aged 65 and older. These programs offer comprehensive coverage and can be a valuable option for those who qualify.

Can I negotiate medical insurance prices with providers?

+Negotiating medical insurance prices directly with providers is generally not feasible as insurance plans are often standardized and regulated. However, you can explore different plan options and compare prices to find the most suitable and cost-effective coverage for your needs. Additionally, consulting with insurance brokers or agents can provide valuable guidance in navigating the insurance market.

What are the potential consequences of not having medical insurance?

+Not having medical insurance can have significant financial and health implications. In the event of an unexpected illness or injury, individuals without insurance may face substantial medical bills, potentially leading to financial hardship. Additionally, lack of insurance can result in delayed or inadequate healthcare, negatively impacting overall health and well-being.

Are there any tax benefits associated with medical insurance premiums?

+Yes, in many countries, medical insurance premiums are tax-deductible, providing individuals with a financial incentive to obtain coverage. This means that a portion of the premium paid can be deducted from taxable income, reducing the overall tax liability. It’s advisable to consult with a tax professional or refer to relevant tax guidelines to understand the specific benefits applicable in your region.