Average Monthly Cost Of Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. The cost of car insurance varies significantly based on numerous factors, making it challenging to determine an exact average monthly expense. However, understanding the key variables that influence insurance premiums can help drivers estimate their costs and make informed decisions about their coverage.

Factors Influencing Car Insurance Costs

Several critical factors contribute to the determination of car insurance premiums. These include:

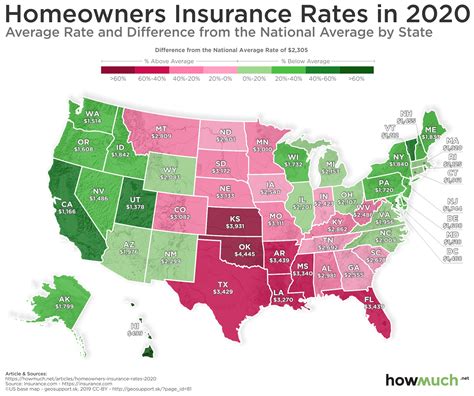

- Location: Insurance rates can vary significantly depending on the state, city, or even the specific neighborhood in which you reside. Different regions have varying levels of risk, including the likelihood of accidents, theft, and natural disasters, which impact insurance costs.

- Vehicle Type and Age: The make, model, and age of your vehicle play a significant role in determining insurance rates. Newer, high-performance cars and luxury vehicles generally have higher insurance costs due to their higher replacement and repair values.

- Driver Profile: Your driving history and personal characteristics are crucial factors. Insurance companies consider your age, gender, driving record, and years of driving experience. Younger and less experienced drivers, for instance, are often charged higher premiums due to their perceived higher risk.

- Coverage and Deductibles: The type and extent of coverage you choose impact your insurance costs. Comprehensive and collision coverage, for example, can increase your premiums. Additionally, higher deductibles (the amount you pay out-of-pocket before your insurance kicks in) can lead to lower monthly premiums.

- Usage and Mileage: How and how often you use your vehicle matters. Those who drive fewer miles annually or primarily use their cars for pleasure rather than commuting may be eligible for lower rates.

- Insurance Company and Policy Features: Different insurance providers offer varying rates and policy options. It's essential to shop around and compare quotes to find the best deal. Additionally, the specific features and benefits of each policy can impact the overall cost.

Estimating Average Monthly Car Insurance Costs

Given the multitude of factors that influence insurance rates, it’s challenging to pinpoint an exact average monthly cost for car insurance. However, based on industry data and average driver profiles, we can provide a general estimate to give you a starting point for your budgeting.

| Driver Profile | Estimated Monthly Premium |

|---|---|

| Experienced Driver (Age 30-50) with a Clean Record | $100 - $150 |

| Young Driver (Age 18-25) with a Clean Record | $150 - $250 |

| Driver with a Minor Violation or Accident | $120 - $200 |

| High-Risk Driver (Multiple Violations or Accidents) | $200+ (varies greatly) |

It's important to note that these estimates are rough averages and may not reflect your specific situation. To get an accurate assessment of your car insurance costs, it's essential to obtain quotes from multiple providers and carefully evaluate the coverage and policy features offered.

Tips for Reducing Car Insurance Costs

While car insurance is a necessary expense, there are strategies you can employ to potentially reduce your monthly premiums:

- Shop Around: Compare quotes from various insurance providers. Different companies may offer significantly different rates for similar coverage.

- Bundle Policies: If you have multiple insurance needs (e.g., home, auto, life), consider bundling them with the same provider. Many insurers offer discounts for bundling policies.

- Increase Your Deductible: Choosing a higher deductible can lead to lower monthly premiums. However, ensure you can afford the deductible in the event of a claim.

- Maintain a Clean Driving Record: A spotless driving history can lead to significant savings. Avoid traffic violations and accidents to keep your insurance costs down.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as safe driving, loyalty, good student status, or safety features in your vehicle. Ask your insurer about available discounts and how you can qualify.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs where your premium is based on how and how much you drive. These programs can be beneficial for low-mileage drivers.

The Future of Car Insurance Costs

The insurance industry is constantly evolving, and technological advancements are shaping the future of car insurance. The rise of autonomous vehicles and the increased use of telematics (the collection and transmission of data from vehicles) are expected to impact insurance costs and coverage in the coming years.

As autonomous vehicles become more prevalent, insurance premiums may decrease due to the potential for fewer accidents and safer driving conditions. Additionally, the use of telematics and data analytics allows insurance companies to gather more precise information about driving behavior, which can lead to more accurate risk assessments and potentially lower premiums for safe drivers.

However, the transition to autonomous vehicles and the adoption of new technologies also present challenges. The initial cost of repairing or replacing advanced technology in autonomous vehicles could drive up insurance costs in the short term. Additionally, the legal and liability issues surrounding autonomous vehicles are still being resolved, which may impact insurance policies and costs.

Despite these uncertainties, the future of car insurance is likely to be characterized by more personalized and data-driven policies. Insurance companies will continue to innovate and adapt to new technologies, offering more precise and tailored coverage options to drivers.

Conclusion

Understanding the factors that influence car insurance costs and staying informed about industry trends can help drivers make smart choices about their coverage. While the average monthly cost of car insurance can vary widely based on individual circumstances, taking advantage of available discounts, maintaining a safe driving record, and exploring innovative insurance options can help keep insurance premiums affordable.

How do I find the best car insurance deal for my needs?

+To find the best car insurance deal, compare quotes from multiple providers, consider bundling policies for discounts, and explore usage-based insurance programs if you’re a low-mileage driver. Additionally, maintain a clean driving record and ask about available discounts to reduce your premiums.

Can I get car insurance if I have a poor driving record?

+Yes, even with a poor driving record, you can still obtain car insurance. However, your premiums may be higher. It’s important to shop around and compare quotes to find the most affordable option. Some insurers specialize in high-risk drivers and may offer more competitive rates.

What are some common car insurance discounts I should look for?

+Common car insurance discounts include safe driver discounts, loyalty discounts, good student discounts, and discounts for vehicles equipped with safety features. Additionally, some insurers offer discounts for bundling multiple policies or enrolling in usage-based insurance programs.