Average Price Of Medical Insurance

Medical insurance, or health insurance, is a vital aspect of healthcare systems worldwide, providing individuals and families with financial protection and access to essential medical services. The average price of medical insurance can vary significantly depending on numerous factors, including geographical location, age, health status, and the level of coverage desired. Understanding the average costs and the factors influencing them is crucial for individuals seeking affordable and comprehensive healthcare coverage.

Factors Influencing Medical Insurance Costs

The cost of medical insurance is influenced by a multitude of factors, each playing a unique role in determining the final price. Here’s a detailed breakdown of these key influencers:

Geographical Location

The average price of medical insurance can vary greatly from one region to another. This variation is primarily due to differences in healthcare costs, which are influenced by factors such as the cost of living, the availability of medical facilities and professionals, and the overall healthcare infrastructure in a given area. For instance, metropolitan areas often have higher healthcare costs due to increased demand and a concentration of specialized medical services, which can drive up insurance premiums.

Age and Health Status

Age and health status are two of the most significant factors in determining the cost of medical insurance. Generally, younger individuals tend to have lower premiums because they are statistically less likely to require extensive medical care. As people age, their risk of developing health conditions increases, leading to higher insurance costs. Additionally, pre-existing health conditions can also significantly impact insurance premiums, as insurers may classify individuals with such conditions as higher-risk.

Level of Coverage

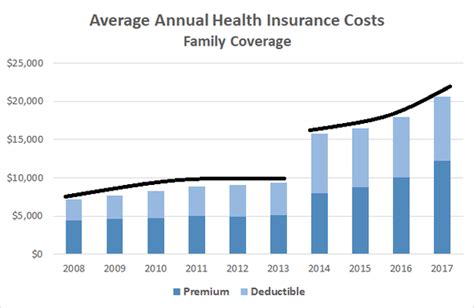

The level of coverage desired by an individual or family also greatly affects the cost of medical insurance. Policies offering comprehensive coverage, including a wide range of medical services and low out-of-pocket expenses, typically come with higher premiums. On the other hand, basic plans with limited coverage and higher deductibles often have lower monthly costs but may result in higher out-of-pocket expenses when medical services are utilized.

| Coverage Type | Average Monthly Premium |

|---|---|

| Comprehensive Plan | $500 - $1,200 |

| Basic Plan | $200 - $400 |

Insurance Provider and Plan Design

Different insurance providers offer a wide range of plans, each with its own unique features and pricing structure. Plan designs can vary significantly, from traditional fee-for-service models to more modern approaches like health maintenance organizations (HMOs) or preferred provider organizations (PPOs). Each plan design has its own cost structure, with some plans offering more flexibility in choosing healthcare providers but potentially higher costs, while others may restrict provider choices but offer more cost-effective options.

Additional Factors

Other factors that can influence the average price of medical insurance include family size, tobacco use, and occupation. Family plans, for instance, often cost more than individual plans due to the increased number of covered individuals. Similarly, tobacco users are typically charged higher premiums due to the increased health risks associated with tobacco consumption. Lastly, certain occupations, especially those with higher physical risk or exposure to hazardous materials, may result in higher insurance costs.

Average Medical Insurance Costs Around the World

The average cost of medical insurance varies significantly across different countries and regions. Here’s a look at the average premiums in some key regions:

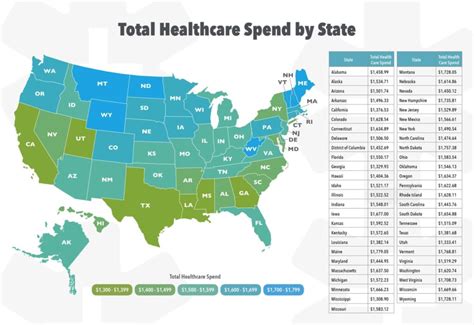

United States

In the United States, the average cost of an individual health insurance plan was approximately $456 per month in 2021, according to the Kaiser Family Foundation. However, this average can vary significantly depending on the state and the type of plan. For instance, states like New York and Massachusetts tend to have higher average premiums due to their robust healthcare infrastructure and higher cost of living, while states like Utah and Idaho often have lower average premiums.

Europe

In Europe, the average cost of medical insurance varies widely from one country to another. For example, in the United Kingdom, the average cost for an individual is around £200 per month, while in France, the average cost is approximately €150 per month. Many European countries have a universal healthcare system, which means that basic healthcare coverage is provided by the government, and additional private insurance can be purchased for more comprehensive coverage.

Asia

In Asia, the average cost of medical insurance also varies significantly across different countries. In Japan, for instance, the average cost for an individual is around ¥20,000 per month, while in India, the average cost is approximately ₹2,000 per month. Similar to Europe, many Asian countries have a mix of public and private healthcare systems, which can influence the average cost of insurance.

Other Regions

In other regions of the world, such as South America, Africa, and Oceania, the average cost of medical insurance can vary widely due to differences in healthcare systems, economic development, and access to healthcare services. It’s important to note that these averages can also be influenced by the level of coverage and the specific healthcare needs of the population.

The Impact of Medical Insurance on Healthcare Access

Medical insurance plays a crucial role in determining an individual’s access to healthcare services. For those with comprehensive insurance coverage, accessing medical care is often more straightforward and less financially burdensome. However, for individuals with limited or no insurance coverage, accessing healthcare can be a significant challenge, leading to potential delays in treatment and increased financial strain.

Financial Protection

One of the primary benefits of medical insurance is the financial protection it provides. By paying regular premiums, individuals can access a wide range of medical services without incurring significant out-of-pocket expenses. This protection is particularly crucial for unexpected medical emergencies or chronic conditions that require ongoing treatment. Without insurance, the cost of such treatments could be prohibitively expensive, potentially leading to financial hardship or even bankruptcy.

Promoting Preventive Care

Medical insurance also plays a vital role in promoting preventive care. Many insurance plans cover a range of preventive services, such as annual check-ups, vaccinations, and screening tests, at little to no cost to the insured individual. By encouraging regular preventive care, insurance providers can help detect health issues early on, when they are often more treatable and less costly to manage. This not only improves individual health outcomes but also contributes to a more efficient and cost-effective healthcare system overall.

Addressing Healthcare Disparities

Medical insurance can also help address healthcare disparities by providing equal access to healthcare services regardless of an individual’s financial status. In many countries, public or government-subsidized insurance plans ensure that even those with low incomes can access necessary medical care. This helps to reduce healthcare inequalities and improve overall population health.

The Future of Medical Insurance: Trends and Innovations

The medical insurance landscape is continually evolving, with new trends and innovations shaping the industry. Here’s a look at some of the key developments that are likely to influence the average price and availability of medical insurance in the future:

Telemedicine and Virtual Care

The rapid advancement of telemedicine and virtual care services is expected to play a significant role in the future of medical insurance. By providing convenient and accessible healthcare services remotely, telemedicine can reduce the need for in-person visits, leading to potential cost savings for both patients and insurance providers. This trend could make healthcare more affordable and accessible, especially for individuals in remote or underserved areas.

Value-Based Insurance Design

Value-based insurance design (VBID) is an emerging concept that focuses on aligning insurance benefits with the specific needs and preferences of individual patients. VBID aims to encourage the use of cost-effective treatments and services while discouraging the use of more expensive, less efficient alternatives. By incentivizing patients to choose more cost-effective care options, VBID has the potential to reduce overall healthcare costs and improve patient outcomes.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the healthcare industry is another trend that could significantly impact medical insurance. AI-powered tools can help insurers more accurately assess risk, predict healthcare needs, and personalize insurance plans based on individual health profiles. This could lead to more efficient risk management and potentially lower insurance premiums for those who adopt healthier lifestyles or engage in preventive care.

Focus on Wellness and Prevention

There is a growing emphasis on wellness and preventive care in the medical insurance industry. Many insurers are now offering incentives and rewards for individuals who engage in healthy behaviors, such as regular exercise, healthy eating, and smoking cessation. By encouraging these behaviors, insurers can potentially reduce the incidence of chronic diseases and costly medical treatments, leading to more affordable insurance premiums for all.

Conclusion: Navigating the Medical Insurance Landscape

Understanding the average price of medical insurance is crucial for individuals seeking affordable and comprehensive healthcare coverage. By considering the various factors that influence insurance costs, such as geographical location, age, health status, and level of coverage, individuals can make more informed decisions when selecting a medical insurance plan. Additionally, staying abreast of the latest trends and innovations in the medical insurance industry can help individuals navigate the evolving healthcare landscape and access the best possible coverage for their needs.

What is the average monthly premium for medical insurance in the United States?

+

The average monthly premium for an individual health insurance plan in the United States was approximately $456 in 2021, according to the Kaiser Family Foundation. However, this average can vary significantly depending on factors such as geographical location, age, and the level of coverage desired.

How do pre-existing health conditions affect the cost of medical insurance?

+

Pre-existing health conditions can significantly impact the cost of medical insurance. Insurers often classify individuals with such conditions as higher-risk, which can result in higher premiums. However, under the Affordable Care Act (ACA) in the United States, insurers are prohibited from denying coverage or charging higher premiums based solely on pre-existing conditions.

What are some ways to reduce the cost of medical insurance?

+

There are several strategies that can help reduce the cost of medical insurance. These include opting for a higher deductible plan, which typically has lower monthly premiums; taking advantage of employer-sponsored plans, which often offer more cost-effective options; and comparing different insurance providers and plans to find the best value for your specific needs.

How does the Affordable Care Act (ACA) impact the average price of medical insurance in the United States?

+

The ACA has had a significant impact on the average price of medical insurance in the United States. It introduced reforms aimed at making healthcare more affordable and accessible, including prohibiting insurers from denying coverage or charging higher premiums based on pre-existing conditions, and providing subsidies to help low- and middle-income individuals afford insurance. These reforms have helped reduce the average cost of insurance for many Americans.

What is the future outlook for medical insurance costs?

+

The future outlook for medical insurance costs is complex and subject to a variety of factors, including advancements in medical technology, changes in healthcare policy, and shifts in population health trends. While it’s challenging to predict exact cost trends, the continued focus on value-based care, the integration of technology, and the promotion of wellness and prevention are likely to play a significant role in shaping the future landscape of medical insurance costs.