Average Yearly Home Insurance Cost

Home insurance is a crucial aspect of protecting your most valuable asset, your home. It provides financial security and peace of mind by covering various risks and liabilities associated with homeownership. Understanding the average yearly cost of home insurance is essential for homeowners to budget effectively and ensure they have adequate coverage.

The Average Yearly Home Insurance Cost

Determining the average yearly cost of home insurance can be a complex task due to the multitude of factors that influence premiums. These factors include the location of the property, the type of dwelling, the level of coverage desired, and the insurance provider. Despite these variables, industry data and trends can offer valuable insights into the average expenses associated with home insurance.

According to recent studies, the average annual premium for home insurance in the United States is approximately $1,200. However, it is crucial to note that this figure is merely an estimate and can vary significantly based on individual circumstances.

Factors Influencing Home Insurance Costs

The cost of home insurance is influenced by a range of factors, each playing a unique role in determining the final premium. Understanding these factors is essential for homeowners to make informed decisions about their coverage and manage their expenses effectively.

- Location: The geographical location of a property is a significant determinant of home insurance costs. Areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, typically have higher premiums due to the increased risk of property damage. Additionally, regions with higher crime rates may also see elevated insurance costs.

- Dwelling Type: The type of dwelling also impacts insurance costs. For instance, a detached single-family home may have different insurance requirements and costs compared to a condominium or a mobile home. The size, age, and construction materials of the dwelling can all influence the premium.

- Coverage Amount: The level of coverage desired by the homeowner is a crucial factor. Higher coverage limits for both the structure and personal belongings will result in increased premiums. It is essential to strike a balance between adequate coverage and affordability.

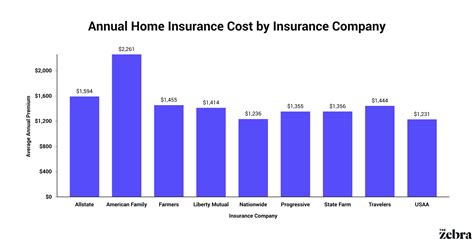

- Insurance Provider: Different insurance companies offer varying rates and coverage options. Shopping around and comparing quotes from multiple providers can help homeowners find the most competitive rates and suitable coverage for their needs.

- Deductibles: The deductible, or the amount the homeowner agrees to pay out of pocket before the insurance coverage kicks in, can significantly impact premiums. Opting for a higher deductible typically results in lower premiums, while a lower deductible often leads to higher premiums.

Comparative Analysis: Regional Variations

The cost of home insurance can vary significantly across different regions within the United States. Let’s explore some regional variations to provide a clearer understanding of these differences.

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,500 |

| Midwest | $1,100 |

| South | $1,300 |

| West | $1,400 |

As evident from the table, the Northeast region has the highest average annual premium, primarily due to the higher risk of natural disasters and extreme weather conditions in this region. Conversely, the Midwest region enjoys relatively lower premiums, likely due to a lower risk of severe weather events and a more stable insurance market.

Performance Analysis: Claims and Coverage

The performance of home insurance policies is closely tied to the number and severity of claims made by policyholders. Understanding the claims process and the coverage provided is crucial for homeowners to ensure they are adequately protected.

When a homeowner files a claim, the insurance company evaluates the damage and determines the payout based on the policy's coverage limits and exclusions. Common types of claims include damage caused by storms, fires, or accidents. The insurance company will assess the extent of the damage and provide compensation accordingly.

It is important to note that some claims may not be covered by a standard home insurance policy. For instance, flood damage is typically not included in a standard policy and requires separate flood insurance. Homeowners should carefully review their policy's coverage limits and exclusions to understand what is and is not covered.

Evidence-Based Future Implications

The home insurance industry is continually evolving, and various factors can influence future premiums and coverage options. Here are some key implications for homeowners to consider:

- Climate Change: As climate change continues to impact weather patterns, the frequency and severity of natural disasters may increase. This could lead to higher insurance premiums, especially in regions vulnerable to extreme weather events.

- Technological Advancements: Advances in technology, such as smart home devices and home security systems, can potentially reduce the risk of certain types of claims. Insurance companies may offer discounts or incentives for homeowners who adopt these technologies, thereby lowering premiums.

- Regulatory Changes: Government regulations and policy changes can significantly impact the home insurance industry. For instance, changes in building codes or insurance laws can influence the cost and availability of coverage.

- Competition: Increased competition among insurance providers can drive down premiums as companies strive to offer more competitive rates to attract customers. Homeowners can benefit from this competitive environment by shopping around for the best deals.

Conclusion

Understanding the average yearly cost of home insurance is crucial for homeowners to make informed decisions about their coverage and financial planning. While the average annual premium in the United States is approximately $1,200, it is essential to remember that this figure can vary significantly based on individual circumstances and regional factors.

By considering the various factors that influence home insurance costs and staying informed about industry trends and future implications, homeowners can ensure they have adequate coverage at a competitive rate. Regularly reviewing and comparing insurance policies can help homeowners make the most of their insurance investments.

What is the difference between home insurance and homeowner’s insurance?

+Home insurance and homeowner’s insurance are often used interchangeably, but they refer to slightly different concepts. Home insurance typically covers the structure of the home and its contents, providing protection against various risks like fire, theft, or natural disasters. On the other hand, homeowner’s insurance is a broader term that encompasses not only home insurance but also liability coverage, which protects against legal claims and personal liability risks.

How often should I review my home insurance policy?

+It is recommended to review your home insurance policy annually or whenever significant changes occur in your life or home. This includes events like moving to a new location, making substantial renovations, or acquiring valuable possessions. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.

Can I negotiate my home insurance premiums?

+While insurance premiums are typically based on standardized rates, there may be room for negotiation in certain circumstances. If you have a long-standing relationship with your insurance provider or have multiple policies with them, you may be able to negotiate a better rate. Additionally, demonstrating a low-risk profile, such as having a secure home and a clean claims history, can also work in your favor during negotiations.