Basic Car Insurance

When it comes to safeguarding our most valuable assets, one of the most important steps we can take is securing adequate car insurance coverage. While the term "basic car insurance" might sound straightforward, there's a lot more to it than meets the eye. In this comprehensive guide, we'll delve into the intricacies of basic car insurance, exploring its coverage, costs, and the factors that influence it.

Understanding Basic Car Insurance

Basic car insurance, often referred to as liability insurance, is the foundational coverage required by law in most states. It serves as a safety net to protect you financially in the event of an accident where you are found at fault. Here’s a closer look at what it entails:

Liability Coverage

The cornerstone of basic car insurance is liability coverage, which can be further broken down into two main components:

- Bodily Injury Liability: This coverage pays for the medical expenses and lost wages of individuals injured in an accident for which you are responsible. It also covers legal fees if the injured party sues you.

- Property Damage Liability: In the event that your vehicle damages someone else’s property, this coverage steps in to cover the costs of repairing or replacing it.

Liability coverage is essential because it safeguards you from potentially devastating financial consequences that can arise from an accident.

State Minimum Requirements

Each state sets its own minimum requirements for car insurance, typically expressed as limits for bodily injury and property damage liability. For instance, a common state minimum might be 25/50/10, which translates to:

- 25,000 for bodily injury per person</li> <li>50,000 for bodily injury per accident

- $10,000 for property damage per accident

These limits represent the maximum amount your insurance provider will pay for the specified coverage.

Additional Coverage Options

While basic car insurance provides a solid foundation, it’s often recommended to enhance your coverage with additional options. Here are some common additions:

- Collision Coverage: Pays for the repair or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle due to non-accident-related incidents like theft, vandalism, weather events, or collisions with animals.

- Medical Payments Coverage: Assists with the medical expenses of you and your passengers, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

These additional coverages provide a more comprehensive safety net, ensuring that you’re protected in a wide range of scenarios.

Factors Influencing Basic Car Insurance Costs

The cost of basic car insurance can vary significantly from one person to another and from one state to another. Here are some key factors that influence these costs:

Location

Where you live plays a significant role in determining your insurance rates. Factors like population density, crime rates, and the frequency of accidents in your area can all impact your premium. For instance, urban areas tend to have higher rates due to increased traffic and accident risks.

Vehicle Type

The make, model, and age of your vehicle can affect your insurance costs. Generally, newer and more expensive vehicles will command higher premiums due to their higher repair and replacement costs. Additionally, vehicles with a history of frequent accidents or thefts may also attract higher rates.

Driving Record

Your driving history is a crucial factor in determining your insurance rates. A clean driving record with no accidents or traffic violations will typically result in lower premiums. On the other hand, if you have a history of accidents or moving violations, your rates may be significantly higher.

Credit Score

Believe it or not, your credit score can also influence your insurance rates. Many insurance providers use credit-based insurance scores to assess your financial responsibility, and those with higher scores are often seen as lower risk and may qualify for lower premiums.

Age and Gender

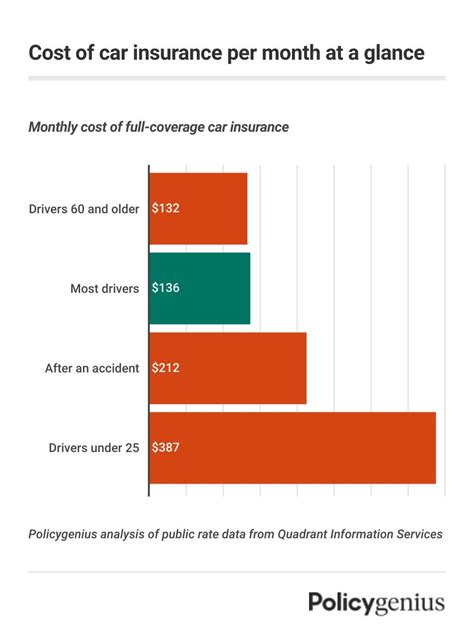

Insurance rates can also be influenced by your age and gender. Younger drivers, especially those under 25, often pay higher premiums due to their lack of driving experience and higher risk of accidents. Similarly, gender can also play a role, with some providers offering slightly different rates based on historical accident statistics.

Performance Analysis and Industry Insights

To provide a more concrete understanding of basic car insurance, let’s examine some real-world scenarios and data:

Case Study: John’s Basic Car Insurance

John, a 30-year-old living in a suburban area, recently purchased a used Toyota Camry. With a clean driving record and a good credit score, he’s looking to secure basic car insurance. Here’s a breakdown of his potential costs:

| Coverage Type | State Minimum | John’s Premium | |

|---|---|---|---|

| Bodily Injury Liability | 25,000 per person / 50,000 per accident | 400 per year</td> </tr> <tr> <td>Property Damage Liability</td> <td>10,000 per accident | 200 per year</td> </tr> <tr> <td>Total Basic Insurance Premium</td> <td>N/A</td> <td>600 per year |

In this scenario, John’s basic car insurance premium comes to a manageable $600 per year. However, it’s important to note that these rates can vary significantly based on the factors discussed earlier.

Industry Trends and Future Implications

The car insurance industry is evolving rapidly, driven by advancements in technology and changing consumer needs. Here are some key trends and their potential impact:

- Telematics and Usage-Based Insurance: With the rise of telematics devices and smartphone apps, insurers are increasingly offering usage-based insurance plans. These plans use real-time driving data to calculate premiums, rewarding safe drivers with lower rates.

- Connected Car Technology: As more vehicles become connected, insurers are exploring ways to leverage this data for risk assessment and fraud detection. This could lead to more accurate and personalized insurance offerings.

- Artificial Intelligence and Machine Learning: AI and machine learning are being used to analyze vast amounts of data, improving risk assessment and claim processing. This technology can also enhance fraud detection, further streamlining the insurance process.

These advancements are set to revolutionize the car insurance industry, making it more efficient, personalized, and responsive to individual needs.

Conclusion: Navigating the World of Basic Car Insurance

Basic car insurance is a crucial aspect of responsible vehicle ownership, providing a safety net against financial risks. By understanding the coverage it offers, the factors that influence its cost, and the evolving trends in the industry, you can make informed decisions to protect yourself and your assets. Remember, while basic car insurance is a solid foundation, it’s often beneficial to explore additional coverage options to ensure you’re fully protected on the road.

What happens if I’m involved in an accident with an uninsured driver?

+If you’re involved in an accident with an uninsured driver and you have uninsured motorist coverage, your insurance provider will step in to cover your damages. This coverage ensures you’re protected even if the other driver doesn’t have insurance.

How often should I review my car insurance coverage?

+It’s a good practice to review your car insurance coverage annually or whenever your circumstances change. This includes buying a new car, moving to a different location, or getting married. Regular reviews ensure your coverage remains adequate and cost-effective.

Can I get a discount on my car insurance premium?

+Yes, many insurance providers offer discounts for a variety of reasons. These can include safe driving records, bundling your insurance policies, installing safety features in your vehicle, or even being a loyal customer for multiple years. It’s worth exploring these options to potentially reduce your premium.