Basic Vehicle Insurance

In the world of personal finance and vehicle ownership, one of the most fundamental aspects to understand is vehicle insurance. It's a crucial aspect of responsible driving and a mandatory requirement in most countries. This comprehensive guide aims to provide an expert-level overview of basic vehicle insurance, helping you navigate the intricacies of this essential financial tool.

Understanding the Basics of Vehicle Insurance

Vehicle insurance, often referred to as car insurance, is a contract between an individual and an insurance provider. This contract, or policy, ensures that the insurer will provide financial protection against physical damage and/or bodily injury resulting from a vehicle accident or other specified incidents. It’s a safety net that ensures you’re not left financially vulnerable in the event of an accident.

The primary goal of vehicle insurance is to minimize the financial risks associated with owning and operating a motor vehicle. These risks can range from minor accidents resulting in cosmetic damage to more severe incidents causing extensive vehicle damage or personal injuries. With a basic vehicle insurance policy, you can have peace of mind knowing that you're covered for a range of potential mishaps.

In most jurisdictions, having at least a basic level of vehicle insurance is mandatory. This is to ensure that all drivers have the means to cover the costs of accidents, thereby reducing the financial burden on victims and society as a whole. The specific requirements for vehicle insurance coverage can vary greatly from one region to another, so it's important to be aware of the legal requirements in your area.

Key Components of a Basic Vehicle Insurance Policy

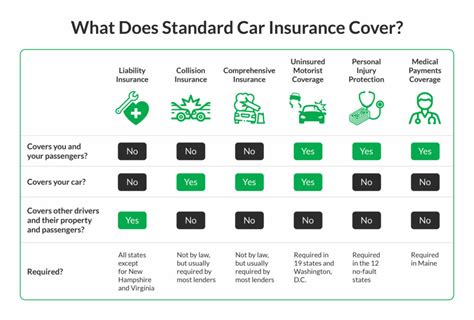

A basic vehicle insurance policy typically includes the following core components:

- Liability Coverage: This covers the costs of damages or injuries you cause to others in an accident. It’s a crucial aspect of insurance, as it ensures that you can provide compensation for any harm you cause while driving.

- Comprehensive Coverage: This provides protection for damage to your vehicle that’s not caused by a collision, such as theft, fire, or natural disasters. It’s an optional coverage, but it’s highly recommended to ensure your vehicle is protected against a wide range of risks.

- Collision Coverage: As the name suggests, this coverage applies to accidents involving your vehicle colliding with another vehicle or object. It helps cover the costs of repairing or replacing your vehicle after such an incident.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages. It ensures that you’re not left financially responsible for the other driver’s lack of insurance.

Each of these components can be tailored to meet your specific needs and budget. For instance, you can choose different levels of coverage, from basic liability coverage to more comprehensive plans that include additional benefits like rental car coverage or roadside assistance.

The Importance of Basic Vehicle Insurance

Basic vehicle insurance is an essential component of responsible financial planning for several reasons:

Financial Protection

In the event of an accident, basic vehicle insurance provides financial protection to both you and the other party involved. It covers the costs of repairs, medical bills, and potential legal fees, ensuring that you’re not overwhelmed by unexpected expenses.

| Coverage Type | Average Coverage Amount |

|---|---|

| Liability Coverage | $50,000 to $100,000 per person, up to $300,000 per accident |

| Collision Coverage | Varies based on the value of your vehicle |

| Comprehensive Coverage | Varies based on the value of your vehicle and the risks covered |

For instance, liability coverage ensures that if you cause an accident resulting in injuries or property damage, your insurance will cover the costs up to the limits of your policy. This can save you from financial ruin and help ensure that accident victims receive the compensation they deserve.

Legal Compliance

In many regions, having at least basic vehicle insurance is a legal requirement. This is to ensure that all drivers on the road have the means to cover the costs of accidents, reducing the burden on victims and society. If you’re caught driving without insurance, you may face severe penalties, including fines, license suspension, or even jail time.

Peace of Mind

Knowing that you have basic vehicle insurance provides peace of mind when you’re on the road. You can drive with confidence, knowing that you’re protected against a wide range of potential incidents. This can significantly reduce stress and anxiety, allowing you to focus on the road and enjoy your driving experience.

Choosing the Right Basic Vehicle Insurance

When selecting a basic vehicle insurance policy, there are several key factors to consider:

Coverage Options

As mentioned earlier, basic vehicle insurance policies come with various coverage options. You’ll need to decide which types of coverage are most important to you based on your specific needs and budget. For instance, if you live in an area with high theft rates, comprehensive coverage might be a priority.

Policy Limits

Policy limits refer to the maximum amount your insurance provider will pay out for a covered claim. It’s important to choose limits that provide adequate protection without being excessive. For liability coverage, consider the potential costs of an accident, including medical bills, property damage, and potential legal fees.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but it means you’ll pay more out of pocket if you need to make a claim. Consider your financial situation and risk tolerance when selecting a deductible.

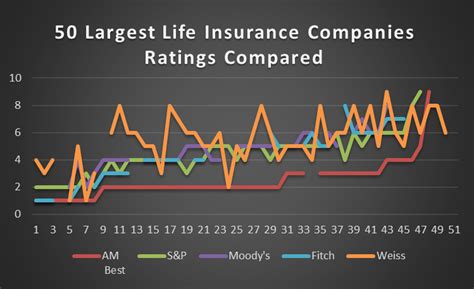

Insurance Provider Reputation

Not all insurance providers are created equal. It’s important to research and choose a reputable provider with a strong financial standing and a history of prompt claim settlements. Check online reviews, ratings from independent agencies, and seek recommendations from trusted sources.

The Future of Vehicle Insurance

The landscape of vehicle insurance is evolving rapidly, driven by technological advancements and changing consumer needs. Here are some key trends and future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology allows insurance providers to track and analyze driver behavior, such as driving speed, acceleration, and braking. This data is then used to determine insurance premiums, rewarding safe drivers with lower rates. Usage-based insurance, or pay-as-you-drive insurance, is gaining popularity and could become a standard feature in the future.

Artificial Intelligence and Machine Learning

AI and machine learning are being used to improve claim processing and fraud detection. These technologies can analyze vast amounts of data to identify patterns and anomalies, speeding up claim settlements and reducing insurance fraud. As these technologies advance, we can expect even more efficient and accurate claim handling processes.

Connected Car Technology

With the rise of connected car technology, vehicles are becoming increasingly integrated with insurance systems. This allows for real-time data sharing, enabling insurers to offer more personalized and dynamic insurance products. For instance, your insurance premium could be adjusted based on your driving behavior or the real-time risk profile of your vehicle.

Autonomous Vehicles and Shared Mobility

The advent of autonomous vehicles and the rise of shared mobility services like ride-sharing and car-sharing are likely to have a significant impact on vehicle insurance. As these technologies mature, we may see a shift towards liability coverage for vehicle owners and manufacturers, rather than individual drivers. This could lead to a simplification of insurance products and a reduction in personal liability coverage.

Conclusion

Basic vehicle insurance is a fundamental aspect of responsible vehicle ownership and financial planning. It provides financial protection, ensures legal compliance, and offers peace of mind. As the insurance landscape evolves, we can expect more personalized and dynamic insurance products, driven by technological advancements and changing consumer needs. Understanding the basics of vehicle insurance is the first step towards making informed decisions about your insurance coverage.

What are the main types of vehicle insurance coverage?

+The main types of vehicle insurance coverage include liability coverage, comprehensive coverage, collision coverage, and uninsured/underinsured motorist coverage. Liability coverage is mandatory in most regions and covers damages or injuries you cause to others. Comprehensive and collision coverage are optional but highly recommended, providing protection for a wide range of incidents.

How much does basic vehicle insurance cost?

+The cost of basic vehicle insurance varies widely depending on factors like your location, driving record, the make and model of your vehicle, and the coverage limits you choose. On average, you can expect to pay anywhere from 500 to 1,500 per year for basic liability coverage. However, prices can be significantly higher or lower based on your specific circumstances.

What happens if I get into an accident without insurance?

+If you’re involved in an accident without insurance, you’ll be personally responsible for all the costs associated with the accident, including repairs to your vehicle, medical bills for injuries, and potential legal fees. In addition, you may face legal penalties for driving without insurance, including fines, license suspension, or even jail time in some cases.