Benefit Term Insurance

Benefit term insurance is a vital aspect of financial planning, offering individuals and families peace of mind by providing a safety net during uncertain times. In today's dynamic world, where unforeseen events can significantly impact our lives, having adequate insurance coverage is more crucial than ever. This comprehensive guide aims to delve into the intricacies of benefit term insurance, exploring its features, benefits, and implications to empower you with the knowledge to make informed decisions about your financial future.

Understanding Benefit Term Insurance

Benefit term insurance, often referred to as term life insurance, is a type of coverage that provides financial protection for a specified period, known as the term. Unlike permanent life insurance policies, which offer lifelong coverage, term insurance is designed to meet specific short-term needs. It is a cost-effective solution for individuals seeking to secure their family’s financial stability in the event of their untimely demise.

The primary objective of benefit term insurance is to offer a lump-sum payment, known as the death benefit, to the policyholder's beneficiaries upon their death during the policy term. This benefit can help cover various expenses, including funeral costs, outstanding debts, daily living expenses, and even provide financial support for long-term goals such as children's education or retirement planning.

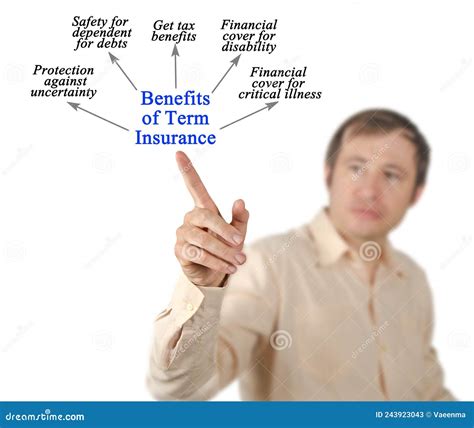

Key Features and Benefits

Affordable Protection

One of the most appealing aspects of benefit term insurance is its cost-effectiveness. Compared to permanent life insurance policies, term insurance offers significantly lower premiums, making it an accessible option for individuals with budget constraints. The premiums are determined based on factors such as age, health status, and the chosen term length.

Flexibility and Customization

Benefit term insurance policies can be tailored to meet individual needs. Policyholders can choose the coverage amount and the term length that aligns with their financial goals. Whether it’s covering short-term debts or providing long-term financial support, term insurance offers the flexibility to adapt to changing circumstances.

Renewal and Conversion Options

Many term insurance policies offer the option to renew the coverage at the end of the initial term. This allows individuals to extend their protection without undergoing a new medical examination. Additionally, some policies provide the opportunity to convert the term insurance into a permanent life insurance policy, ensuring lifelong coverage if needed.

Rider Benefits

Benefit term insurance often comes with the option to add riders, which are additional benefits or coverage enhancements. Common riders include accelerated death benefits, which provide access to a portion of the death benefit if the policyholder is diagnosed with a terminal illness, and waiver of premium riders, which waive premium payments if the policyholder becomes disabled.

Real-Life Examples and Case Studies

Case Study: Young Family Protection

Consider a young couple, Sarah and John, who recently welcomed their first child. They understand the importance of financial security and decide to opt for benefit term insurance. With a 20-year term policy and a coverage amount of $500,000, they ensure that their child’s future is financially secure, even in the unfortunate event of their passing.

Case Study: Debt Management

Mark, a 35-year-old professional, has significant student loans and a mortgage. He chooses a 10-year term insurance policy with a coverage amount of $300,000. This policy provides peace of mind, knowing that his debts can be cleared if something were to happen to him during this critical repayment period.

Case Study: Business Continuity

Small business owners often rely on benefit term insurance to ensure the continuity of their ventures. For instance, Jane, the owner of a thriving boutique, takes out a 15-year term policy to cover the key personnel in her business. This policy ensures that the business can continue operating and meet its financial obligations if one of the key employees passes away.

Technical Specifications and Performance Analysis

Benefit term insurance policies offer a range of coverage options to suit different needs. These include level term, where the death benefit and premium remain constant throughout the term, and increasing term, where the death benefit increases over time to keep pace with inflation or rising financial obligations.

The premium structure varies based on the chosen term length and the policyholder's age and health. Younger individuals typically enjoy lower premiums, while longer term lengths may result in slightly higher costs. It's essential to carefully consider these factors when selecting a policy.

| Term Length | Premium |

|---|---|

| 10 Years | $25/month |

| 20 Years | $30/month |

| 30 Years | $40/month |

Implications and Future Considerations

Benefit term insurance plays a pivotal role in financial planning, offering a safety net for families and individuals. As life circumstances change, it’s essential to review and adjust your insurance coverage accordingly. Here are some key considerations for the future:

- Regular Reviews: Periodically assess your term insurance policy to ensure it aligns with your current financial situation and goals. Life events such as marriage, childbirth, or career changes may warrant an increase in coverage.

- Long-Term Financial Planning: Consider how benefit term insurance fits into your overall financial strategy. It's an essential component, but it should be complemented by other savings and investment strategies to build a robust financial foundation.

- Inflation and Coverage Amount: Keep in mind that inflation can erode the value of your coverage over time. Regularly review and adjust your coverage amount to ensure it remains adequate to meet your future financial needs.

- Health and Lifestyle Changes: Changes in your health or lifestyle may impact your insurance needs. For instance, quitting smoking or adopting a healthier lifestyle can lead to lower premiums and improved coverage options.

Frequently Asked Questions

Can I extend my benefit term insurance policy beyond the initial term?

+

Yes, many benefit term insurance policies offer the option to renew or extend the coverage period. This allows you to maintain protection beyond the initial term, typically at a higher premium rate due to increased age.

Are there any medical examinations required for benefit term insurance?

+

In most cases, benefit term insurance requires a medical examination to assess your health status and determine your premium rate. However, some providers offer simplified issue policies with reduced coverage amounts that may not require a medical exam.

Can I add my spouse or children as beneficiaries to my policy?

+

Absolutely! You can designate your spouse, children, or any other dependent as beneficiaries of your benefit term insurance policy. This ensures that they receive the death benefit in the event of your passing.

What happens if I stop paying my premiums during the term?

+

If you fail to pay your premiums, your benefit term insurance policy will typically lapse, and you’ll lose coverage. However, some policies offer a grace period of a few weeks to allow for late payments without penalty.

Benefit term insurance is a powerful tool to secure your family’s financial future. By understanding its features, benefits, and implications, you can make informed decisions to protect your loved ones and ensure a stable financial foundation. Remember, regular reviews and adjustments are key to maintaining adequate coverage as your life evolves.