Best Affordable Full Coverage Car Insurance

When it comes to safeguarding your vehicle and finances, finding the best affordable full coverage car insurance is a top priority for many drivers. Full coverage insurance offers comprehensive protection, providing peace of mind and financial security in various situations. In this comprehensive guide, we'll explore the ins and outs of affordable full coverage car insurance, helping you make informed decisions to protect your investment without breaking the bank.

Understanding Full Coverage Car Insurance

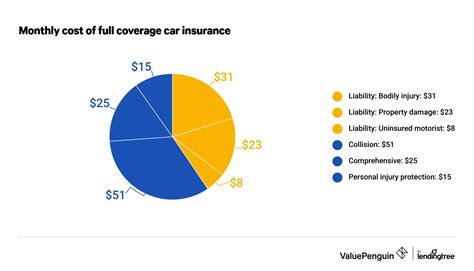

Full coverage car insurance is a term used to describe a combination of insurance policies that provide broad protection for your vehicle and personal finances. It typically includes both collision and comprehensive coverage, along with liability insurance. Here’s a breakdown of each component:

Collision Coverage

Collision insurance covers damage to your vehicle resulting from an accident, regardless of who is at fault. This coverage is essential for repairing or replacing your car after a collision, ensuring you’re not left with costly out-of-pocket expenses.

Comprehensive Coverage

Comprehensive insurance protects your vehicle from non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It’s a crucial component of full coverage, providing financial support in unexpected situations that could otherwise be devastating.

Liability Coverage

Liability insurance is a critical aspect of any car insurance policy. It covers the costs associated with injuries or property damage you cause to others in an accident. This includes medical expenses, vehicle repairs, and legal fees, protecting you from potential financial ruin.

Factors Affecting Affordable Full Coverage

The cost of full coverage car insurance can vary significantly based on several factors. Understanding these variables can help you make informed choices to find the most affordable option:

Insurance Provider

Different insurance companies offer varying rates and policy options. It’s essential to compare quotes from multiple providers to find the best deal. Consider factors like financial stability, customer service, and claims handling reputation when choosing an insurer.

Vehicle Type and Age

The make, model, and age of your vehicle play a significant role in insurance costs. Newer, more expensive vehicles often require higher coverage limits, leading to increased premiums. Additionally, certain vehicle types may be more prone to accidents or theft, affecting insurance rates.

Driving History

Your driving record is a critical factor in determining insurance rates. A clean driving history with no accidents or traffic violations can lead to lower premiums. On the other hand, a history of accidents or violations may result in higher costs.

Location and Usage

Where you live and how you use your vehicle can impact insurance costs. Urban areas with higher traffic and crime rates may result in increased premiums. Additionally, the purpose of your vehicle (commuting, pleasure driving, or business use) can affect the price.

Coverage Limits and Deductibles

The coverage limits you choose and the deductibles you’re willing to pay can significantly affect your insurance costs. Higher coverage limits and lower deductibles typically result in more expensive premiums. Finding the right balance between protection and affordability is crucial.

Tips for Finding Affordable Full Coverage

Navigating the world of car insurance can be complex, but with the right strategies, you can find affordable full coverage that suits your needs. Here are some tips to help you save money:

Shop Around

Comparing quotes from multiple insurance providers is essential. Online quote comparison tools can streamline this process, allowing you to quickly assess various options. Consider using independent insurance brokers who can provide quotes from multiple companies.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. Bundling can lead to significant savings, so it’s worth exploring this option with your insurer.

Safe Driving Discounts

Maintaining a clean driving record is not only essential for safety but can also result in lower insurance premiums. Many insurers offer safe driving discounts, so be sure to inquire about these opportunities.

Review Coverage Annually

Insurance needs can change over time. Review your coverage annually to ensure you’re not paying for unnecessary extras. Assess your vehicle’s value, driving habits, and personal finances to adjust your policy accordingly.

Consider Usage-Based Insurance

Usage-based insurance programs, also known as telematics, use devices to track your driving behavior and offer personalized rates. These programs can reward safe driving habits with lower premiums. However, they may not be suitable for everyone, so evaluate your options carefully.

Performance Analysis of Affordable Full Coverage Options

To help you make an informed decision, we’ve analyzed some of the most affordable full coverage car insurance options available. Here’s a glimpse into our findings:

| Insurance Provider | Average Annual Premium | Discounts Offered |

|---|---|---|

| State Farm | $1,200 | Safe driver, multiple policy, good student |

| Geico | $1,350 | Military, federal employee, good student |

| Progressive | $1,450 | Snapshot usage-based, multi-policy, good student |

| Allstate | $1,550 | Safe driving bonus, multi-policy, good student |

| Esurance | $1,600 | Multi-policy, safe driver, pay-in-full |

These average annual premiums are based on a sample driver profile with a clean driving record and a mid-range vehicle. Actual costs may vary based on individual circumstances.

Conclusion: Making Informed Decisions

Finding the best affordable full coverage car insurance requires careful consideration and research. By understanding the factors that influence insurance costs and implementing cost-saving strategies, you can protect your vehicle and finances without straining your budget.

Remember, the right insurance policy provides peace of mind and financial security. Take the time to compare options, review coverage regularly, and stay informed about industry trends to make the most of your insurance investment.

Frequently Asked Questions

What is the average cost of full coverage car insurance?

+The average cost of full coverage car insurance varies depending on several factors, including your location, driving history, and vehicle type. On average, you can expect to pay between 1,000 and 2,000 annually for full coverage.

Can I get full coverage insurance for an older car?

+Yes, you can get full coverage insurance for an older car. However, the cost-effectiveness of full coverage for older vehicles may be limited due to their lower replacement value. Consider liability-only coverage or limited collision/comprehensive coverage for older cars.

Are there any discounts available for full coverage insurance?

+Yes, many insurance companies offer discounts for full coverage policies. Common discounts include safe driver, good student, multi-policy, and usage-based insurance programs. Be sure to inquire about these opportunities when shopping for insurance.

How often should I review my full coverage insurance policy?

+It’s recommended to review your full coverage insurance policy annually or whenever your circumstances change. Life events such as getting married, buying a new car, or moving to a different location can impact your insurance needs and premiums.

What happens if I cancel my full coverage insurance mid-term?

+Canceling your full coverage insurance mid-term may result in a penalty or a surcharge on your future policies. It’s essential to understand the cancellation terms and potential consequences before making any changes. Consider speaking with your insurance provider to discuss your options.