Best And Least Expensive Auto Insurance

When it comes to auto insurance, finding the best coverage at an affordable price is a priority for many vehicle owners. The cost of auto insurance can vary significantly depending on various factors, including your location, driving history, vehicle type, and the coverage options you choose. This article aims to guide you through the process of selecting the most suitable and cost-effective auto insurance policy for your needs.

Understanding the Factors that Affect Auto Insurance Costs

Before diving into the best and least expensive auto insurance options, it’s crucial to comprehend the factors that insurance companies consider when calculating your premium. These factors can significantly influence the cost of your policy.

Driver Profile and History

Your driving record plays a vital role in determining your insurance rates. A clean driving history with no accidents or traffic violations typically results in lower premiums. Conversely, if you have a history of accidents or moving violations, you may face higher insurance costs. Insurance companies consider the risk associated with your driving behavior when assessing your premium.

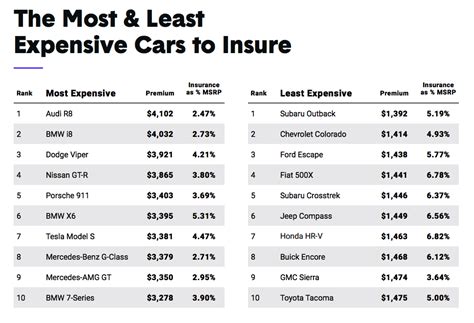

Vehicle Type and Usage

The make, model, and age of your vehicle impact the cost of your insurance. Sports cars and luxury vehicles often require more expensive insurance due to their higher repair costs and increased risk of theft. Additionally, the primary use of your vehicle, such as commuting, pleasure driving, or business purposes, can affect your insurance rates. Commercial vehicles, for example, may require specialized coverage and potentially higher premiums.

Location and Geographical Factors

Where you live and drive your vehicle can significantly impact your insurance rates. Insurance companies consider the region’s accident and crime rates, traffic congestion, and weather conditions. Areas with a higher incidence of accidents, thefts, or natural disasters may have higher insurance costs. Urban areas, in particular, often have higher insurance rates due to increased traffic and the potential for accidents.

Coverage Options and Deductibles

The level of coverage you choose directly affects your insurance premium. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. Conversely, liability-only coverage, which only covers damage to other vehicles or property, may be more affordable. Additionally, selecting a higher deductible can lower your monthly premium, as you’ll be responsible for a larger portion of the costs in the event of a claim.

Comparing Auto Insurance Providers

To find the best and least expensive auto insurance, it’s essential to compare multiple insurance providers. Each company has its own rating system and pricing structure, so shopping around can help you identify the most cost-effective options for your specific circumstances.

Top Auto Insurance Companies

Some of the leading auto insurance providers in the industry include State Farm, Geico, Progressive, Allstate, and USAA. These companies offer a wide range of coverage options and competitive pricing. It’s worth noting that while these companies may have a strong reputation, the best option for you may vary based on your individual needs and circumstances.

| Company | Average Annual Premium |

|---|---|

| State Farm | $1,630 |

| Geico | $1,450 |

| Progressive | $1,550 |

| Allstate | $1,720 |

| USAA | $1,320 |

Factors to Consider When Comparing Providers

When comparing auto insurance providers, consider the following factors to ensure you’re getting the best value for your money:

- Coverage Options: Assess the coverage options offered by each provider. Look for policies that provide adequate protection for your vehicle and liabilities, considering factors like comprehensive and collision coverage, rental car coverage, and personal injury protection.

- Discounts and Bundling Options: Many insurance companies offer discounts for safe driving, multiple policies, or certain vehicle safety features. Bundling your auto insurance with other policies, such as home or renters insurance, can often result in significant savings.

- Claims Process and Customer Service: Research the claims process and customer service reputation of each provider. You want to ensure that the company provides prompt and efficient service when you need it most.

- Financial Strength and Reputation: Consider the financial stability and reputation of the insurance company. A financially stable company is more likely to be able to honor its policy obligations, providing peace of mind in the event of a claim.

Tips for Lowering Your Auto Insurance Costs

In addition to comparing insurance providers, there are several strategies you can employ to reduce your auto insurance costs:

Improve Your Driving Record

A clean driving record is one of the most effective ways to lower your insurance premiums. Avoid traffic violations and accidents, as they can significantly increase your insurance costs. Consider taking defensive driving courses, as some insurance companies offer discounts for completing such programs.

Choose the Right Coverage

Assess your specific needs and choose the coverage that best suits your circumstances. If you own an older vehicle, consider opting for liability-only coverage, which can be more cost-effective than comprehensive coverage. However, if you have a newer or more expensive vehicle, comprehensive coverage may be a wiser choice to protect your investment.

Raise Your Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lower your monthly premium. However, be sure to choose a deductible amount that you can afford in the event of an accident or claim. A higher deductible means you’ll pay more upfront, but it can lead to significant savings over time.

Explore Discounts and Bundles

Insurance companies often offer various discounts to attract customers. Some common discounts include safe driver discounts, good student discounts, multi-policy discounts, and loyalty discounts. Additionally, bundling your auto insurance with other policies, such as homeowners or renters insurance, can result in substantial savings.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk and determine premiums. Maintaining a good credit score can lead to lower insurance costs, so be sure to manage your credit responsibly.

Future Trends and Considerations

The auto insurance industry is constantly evolving, and several trends and considerations may impact your insurance costs in the future.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is becoming increasingly popular. Some insurance companies offer usage-based insurance programs that use telematics devices to monitor driving habits and adjust premiums accordingly. While this can provide an opportunity for safe drivers to lower their premiums, it may also result in higher costs for those with risky driving habits.

Autonomous Vehicles and Safety Innovations

The advent of autonomous vehicles and advanced safety features is expected to significantly impact auto insurance in the coming years. As these technologies become more prevalent, insurance companies may adjust their pricing models to reflect the reduced risk associated with these vehicles. However, the transition period may bring about uncertainty in insurance rates as companies adapt to this new landscape.

Regulatory Changes and Market Competition

Regulatory changes and increased market competition can also influence auto insurance costs. As new regulations are introduced, insurance companies may need to adjust their pricing structures and coverage options. Additionally, increased competition among insurance providers can drive down prices and improve customer service, ultimately benefiting consumers.

Conclusion

Finding the best and least expensive auto insurance requires a comprehensive understanding of the factors that influence insurance costs and a willingness to compare multiple providers. By considering your driving history, vehicle type, coverage needs, and exploring various discounts and bundles, you can identify the most cost-effective auto insurance policy for your situation. Additionally, staying informed about industry trends and considering future innovations can help you make informed decisions when selecting your auto insurance coverage.

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the United States varies significantly based on factors such as location, driving history, and vehicle type. According to industry data, the average annual premium ranges from 1,000 to 2,000, with some states having higher or lower averages.

How can I get the cheapest auto insurance quote?

+

To get the cheapest auto insurance quote, you should compare multiple providers, consider increasing your deductible, explore discounts, and choose the coverage that aligns with your specific needs. Additionally, maintaining a clean driving record and a good credit score can lead to lower insurance costs.

Are there any alternatives to traditional auto insurance providers?

+

Yes, there are alternatives to traditional auto insurance providers. Some companies offer usage-based insurance, where your premium is determined by your actual driving behavior. Additionally, peer-to-peer insurance platforms and insurance cooperatives are emerging as potential alternatives, offering unique coverage options and pricing models.