Best Auto Insurance Ratings

Finding the best auto insurance coverage is crucial for every vehicle owner, as it provides financial protection and peace of mind. With numerous insurance companies offering various policies, it can be challenging to determine which provider offers the highest-rated coverage. This comprehensive guide will explore the top-rated auto insurance companies, their unique features, and the factors to consider when choosing the best policy for your needs.

Top-Rated Auto Insurance Companies

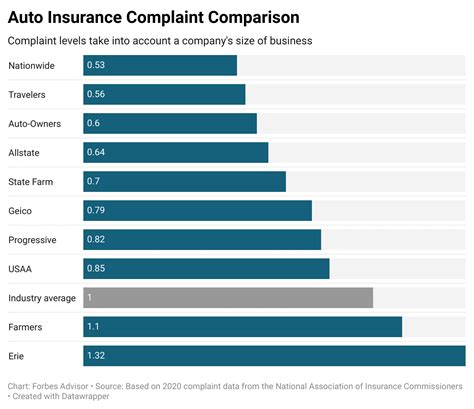

The auto insurance landscape is diverse, with numerous companies vying for your business. However, some stand out for their exceptional services, financial stability, and customer satisfaction. Here are the top-rated auto insurance providers based on industry ratings and consumer feedback:

State Farm

State Farm has consistently ranked among the top auto insurance providers in the United States. With a strong focus on customer service and a wide range of coverage options, State Farm offers personalized policies to meet diverse needs. They provide standard auto insurance coverage, including liability, collision, and comprehensive protection, as well as optional add-ons like rental car reimbursement and roadside assistance.

State Farm’s digital tools and resources make it convenient for policyholders to manage their accounts and file claims. Their Drive Safe & Save program utilizes telematics to reward safe driving habits with potential discounts.

USAA

USAA is highly regarded for its exceptional auto insurance offerings, catering specifically to military members, veterans, and their families. Known for its competitive rates and comprehensive coverage, USAA provides various auto insurance options, including liability, collision, and comprehensive coverage, as well as specialized coverage for classic cars and military deployments.

USAA’s SafePilot app utilizes telematics to track driving habits, offering potential discounts for safe driving. Their Young Driver Program helps young drivers develop safe driving habits and potentially reduce insurance costs.

Geico

Geico, an acronym for Government Employees Insurance Company, is a well-known and highly rated auto insurance provider. With a strong focus on digital convenience and affordability, Geico offers a wide range of coverage options, including liability, collision, comprehensive, and specialized coverage for classic cars and motorcycles.

Geico’s Digital Garage provides policyholders with a suite of digital tools to manage their accounts, file claims, and access discounts. Their Military Program offers dedicated support and discounts for military members and their families.

Progressive

Progressive is another top-rated auto insurance provider known for its innovative approaches and competitive rates. They offer a wide range of coverage options, including liability, collision, comprehensive, and specialized coverage for high-risk drivers and teen drivers.

Progressive’s Name Your Price tool allows policyholders to set their budget and find a coverage level that suits their needs. Their Snapshot program utilizes telematics to track driving habits, potentially leading to discounts for safe drivers.

Allstate

Allstate is a well-established auto insurance provider offering a comprehensive range of coverage options. Their policies include liability, collision, comprehensive, and specialized coverage for teen drivers, high-risk drivers, and classic car enthusiasts.

Allstate’s Drivewise program utilizes telematics to track driving habits, offering potential discounts for safe driving. Their Easy Pay Plan provides policyholders with flexible payment options, making insurance more accessible.

| Insurance Provider | Rating | Coverage Options | Unique Features |

|---|---|---|---|

| State Farm | A++ (Superior) | Liability, Collision, Comprehensive, Rental Car Reimbursement, Roadside Assistance | Drive Safe & Save Program, Personalized Policies |

| USAA | A++ (Superior) | Liability, Collision, Comprehensive, Classic Car Coverage, Military Deployment Coverage | SafePilot App, Young Driver Program |

| Geico | A++ (Superior) | Liability, Collision, Comprehensive, Classic Car Coverage, Motorcycle Coverage | Digital Garage, Military Program |

| Progressive | A+ (Superior) | Liability, Collision, Comprehensive, High-Risk Driver Coverage, Teen Driver Coverage | Name Your Price Tool, Snapshot Program |

| Allstate | A+ (Superior) | Liability, Collision, Comprehensive, Teen Driver Coverage, High-Risk Driver Coverage | Drivewise Program, Easy Pay Plan |

Factors to Consider When Choosing Auto Insurance

Selecting the best auto insurance policy involves considering various factors. Here are some key aspects to evaluate when comparing auto insurance providers:

Coverage Options

Ensure the insurance provider offers the coverage options you require. Standard coverage includes liability, collision, and comprehensive protection. Additionally, consider specialized coverage for unique needs, such as classic car coverage, rental car reimbursement, or roadside assistance.

Financial Stability

Opt for an insurance company with a strong financial rating, indicating their ability to pay claims promptly. Look for ratings from reputable agencies like AM Best, Moody’s, or Standard & Poor’s.

Customer Service

Excellent customer service is crucial when dealing with insurance claims. Assess the provider’s reputation for prompt and courteous service, as well as their digital tools and resources for managing policies and filing claims.

Discounts and Rewards

Many insurance companies offer discounts and rewards programs to encourage safe driving and policy loyalty. Look for providers that offer discounts based on your driving habits, vehicle safety features, or multi-policy discounts.

Digital Convenience

In today’s digital age, consider the insurance provider’s digital capabilities. Look for companies that offer convenient online or mobile tools for managing policies, filing claims, and accessing discounts.

Policy Customization

Every driver has unique needs, so choose an insurance provider that allows for policy customization. This ensures you can tailor your coverage to your specific requirements and budget.

Claims Process

Research the insurance provider’s claims process, including their average response time, customer satisfaction ratings, and any unique features that streamline the claims experience.

Additional Benefits

Some insurance providers offer additional benefits beyond standard coverage. These may include accident forgiveness, rental car coverage, or roadside assistance. Evaluate which benefits are most valuable to you.

Price and Value

While price is an important consideration, remember that the cheapest policy may not always offer the best value. Compare quotes from multiple providers, taking into account the coverage options, discounts, and overall value provided.

Making an Informed Decision

Choosing the best auto insurance policy involves a thoughtful evaluation of your specific needs and the offerings of top-rated insurance providers. By considering factors such as coverage options, financial stability, customer service, and discounts, you can make an informed decision that provides you with the protection and peace of mind you deserve.

Remember to compare quotes, read reviews, and ask questions to ensure you understand the fine print of each policy. With the right auto insurance coverage, you can drive with confidence, knowing you’re protected in the event of an accident or other unforeseen circumstances.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the United States varies depending on factors such as location, driving record, and vehicle type. According to recent data, the national average annual premium is approximately $1,674. However, it’s important to note that rates can differ significantly based on individual circumstances.

How can I save money on my auto insurance policy?

+There are several strategies to reduce your auto insurance costs. These include comparing quotes from multiple providers, maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver or multi-policy discounts), and opting for a higher level of coverage if you have a newer or more valuable vehicle.

What factors determine my auto insurance premium?

+Various factors influence your auto insurance premium, including your age, gender, driving record, location, type of vehicle, and coverage options. Insurance providers use these factors to assess the risk associated with insuring you and determine your premium. It’s important to review these factors regularly and consider any changes that may impact your rate.