Best Car Auto Insurance

Securing the best car auto insurance is an essential aspect of responsible vehicle ownership, offering financial protection and peace of mind. This comprehensive guide aims to delve into the intricacies of car insurance, exploring the factors that influence policy choices, the benefits they provide, and the key considerations for selecting the right coverage. By understanding the landscape of auto insurance, you can make informed decisions to safeguard your vehicle, yourself, and your finances.

Understanding Car Auto Insurance

Car auto insurance is a contract between an individual and an insurance company. This contract, known as a policy, provides financial protection in the event of an accident, theft, or other vehicle-related incidents. It ensures that policyholders are covered for potential costs arising from damage to their vehicle, injury to themselves or others, and property damage.

The primary goal of auto insurance is to mitigate the financial risks associated with vehicle ownership. By purchasing an insurance policy, drivers can ensure they have the necessary resources to cover expenses related to accidents, medical bills, and legal liabilities. Auto insurance policies are tailored to individual needs, offering customizable coverage options to suit different driving scenarios and budgets.

Key Components of Auto Insurance Policies

Auto insurance policies typically consist of several key components, each providing different types of coverage:

- Liability Coverage: This is a fundamental part of any auto insurance policy. It covers the costs associated with bodily injury or property damage caused to others in an accident for which the policyholder is at fault.

- Collision Coverage: This coverage pays for the repair or replacement of the policyholder’s vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This provides protection against non-collision incidents such as theft, vandalism, natural disasters, or damage caused by animals.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the policyholder and their passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders when involved in an accident with a driver who either has no insurance or insufficient insurance to cover the damages.

Additionally, auto insurance policies may include optional add-ons such as rental car reimbursement, roadside assistance, and gap insurance, which covers the difference between the actual cash value of a totaled vehicle and any remaining loan or lease balance.

Factors Influencing Auto Insurance Rates

The cost of auto insurance, often referred to as the premium, can vary significantly based on several factors. Understanding these factors can help policyholders make informed decisions about their coverage and potentially lower their insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Generally, newer, more expensive vehicles and those with high-performance engines may have higher premiums due to the cost of repairs and the potential for higher speeds and accidents. Additionally, the primary use of your vehicle (commuting, leisure, or business) can influence your rates, as can the annual mileage you drive.

Driver Profile

Your personal driving history and demographics play a significant role in determining your insurance rates. Insurance companies consider factors such as your age, gender, marital status, and driving record. Young drivers, especially males under the age of 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, drivers with a history of accidents, speeding tickets, or DUI convictions may also pay more for insurance.

Location and Driving Environment

The area where you live and drive can significantly affect your insurance rates. Urban areas often have higher premiums due to increased traffic congestion, the risk of accidents, and the potential for vehicle theft. Additionally, weather conditions and the prevalence of natural disasters in your region can impact your insurance costs.

Credit History

In many states, insurance companies are allowed to use your credit score as a factor in determining your insurance premium. Generally, individuals with higher credit scores are seen as lower risk and may qualify for lower insurance rates.

Insurance Company and Policy Features

Different insurance companies offer varying levels of coverage and have different pricing structures. It’s essential to compare policies from multiple providers to find the best combination of coverage and cost. Additionally, the features and discounts offered by insurance companies can significantly impact your premium. Common discounts include safe driver incentives, multi-policy discounts, and loyalty rewards.

Selecting the Best Auto Insurance

When choosing the best auto insurance policy for your needs, it’s crucial to strike a balance between comprehensive coverage and a competitive premium. Here are some key considerations to guide your decision-making process:

Assess Your Coverage Needs

Evaluate your specific requirements based on your vehicle, driving habits, and financial situation. Consider the minimum liability coverage required by your state, but also think about additional coverage that might be beneficial, such as collision, comprehensive, and medical payments coverage.

Compare Multiple Quotes

Obtain quotes from several insurance providers to compare coverage and prices. Online quote comparison tools can be a convenient way to quickly gather multiple quotes. Remember to ensure that the quotes you’re comparing are for the same level of coverage to make an accurate comparison.

Understand Policy Terms and Conditions

Read the fine print of your insurance policy to understand the terms and conditions. Pay attention to details such as deductibles (the amount you pay out of pocket before your insurance coverage kicks in), coverage limits, and any exclusions or limitations.

Consider Additional Coverage Options

Evaluate whether optional add-ons, such as rental car reimbursement or roadside assistance, are worth the extra cost based on your personal needs and circumstances.

Research the Insurance Provider

Investigate the reputation and financial stability of the insurance company you’re considering. Look for customer reviews and ratings, and ensure the company has a good track record of paying claims promptly and fairly.

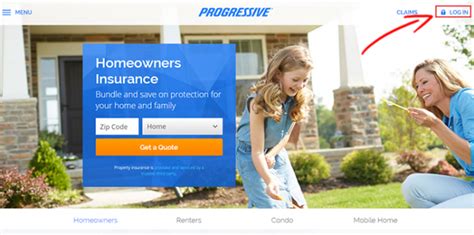

Bundle Policies for Potential Savings

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who bundle multiple policies, potentially saving you money.

Managing Your Auto Insurance Policy

Once you’ve selected your auto insurance policy, there are several steps you can take to ensure you’re getting the most value from your coverage and to potentially reduce your premiums over time.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance premiums low. Avoid accidents, speeding tickets, and other traffic violations. Over time, a spotless driving record can lead to significant savings on your insurance.

Review Your Policy Annually

Insurance needs can change over time, so it’s essential to review your policy annually. Assess whether your current coverage still meets your needs, and shop around to ensure you’re still getting the best rate.

Consider Increasing Your Deductible

Increasing your deductible (the amount you pay out of pocket before your insurance coverage kicks in) can lower your insurance premiums. However, this strategy requires careful consideration, as a higher deductible means you’ll pay more out of pocket if you need to make a claim.

Take Advantage of Discounts

Insurance companies often offer various discounts, such as safe driver incentives, good student discounts, and loyalty rewards. Ensure you’re taking advantage of all applicable discounts to lower your insurance costs.

The Future of Auto Insurance

The auto insurance industry is evolving, driven by technological advancements and changing consumer expectations. Here are some trends and innovations that are shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology allows insurance companies to track driving behavior in real-time, offering personalized insurance rates based on how, when, and where you drive. Usage-based insurance (UBI) programs use telematics to reward safe driving with lower premiums.

Connected Car Technology

The integration of advanced technology into vehicles, known as connected car technology, is transforming the insurance landscape. These vehicles can communicate with insurance companies, providing real-time data on vehicle performance, maintenance needs, and even driving behavior, which can impact insurance rates.

Artificial Intelligence and Machine Learning

AI and machine learning are being used to analyze vast amounts of data, including driving behavior, weather conditions, and accident statistics, to improve risk assessment and pricing accuracy. These technologies are also being leveraged to enhance customer service, offering personalized recommendations and improving claim processing.

Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing focus on online and mobile platforms. Customers now expect convenient and seamless digital experiences, including online quoting, policy management, and claims filing. Insurance companies are investing in digital technologies to meet these expectations and improve customer satisfaction.

Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD) Insurance

PAYD and PHYD insurance models are gaining popularity, offering more flexibility and customization for policyholders. These models allow customers to pay insurance premiums based on the distance they drive (PAYD) or their driving behavior (PHYD), providing a more tailored and potentially more cost-effective insurance option.

Conclusion

Selecting the best car auto insurance policy is a critical decision that requires careful consideration of your unique circumstances and needs. By understanding the key components of auto insurance policies, the factors that influence insurance rates, and the trends shaping the future of the industry, you can make informed choices to protect yourself, your vehicle, and your finances. Remember to regularly review your policy, take advantage of available discounts, and stay up-to-date with the latest innovations in the auto insurance landscape to ensure you’re always getting the best value for your insurance dollar.

What is the average cost of car auto insurance in the United States?

+The average cost of car insurance in the U.S. varies greatly depending on various factors such as the state you live in, your age, gender, driving history, and the type of vehicle you own. According to data from the Insurance Information Institute (III), the average annual premium for auto insurance in 2021 was $1,674. However, this figure can be significantly higher or lower depending on individual circumstances.

How can I lower my car insurance premiums?

+There are several strategies you can employ to potentially lower your car insurance premiums. These include maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver or good student discounts), and shopping around for the best rates. Additionally, consider bundling your auto insurance with other policies, such as home or life insurance, to potentially save money.

What are the minimum liability coverage requirements in my state?

+Minimum liability coverage requirements vary by state. You can check with your state’s Department of Motor Vehicles (DMV) or refer to the Insurance Information Institute’s website, which provides state-by-state information on minimum liability coverage requirements. It’s important to note that while meeting the minimum liability requirements is mandatory, additional coverage beyond these limits is often recommended to provide more comprehensive protection.