Best Car Insurance Consumer Reports

In the vast landscape of car insurance options, finding the best coverage can be a daunting task for consumers. With countless providers promising the best rates and services, it's essential to navigate the market with informed choices. Consumer Reports, a trusted name in the world of product evaluations, has delved into the intricate realm of car insurance to offer valuable insights. This article aims to dissect their findings, providing a comprehensive guide to help you identify the best car insurance providers based on your unique needs and circumstances.

Understanding the Consumer Reports Methodology

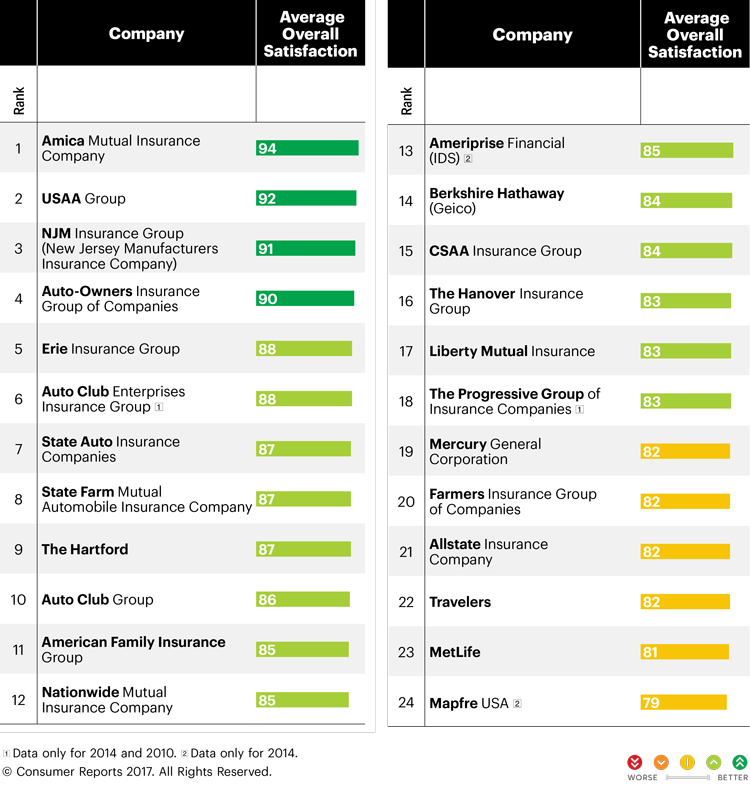

Consumer Reports employs a rigorous methodology to evaluate car insurance providers. Their approach involves assessing a wide range of factors, including financial strength, customer satisfaction, claim processing efficiency, and the breadth of coverage options. By considering these aspects, Consumer Reports aims to provide an unbiased, data-driven analysis that empowers consumers to make informed decisions.

The organization's methodology places a strong emphasis on consumer feedback and real-world experiences. They conduct extensive surveys and gather feedback from policyholders to gauge satisfaction levels and identify potential pain points. This consumer-centric approach ensures that the recommendations are grounded in the realities of the insurance experience, offering a nuanced understanding of the market.

The Top-Rated Car Insurance Providers

Based on their comprehensive evaluation, Consumer Reports has identified several car insurance providers that consistently rank highly across various categories. These providers have demonstrated a strong commitment to customer satisfaction, offering competitive rates, efficient claim processing, and a wide array of coverage options to cater to diverse needs.

State Farm: A Traditional Powerhouse

State Farm has long been a stalwart in the car insurance industry, known for its extensive network and personalized approach. Consumer Reports highlights State Farm’s strong financial stability and customer satisfaction ratings. With a comprehensive range of coverage options, including specialized policies for classic cars and young drivers, State Farm caters to a diverse clientele.

| Category | State Farm's Performance |

|---|---|

| Financial Strength | Excellent (A++) |

| Customer Satisfaction | 4.5/5 (Very Good) |

| Claim Processing | 4/5 (Good) |

Pros: Extensive coverage options, strong financial stability, and a focus on personalized service.

Cons: Rates may be slightly higher than some competitors, and claim processing times can vary.

GEICO: Competitive Rates and Digital Convenience

GEICO has revolutionized the car insurance landscape with its digital-first approach and competitive pricing. Consumer Reports recognizes GEICO for its excellent customer satisfaction and claim processing efficiency. With a focus on convenience and simplicity, GEICO offers an intuitive online platform for policy management and claims filing, appealing to tech-savvy consumers.

| Category | GEICO's Performance |

|---|---|

| Financial Strength | Excellent (A++) |

| Customer Satisfaction | 4.8/5 (Excellent) |

| Claim Processing | 4.5/5 (Very Good) |

Pros: Competitive rates, exceptional customer satisfaction, and a seamless digital experience.

Cons: Limited physical branch locations may be a drawback for those seeking in-person support.

USAA: Exceptional Service for Military Families

USAA stands out as a leader in car insurance for military service members and their families. Consumer Reports acknowledges USAA’s outstanding financial strength and customer satisfaction ratings. With a deep understanding of the unique needs of military personnel, USAA offers specialized coverage options and a dedicated focus on serving this community.

| Category | USAA's Performance |

|---|---|

| Financial Strength | Excellent (A++) |

| Customer Satisfaction | 4.9/5 (Exceptional) |

| Claim Processing | 4.8/5 (Exceptional) |

Pros: Exceptional customer satisfaction, tailored coverage for military families, and competitive rates.

Cons: Eligibility is restricted to military members, veterans, and their families.

Choosing the Right Car Insurance for Your Needs

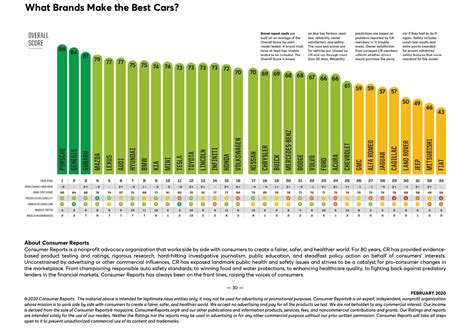

While Consumer Reports’ evaluations provide valuable insights, it’s crucial to tailor your car insurance choice to your specific circumstances. Consider factors such as your driving history, the make and model of your vehicle, and any additional coverage needs you may have.

For instance, if you own a classic car, you'll want to ensure your provider offers specialized coverage for its unique requirements. Similarly, if you frequently travel or use your vehicle for business purposes, you'll need to explore options that cater to these specific needs.

Comparative Analysis: Key Factors to Consider

- Financial Strength: Ensure your provider has a strong financial rating to guarantee they can fulfill claims in the long term.

- Customer Satisfaction: High customer satisfaction ratings indicate a provider’s commitment to delivering an exceptional experience.

- Claim Processing: Efficient claim processing is crucial to ensure prompt and fair settlements in the event of an accident.

- Coverage Options: Evaluate the range of coverage options to ensure your provider can cater to your specific needs.

- Digital Convenience: In today’s digital age, consider the provider’s online and mobile capabilities for policy management and claims filing.

The Impact of Technological Innovations

The car insurance landscape is evolving rapidly, driven by technological advancements. Telematics, for instance, allows providers to offer usage-based insurance, where rates are determined by your actual driving behavior. This innovative approach rewards safe drivers with lower premiums.

Additionally, the rise of autonomous vehicles is set to revolutionize the industry. As self-driving technology becomes more prevalent, the nature of car insurance will need to adapt to address new risks and liabilities. Consumer Reports anticipates these changes and will continue to provide insights into how these technological shifts impact consumer choices.

FAQs

How often does Consumer Reports update their car insurance ratings and reviews?

+Consumer Reports regularly updates their car insurance ratings and reviews to reflect the latest market trends and consumer feedback. While the frequency of updates may vary, they strive to provide timely and accurate information, ensuring their recommendations remain relevant.

Are there any providers that offer specialized coverage for electric vehicles (EVs)?

+Yes, several providers now offer specialized coverage for electric vehicles. These policies often include additional benefits such as roadside assistance for charging needs and coverage for battery-related issues. It’s worth exploring these options if you own or plan to purchase an EV.

What factors should I consider if I frequently travel or use my vehicle for business purposes?

+If you travel frequently or use your vehicle for business, you’ll want to consider providers that offer specialized coverage for these scenarios. Look for policies that provide enhanced roadside assistance, coverage for rental cars, and options to protect your vehicle while it’s in transit or parked at remote locations.

In conclusion, Consumer Reports’ evaluations provide an invaluable guide for consumers seeking the best car insurance. By understanding their methodology and the strengths of top-rated providers, you can make informed choices that align with your unique needs and circumstances. Remember, the right car insurance provider should offer not only competitive rates but also exceptional service, financial stability, and tailored coverage options to protect you and your vehicle.