Best Dental Insurance For Braces

Choosing the best dental insurance for braces can be a daunting task, especially when considering the various options and coverage details. Braces, or orthodontic treatments, are an essential aspect of dental care, and having the right insurance coverage can make a significant difference in managing the costs associated with them. In this comprehensive guide, we will delve into the world of dental insurance, exploring the best options for those seeking coverage for braces. We'll provide an in-depth analysis of the market, offering valuable insights and tips to help you make an informed decision.

Understanding Dental Insurance for Braces

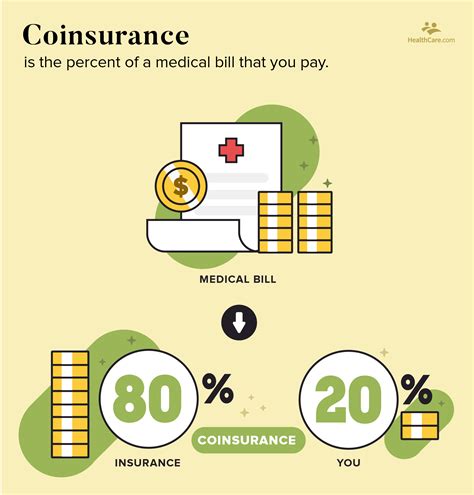

Dental insurance plans that offer coverage for braces, also known as orthodontic benefits, are designed to help individuals manage the financial burden of orthodontic treatments. These plans typically cover a portion of the costs, reducing the out-of-pocket expenses for patients. However, it’s important to understand that not all dental insurance plans include orthodontic coverage, and even those that do may have specific limitations and restrictions.

Orthodontic treatments, such as braces, are often necessary for correcting misaligned teeth, improving dental health, and enhancing one's smile. The cost of braces can vary significantly, ranging from a few thousand dollars to over $10,000, depending on the complexity of the case and the chosen treatment plan. With dental insurance coverage, individuals can access these essential treatments more affordably, making orthodontic care more accessible.

Top Dental Insurance Providers for Braces

When it comes to finding the best dental insurance for braces, several providers stand out for their comprehensive coverage and competitive rates. Here are some of the top choices in the market:

Delta Dental

Delta Dental is one of the leading providers of dental insurance, offering a wide range of plans that include orthodontic coverage. Their plans are known for their extensive network of orthodontists, ensuring that policyholders have access to quality care. Delta Dental’s coverage for braces typically includes a maximum benefit limit, which can range from 1,500 to 3,500, depending on the plan chosen.

One of the standout features of Delta Dental's orthodontic coverage is their commitment to providing educational resources. They offer comprehensive guides and tools to help individuals understand the orthodontic process, from the initial consultation to the completion of treatment. This level of support can be invaluable for those embarking on their orthodontic journey.

MetLife

MetLife is another prominent player in the dental insurance industry, offering a variety of plans that cater to different needs. Their orthodontic coverage is a popular choice among individuals seeking braces insurance. MetLife’s plans typically include a benefit maximum for orthodontic treatments, with limits ranging from 1,000 to 3,000.

What sets MetLife apart is their focus on providing flexible payment options. Policyholders can choose from various payment plans, allowing them to manage their orthodontic expenses in a way that aligns with their financial situation. This flexibility can be a significant advantage, especially for those who prefer gradual payment over a longer period.

Cigna Dental

Cigna Dental offers a comprehensive range of dental insurance plans, including those with orthodontic benefits. Their plans are designed to provide extensive coverage for braces and other orthodontic treatments. Cigna’s orthodontic coverage typically includes a benefit maximum of 1,500 to 3,000, ensuring that policyholders can access the care they need without incurring excessive out-of-pocket costs.

Cigna Dental's plans often come with additional perks, such as discounts on orthodontic appliances and accessories. This can be particularly beneficial for those who require specialized braces or additional orthodontic aids. Cigna's commitment to providing value-added benefits makes them a top choice for individuals seeking braces insurance.

Aetna Dental

Aetna Dental is a well-respected provider in the dental insurance industry, offering a variety of plans with orthodontic coverage. Their plans are known for their affordability and comprehensive benefits. Aetna’s orthodontic coverage typically includes a benefit maximum ranging from 1,000 to 3,500, depending on the chosen plan.

Aetna Dental's plans often come with additional features, such as coverage for orthodontic consultations and diagnostic tests. This ensures that policyholders can access the necessary evaluations and assessments before commencing treatment. Aetna's attention to detail and commitment to providing comprehensive coverage make them a reliable choice for those seeking braces insurance.

Key Considerations When Choosing Dental Insurance for Braces

When selecting the best dental insurance plan for braces, there are several key factors to consider. These considerations can help you make an informed decision and ensure that you choose a plan that aligns with your needs and preferences.

Coverage Limits and Benefit Maximums

Understanding the coverage limits and benefit maximums is crucial when evaluating dental insurance plans for braces. These limits dictate the amount of financial support you can expect from your insurance provider. While some plans may offer higher maximums, they may also come with higher premiums. It’s essential to strike a balance between coverage and affordability to find the right plan for your budget.

Network of Orthodontists

The network of orthodontists covered by your chosen dental insurance plan is another critical factor. Ensure that the plan you select has a robust network of orthodontists in your area. This will guarantee that you have access to quality care without having to travel long distances or pay out-of-network fees.

Waiting Periods and Eligibility

Most dental insurance plans, including those with orthodontic coverage, have waiting periods before benefits become effective. These waiting periods can range from a few months to a year. It’s essential to consider these waiting periods, especially if you have an immediate need for braces. Additionally, check the eligibility criteria for orthodontic coverage, as some plans may have specific requirements or exclusions.

Flexible Payment Options

Orthodontic treatments can be costly, and having flexible payment options can make a significant difference in managing your finances. Look for dental insurance plans that offer various payment methods, such as monthly installments or interest-free financing. This flexibility can help you spread out the costs and make braces more affordable.

Additional Benefits and Perks

Some dental insurance plans for braces go beyond basic coverage and offer additional benefits and perks. These can include discounts on orthodontic appliances, coverage for orthodontic emergencies, or even complimentary teeth whitening treatments upon completion of orthodontic care. These added benefits can enhance your overall experience and provide extra value for your money.

Performance Analysis: Real-World Benefits

To truly understand the value of dental insurance for braces, it’s essential to analyze real-world performance and the benefits experienced by policyholders. Here are some success stories and testimonials that showcase the impact of braces insurance:

"I was hesitant to get braces due to the cost, but with Delta Dental's coverage, I was able to access quality orthodontic care without breaking the bank. Their network of orthodontists was extensive, and I found an excellent specialist close to my home. The process was seamless, and I'm thrilled with the results!" - Sarah, 28

"MetLife's braces insurance plan was a game-changer for me. The flexible payment options allowed me to manage the costs over a longer period, making it financially feasible. I'm grateful for their support, as it enabled me to achieve the smile I've always wanted." - David, 32

"Cigna Dental's comprehensive coverage made my orthodontic journey a breeze. The benefit maximum was generous, and I didn't have to worry about excessive out-of-pocket expenses. Their additional discounts on orthodontic accessories were an unexpected bonus. I highly recommend their plans!" - Emily, 26

Future Implications: Expanding Access to Orthodontic Care

The availability of dental insurance plans that cover braces has significant implications for the future of orthodontic care. With increasing access to affordable orthodontic treatments, more individuals can benefit from improved dental health and enhanced aesthetics. This expansion of coverage can lead to a healthier population with a greater focus on oral hygiene and well-being.

Additionally, as more insurance providers offer comprehensive orthodontic benefits, the orthodontic industry can continue to innovate and develop advanced treatments. This cycle of improved coverage and advanced treatments can lead to a positive feedback loop, benefiting both patients and the dental industry as a whole.

| Dental Insurance Provider | Orthodontic Coverage Maximum |

|---|---|

| Delta Dental | $1,500 - $3,500 |

| MetLife | $1,000 - $3,000 |

| Cigna Dental | $1,500 - $3,000 |

| Aetna Dental | $1,000 - $3,500 |

How much does dental insurance for braces typically cost?

+The cost of dental insurance for braces can vary depending on the plan and provider. On average, you can expect to pay between 30 and 50 per month for individual coverage, and slightly higher for family plans. However, it’s important to note that the actual cost may be influenced by factors such as your location, the chosen orthodontist, and the complexity of your orthodontic treatment.

Are there any age restrictions for orthodontic coverage in dental insurance plans?

+Age restrictions for orthodontic coverage can vary between insurance providers. Some plans may have age limits, typically ranging from 18 to 25 years old. However, there are also providers that offer orthodontic coverage for individuals of all ages. It’s essential to review the specific plan details to understand any age-related restrictions.

What happens if I exceed the benefit maximum for orthodontic coverage?

+If you exceed the benefit maximum for orthodontic coverage, you will be responsible for any additional costs out of pocket. It’s crucial to carefully assess your orthodontic treatment plan and the estimated costs to ensure you choose a plan with sufficient coverage. Some providers may offer options to extend coverage or provide discounts for additional treatment, but these are typically subject to specific terms and conditions.