Best Federal Health Insurance

Navigating the world of health insurance can be daunting, especially when it comes to understanding the intricacies of federal health insurance plans. With a myriad of options available, choosing the best plan for your needs is crucial. In this comprehensive guide, we will delve into the world of federal health insurance, exploring its various aspects, benefits, and considerations to help you make an informed decision.

Understanding Federal Health Insurance

Federal health insurance, also known as government-sponsored health coverage, plays a vital role in ensuring access to healthcare for millions of Americans. These plans are typically offered through federal programs such as Medicare, Medicaid, and the Federal Employees Health Benefits Program (FEHBP). Each program caters to specific demographics and provides a range of coverage options to meet diverse healthcare needs.

Medicare: A Comprehensive Overview

Medicare is a federal health insurance program primarily designed for individuals aged 65 and above, as well as those with certain disabilities or end-stage renal disease. It is divided into different parts, each covering specific aspects of healthcare:

- Part A (Hospital Insurance): This covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. Part A is generally premium-free for those who have worked and paid Medicare taxes for a minimum specified period.

- Part B (Medical Insurance): Part B covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and some preventive services. A monthly premium is typically required for Part B coverage.

- Part C (Medicare Advantage): Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B). It is offered by private insurance companies approved by Medicare and combines Parts A and B, often including additional benefits like prescription drug coverage and vision care.

- Part D (Prescription Drug Coverage): Part D is an optional prescription drug plan that can be added to Original Medicare or Medicare Advantage plans. It helps cover the cost of prescription medications and is offered by private insurance companies approved by Medicare.

Medicare provides a safety net for seniors and those with specific health conditions, offering a range of benefits tailored to their unique healthcare needs. However, it's essential to understand the differences between Original Medicare and Medicare Advantage, as well as the potential costs and coverage gaps associated with each.

Medicaid: Ensuring Healthcare Access

Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. It is the largest source of funding for medical and health-related services for Americans with limited resources. While the federal government sets the basic guidelines for Medicaid, each state has the flexibility to establish its own eligibility criteria, benefits, and administration.

Eligibility for Medicaid is primarily based on income and certain other factors, such as age, pregnancy, disability, and family status. The program covers a wide range of healthcare services, including doctor visits, hospital stays, laboratory tests, nursing home care, and prescription medications. Additionally, Medicaid often provides coverage for long-term care services and supports, making it an essential safety net for those in need.

One of the key advantages of Medicaid is its cost-sharing arrangements, which can significantly reduce the financial burden of healthcare for eligible individuals. While some states require small copayments for certain services, many Medicaid beneficiaries receive coverage with minimal or no out-of-pocket costs.

Federal Employees Health Benefits Program (FEHBP)

The Federal Employees Health Benefits Program (FEHBP) is a comprehensive health insurance program designed specifically for federal employees, annuitants, and their families. It offers a wide range of health plans, providing flexibility and choice to meet the diverse needs of federal employees.

FEHBP is administered by the Office of Personnel Management (OPM) and offers more than 100 health plans from various private insurance carriers. These plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), High Deductible Health Plans (HDHPs), and more. Federal employees can choose the plan that best aligns with their healthcare preferences and budget.

One of the unique features of FEHBP is the availability of self-plus-one and self-and-family coverage options, allowing federal employees to customize their coverage to include their spouse or children. Additionally, FEHBP plans often provide comprehensive coverage for preventive care, prescription drugs, mental health services, and specialized treatments, ensuring comprehensive healthcare for federal employees and their families.

| Plan Type | Description |

|---|---|

| HMO | Health Maintenance Organization plans that typically require members to choose a primary care physician and obtain referrals for specialist care. |

| PPO | Preferred Provider Organization plans offering more flexibility in choosing healthcare providers but often with higher out-of-pocket costs. |

| HDHP | High Deductible Health Plans with lower premiums and a higher deductible, often paired with a Health Savings Account (HSA) for tax-advantaged savings. |

Choosing the Best Federal Health Insurance Plan

Selecting the best federal health insurance plan requires careful consideration of your individual needs, preferences, and circumstances. Here are some key factors to keep in mind when making your decision:

Assessing Your Healthcare Needs

Start by evaluating your current and anticipated healthcare needs. Consider factors such as age, existing health conditions, prescription medications, and the likelihood of requiring specialized treatments or long-term care. Understanding your healthcare needs will help you choose a plan that provides adequate coverage without unnecessary costs.

Understanding Coverage and Benefits

Review the coverage and benefits offered by each plan. Compare the scope of services covered, including preventive care, hospital stays, outpatient services, prescription drugs, and any additional benefits like vision or dental care. Ensure that the plan aligns with your healthcare priorities and provides adequate protection against unexpected medical expenses.

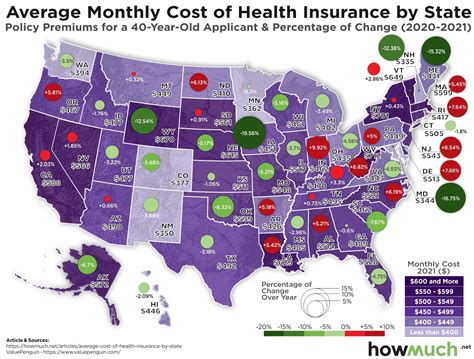

Analyzing Costs and Premiums

Evaluate the costs associated with each plan, including premiums, deductibles, copayments, and out-of-pocket maximums. Consider your budget and financial situation when making your choice. Remember that while some plans may have lower premiums, they may have higher out-of-pocket costs or limited coverage. Striking the right balance between cost and coverage is crucial.

Evaluating Network and Provider Options

Review the network of healthcare providers associated with each plan. Consider whether your preferred doctors, specialists, and hospitals are included in the plan’s network. If you have a specific healthcare provider you wish to continue seeing, ensure that they are in-network to avoid higher out-of-pocket costs.

Considering Additional Benefits and Services

Explore the additional benefits and services offered by each plan. These may include wellness programs, disease management support, travel coverage, or access to telemedicine services. Understanding the extra perks can help you choose a plan that provides comprehensive support for your overall well-being.

Comparing Customer Service and Plan Reputation

Research the reputation and customer service record of the insurance providers offering the federal health insurance plans. Read reviews and seek recommendations from friends, family, or colleagues who have experience with the plans. A plan with excellent customer service and a positive reputation can provide added peace of mind and support when navigating the complexities of healthcare.

Making an Informed Decision

Choosing the best federal health insurance plan involves a thoughtful and personalized approach. By assessing your healthcare needs, understanding coverage and benefits, evaluating costs, and considering additional factors such as network options and customer service, you can make an informed decision that aligns with your unique circumstances. Remember, the right plan should provide comprehensive coverage, meet your healthcare priorities, and offer a level of financial protection that suits your budget.

What is the eligibility criteria for Medicare?

+To be eligible for Medicare, you must be a U.S. citizen or permanent legal resident aged 65 or older. Certain individuals under 65 with specific disabilities or those with end-stage renal disease may also qualify. It’s important to note that eligibility criteria may vary based on the specific Medicare program (Parts A, B, C, or D) and individual circumstances.

How does Medicaid eligibility vary by state?

+Medicaid eligibility criteria can differ significantly between states. While the federal government sets certain basic guidelines, states have the flexibility to establish their own eligibility requirements, including income limits, asset tests, and certain mandatory and optional eligibility groups. It’s crucial to check with your state’s Medicaid program for specific eligibility criteria.

What are the enrollment periods for federal health insurance plans?

+Federal health insurance plans, such as Medicare and FEHBP, have specific enrollment periods. For Medicare, the Initial Enrollment Period is a 7-month window around your 65th birthday. FEHBP has an annual Open Season for federal employees to enroll, change, or cancel their coverage. It’s important to be aware of these enrollment periods to ensure you don’t miss out on coverage opportunities.