Best Full Coverage Car Insurance In California

When it comes to safeguarding your vehicle and ensuring peace of mind on the roads, full coverage car insurance is an essential aspect of responsible car ownership. In the bustling state of California, known for its diverse landscapes and bustling cities, finding the best full coverage car insurance policy is crucial to protect yourself and your vehicle. This article will delve into the intricacies of full coverage insurance, provide a comprehensive analysis of the top providers in California, and offer valuable insights to help you make an informed decision.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive policy that provides an extensive level of protection for your vehicle. It typically combines collision coverage and comprehensive coverage to offer a robust safety net for various scenarios. Collision coverage takes care of repairs or replacements if your vehicle is involved in an accident, regardless of fault. On the other hand, comprehensive coverage safeguards against non-collision incidents like theft, vandalism, natural disasters, or damage caused by animals.

Additionally, full coverage insurance often includes liability coverage, which is vital for legal and financial protection. It covers the costs associated with injuries or property damage caused to others in an accident for which you are at fault. This aspect is especially crucial in California, where the state's financial responsibility laws require a minimum level of liability insurance.

Top Providers of Full Coverage Car Insurance in California

California boasts a competitive insurance market, with numerous providers offering full coverage policies. Here, we highlight some of the leading companies and their unique offerings to help you find the best fit for your needs.

State Farm

State Farm is a well-established insurance provider known for its extensive coverage options and personalized customer service. Their full coverage car insurance policies include:

- Collision Coverage: Repairs or replacements for damages caused by collisions, regardless of fault.

- Comprehensive Coverage: Protection against theft, vandalism, and natural disasters.

- Liability Coverage: Covers medical expenses and property damage costs for others involved in an accident.

- Optional Coverages: State Farm offers additional coverages like rental car reimbursement, roadside assistance, and gap insurance.

| Coverage Type | State Farm |

|---|---|

| Collision | Standard |

| Comprehensive | Standard |

| Liability | Standard |

| Optional Coverages | Diverse Options |

State Farm's reputation for excellent customer service and their tailored approach make them a top choice for many Californians seeking full coverage.

GEICO

GEICO, an acronym for Government Employees Insurance Company, has expanded its reach beyond government employees and now serves a wide range of customers. Their full coverage car insurance policies include:

- Collision Coverage: Repairs or replacements for accident-related damages.

- Comprehensive Coverage: Protection against various non-collision incidents.

- Liability Coverage: Covers bodily injury and property damage costs for others.

- Discounts: GEICO offers numerous discounts, including multi-policy, good student, and safe driver discounts.

| Coverage Type | GEICO |

|---|---|

| Collision | Standard |

| Comprehensive | Standard |

| Liability | Standard |

| Discounts | Varied Options |

GEICO's focus on discounts and their extensive online resources make them an attractive option for cost-conscious drivers.

Progressive

Progressive is known for its innovative approach to insurance and has earned a solid reputation in the industry. Their full coverage car insurance policies include:

- Collision Coverage: Comprehensive collision protection.

- Comprehensive Coverage: Protection against a wide range of incidents.

- Liability Coverage: Covers legal and financial obligations for bodily injury and property damage.

- Snapshot Program: Progressive’s unique program offers discounts based on your driving behavior, monitored through a device or smartphone app.

| Coverage Type | Progressive |

|---|---|

| Collision | Standard |

| Comprehensive | Standard |

| Liability | Standard |

| Snapshot Program | Yes |

Progressive's Snapshot program provides an opportunity for safe drivers to save on their insurance premiums.

Allstate

Allstate is a trusted name in the insurance industry, known for its reliable coverage and customer-centric approach. Their full coverage car insurance policies include:

- Collision Coverage: Repairs or replacements for accident-related damages.

- Comprehensive Coverage: Protection against theft, vandalism, and natural disasters.

- Liability Coverage: Covers bodily injury and property damage costs for others.

- Drivewise Program: Allstate’s program offers discounts based on your driving habits, monitored through a mobile app.

| Coverage Type | Allstate |

|---|---|

| Collision | Standard |

| Comprehensive | Standard |

| Liability | Standard |

| Drivewise Program | Yes |

Allstate's Drivewise program encourages safe driving and provides an opportunity for discounts.

USAA

USAA is a highly regarded insurance provider that primarily serves military members, veterans, and their families. Their full coverage car insurance policies include:

- Collision Coverage: Repairs or replacements for accident-related damages.

- Comprehensive Coverage: Protection against theft, vandalism, and natural disasters.

- Liability Coverage: Covers bodily injury and property damage costs for others.

- Discounts: USAA offers various discounts, including safe driver, multi-policy, and loyalty discounts.

| Coverage Type | USAA |

|---|---|

| Collision | Standard |

| Comprehensive | Standard |

| Liability | Standard |

| Discounts | Military-focused Options |

USAA's dedication to serving the military community and their competitive rates make them a top choice for eligible individuals.

Comparative Analysis: Key Considerations

When comparing these top providers, several key factors come into play:

- Coverage Options: Ensure the provider offers the specific coverages you require, such as rental car reimbursement or gap insurance.

- Discounts: Explore the available discounts to find the provider that offers the best savings based on your circumstances.

- Customer Service: Consider the provider’s reputation for customer service, claims handling, and overall satisfaction.

- Digital Tools and Resources: Evaluate the provider’s online platform, mobile apps, and other digital resources for convenience and accessibility.

- Financial Strength: Assess the provider’s financial stability and rating to ensure they can provide long-term coverage and support.

Future Implications and Industry Trends

The insurance industry is continually evolving, and several trends are shaping the future of full coverage car insurance in California:

- Telematics and Usage-Based Insurance: Insurance providers are increasingly adopting telematics technology to monitor driving behavior and offer usage-based insurance policies. This trend is expected to grow, providing more personalized and data-driven insurance options.

- Digital Transformation: The insurance industry is embracing digital transformation, with providers investing in online platforms, mobile apps, and AI-powered chatbots for enhanced customer experiences.

- Connected Cars and Data Analytics: As more vehicles become connected, insurance providers can leverage data analytics to offer innovative coverage options and risk assessment tools.

- Climate Change and Natural Disasters: With the increasing frequency and severity of natural disasters, insurance providers are adapting their policies to provide better protection against climate-related risks.

Conclusion

Choosing the best full coverage car insurance in California involves careful consideration of your specific needs and circumstances. By understanding the key components of full coverage insurance and exploring the offerings of top providers like State Farm, GEICO, Progressive, Allstate, and USAA, you can make an informed decision. Remember to assess coverage options, discounts, customer service, and digital tools to find the provider that aligns with your priorities. As the insurance industry continues to evolve, staying informed about emerging trends and technologies will help you navigate the changing landscape and make the most of your full coverage car insurance policy.

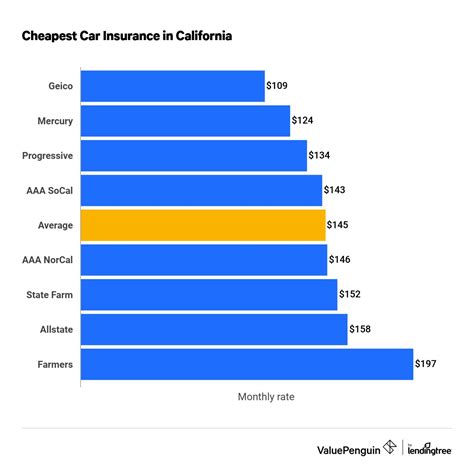

What is the average cost of full coverage car insurance in California?

+

The average cost of full coverage car insurance in California can vary significantly based on factors like age, driving history, vehicle type, and location. According to recent data, the average annual premium for full coverage insurance in California is around 1,500, but it can range from 1,000 to $2,500 or more depending on individual circumstances.

Are there any discounts available for full coverage car insurance in California?

+

Yes, most insurance providers offer a variety of discounts to help reduce the cost of full coverage car insurance. These may include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts. It’s advisable to inquire about these discounts when obtaining quotes to ensure you receive the best rate.

How do I choose the right coverage limits for my full coverage car insurance policy in California?

+

Choosing the right coverage limits involves assessing your assets and financial situation. It’s recommended to opt for higher liability limits to protect your assets in the event of a serious accident. Additionally, consider your vehicle’s value and potential repair costs when selecting collision and comprehensive coverage limits.